Louisiana Name Change With Irs

Description

Form popularity

FAQ

Unfortunately, you cannot submit IRS Form 8822 online at this time. You need to print the completed form and mail it to the IRS. It's essential to follow this procedure, particularly if you're managing a Louisiana name change with IRS because precise record updates aid in seamless tax processing. Always check the IRS instructions for the proper mailing address to ensure efficient handling of your request.

Yes, the name on your W-2 must match the name on your Social Security card. This requirement is crucial, especially if you are undergoing a Louisiana name change with IRS. Discrepancies can lead to delays in tax processing and potential issues with your refunds. Always make sure your employer has your correct name to avoid any complications come tax season.

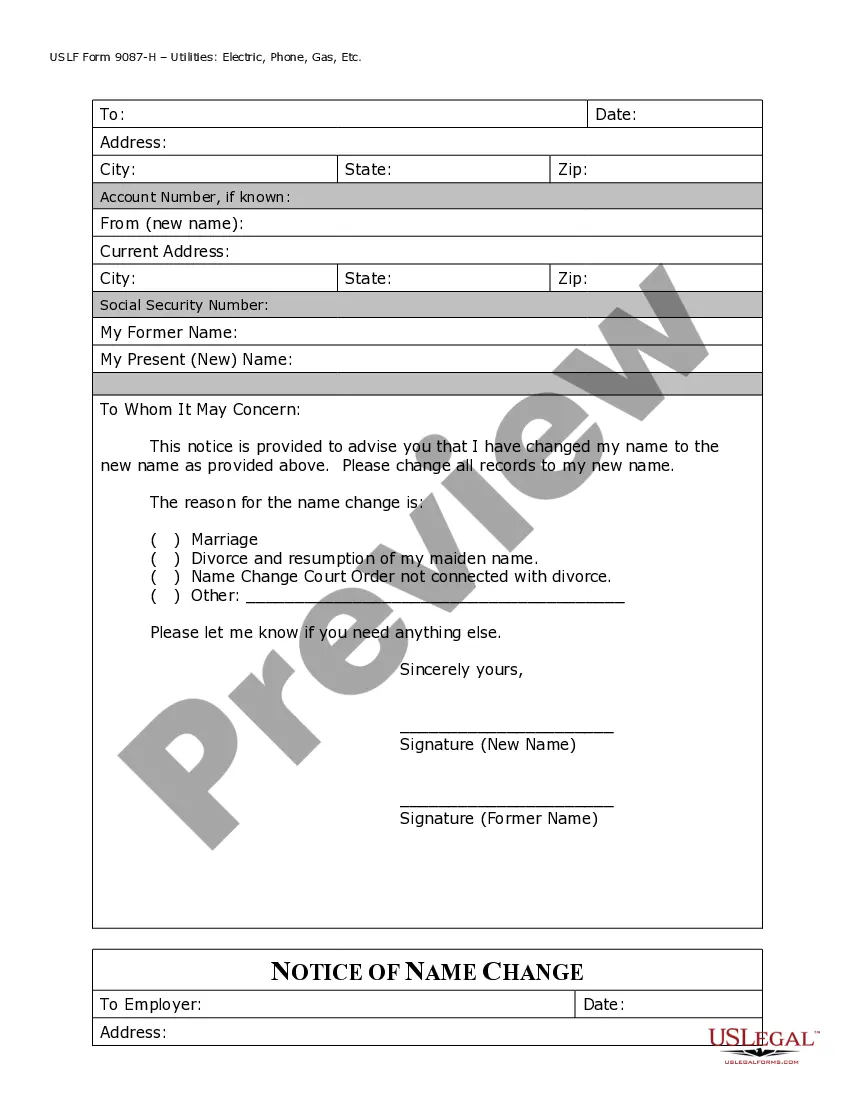

To notify the IRS of your name change, you should complete Form 8822 and specify your new name. If your name change is part of a Louisiana name change with IRS, ensure the name on the form matches the new name on your Social Security card. You'll need to send the completed form to the IRS at the address provided in the instructions. This alerts the IRS to your updated information, helping maintain accurate tax records.

The easiest way to change your address with the IRS is to use Form 8822. You simply fill out the form and send it to the IRS to reflect your new address. This is particularly important if you've experienced a Louisiana name change with IRS, as it keeps your account information correct. An updated address ensures that the IRS sends any correspondence and tax documents to the right place.

To update your information with the IRS, you'll need to complete Form 8822, which is specifically designed for changes to your address and name. If you're dealing with a Louisiana name change with IRS, you must ensure that the updated name matches your legal documents. Once you fill out the form, mail it to the address listed in the instructions. Remember, this process ensures that your records remain current and help you avoid potential issues with your tax filings.

To correct an IRS form, you must submit an amended return using Form 1040-X, or the equivalent form for the type of tax return involved. Clearly indicate the changes and provide any additional information needed. If your name has recently changed, ensure that your corrected IRS form reflects this, especially if you're navigating a Louisiana name change with IRS matters.

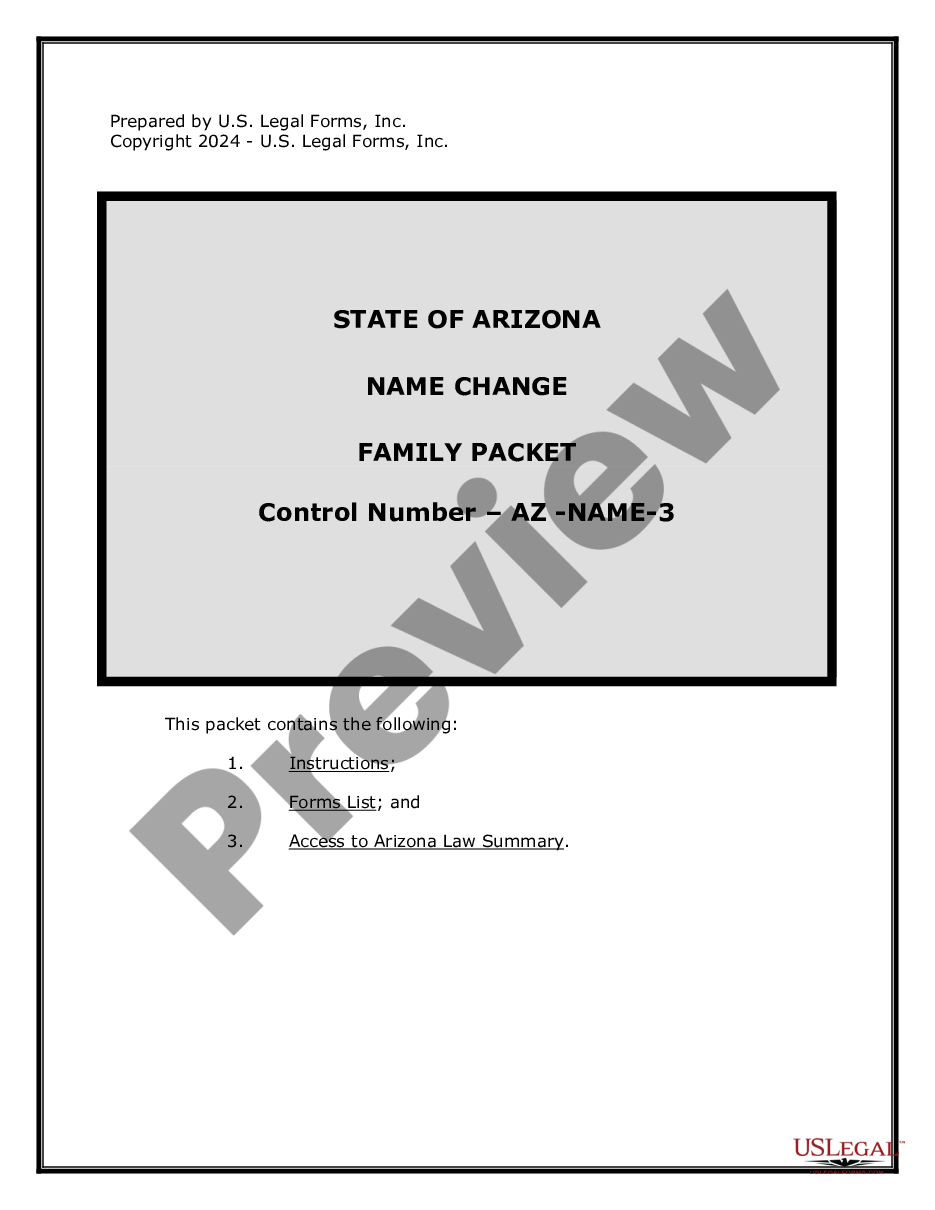

Legally changing your name in Louisiana involves filing a petition in court, followed by a hearing. You will need to provide a valid reason for your name change and submit all required documentation. After approval, ensure to update your IRS information to align with your new legal identity, particularly if this affects tax obligations.

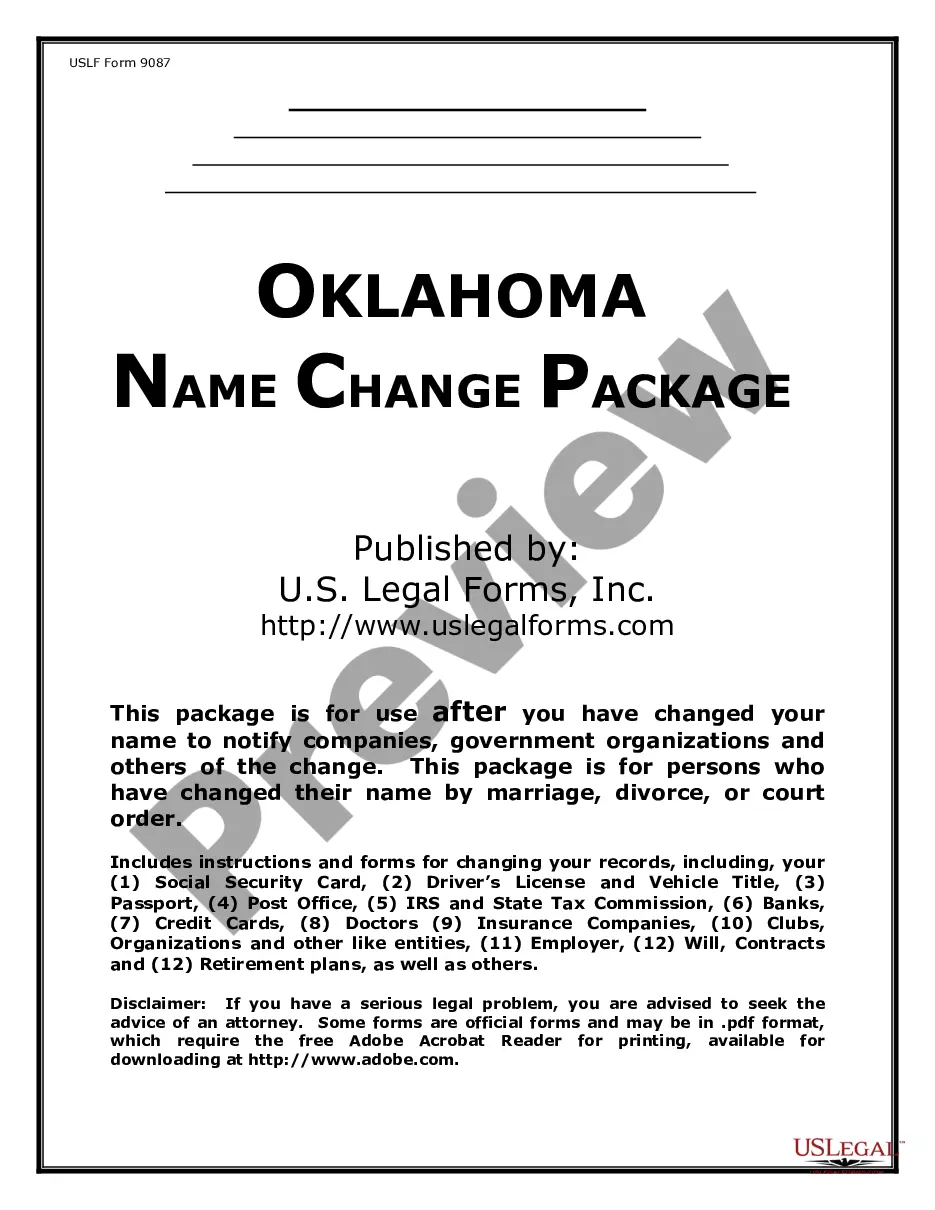

To change the name of your small business, begin by checking name availability with Louisiana's Secretary of State. Once you find an available name, file the necessary forms for an official name change. Don't forget to update your IRS records reflecting your new business name as part of the Louisiana name change with IRS.

Indeed, Louisiana does require a 'Doing Business As' (DBA) registration if your business operates under a name different from its legal name. This ensures transparency in business transactions and helps avoid legal issues. A proper DBA registration can facilitate a smooth Louisiana name change with IRS processes too.