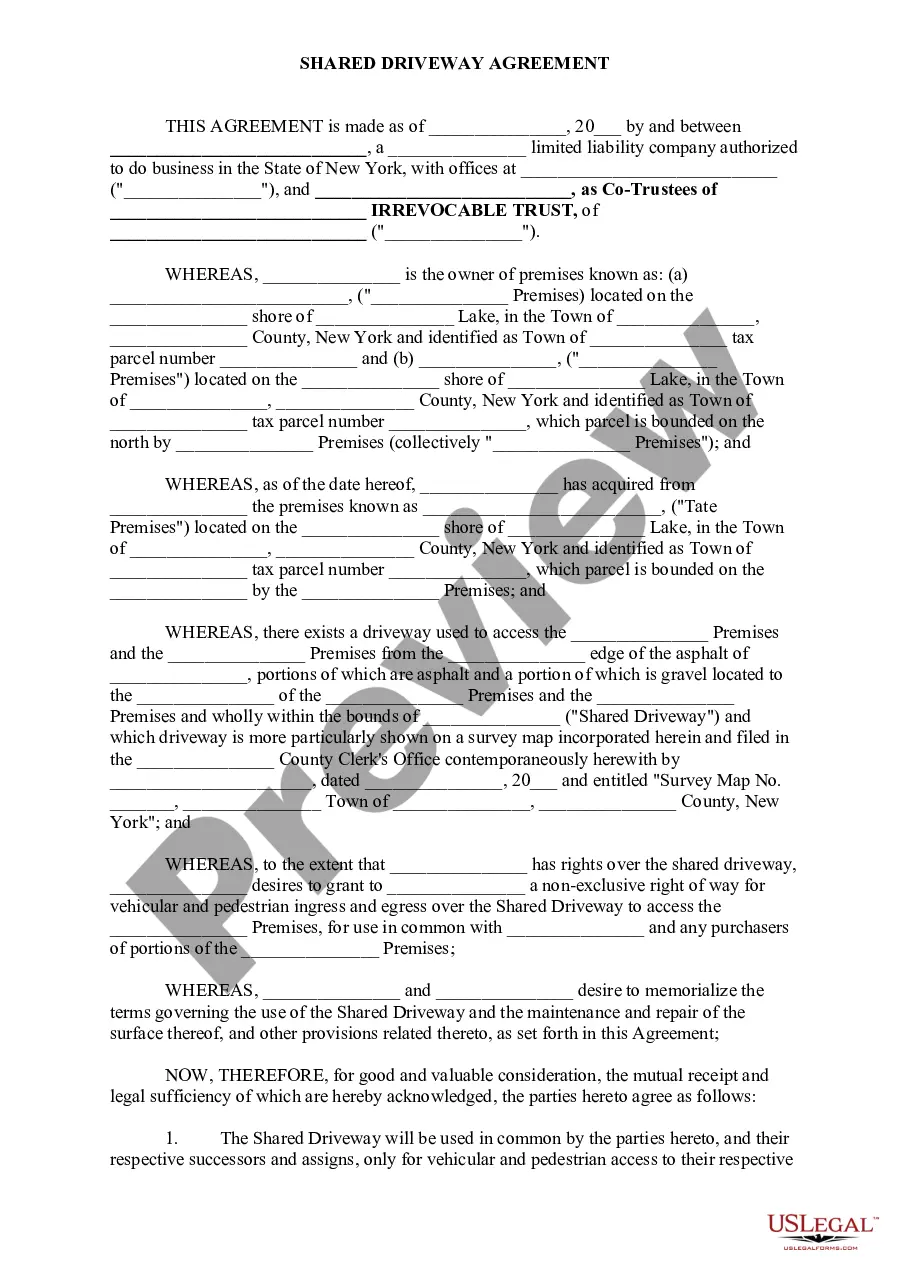

Mortgage Deed Template With Calculator

Description

How to fill out Florida Mortgage Deed From Individual?

Acquiring a reliable resource to obtain the latest and pertinent legal templates is a significant part of navigating bureaucracy.

Identifying the appropriate legal documents necessitates precision and carefulness, which is why it is essential to obtain samples of Mortgage Deed Template With Calculator exclusively from credible sources, such as US Legal Forms. An incorrect template will squander your time and prolong your current situation. With US Legal Forms, there's not much to be concerned about. You can access and review all the specifics regarding the document's application and significance for your circumstances and in your state or county.

Eliminate the stress associated with your legal documentation. Explore the comprehensive US Legal Forms library to discover legal templates, assess their applicability to your situation, and download them immediately.

- Utilize the library navigation or search bar to find your sample.

- Examine the form’s details to determine if it meets the criteria of your state and county.

- Check the form preview, if available, to ensure the template is the one you need.

- Return to the search to locate the correct template if the Mortgage Deed Template With Calculator does not fulfill your criteria.

- Once you are confident about the form’s applicability, download it.

- If you are an authorized user, click Log in to verify and access your selected templates in My documents.

- If you haven't created an account yet, click Buy now to acquire the template.

- Select the pricing option that suits your requirements.

- Proceed to the registration to complete your purchase.

- Conclude your purchase by choosing a payment method (credit card or PayPal).

- Select the document format for downloading Mortgage Deed Template With Calculator.

- Once you have the form on your device, you may modify it using the editor or print it and fill it out manually.

Form popularity

FAQ

Tax Rate. In all Florida counties except Miami-Dade, the tax rate imposed on documents subject to tax is 70 cents on each $100 or portion thereof of the total consideration.

It may be different from the purchase-sale value. The mortgage value is the reference value used when applying for and arranging the mortgage and it constitutes the Bank's guarantee. The mortgage value will determine how much the Bank will lend for the transaction.

A mortgage is a temporary transfer of property in order to secure a loan of money. The person who owns the land is the 'mortgagor'. The person lending the money is the 'mortgagee'.

Tax Rate. In all Florida counties except Miami-Dade, the tax rate imposed on documents subject to tax is 70 cents on each $100 or portion thereof of the total consideration.

You can calculate your total interest by using this formula: Principal loan amount x interest rate x loan term = interest.