California Deed Form Withholding

Description

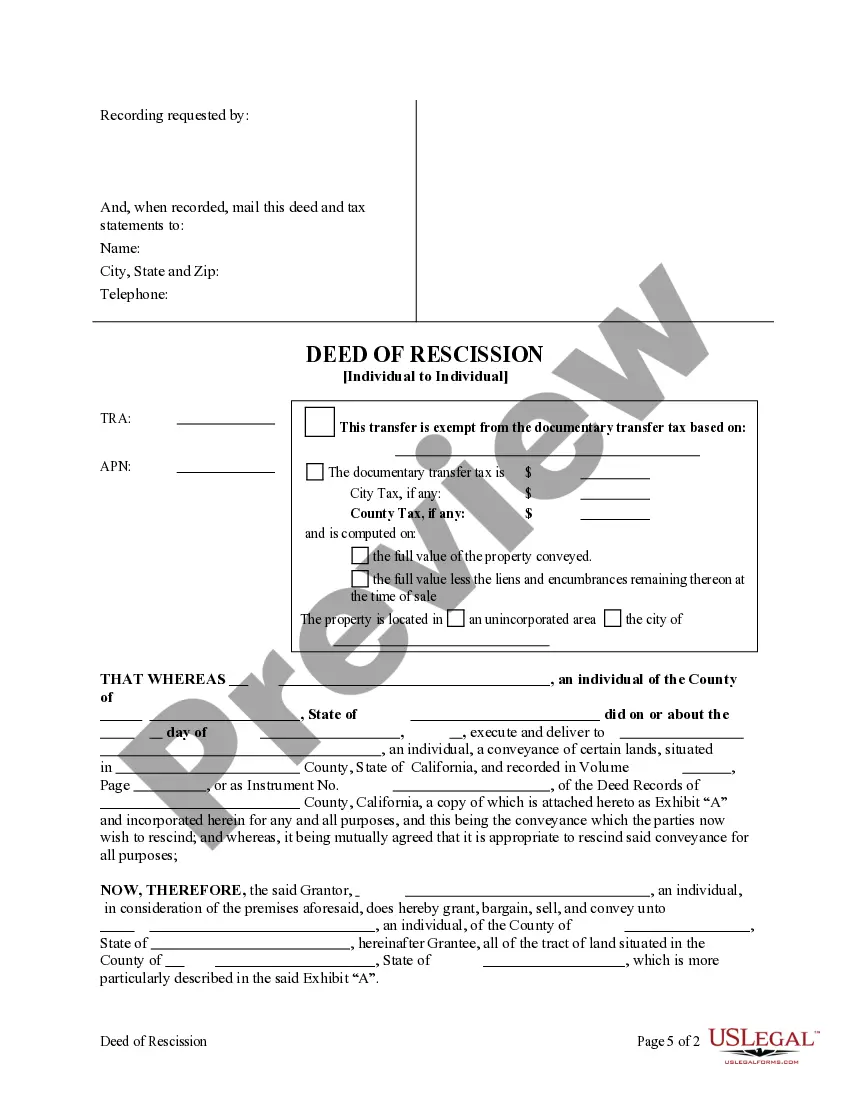

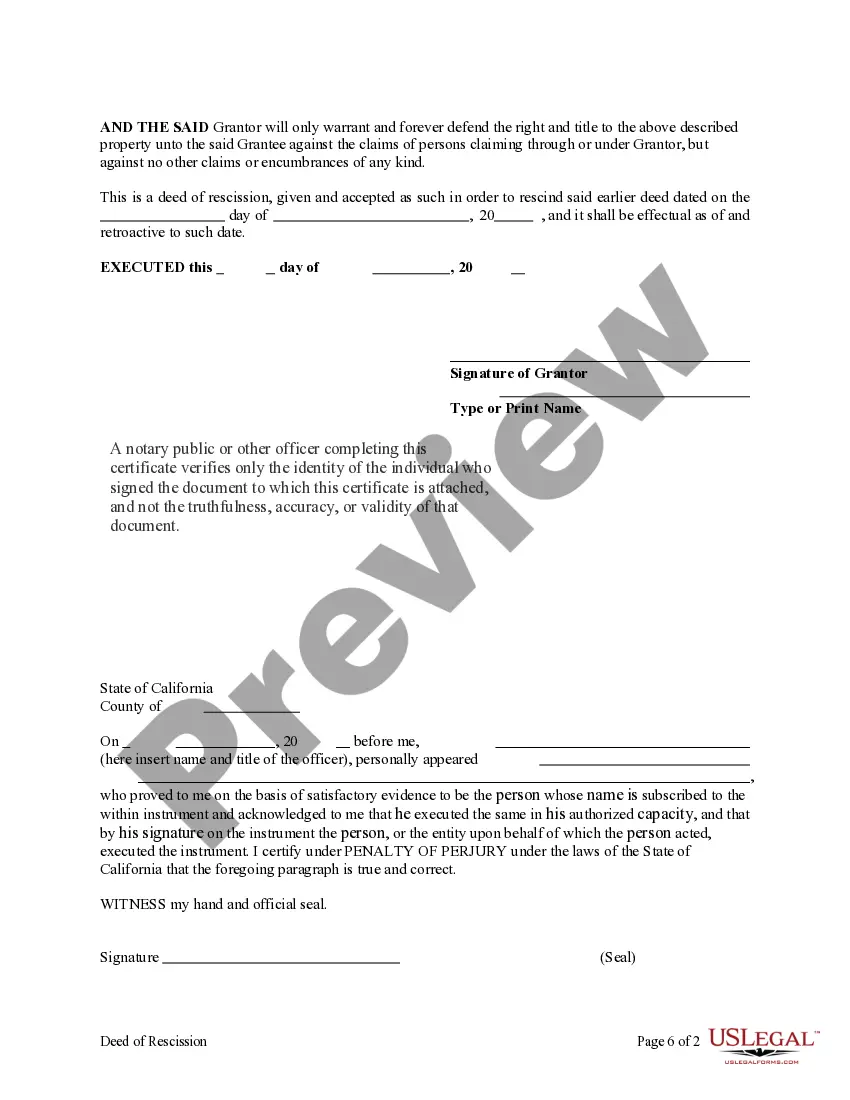

How to fill out California Deed Of Rescission - Individual To Individual?

Getting a go-to place to access the most recent and relevant legal samples is half the struggle of dealing with bureaucracy. Choosing the right legal files demands accuracy and attention to detail, which is why it is important to take samples of California Deed Form Withholding only from trustworthy sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to worry about. You may access and view all the information regarding the document’s use and relevance for the situation and in your state or region.

Consider the listed steps to finish your California Deed Form Withholding:

- Make use of the library navigation or search field to locate your template.

- View the form’s information to check if it suits the requirements of your state and region.

- View the form preview, if there is one, to make sure the form is definitely the one you are looking for.

- Resume the search and find the proper document if the California Deed Form Withholding does not suit your requirements.

- If you are positive regarding the form’s relevance, download it.

- When you are an authorized user, click Log in to authenticate and access your picked forms in My Forms.

- If you do not have a profile yet, click Buy now to get the form.

- Pick the pricing plan that suits your requirements.

- Go on to the registration to finalize your purchase.

- Complete your purchase by selecting a transaction method (credit card or PayPal).

- Pick the document format for downloading California Deed Form Withholding.

- Once you have the form on your device, you may change it with the editor or print it and complete it manually.

Remove the inconvenience that comes with your legal documentation. Discover the extensive US Legal Forms catalog where you can find legal samples, examine their relevance to your situation, and download them on the spot.

Form popularity

FAQ

Purpose: This certificate, DE 4, is for California Personal Income Tax (PIT) withholding purposes only. The DE 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation.

Any person who withheld on the sale or transfer of California real property during the calendar month must file Form 593 to report, and Form 593-V to remit the amount withheld. Normally, this will be the title company, escrow company, intermediary, or accommodator.

Buyers must withhold 3 1/3 percent of the gross sales price on sales of California real property interests from both individuals (e.g., "natural" persons) and non-individuals (e.g., corporations, trusts, estates) and pay this amount to the Franchise Tax Board (FTB).

Any remitter (individual, business entity, trust, estate, or REEP) who withheld on the sale/transfer of California real property must file Form 593 to report the amount withheld. If this is an installment sale payment after escrow closed, the buyer/transferee is the responsible person.

For the State, the law is written such that all real property being sold requires the payment of tax at the close of escrow in an amount equal to 3.33% of the Sales Price. An Alternative Calculated Amount can also be used.