Work For Overtime Hours

Description

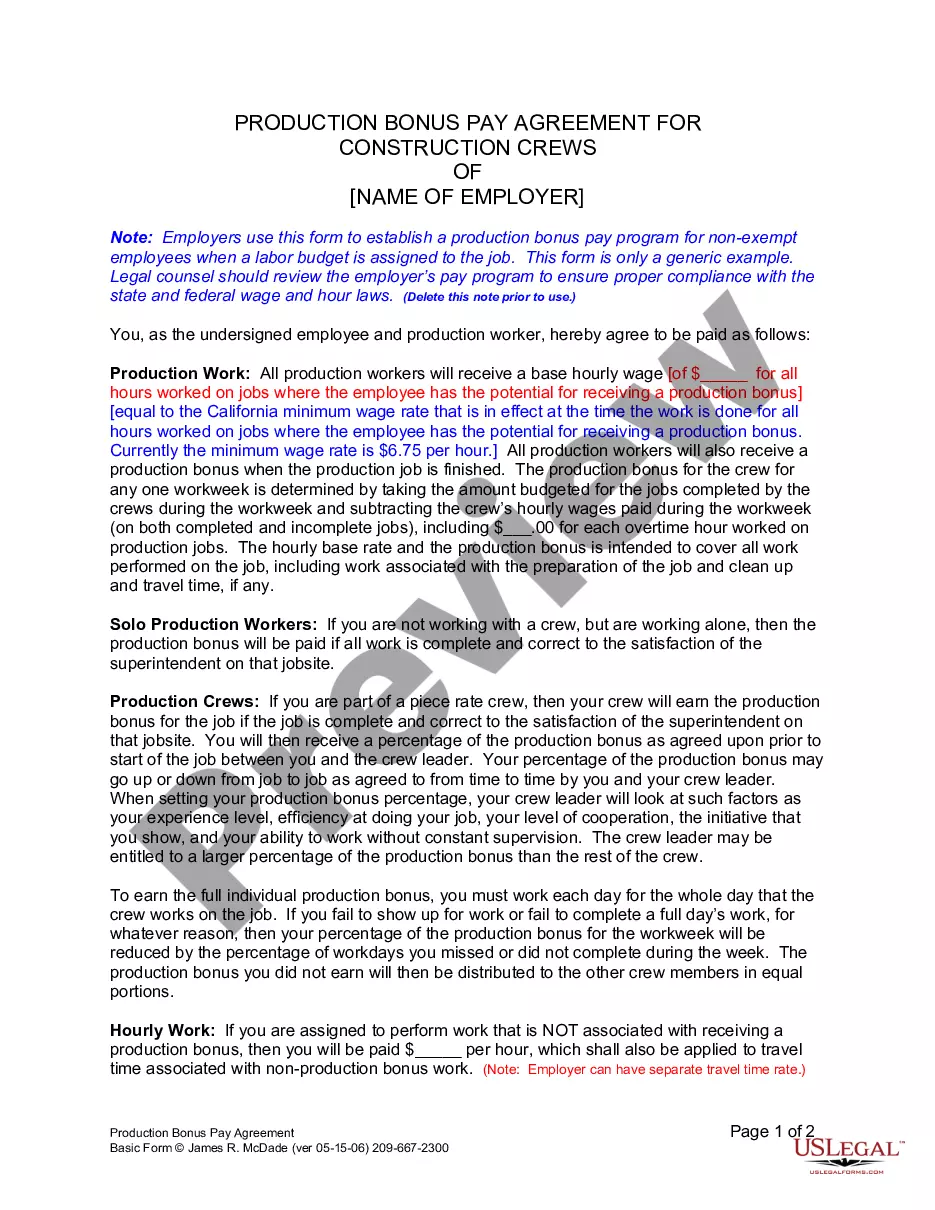

How to fill out California Production Bonus Pay Agreement For Construction?

Securing a reliable source for obtaining the latest and most suitable legal templates is half the battle of navigating bureaucracy.

Selecting the appropriate legal documents requires precision and meticulousness, which is why it is crucial to gather samples of Work For Overtime Hours exclusively from trustworthy sources, such as US Legal Forms.

Once you have the form on your device, you can modify it with the editor or print it out to complete it manually. Eliminate the stress associated with your legal documentation. Explore the extensive US Legal Forms library to find legal samples, evaluate their relevance to your situation, and download them immediately.

- Utilize the catalog navigation or search bar to locate your template.

- Access the form’s details to verify if it meets the standards of your state and locality.

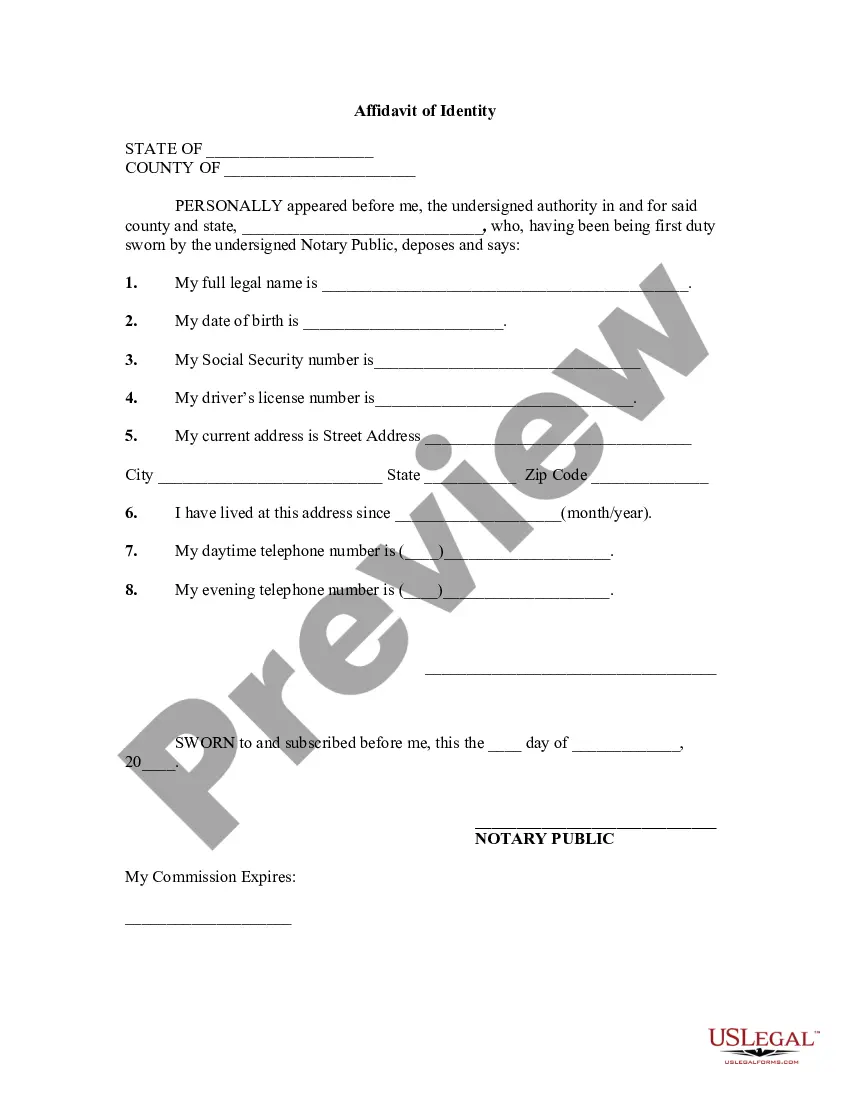

- View the form preview, if available, to confirm it is the document you need.

- Continue your search and seek the correct document if the Work For Overtime Hours does not fulfill your needs.

- If you are confident in the form's applicability, download it.

- If you are a registered user, click Log in to verify and access your chosen templates in My documents.

- If you haven't created an account yet, click Buy now to obtain the template.

- Choose the pricing plan that aligns with your needs.

- Proceed to the registration to complete your purchase.

- Finalize your transaction by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Work For Overtime Hours.

Form popularity

FAQ

The longest shift you can legally work often varies by state and industry. Generally, most employers aim to keep shifts under 16 hours for safety reasons. When you work for overtime hours, it's important to know that regulations may differ based on local labor laws. Always check with your employer and local labor department for specific guidelines.

No, 40 hours and 30 minutes do not count as overtime. Overtime typically starts once you exceed 40 hours in a work week. In this case, your overtime would begin only after you reach the 41-hour mark. It is important to track your hours accurately as you work for overtime hours, ensuring you are compensated fairly.

To calculate your overtime hours, first identify your regular work hours. Typically, hours beyond 40 in a week count as overtime. However, some states have specific rules regarding this. Once you have your total hours, simply subtract 40, and that number represents your overtime hours. Remember, if you work for overtime hours, proper calculation ensures you receive fair compensation.

Claiming for overtime involves knowing your rights and taking action. First, collect evidence of the additional hours you've worked, such as time logs or emails. Next, contact your employer or HR to follow their process for making a claim to work for overtime hours. If you encounter difficulties, consider seeking professional advice or utilizing resources on US Legal Forms to guide you through the necessary steps.

What is the formula to calculate overtime pay? ing to the FLSA, the formula for calculating overtime pay is the nonexempt employee's regular rate of pay x 1.5 x overtime hours worked. This calculation may differ in states that have requirements, such as double time, which are more favorable to the employee.

What to Include in an Overtime Request Basic employee information (name, position, employee ID number, contact information, etc.) Manager name and contact information. Number of overtime hours requested. Time(s) and date(s) of requested overtime hours. Calculated total cost of overtime hours.

To calculate any overtime you're entitled to, you can follow the same process as if you were an hourly employee. In other words, calculate overtime as your hourly pay rate multiplied by 1.5, then multiplied again by the number of overtime hours you worked.

The standard overtime rate is 1.5 times the employee's regular hourly wage. This number is also commonly known as ?time-and-a-half.? So if one employee makes $15 per hour, their overtime rate is $22.50 per hour ($15 x 1.5). If another employee makes $25 per hour, their overtime rate is $37.50 per hour ($25 x 1.5).

Overtime is when you pay your employees 1.5 times their normal rate, while double time is when you pay your employees twice their normal rate. For instance, if an employee regularly earns $17, their overtime rate is $25.5 per hour, while their double time rate is $34 per hour.