Az Inheritance Without Tax

Description

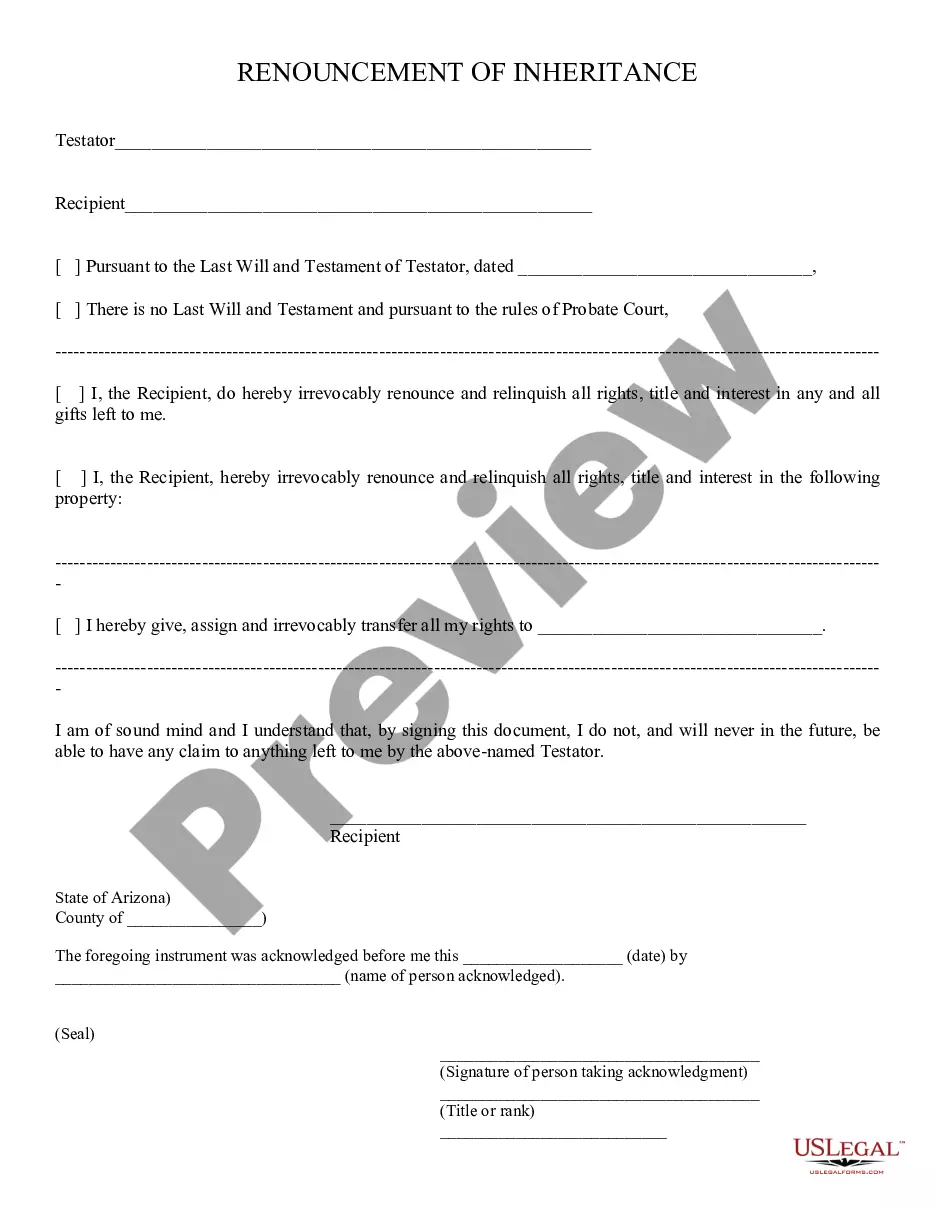

How to fill out Arizona Renouncement Of Inheritance?

It’s clear that you cannot transform into a legal expert instantly, nor can you swiftly acquire the skill to draft Az Inheritance Without Tax without possessing the necessary background knowledge.

Formulating legal documents is a lengthy endeavor demanding specific training and expertise. So why not entrust the creation of the Az Inheritance Without Tax to the experts.

With US Legal Forms, one of the most extensive collections of legal templates, you can discover everything from court documents to templates for internal communications.

You can regain access to your documents from the My documents tab at any time. If you’re an established customer, you can simply Log In, and locate and download the template from the same section.

Regardless of the aim of your paperwork—be it financial and legal, or personal—our platform has you covered. Experience US Legal Forms today!

- Identify the necessary form by utilizing the search bar situated at the top of the page.

- Examine it (if this feature is available) and review the accompanying description to ascertain whether Az Inheritance Without Tax meets your needs.

- Start your search anew if you require any additional template.

- Create a complimentary account and select a subscription plan to acquire the form.

- Click Buy now. Once the payment is completed, you can obtain the Az Inheritance Without Tax, fill it out, print it, and send or mail it to the appropriate individuals or organizations.

Form popularity

FAQ

In Arizona, you can inherit any amount without paying state inheritance taxes, as the state does not impose such taxes. This means you can receive your full inheritance, regardless of its size. Understanding the benefits of Az inheritance without tax can lead to better financial decisions and help you preserve your wealth.

No, Arizona does not require an inheritance tax waiver since there is no inheritance tax in the state. This means you can receive your inheritance without the need for additional paperwork related to taxes. Knowing this can simplify the process when it comes to managing your inheritance under Az inheritance without tax.

In Arizona, you can inherit an unlimited amount from your parents without incurring an inheritance tax. This is because Arizona does not impose an inheritance tax, allowing you to receive your inheritance without worrying about state taxes. Additionally, understanding the rules surrounding Az inheritance without tax can help you plan effectively for the future.

Arizona does not impose an inheritance tax, which means you typically do not need a waiver form for Az inheritance without tax. However, it is essential to confirm any specific requirements in your situation. To ensure a smooth process, you can utilize uslegalforms, which offers guidance and templates to assist with any necessary documentation. This way, you can focus more on your inheritance and less on paperwork.

To inherit assets without tax, it's crucial to understand the local laws and utilize strategies like gifting. In Arizona, you can explore trusts and other estate planning tools that facilitate Az inheritance without tax. Consulting with a knowledgeable estate planner can help you navigate these options. Additionally, consider using platforms like uslegalforms, which provide resources to ensure you are informed and compliant.

How Much Can You Inherit From Your Parents Without Paying Taxes? Based on state and federal tax rules in 2022, a person may inherit up to $12.06 million without paying taxes, provided that the deceased was a resident of Arizona or another state that does not impose an inheritance tax.

If you received a gift or inheritance, do not include it in your income. However, if the gift or inheritance later produces income, you will need to pay tax on that income. Example: You inherit and deposit cash that earns interest income. Include only the interest earned in your gross income, not the inhereted cash.

There is no inheritance tax in Arizona. If you have a loved one who lives in another state, however, you should check the local laws. Pennsylvania, for instance, as an inheritance tax that can apply to out-of-state heirs. Arizona also has no gift tax.

Here are 4 ways to protect your inheritance from taxes: See if the alternate valuation date will help. For tax purposes, the estates are evaluated based on their fair market value at the time of the decedent's death. ... Transfer your assets into a trust. ... Minimize IRA distributions. ... Make charitable gifts. ... Next steps for you.