Ex Parte Application To Advance Hearing Date California Form 568 Instructions

Description

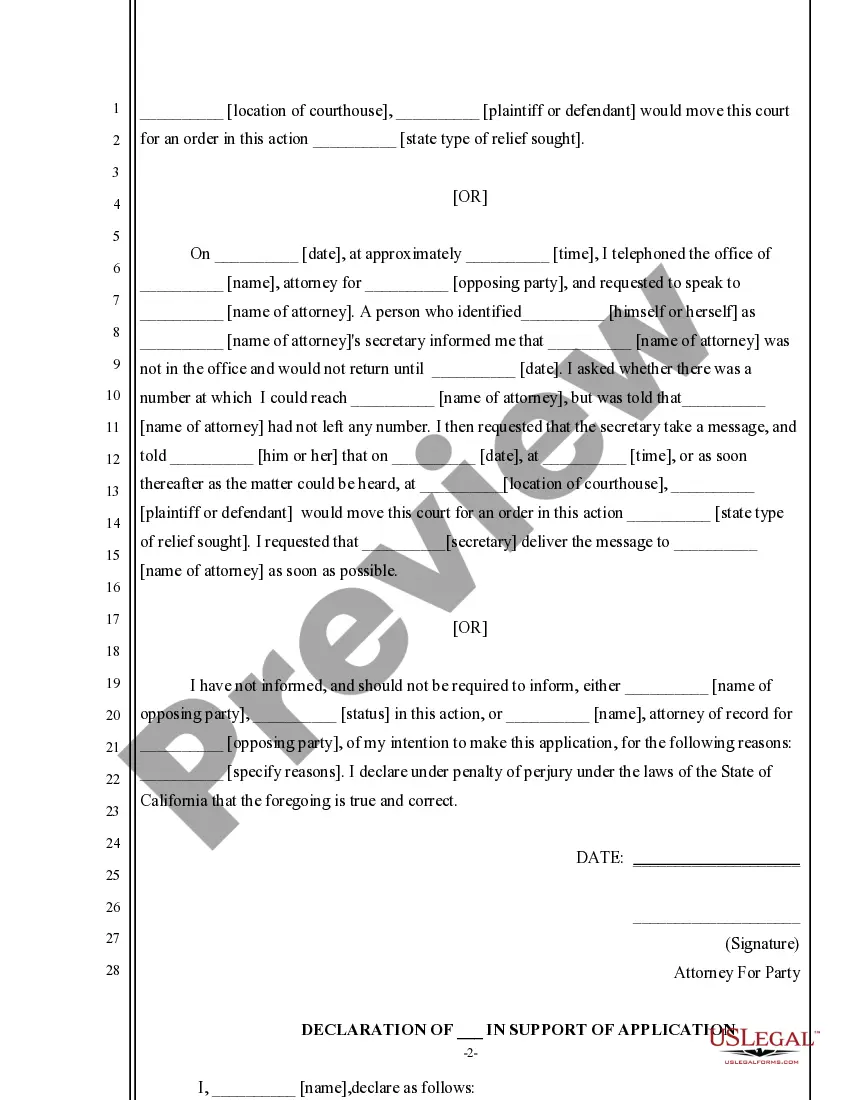

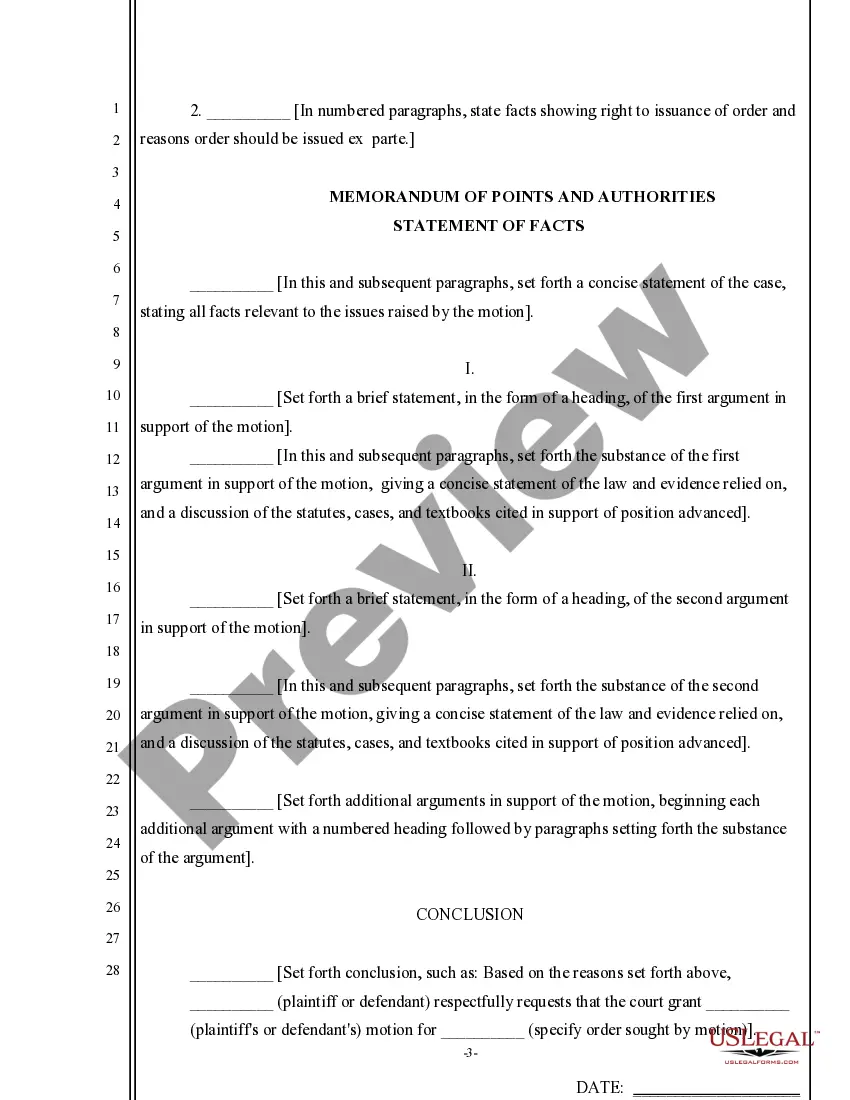

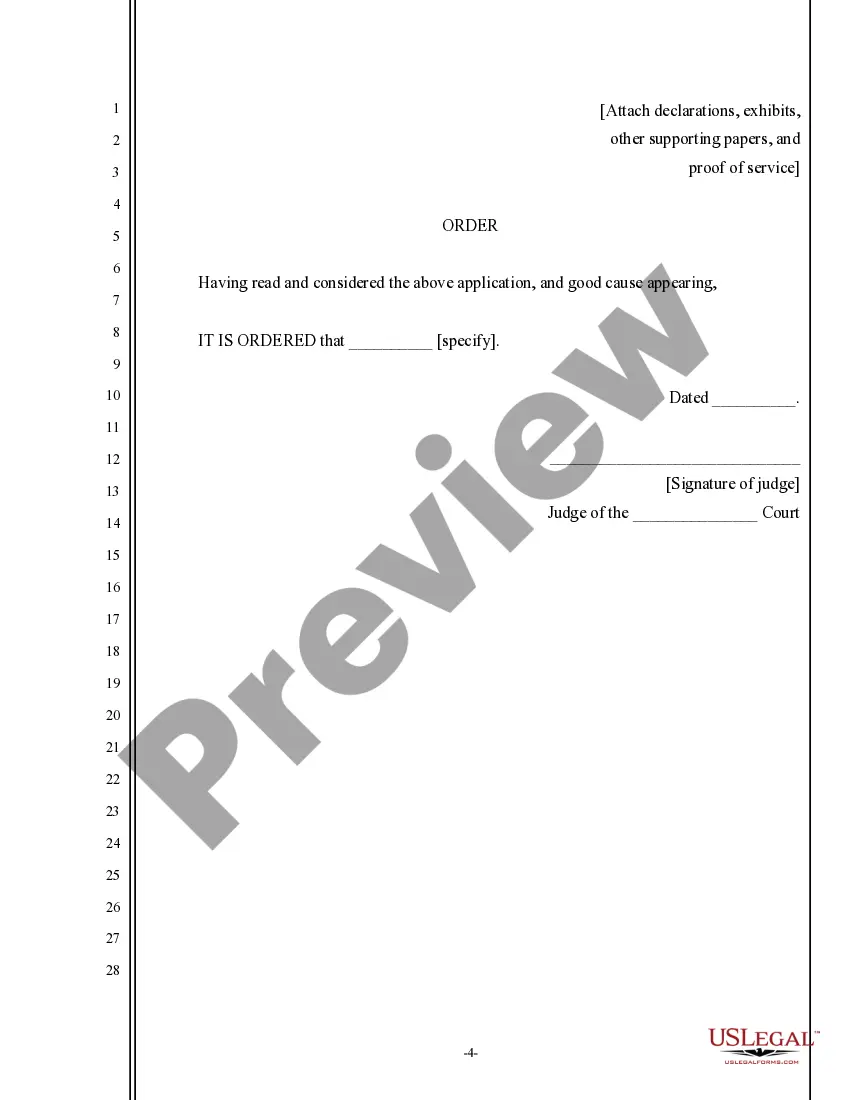

How to fill out California Ex Parte Application For Orders And Memo Of Points And Authorities - General Sample?

The Ex Parte Application To Advance Hearing Date California Form 568 Instructions you see on this page is a reusable legal template drafted by professional lawyers in line with federal and state regulations. For more than 25 years, US Legal Forms has provided people, companies, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the quickest, most straightforward and most trustworthy way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Obtaining this Ex Parte Application To Advance Hearing Date California Form 568 Instructions will take you just a few simple steps:

- Browse for the document you need and review it. Look through the file you searched and preview it or check the form description to confirm it suits your requirements. If it does not, make use of the search bar to find the appropriate one. Click Buy Now when you have found the template you need.

- Sign up and log in. Opt for the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Get the fillable template. Select the format you want for your Ex Parte Application To Advance Hearing Date California Form 568 Instructions (PDF, Word, RTF) and save the sample on your device.

- Complete and sign the document. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a eSignature.

- Download your paperwork one more time. Make use of the same document again whenever needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

If you have an LLC, here's how to fill in the California Form 568: Line 1?Total income from Schedule IW. Enter the total income. Line 2?Limited liability company fee. Enter the amount of the LLC fee. The LLC must pay a fee if the total California income is equal to or greater than $250,000.

Purpose. Use Schedule EO (568), Pass-Through Entity Ownership, to report all partnership, limited liability company (LLC) taxable as partnerships, and disregarded entity ownership interests held by the taxpayer.

What is Form 568? Most LLCs doing business in California must file Form CA Form 568 (Limited Liability Company Return of Income), Form FTB 3522 (LLC Tax Voucher), and pay an annual franchise tax of $800. These businesses are classified as a disregarded entity or Partnership.

If you have an LLC, here's how to fill in the California Form 568: Line 1?Total income from Schedule IW. Enter the total income. Line 2?Limited liability company fee. Enter the amount of the LLC fee. The LLC must pay a fee if the total California income is equal to or greater than $250,000.

Business FormWithout paymentWith payment100 100S 100W 100X 109 565 568Franchise Tax Board PO Box 942857 Sacramento CA 94257-0500Franchise Tax Board PO Box 942857 Sacramento CA 94257-0501