Georgia Property Ga For Rent

Description

How to fill out Georgia Property Management Package?

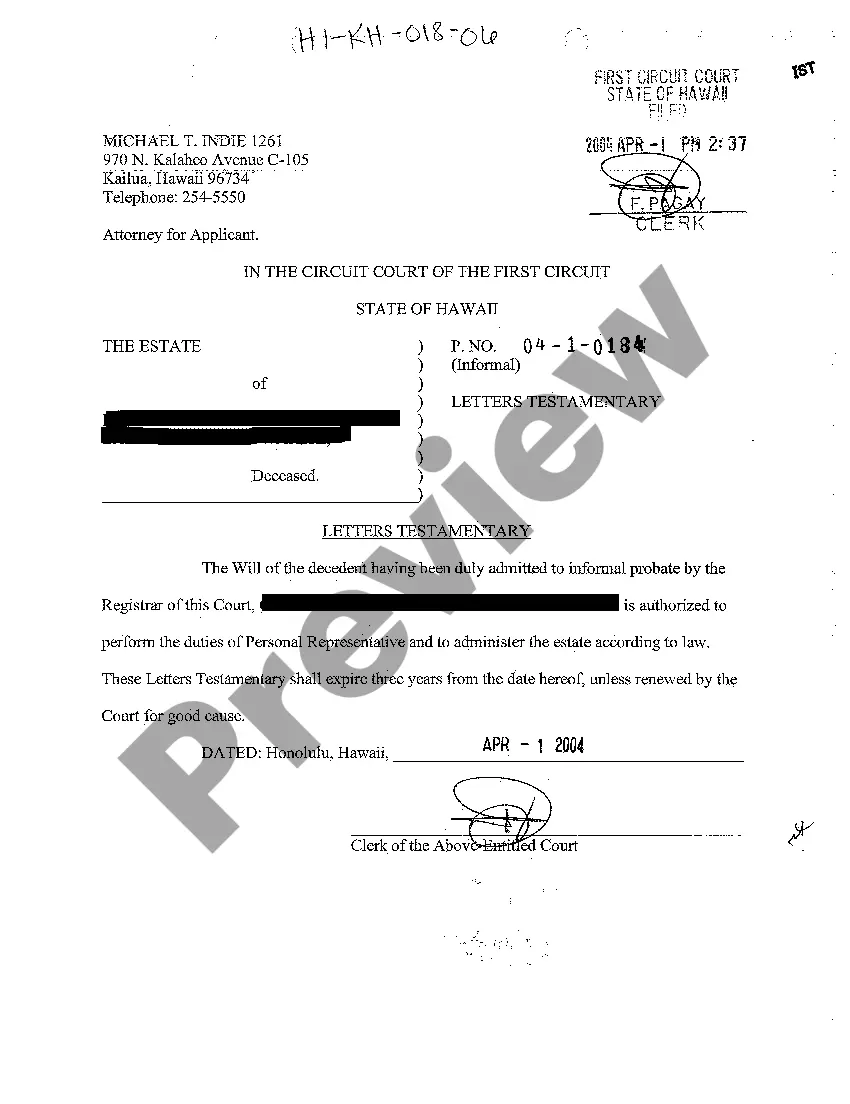

Accessing legal templates that comply with federal and local laws is crucial, and the internet offers a lot of options to choose from. But what’s the point in wasting time looking for the right Georgia Property Ga For Rent sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the biggest online legal library with over 85,000 fillable templates drafted by lawyers for any business and personal situation. They are easy to browse with all papers arranged by state and purpose of use. Our experts keep up with legislative changes, so you can always be confident your paperwork is up to date and compliant when acquiring a Georgia Property Ga For Rent from our website.

Getting a Georgia Property Ga For Rent is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, follow the guidelines below:

- Examine the template using the Preview option or through the text outline to ensure it meets your needs.

- Browse for a different sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve located the correct form and opt for a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Select the best format for your Georgia Property Ga For Rent and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and fill out earlier purchased forms, open the My Forms tab in your profile. Take advantage of the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

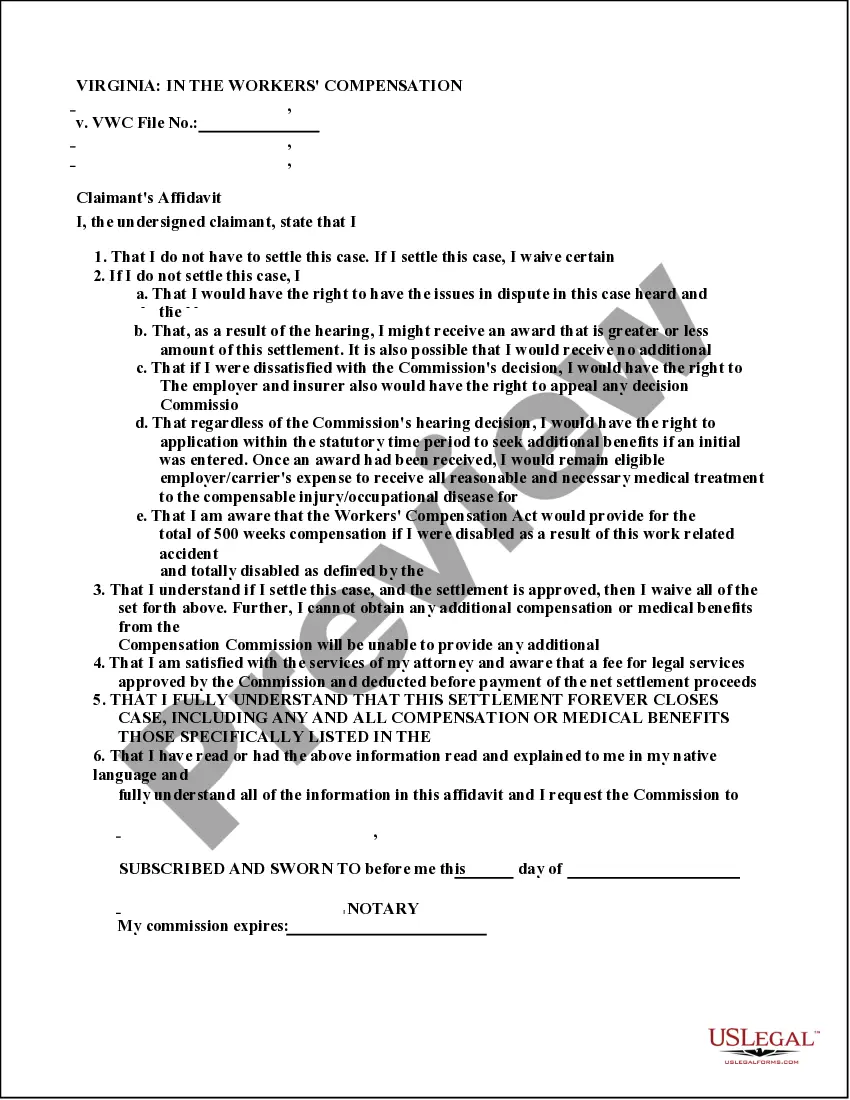

CRITERIA REQUIREMENTS: Proof of Current Income: It is important that you provide the source of income that will cover the term of the lease. ... Income Requirement: ... Credit History: Must have satisfactory credit. ... Criminal History: Must have satisfactory criminal background.

However, Georgia has no rent stabilization or rent control laws. This enables landlords to set rent and increase it across the state, given that they provide proper notice. On the other hand, the landlord can increase the rent with certain discretions, as much as they wish, and whenever they want.

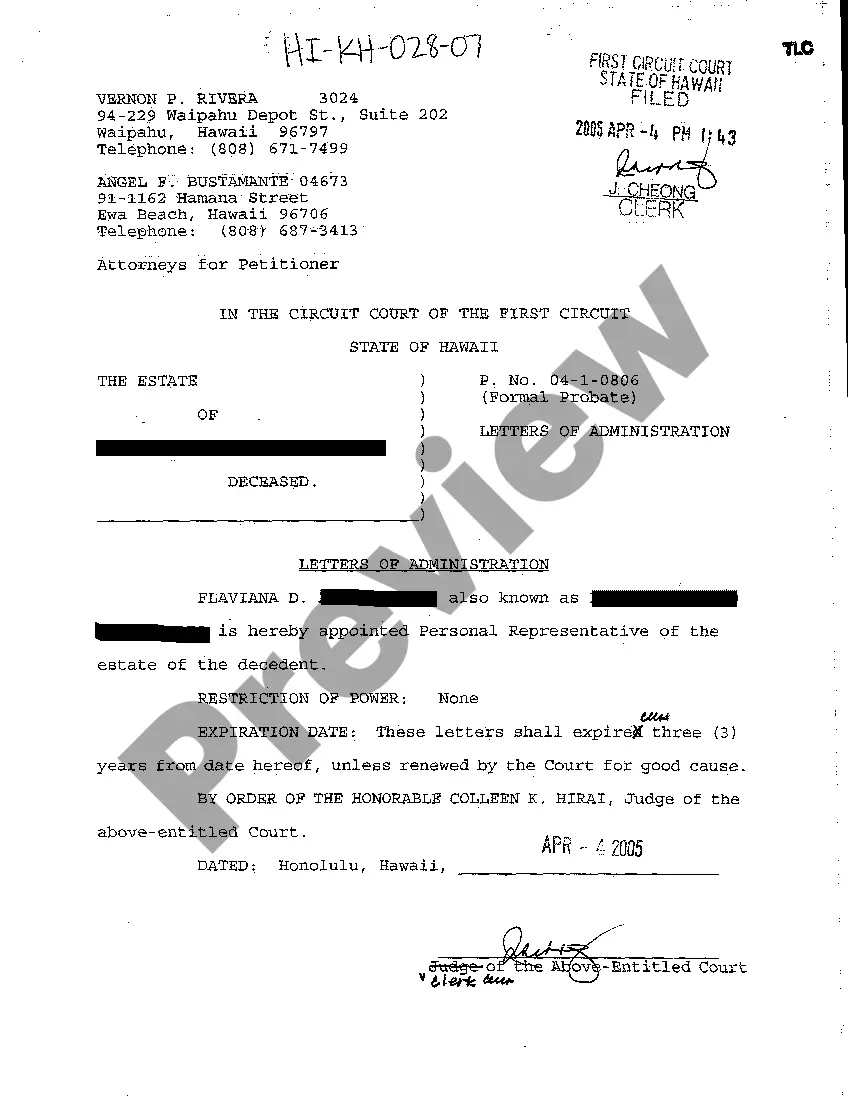

Some examples of Georgia source income are: Wages. Georgia Lottery Winnings. Income from flow through entities (S-Corporations, Partnerships, LLCs, Trust, and estates.

Georgia business licenses There is no Georgia landlord-tenant law stating local landlords need rental licenses. However, you may need a license in some cities or counties. Check with your local authorities to learn the rules in your part of the state.

In Georgia, residential rental income is taxed at a flat rate of 5%. However, operating expenses such as mortgage interest, property taxes, property insurance, structural improvements, and pest control can reduce your taxable rental property income.