Employee Period During With 2 Years

Description

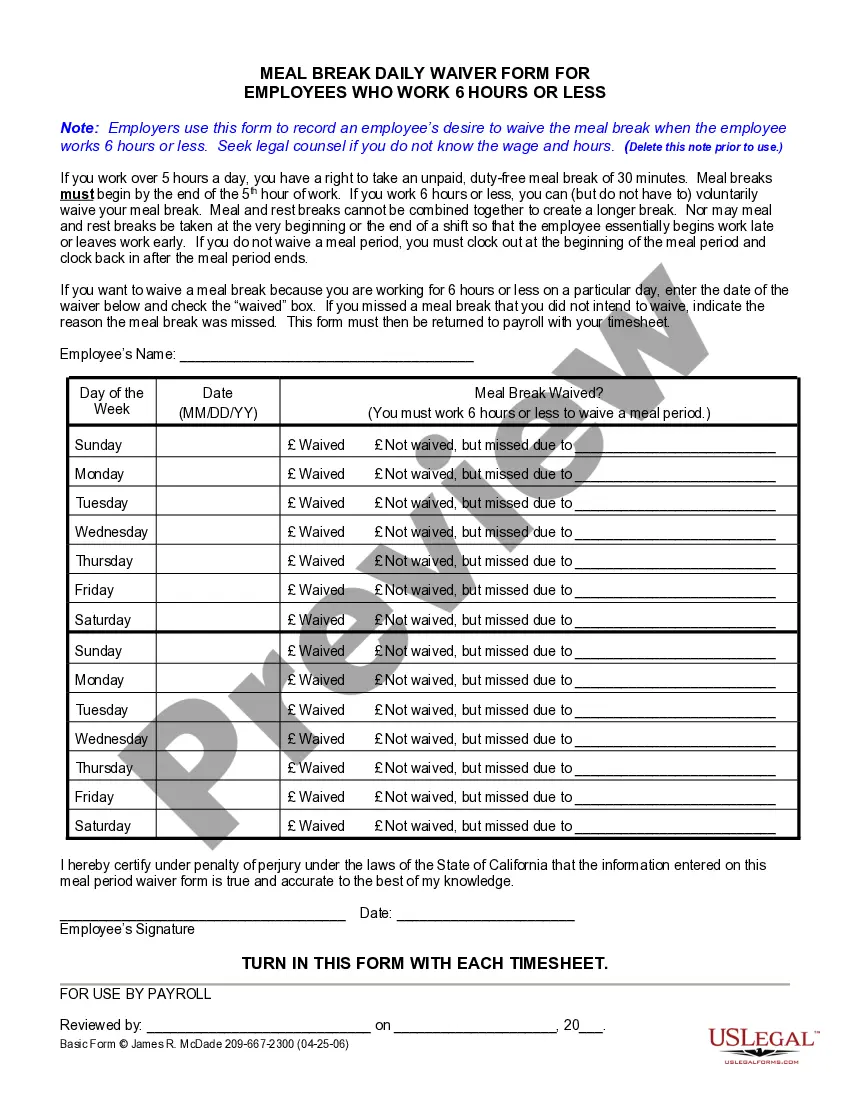

How to fill out California On Duty Meal Period Agreement?

- Log in to your account if you're a returning user; make sure your subscription is active.

- Preview the available forms and read their descriptions carefully to ensure they meet your jurisdictional needs.

- Utilize the search feature if you need to find a different template or if you encounter any discrepancies.

- Select the desired form and click on the 'Buy Now' button to choose your subscription plan.

- Complete your purchase using your credit card or PayPal account to access the full library.

- Finally, download the form to your device. You can find it later in the 'My documents' section of your profile.

By following these steps, you can easily navigate US Legal Forms to access the legal documents you need. This platform not only offers a vast collection of forms but also ensures that users can obtain necessary legal documents swiftly and efficiently.

Start winning your legal battles today by exploring US Legal Forms. Unlock your access to over 85,000 forms and professional assistance for all your legal documentation needs.

Form popularity

FAQ

The IRS 100,000 deposit rule pertains to employers who accumulate $100,000 or more in payroll taxes within a deposit period. If this threshold is reached, the employer must deposit the taxes by the next business day. This relates to the employee period during with 2 years, highlighting the importance of timely payments to avoid penalties. Utilize USLegalForms for resources that help manage your payroll tax obligations efficiently.

If you have no wages during a specific quarter, you are still required to file Form 941, even if it shows zero income. This regular filing fulfills compliance for the employee period during with 2 years, ensuring the IRS recognizes your status. Reporting zero wages keeps your business in good standing and avoids potential penalties. USLegalForms can guide you through the form-filing process, making it easier.

2 wages are calculated based on the total earnings an employee receives during the tax year, including salaries, bonuses, and other compensations. This calculation encompasses the employee period during with 2 years, reflecting all income earned. Employers must accurately report these figures to comply with IRS requirements. For streamlined filing and management of documents, consider leveraging USLegalForms.

2 form covers the calendar year for which it is issued, reporting income earned by an employee during that time. Specifically, it details the employee period during with 2 years, showing total earnings and taxes withheld. Understanding this timeframe helps employees file their taxes accurately and ensures all income is reported. For assistance with W2 management, check out USLegalForms for helpful resources.

Employers are required to keep W-2 forms for at least four years after the tax year ends. This retention period covers the employee period during with 2 years for potential audits or inquiries. Keeping accurate records can benefit both employers and employees by ensuring compliance and quick access to important financial information. Consider using USLegalForms to organize and manage your W-2 files effectively.

If both you and your spouse work and have kids, you should accurately reflect your combined income on your W-4. Begin by assessing the total number of allowances each of you can claim, considering your children. Using the uslegalforms platform can help simplify the process by providing clear instructions tailored to situations like yours during an employee period within 2 years.

To complete your W-4 with 2 dependents, you will want to indicate the number of allowances based on your family situation. Fill out your personal information, and then calculate your allowances using the worksheet provided in the form. This will ensure you have the correct withholdings for your tax situation during an employee period of 2 years.

The tax refund amount for a married couple with two kids varies based on income, deductions, and credits. Generally, families may receive larger refunds due to child tax credits. The uslegalforms platform can assist you in estimating your tax refund effectively by guiding you through the necessary calculations.

When you are married with two children, you should typically claim 3 allowances on your W-4. This accounts for yourself, your spouse, and each of your children. However, it's essential to consider your overall tax situation. You might want to consult resources, like the uslegalforms platform, to ensure you get your allowance claims right.

The 1000 hour rule for a 401k generally states that employees must work at least 1000 hours in a year to qualify for employer contributions. This rule helps employers determine who is vested in the company’s retirement plan. Understanding this requirement is vital, as it affects not only your eligibility for contributions but also your long-term financial planning. Managing your hours well during the employee period over the next 2 years can have a significant impact on your retirement savings.