State Of Colorado Operating Agreement For Llc

Description

How to fill out Colorado Limited Liability Company LLC Operating Agreement?

It’s clear that you cannot instantly become a legal expert, nor can you swiftly learn how to draft the State Of Colorado Operating Agreement For Llc without a specialized foundation.

Drafting legal documents is an extensive process that requires particular education and abilities.

So why not entrust the creation of the State Of Colorado Operating Agreement For Llc to the experts.

You can revisit your documents from the My documents section at any time.

If you’re a current client, simply Log In to find and download the template from the same section.

- Locate the document you need using the search feature at the top of the page.

- Preview it (if available) and read the accompanying description to determine if the State Of Colorado Operating Agreement For Llc is what you are looking for.

- Start your search anew if you need a different template.

- Sign up for a free account and select a subscription plan to obtain the form.

- Click Buy now. Once the purchase is finalized, you can acquire the State Of Colorado Operating Agreement For Llc, complete it, print it, and send or mail it to the appropriate individuals or entities.

Form popularity

FAQ

While it is not legally required, having an operating agreement (OA) for your LLC is highly recommended. A State of Colorado operating agreement for LLC helps you clarify roles, responsibilities, and operational procedures. It can also protect your personal assets by reinforcing the limited liability of your business. By using services like USLegalForms, you can easily create an effective OA that suits your specific needs.

If your LLC does not have an operating agreement, you may face challenges regarding management and operational disputes. The absence of a State of Colorado operating agreement for LLC leaves essential decisions unaddressed, leading to potential conflicts among members. Without this agreement, state default rules will apply, which may not align with your business intentions. It's wise to create one to avoid these complications.

Colorado does not require an LLC to have an operating agreement. However, creating a State of Colorado operating agreement for LLC is beneficial for managing the internal operations and relationships within the business. It provides clarity and structure, which can be especially helpful if disputes arise in the future. Therefore, while not mandatory, it is certainly advantageous.

While Colorado does not legally require an LLC to have an operating agreement, it is highly advisable to have one. A State of Colorado operating agreement for LLC sets forth essential guidelines and defines the rights and duties of members. Implementing this document promotes a stable operational framework and can prevent miscommunication among members. It ensures everyone understands their roles and obligations.

Yes, you can write your own operating agreement for an LLC. In fact, creating a customized State of Colorado operating agreement for LLC allows you to tailor the document to fit your unique business needs. You can outline roles, responsibilities, and procedures that suit your business model. Additionally, utilizing templates available on platforms like USLegalForms can simplify the process.

Yes, an LLC can exist without an operating agreement; however, it is not recommended. Without a State of Colorado operating agreement for LLC, you risk facing ambiguity regarding management roles and procedures. This ambiguity can lead to disagreements or disputes among members. Having a clear agreement helps to outline the operational structure and responsibilities.

Does my LLC Operating Agreement need to be notarized? No, your Operating Agreement doesn't need to be notarized. Each Member just needs to sign it. Once you (and the other LLC Members, if applicable) sign the Operating Agreement, then it becomes a legal document.

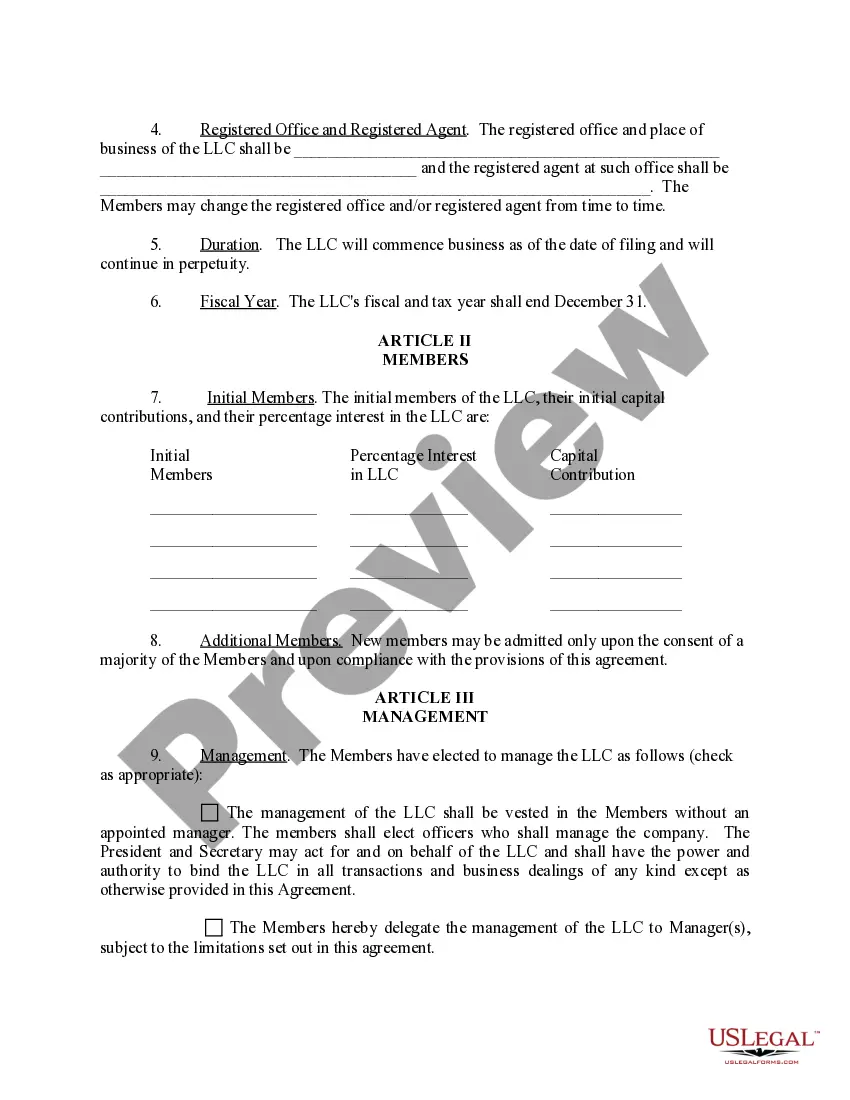

A Colorado single-member LLC operating agreement is a legal document that establishes operating terms between the owner and the business itself. The state of Colorado does not require an agreement, however, it is highly recommended that all businesses have one in place, no matter what the size of the business.

Colorado does not require you to submit an Operating Agreement to form your LLC. However, it is important for every LLC to have an Operating Agreement, establishing the rules and structure of the business.

Colorado does not require you to submit an Operating Agreement to form your LLC. However, it is important for every LLC to have an Operating Agreement, establishing the rules and structure of the business.