Rental Protheus

Description

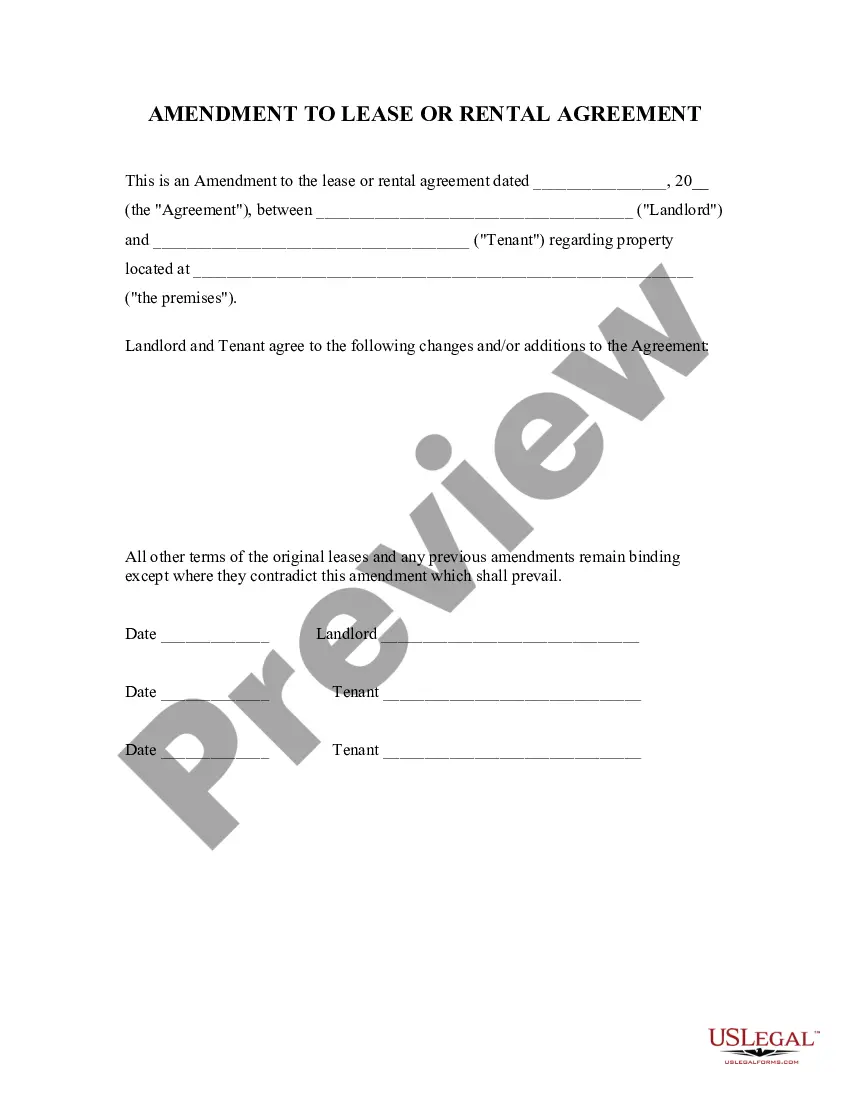

How to fill out California Amendment To Lease Or Rental Agreement?

- If you already have a US Legal Forms account, log in to access your dashboard and download your desired document template by clicking the Download button. Confirm the validity of your subscription before proceeding.

- For first-time users, begin by previewing the available forms. Review the description to ensure it meets your requirements and aligns with local jurisdiction stipulations.

- If necessary, use the Search tab to find alternative templates that suit your needs better. Ensure you’ve chosen the correct form before moving forward.

- Purchase the document by clicking on the Buy Now button and selecting your preferred subscription plan. Registration is required to access the library resources.

- Complete the purchase by entering your credit card information or using a PayPal account for payment.

- Finally, download your form to your device. Access it anytime through the My Forms section of your profile.

By following these steps, you can efficiently navigate the rental protheus system and secure the legal documents you need. US Legal Forms not only provides an extensive library but also ensures that users have access to premium experts for document assistance.

Start utilizing Rental Protheus today and experience the advantages of quick and precise legal document execution!

Form popularity

FAQ

Yes, rental income from overseas property is taxable in the U.S. if you are a U.S. citizen or resident. You are expected to report this income to the IRS, regardless of where the property is located. Understanding your tax responsibilities will help you avoid complications later. Rental Protheus offers resources to help you navigate these tax rules with confidence.

You report rent to the IRS by including it on your tax return using Schedule E, specifically designed for reporting rental income and expenses. Keep comprehensive records of your rental activities for clarity and accuracy. This ensures you can benefit from potential deductions. With Rental Protheus, the reporting process becomes simpler and more efficient.

To declare foreign rental income, you need to report it on your annual tax return using Form 1040NR if you are a non-resident. Make sure to include all relevant details concerning income and expenses associated with your foreign property. Proper documentation is key, and Rental Protheus can assist you in organizing and reporting this information.

For foreigners, rental income sourced from U.S. property is generally subject to U.S. taxation. You must file a tax return to report this income, even if you reside outside the U.S. Understanding the tax implications and deductions available can significantly impact your tax liabilities. Rental Protheus provides guidance tailored to foreign property owners.

To show proof of rental income, you can use bank statements, lease agreements, or tax returns that document your rental earnings. Keep detailed records of all income received and associated expenses for accuracy. Utilizing platforms like Rental Protheus can streamline this process, making it easier to generate documentation when needed.

Yes, you should report rental income on your taxes, as it is considered taxable income. This applies whether the rental property is located in the U.S. or abroad. By accurately reporting your income, you ensure you fulfill your tax obligations and make the most of deductions. Rental Protheus enables you to track and report this income easily.

Yes, you must declare foreign property to the IRS if you are a U.S. citizen or resident. This includes rental property owned outside the United States. Failure to report can lead to significant penalties, so it's vital to stay compliant. Tools like Rental Protheus can help simplify the reporting process.

Filling out an inspection report requires gathering information about the property's condition. Start with a thorough walkthrough, documenting any issues like wear and tear or damage. Ensure that all observations are clear and precise, as this report serves a critical role. Utilizing Rental protheus can enhance your efficiency, as it offers templates specifically designed for inspection reporting.

For rental property, you typically fill out a rental application or lease agreement form. These documents require your personal details and references, as well as information about your rental history. Make sure to fill in all sections completely to increase your chances of approval. Rental protheus simplifies this process by providing access to various legal forms that cater to rental needs.

To fill out an apartment condition form, start by systematically evaluating each area of the apartment. Take notes on the condition of walls, floors, appliances, and fixtures. Be detailed in your descriptions, as this creates an accurate record for future reference. With Rental protheus, you can access helpful tools and templates to guide you through this process.