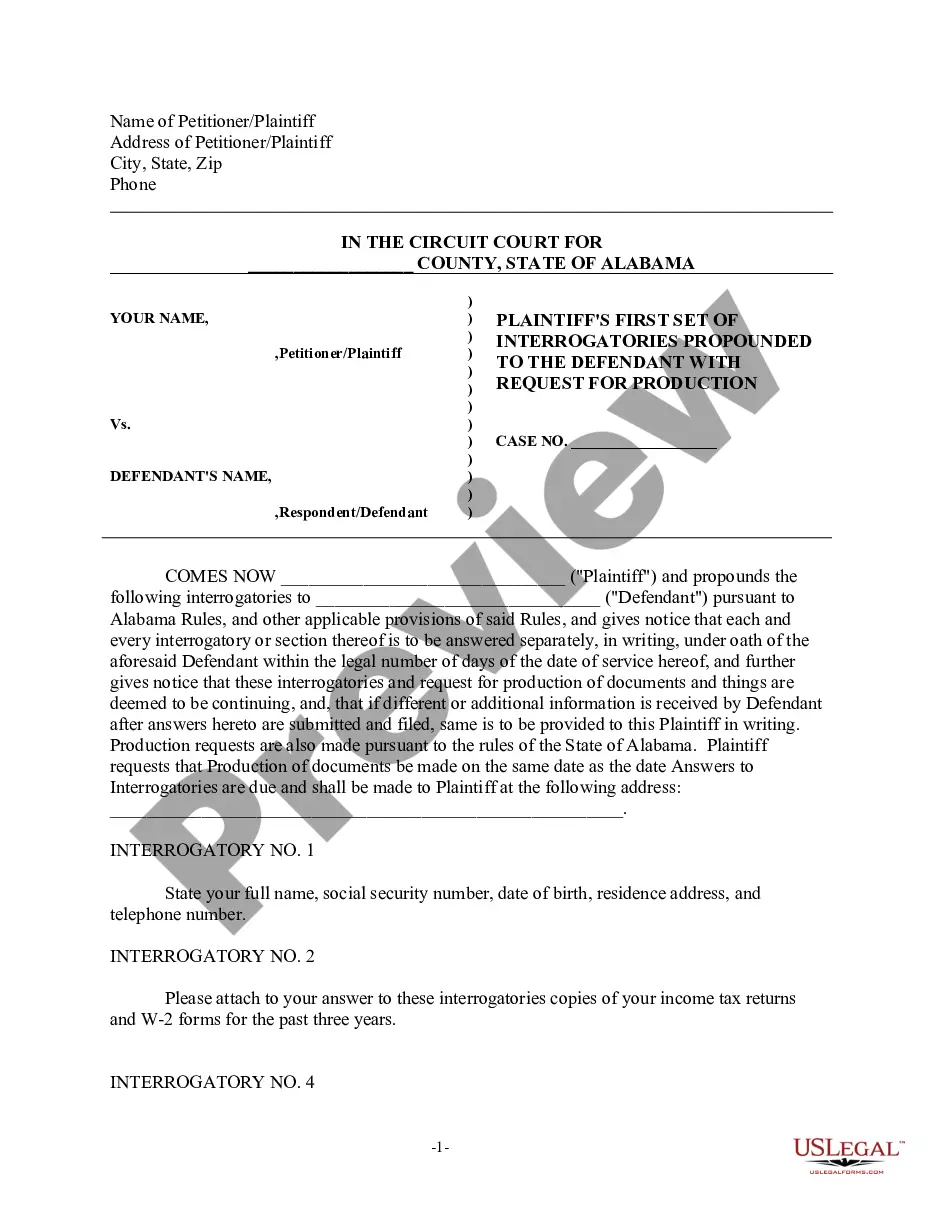

Georgia Property Ga With Utilities Included

Description

How to fill out Georgia Property Management Package?

Getting a go-to place to take the most recent and relevant legal templates is half the struggle of dealing with bureaucracy. Discovering the right legal documents needs accuracy and attention to detail, which is why it is crucial to take samples of Georgia Property Ga With Utilities Included only from trustworthy sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You may access and see all the details concerning the document’s use and relevance for your circumstances and in your state or region.

Consider the following steps to finish your Georgia Property Ga With Utilities Included:

- Utilize the library navigation or search field to locate your sample.

- View the form’s information to ascertain if it fits the requirements of your state and county.

- View the form preview, if there is one, to make sure the template is definitely the one you are looking for.

- Go back to the search and look for the correct document if the Georgia Property Ga With Utilities Included does not match your needs.

- When you are positive regarding the form’s relevance, download it.

- If you are a registered customer, click Log in to authenticate and gain access to your selected forms in My Forms.

- If you do not have a profile yet, click Buy now to get the template.

- Pick the pricing plan that suits your preferences.

- Go on to the registration to complete your purchase.

- Complete your purchase by selecting a transaction method (credit card or PayPal).

- Pick the file format for downloading Georgia Property Ga With Utilities Included.

- When you have the form on your device, you may modify it using the editor or print it and finish it manually.

Get rid of the headache that comes with your legal documentation. Discover the extensive US Legal Forms library to find legal templates, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

You may be eligible for the HB 162 Surplus Tax Refund if you: File your Individual Income Tax Return for tax year 2021 and tax year 2022 by the April 18, 2023 deadline (or by October 16, 2023 if an extension was granted) Had a tax liability for tax year 2021. Are a Georgia resident, part-year resident, or nonresident.

You must be 65 years old or older. You must be living in the home to which the exemption applies on January 1 of the year for which the exemption applies. Your net income, or the combined net income of you and your spouse must not be greater than $10,000 for the preceding year.

Personal property in the State of Georgia is generally defined as any movable property; that is, property that is not permanently affixed to and part of real estate.

The Internal Revenue Service splits personal property into two types: Tangible personal property ? includes vehicles, antiques, silver, artwork, collectibles, furniture, machinery and equipment. Intangible personal property ? includes patents, copyrights, stocks and the goodwill value of a business.