Iowa Llc Operating Agreement With Non Voting Members

Description

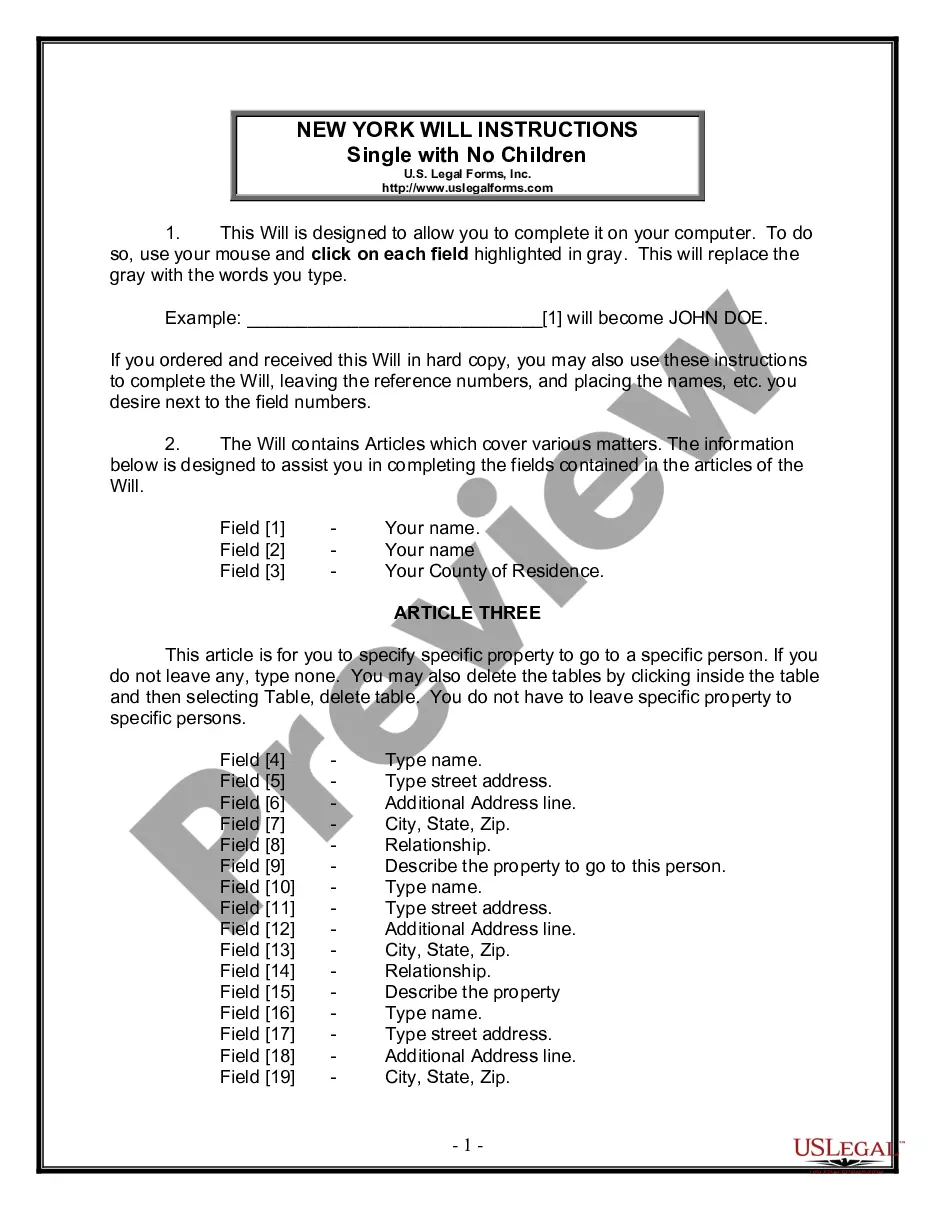

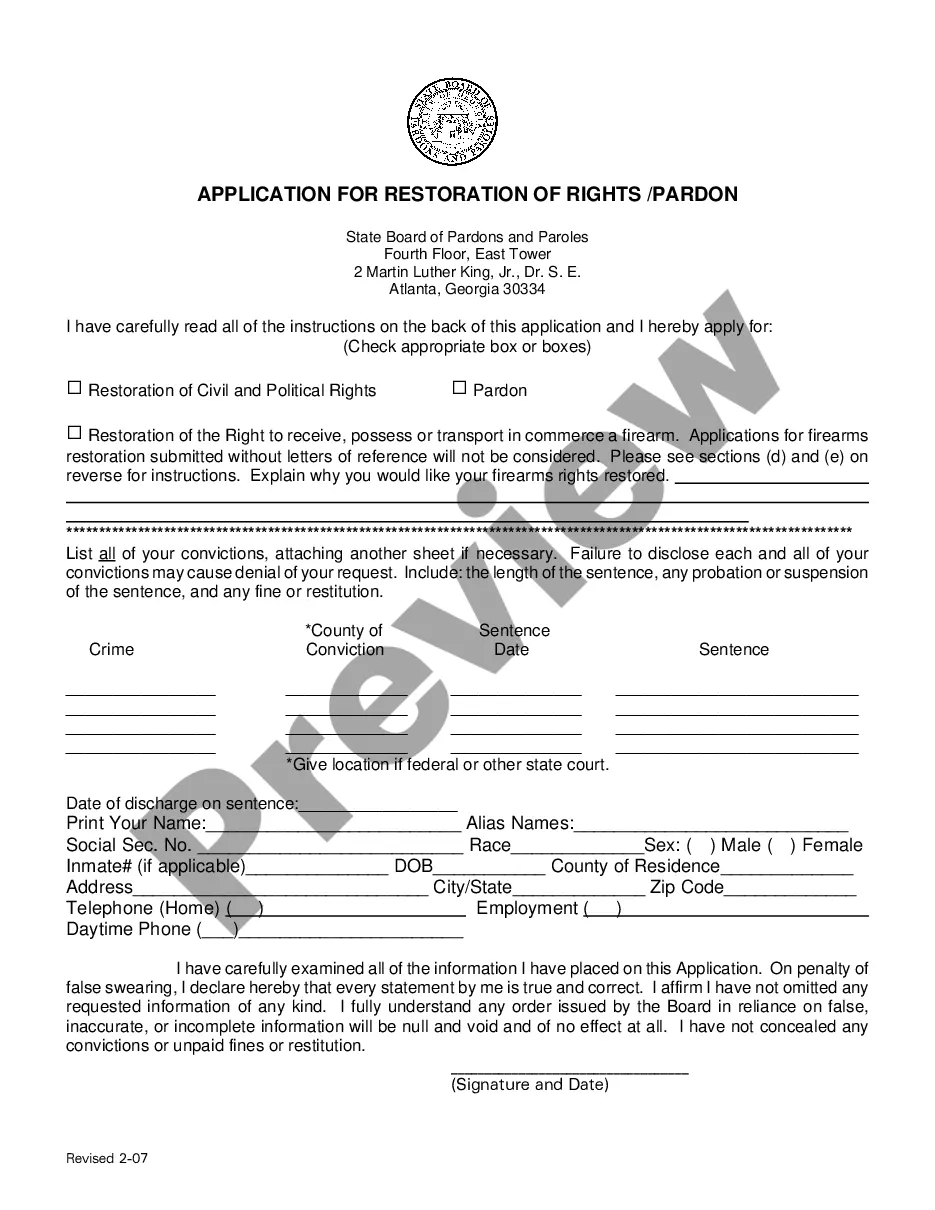

How to fill out Iowa Limited Liability Company LLC Operating Agreement?

Whether for business purposes or for personal affairs, everyone has to deal with legal situations sooner or later in their life. Filling out legal papers demands careful attention, starting with picking the right form sample. For instance, when you select a wrong version of the Iowa Llc Operating Agreement With Non Voting Members, it will be turned down once you send it. It is therefore crucial to get a dependable source of legal papers like US Legal Forms.

If you have to obtain a Iowa Llc Operating Agreement With Non Voting Members sample, stick to these simple steps:

- Find the sample you need by using the search field or catalog navigation.

- Examine the form’s description to make sure it suits your case, state, and region.

- Click on the form’s preview to examine it.

- If it is the wrong form, get back to the search function to find the Iowa Llc Operating Agreement With Non Voting Members sample you need.

- Download the template if it matches your needs.

- If you have a US Legal Forms profile, just click Log in to access previously saved templates in My Forms.

- In the event you don’t have an account yet, you may download the form by clicking Buy now.

- Select the correct pricing option.

- Finish the profile registration form.

- Select your payment method: you can use a bank card or PayPal account.

- Select the file format you want and download the Iowa Llc Operating Agreement With Non Voting Members.

- Once it is saved, you can complete the form by using editing software or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you never need to spend time seeking for the appropriate sample across the web. Use the library’s simple navigation to get the proper form for any occasion.

Form popularity

FAQ

An Iowa single-member LLC operating agreement is a legal document that is created specifically for use by a sole proprietor so they would have the ability to establish company ownership as well, any specific company procedures and policies.

A limited liability company (LLC) is a business entity type that can have more than one owner. These owners are referred to as ?members? and can include individuals, corporations, other LLCs, and foreign entities. Most states do not restrict LLC ownership, and there is generally no maximum number of members.

LLCs can create different classes of LLC Members in the Operating Agreement, with different voting rights based on factors like total ownership interest, capital contributions, or management responsibilities.

Without the operating agreement, your state might not acknowledge you as an LLC, which means someone could sue you without there being any shield to protect your personal assets. You've already put in the time and effort to form your LLC to get liability protection.

Is an Operating Agreement required for an LLC in Iowa? As per Section 489.110 of the Iowa Statutes, Iowa LLC Operating Agreements aren't required for LLCs in Iowa. But while it's not required in Iowa to conduct business, we strongly recommend having an Operating Agreement for your LLC.