Work Hours And Overtime Calculator

Description

How to fill out California Production Bonus Pay Agreement For Construction?

Accessing legal document examples that adhere to national and local regulations is essential, and the internet provides a variety of choices.

But what’s the purpose of spending time looking for the proper Work Hours And Overtime Calculator template online when the US Legal Forms digital library already contains such forms compiled in one location.

US Legal Forms is the largest online legal repository featuring over 85,000 editable documents created by attorneys for every business and personal situation. They are easy to navigate, with all documents categorized by state and intended use. Our experts monitor legislative changes, so you can always rest assured that your form is current and compliant when obtaining a Work Hours And Overtime Calculator from our site.

Click Buy Now once you have found the appropriate form and select a subscription package. Create an account or Log In and complete the payment via PayPal or credit card. Choose the most suitable format for your Work Hours And Overtime Calculator and download it. All documents obtained through US Legal Forms are reusable. To re-download and complete previously purchased documents, visit the My documents section in your profile. Take advantage of the most comprehensive and user-friendly legal paperwork service!

- Acquiring a Work Hours And Overtime Calculator is swift and straightforward for both existing and new users.

- If you have an account with an active subscription, Log In and download the document sample you require in the preferred format.

- If you are new to our site, follow the instructions below.

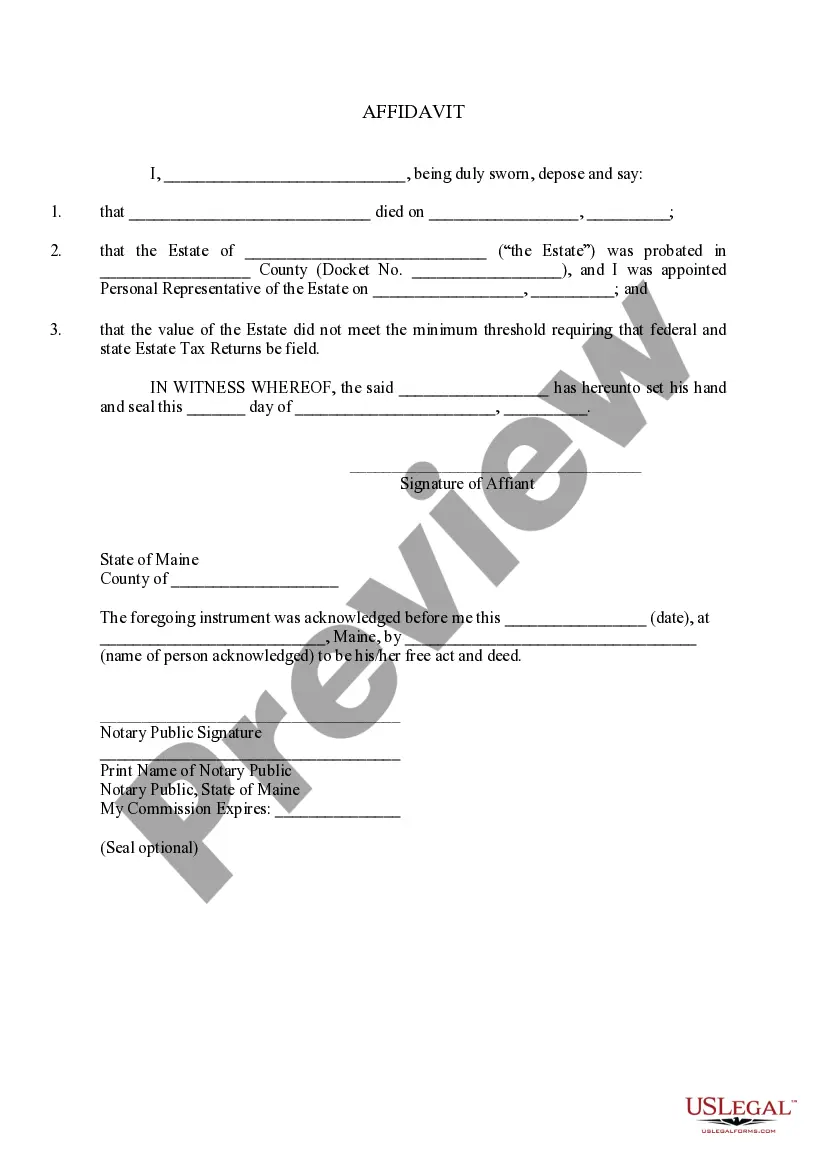

- Examine the template using the Preview option or through the text description to confirm it fits your requirements.

- Utilize the search feature at the top of the page to find an alternative sample if needed.

Form popularity

FAQ

To find out how much you earn at $19 an hour for 40 hours a week, multiply your hourly wage by the number of hours worked. In this case, $19 multiplied by 40 hours equals $760 for the week. A reliable Work hours and overtime calculator can help you determine your earnings quickly and easily, ensuring you understand your financial situation.

If the employee worked 45 hours and their hourly wage is $18. $18 multiplied by 1.5 equals $27. Multiply $27 by 5 (the number of overtime hours), which equals $135 - the amount you owe them for overtime. Multiply $18 by 40, which equals $720 ? the amount you owe them for the standard workweek.

The standard overtime rate is 1.5 times the employee's regular hourly wage. This number is also commonly known as ?time-and-a-half.? So if one employee makes $15 per hour, their overtime rate is $22.50 per hour ($15 x 1.5). If another employee makes $25 per hour, their overtime rate is $37.50 per hour ($25 x 1.5).

This means if your regular hourly rate is $9.00, and you work 50 hours during a given workweek, you should be receiving $135.00 in overtime pay that week ($9.00 x 1.5 = $13.50 x 10 OT hours = $135.00). Keep in mind, that is in addition to the 40 hours of regular wages.

How to calculate hours worked Step 1: Determine start and end time. Simple as that. ... Step 2: Convert time to military time. ... Step 3: Subtract start time from end time. ... Step 4: Subtract unpaid breaks. ... Step 5: Convert to decimal format. ... Step 6: Add up total hours for pay period.

Determine the employee's regular hourly rate. Compute the NSD rate by adding 10% of the regular hourly rate to the regular hourly rate. Multiply the NSD rate by 1.25 to get the overtime rate for work performed in excess of 8 hours. Multiply the overtime rate by the number of overtime hours worked.