Massachusetts Records Corporation Withdrawal

Description

How to fill out Massachusetts Corporate Records Maintenance Package For Existing Corporations?

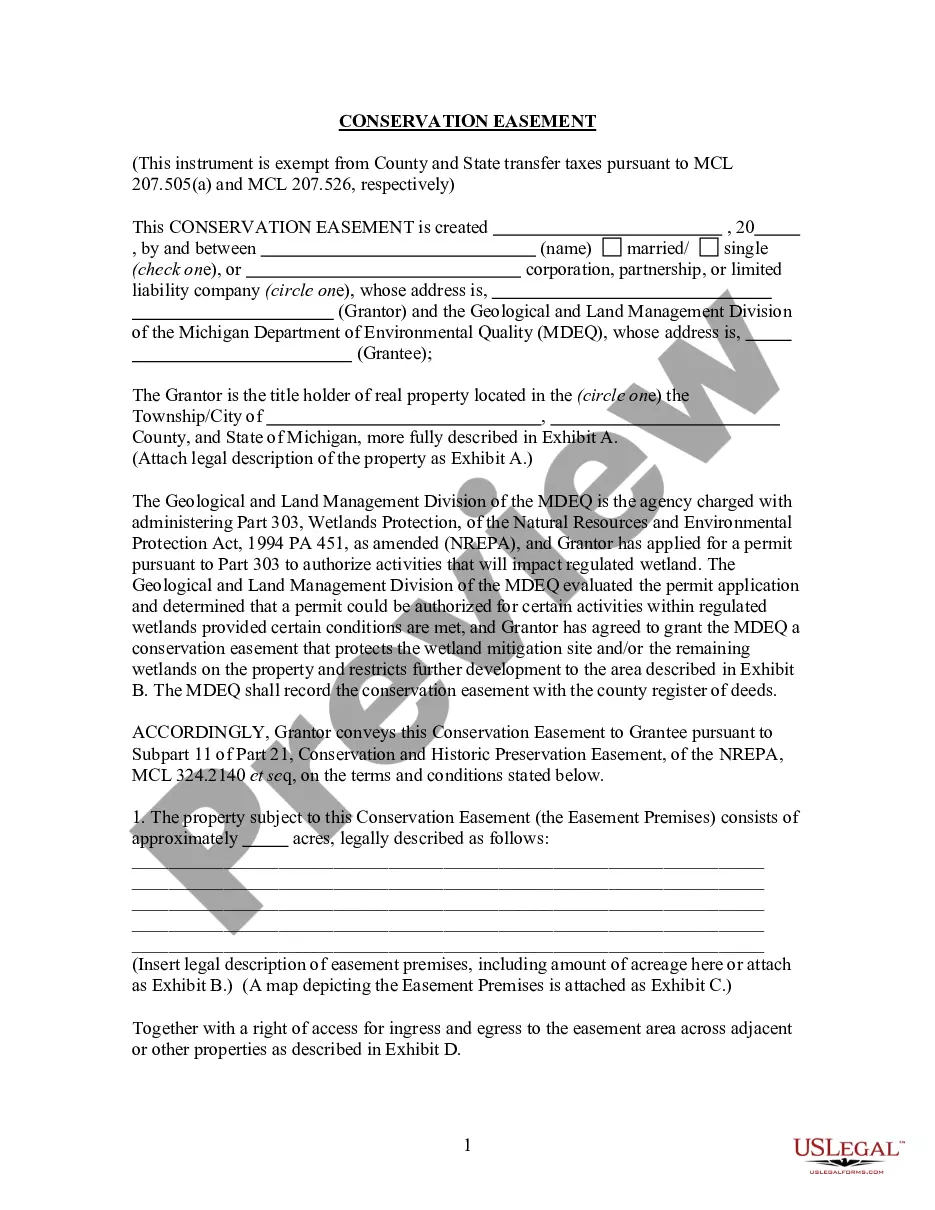

It’s well known that you cannot instantly become a legal expert, nor can you understand how to swiftly prepare Massachusetts Records Corporation Withdrawal without possessing specialized knowledge.

Drafting legal documents is a lengthy procedure that necessitates specific education and abilities. So why not assign the task of preparing the Massachusetts Records Corporation Withdrawal to the professionals.

With US Legal Forms, which features one of the largest collections of legal templates, you can locate everything from court documents to templates for internal corporate communications.

If you require another document, initiate your search again.

Create a complimentary account and select a subscription plan to purchase the document.

- We recognize how important it is to comply with federal and local regulations.

- That’s the reason all forms on our website are tailored to specific locations and are current.

- Begin with our platform and obtain the document you need in just minutes.

- Find the document you are looking for using the search bar at the top of the website.

- Review it (if this feature is available) and read the accompanying description to determine whether Massachusetts Records Corporation Withdrawal meets your needs.

Form popularity

FAQ

If a corporation has failed to comply with the provisions of the General Laws requiring the filing of annual reports with the Division or tax returns with the Commissioner of Revenue or the payment of any taxes under M.G.L.

Corporations must complete a Form 966, Corporate Dissolution or Liquidation, and file it with the final corporate return. Partnerships must file the final Form 1065 and Schedule K-1s. Sole proprietors stop filing the Schedule C with the individual income tax return.

To withdraw your LLC from Massachusetts you would submit a signed Certificate of Withdrawal and the filing fee to the Massachusetts Secretary of the Commonwealth, Corporations Division (SOC). There is no SOC withdrawal form for LLCs. You have to draft your own certificate based on Massachusetts statutory requirements.

Most Massachusetts Annual Reports can be filed online or with paper forms. To file online, log in to the Corporations Division's online filing portal. To file a paper form, you'll need to download and print one from the file by mail or walk-in section of the Corporation Division's website.

Most Massachusetts Annual Reports can be filed online or with paper forms. To file online, log in to the Corporations Division's online filing portal. To file a paper form, you'll need to download and print one from the file by mail or walk-in section of the Corporation Division's website.