199 Superior Client With Disabilities

Description

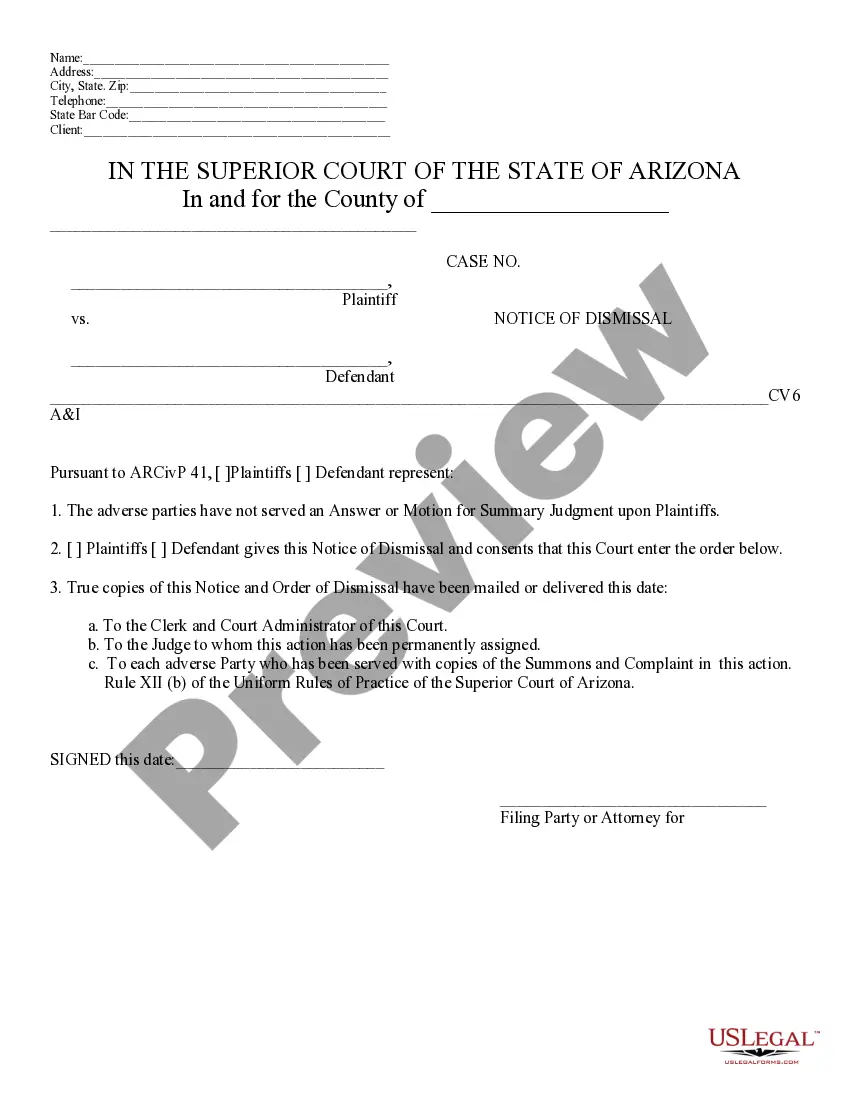

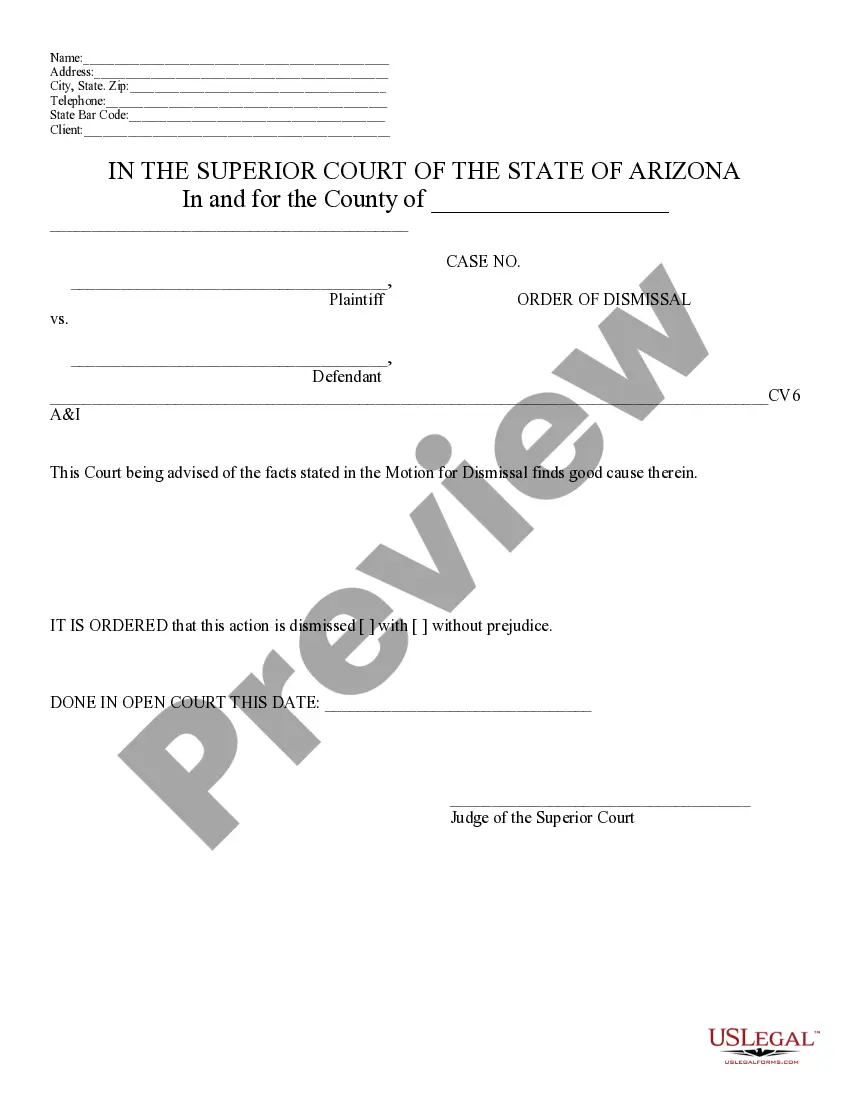

How to fill out Arizona Motion For Dismissal?

It’s no secret that you can’t become a legal professional overnight, nor can you grasp how to quickly prepare 199 Superior Client With Disabilities without having a specialized set of skills. Creating legal documents is a long process requiring a certain education and skills. So why not leave the creation of the 199 Superior Client With Disabilities to the pros?

With US Legal Forms, one of the most comprehensive legal template libraries, you can find anything from court documents to templates for in-office communication. We understand how crucial compliance and adherence to federal and state laws and regulations are. That’s why, on our platform, all templates are location specific and up to date.

Here’s how you can get started with our platform and obtain the form you need in mere minutes:

- Find the document you need by using the search bar at the top of the page.

- Preview it (if this option available) and check the supporting description to figure out whether 199 Superior Client With Disabilities is what you’re searching for.

- Begin your search again if you need any other form.

- Register for a free account and select a subscription plan to purchase the form.

- Choose Buy now. Once the payment is complete, you can get the 199 Superior Client With Disabilities, fill it out, print it, and send or mail it to the necessary people or organizations.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your documents-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

However, you're usually considered disabled for tax purposes if either of these applies: You're unable to engage in any gainful activity due to physical or mental impairment. Your impairment is expected to result in death or last for a long or indefinite period.

For years that you receive CPP disability, you will get a T4A(P) slip. It will list the total amount of disability benefit paid to you and possibly retroactive amounts as well. On the T4A(P), box [] will give you the total amount that you received.

To complete the T2201 form, first, you must fill out all personal details in the 'individual's section' of the form, Part A (pages 1-2). After which, you must ask a medical practitioner to fill out and complete Part B (pages 3-16).

How to claim Disability Tax Credit T2201 / TurboTax Support Canada YouTube Start of suggested clip End of suggested clip To claim the disability credit using TurboTax. First click the fine. Button then start typing theMoreTo claim the disability credit using TurboTax. First click the fine. Button then start typing the word disability.

The Child Disability Tax Credit can be applied for by any parent who is taking primary care of the child under the age of 18 who has an impairment. If both parents provide for the child equally, only one of them can receive the tax credit.