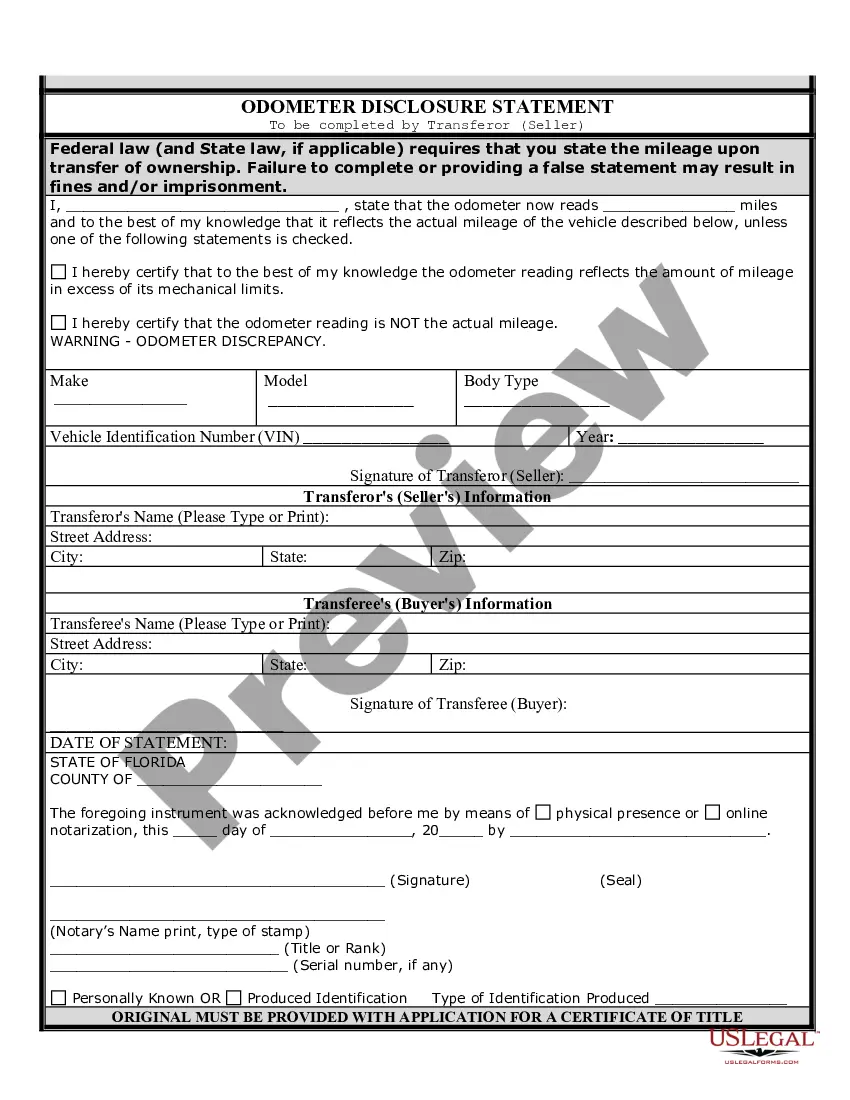

Florida Odometer Statement With Text

Description

How to fill out Florida Bill Of Sale Of Automobile And Odometer Statement?

Finding a reliable destination to obtain the latest and most pertinent legal templates is a significant portion of dealing with bureaucracy.

Locating the appropriate legal documents requires precision and carefulness, which is why sourcing samples of the Florida Odometer Statement With Text only from trustworthy providers, such as US Legal Forms, is crucial. An incorrect template may squander your time and hinder your current situation.

Once you have the form saved on your device, you can modify it using the editor or print it out and fill it manually. Eliminate the stress associated with your legal paperwork. Explore the extensive US Legal Forms catalog to discover legal examples, verify their applicability to your case, and download them instantly.

- Utilize the library navigation or search feature to identify your template.

- Examine the form’s details to verify if it aligns with the regulations of your state and area.

- Access the form preview, if available, to confirm that the template is truly what you need.

- Return to the search to find the suitable document if the Florida Odometer Statement With Text does not fulfill your requirements.

- Once you are certain of the form’s appropriateness, proceed to download it.

- If you are a registered user, click Log in to validate and access your selected templates in My documents.

- If you do not possess an account yet, click Buy now to acquire the template.

- Choose the pricing plan that suits your needs.

- Proceed to the registration to complete your purchase.

- Conclude your transaction by selecting a payment method (card or PayPal).

- Choose the document format for downloading the Florida Odometer Statement With Text.

Form popularity

FAQ

The UCC-1 form, or Financing Statement, is a form you must file to place a lien on property or assets belonging to someone you have made a loan to. This creates a public record and serves as evidence in any legal dispute over liability.

A Connecticut taxable estate must file Form CT-4422 UGE with DRS to request the release of a lien. A separate Form CT-4422 UGE must be filed for each property address requiring a release of lien. Form CT-4422 UGE will be considered incomplete if an affirmation box agreeing to payment is not checked.

The UCC-1 form, or Financing Statement, is a form you must file to place a lien on property or assets belonging to someone you have made a loan to. This creates a public record and serves as evidence in any legal dispute over liability.

Special note on mechanics lien signatures. Connecticut law says that liens must be attested to under oath and must be notarized to be valid. ... Prepare the lien form. ... Sign & notarize the form. ... Deliver the lien to the town clerk. ... Serve a copy on the property owner.

Mechanic's liens in Connecticut must be served on the property owner and recorded on land records within 90 days of the last date substantial work was done. Once a mechanic's lien is recorded on the land records, it starts a one year clock to foreclose the lien.

Removing a CT Car Title Lien Once your car loan agreement is fulfilled, you do not have to apply for a new title. The Connecticut Department of Motor Vehicles requires the lienholder to sign off on the title and send it to you, and/or provide you with a lien release letter on the their letterhead attached to the title.

A Connecticut taxable estate must file Form CT-4422 UGE with DRS to request the release of a lien. A separate Form CT-4422 UGE must be filed for each property address requiring a release of lien. Form CT-4422 UGE will be considered incomplete if an affirmation box agreeing to payment is not checked.

Title services If your loan has been satisfied, you don't need to request a new certificate of title removing the previous lienholder. You may retain the stamped paid certificate of title from your lienholder. This title can be used for the future sale or transfer of the vehicle.

Limitation period. The lien shall be effective for a period of fifteen years from the date of filing unless discharged as provided in section 12-195g. A notice of tax lien shall not be effective if filed more than two years from the date of assessment for the taxes claimed to be due.

This Connecticut lien notice form is required to be sent by all potential claimants that did not contract directly with the property owner within 90 days of the claimant's last furnishing of labor or materials to the project. Plan ahead, as the deadline to file a CT mechanics lien is the same timeframe.