Sublease Form Ontario

Description

How to fill out California Application For Sublease?

Handling legal documents can be exasperating, even for seasoned experts.

When you are looking for an Ontario Sublease Form and cannot spare the time to find the accurate and latest version, the experience can become overwhelming.

Obtain a library of articles, guidance, and manuals pertinent to your situation and specifications.

Conserve time and effort searching for the documents you require, and use US Legal Forms’ advanced search and Preview function to locate the Ontario Sublease Form and download it.

Savor the US Legal Forms online library, backed by 25 years of expertise and reliability. Transform your daily document management into a seamless and user-friendly experience today.

- If you are a subscriber, sign in to your US Legal Forms account, find the form, and download it.

- Check your My documents section to view the documents you have previously downloaded and organize your files.

- If this is your first experience with US Legal Forms, create an account to receive unlimited access to all features of the library.

- Here are the steps to follow after obtaining the form you require.

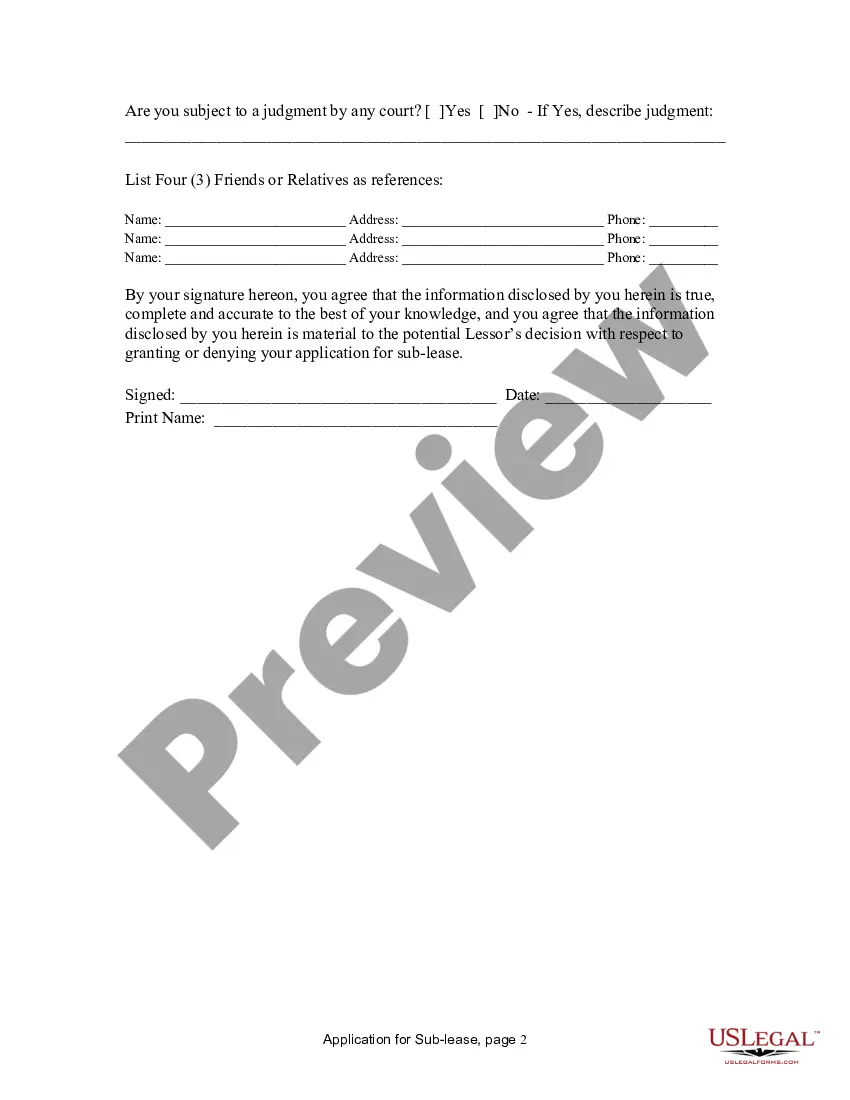

- Confirm it is the correct document by previewing it and reviewing its details.

- Access region- or county-specific legal and business forms.

- US Legal Forms addresses all your needs, from personal to professional documents, in one platform.

- Leverage sophisticated tools to complete and manage your Ontario Sublease Form.

Form popularity

FAQ

A living trust can help you manage and pass on a variety of assets. However, there are a few asset types that generally shouldn't go in a living trust, including retirement accounts, health savings accounts, life insurance policies, UTMA or UGMA accounts and vehicles.

The cost of creating a trust in Kentucky varies depending on the complexity of your estate and the attorney's fees. The average cost for a basic Revocable Living Trust ranges from $1,000 to $3,000, while more complex trusts may cost more.

To create a living trust in Kentucky, you must create the trust in writing and sign before a notary public. The next step is to fund the trust by transferring ownership of assets into the trust.

Revocable and Irrevocable Trusts are not recorded for public record. However, a Trust Under Will is recorded and becomes public record.

Limitations: Requires adherence to trust document's instructions on asset assignments. Joint assets, including certain IRAs and retirement plans, cannot be placed into a one-person trust. No complete tax avoidance: Total avoidance of taxes is rarely possible with living trusts, though there may be ways to reduce them.

The two basic types of trusts are a revocable trust, also known as a revocable living trust or simply a living trust, and an irrevocable trust. The owner of a revocable trust may change its terms at any time.

The Disadvantage of a Revocable Living Trust Expansive: Creating a revocable living trust can be more expensive than a simple will due to legal fees and document preparation. Complexity: Managing a trust requires ongoing paperwork and record-keeping, which can be burdensome and time-consuming.

A revocable trust and living trust are separate terms that describe the same thing: a trust in which the terms can be changed at any time. An irrevocable trust describes a trust that cannot be modified after it is created without the beneficiaries' consent.