Fl Enhanced Husband Withdrawal

Description

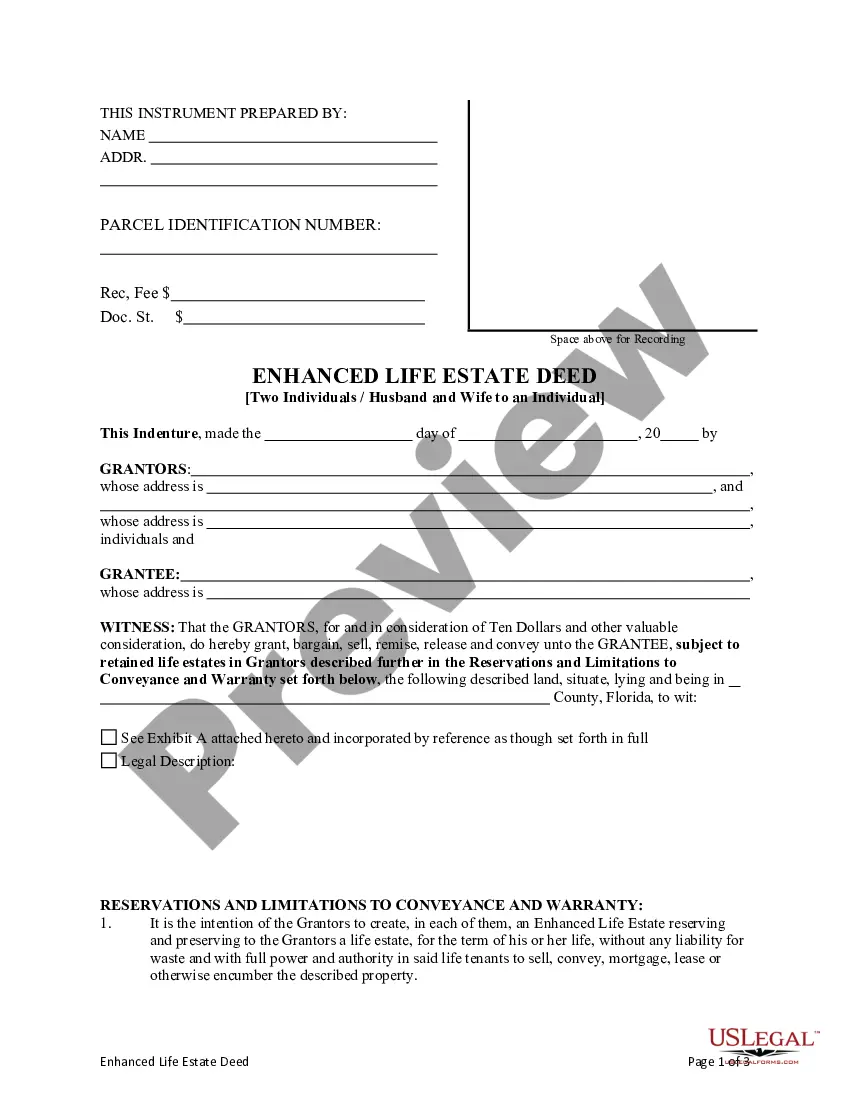

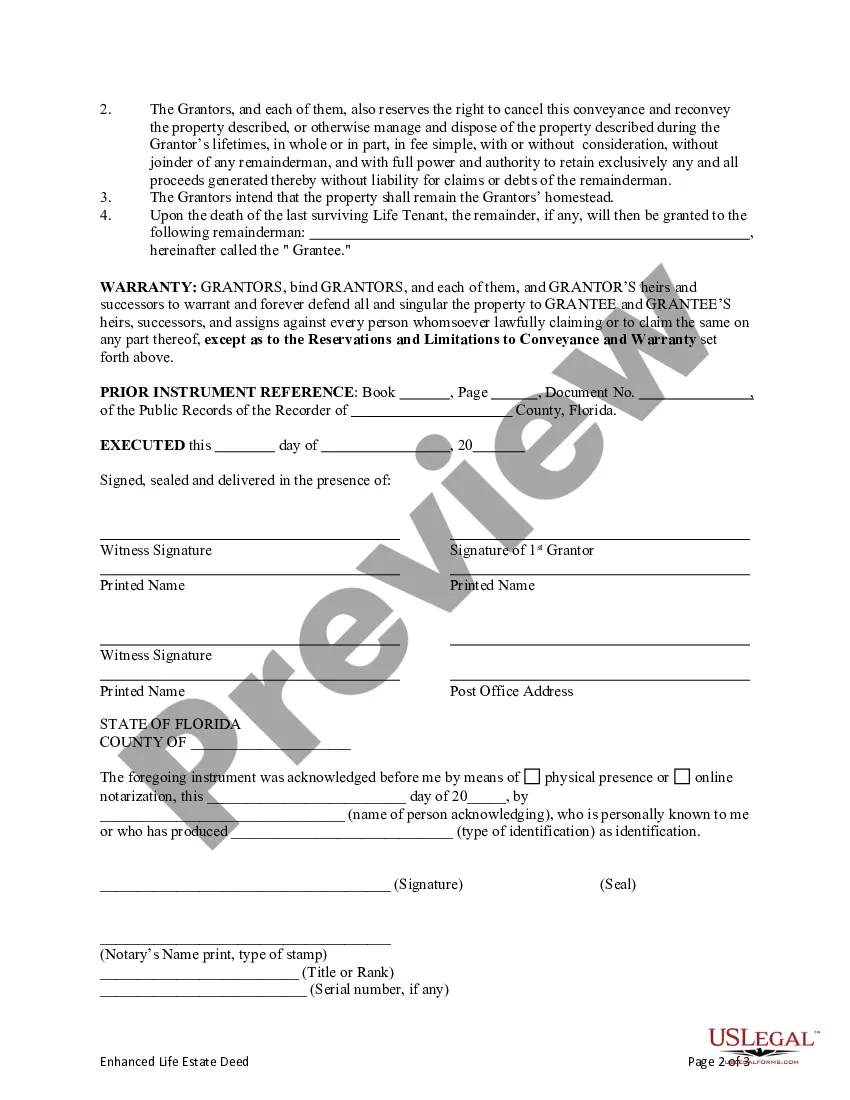

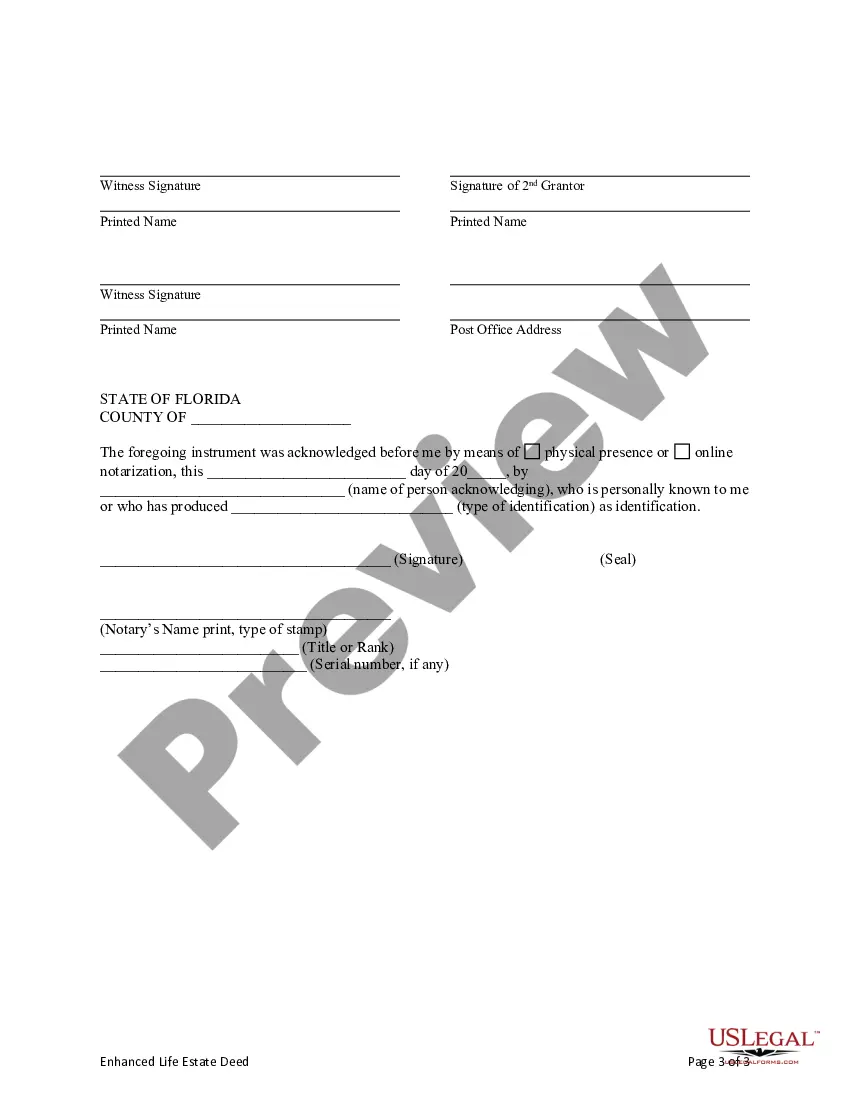

How to fill out Florida Enhanced Life Estate Or Lady Bird Deed - Two Individual / Husband And Wife To Individual?

Regardless of whether for corporate reasons or private matters, everyone faces legal issues at some stage in life.

Filling out legal paperwork requires meticulous focus, beginning with selecting the correct template.

Once downloaded, you can complete the form using editing software or print it out and fill it in manually. With an extensive catalog from US Legal Forms available, you won't need to waste time searching for the right sample online. Utilize the library's user-friendly navigation to find the suitable template for any circumstance.

- Obtain the template you require by utilizing the search feature or browsing the catalog.

- Review the form's details to ensure it is appropriate for your situation, state, and county.

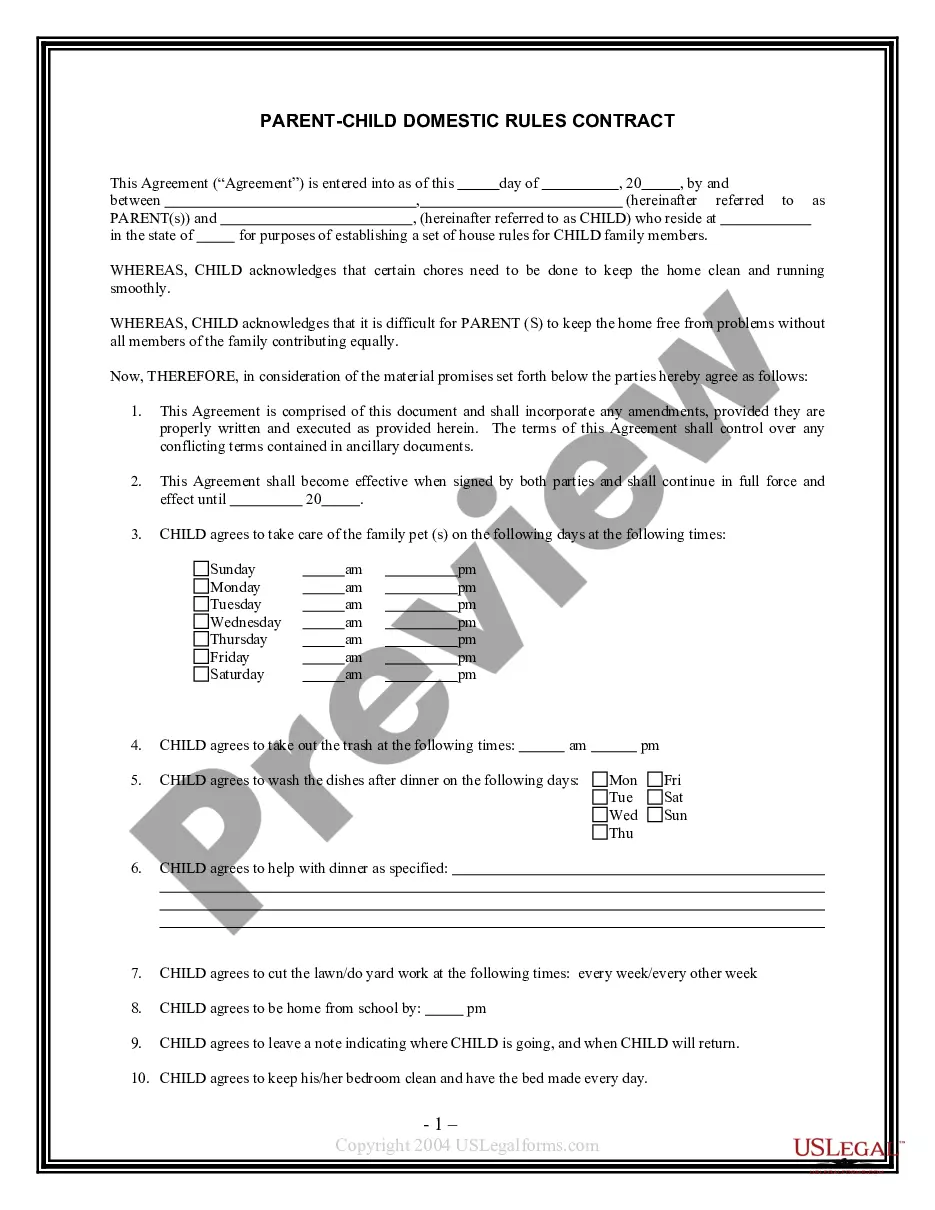

- Click on the form's preview to inspect it.

- If it is the wrong form, return to the search feature to locate the Fl Enhanced Husband Withdrawal template you need.

- Download the template when it meets your specifications.

- If you possess a US Legal Forms account, simply click Log in to access previously stored templates in My documents.

- In case you lack an account, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the registration form for your profile.

- Choose your payment method: either a credit card or PayPal account.

- Select the file format you prefer and download the Fl Enhanced Husband Withdrawal.

Form popularity

FAQ

In a perfect world, you would file a QDRO, or qualified domestic relations order, as soon as you and your former partner agree on the basics of your divorce proceedings and settlement. There's no limit on how long after the divorce you can file a QDRO, but timeliness is ideal.

Assets distributed from a QDRO are exempt from a 10% early withdrawal penalty on any funds withdrawn if the person is under the age of 59½. But any amount that is paid directly to you instead of being rolled over to an eligible retirement plan will be subject to a mandatory withholding tax.

If I decide to cash out my interest in my former spouse's 401(k)/403(b)/457(b) Plan via QDRO, will I have to pay any taxes on the money I receive? Yes. You will have to pay ordinary taxes based on your own personal tax bracket. The Plan Administrator will withhold 20% of the funds payable to you for estimated taxes.

The time it takes to receive funds from a QDRO (qualified domestic relations order) can vary widely based on several factors. You can typically expect the entire process to take between six and eight months, but it can be as fast as two months or take as long as two years or more.

California QDRO Process Step by Step Step 1 ? Gather Information. ... Step 2 ? Draft the QDRO. ... Step 3 ? Obtain Spousal Approval. ... Step 4 ? Obtain Plan Administrator Approval. ... Step 5 ? Have All Parties Sign the QDRO. ... Step 6 ? Obtain Judge Approval. ... Step 7 ? Send a Certified Copy to the Plan Administrator.