199 Respectfully Client For Windows

Description

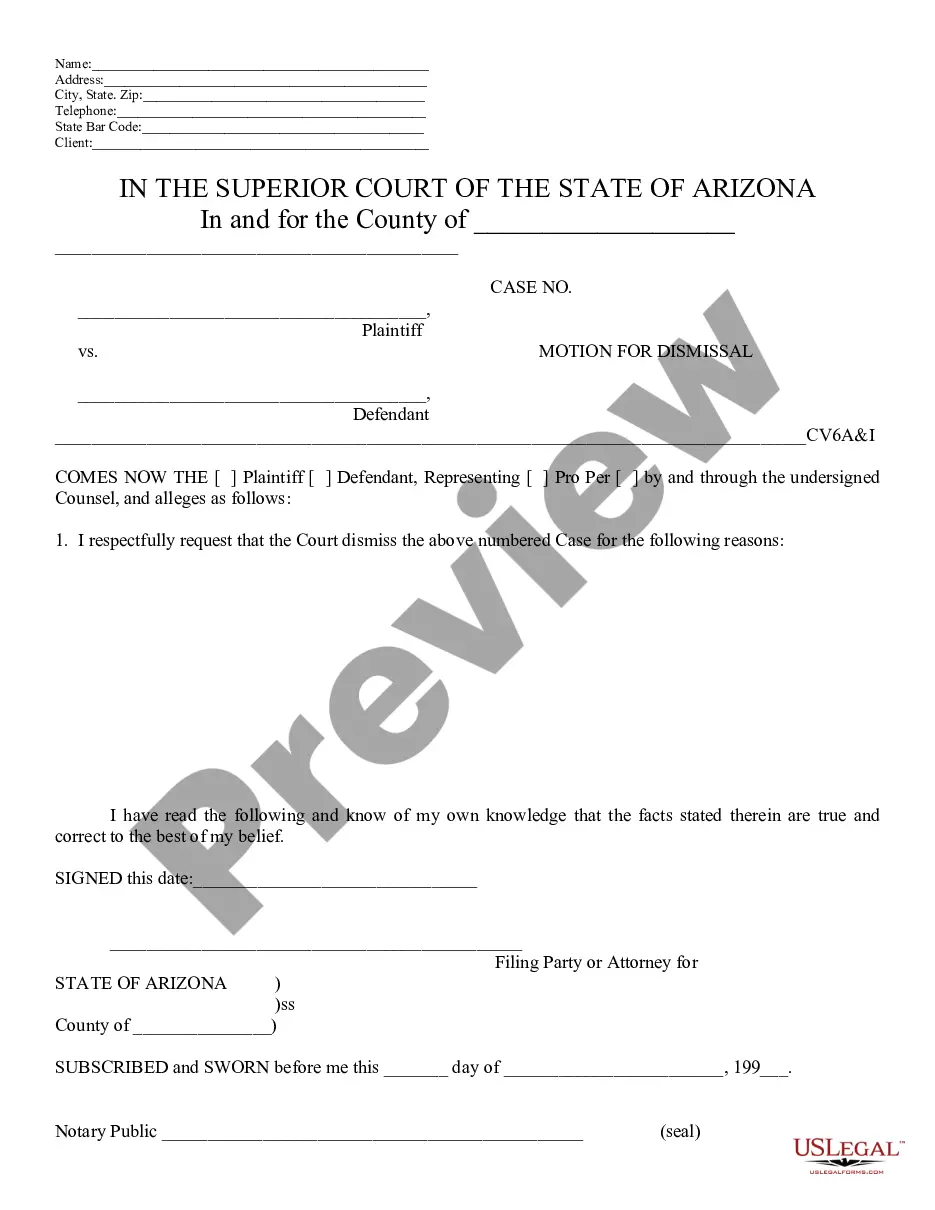

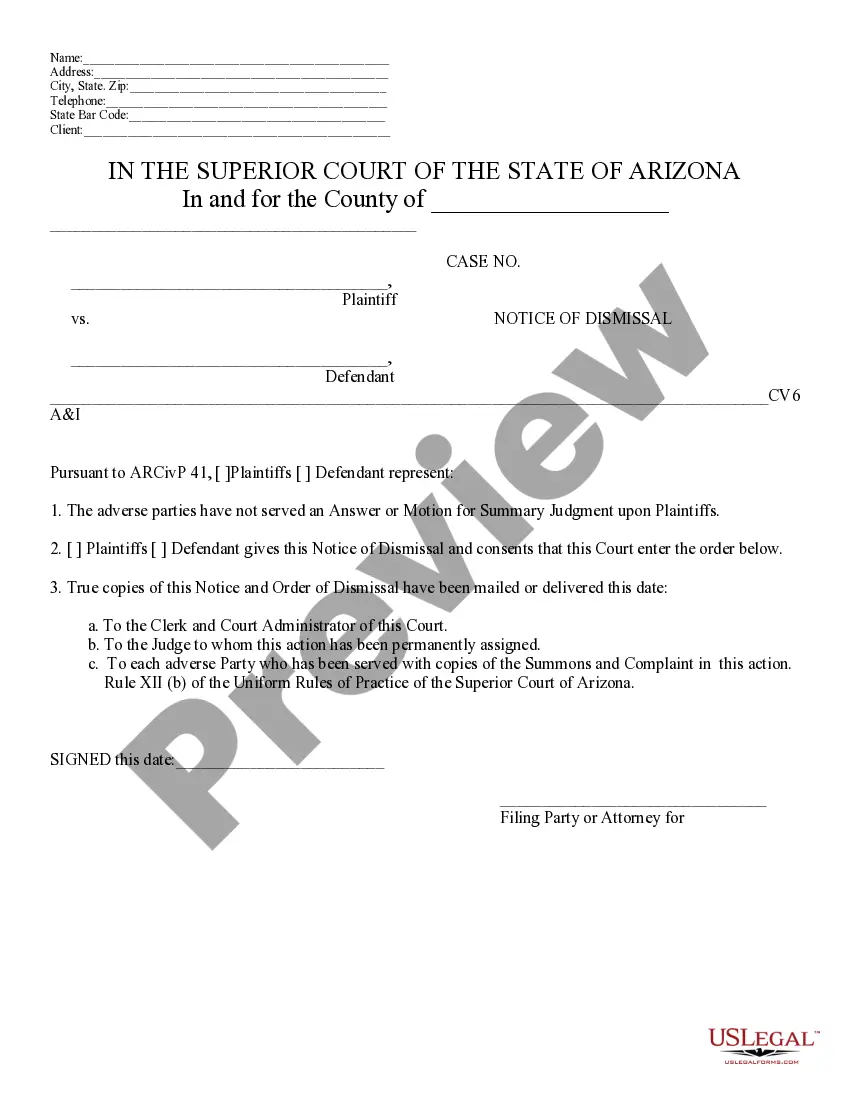

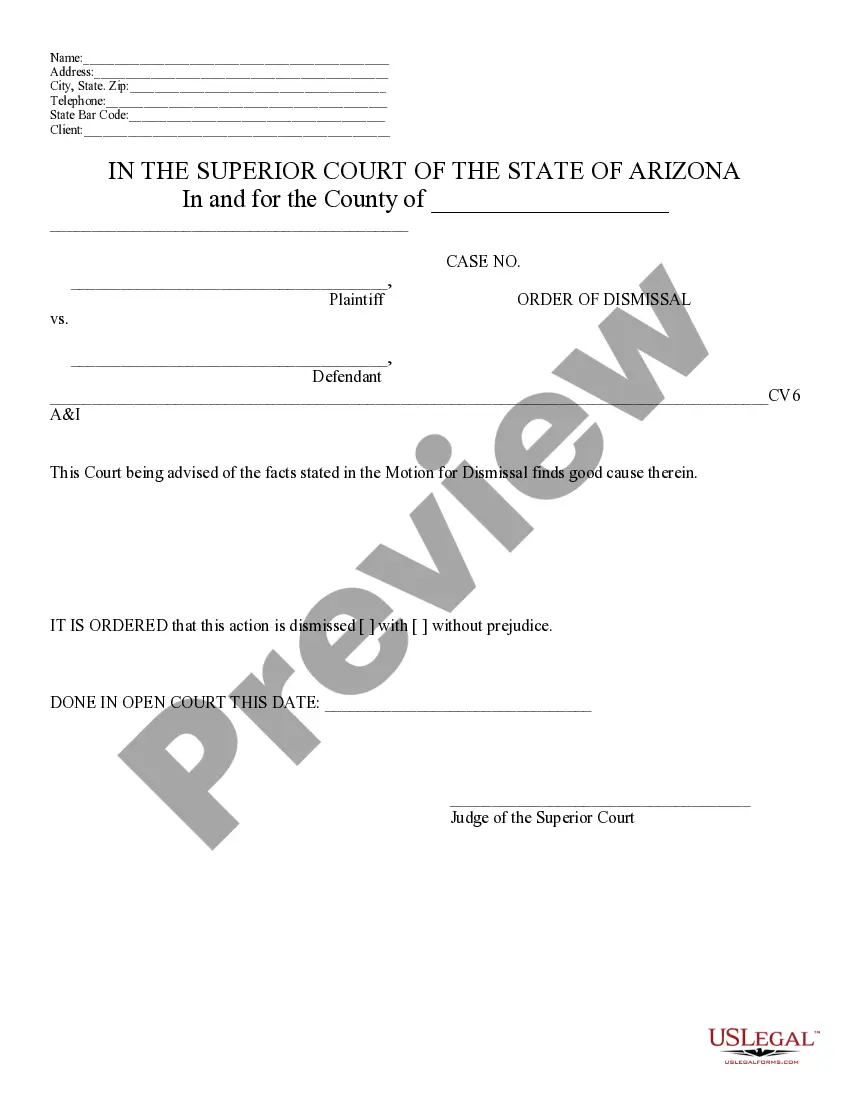

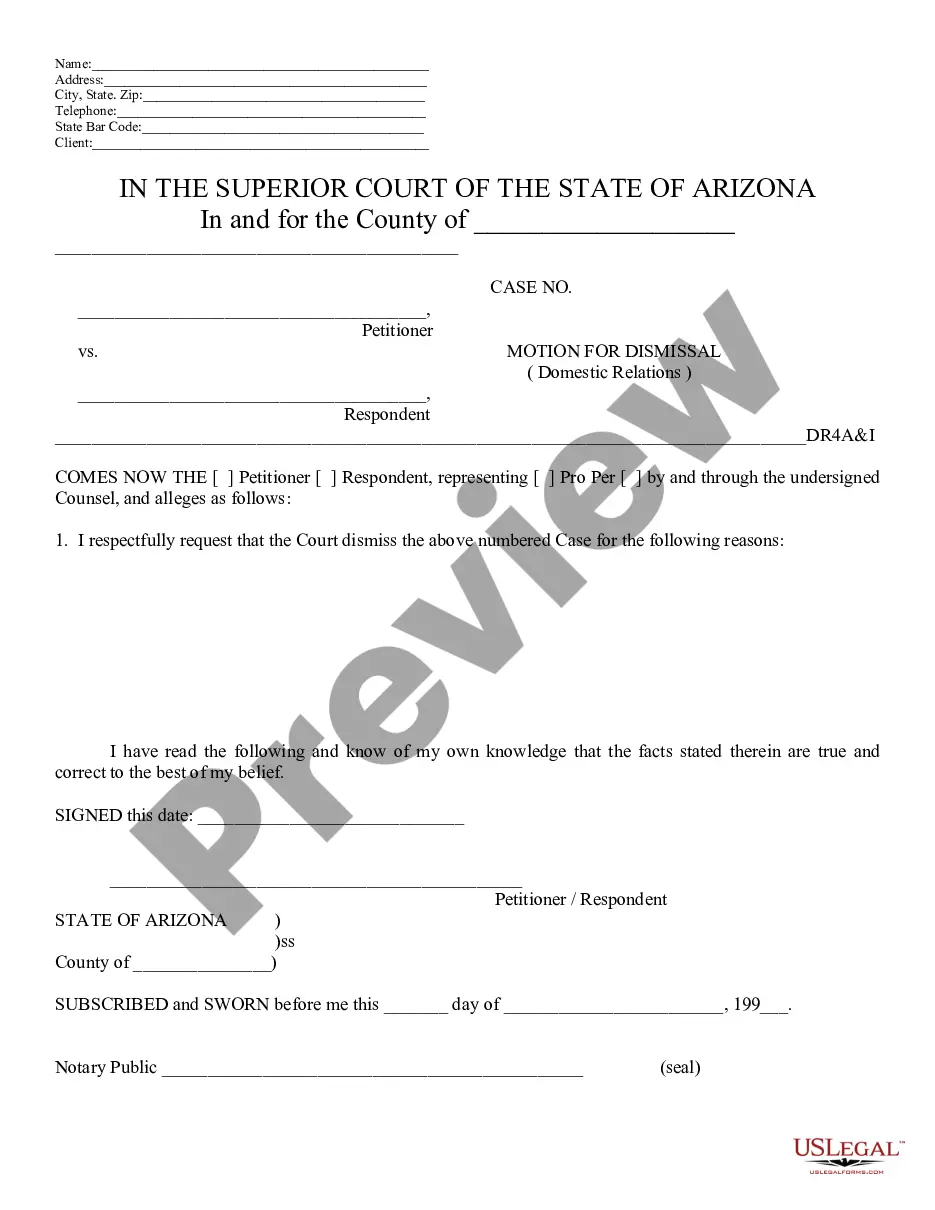

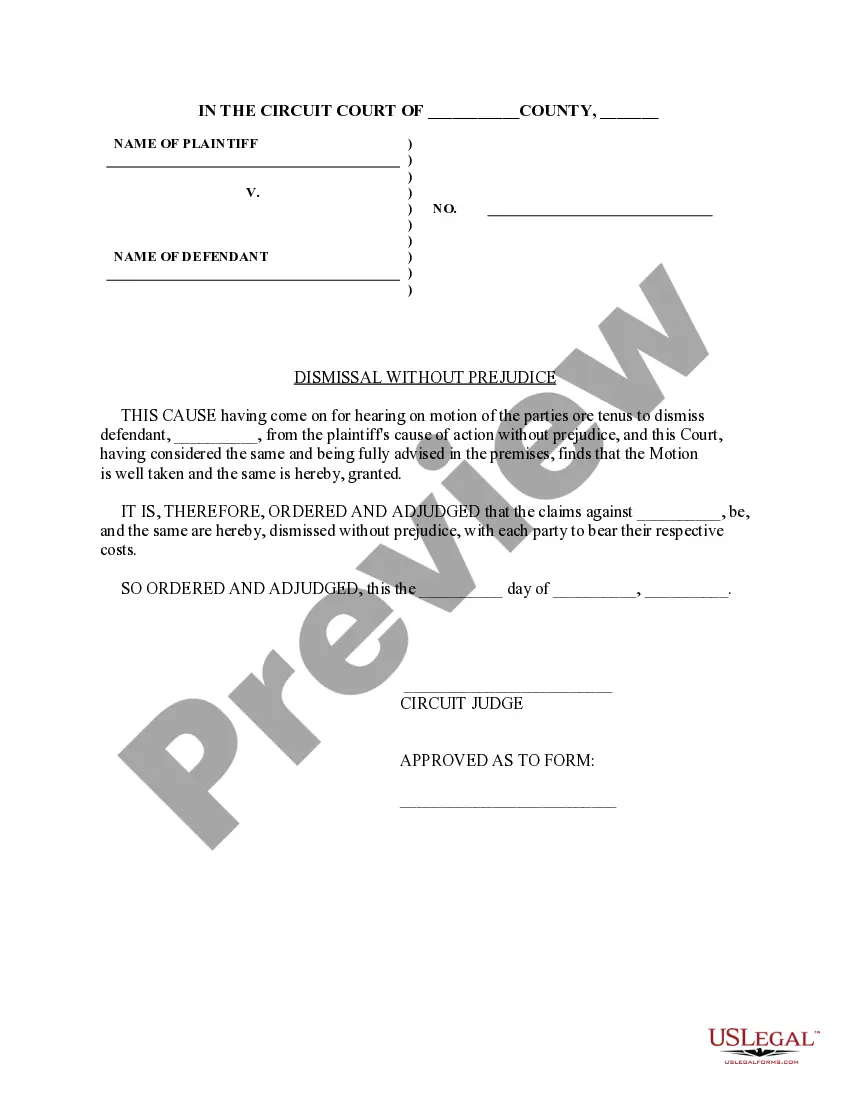

How to fill out Arizona Motion For Dismissal?

It’s no secret that you can’t become a law expert immediately, nor can you figure out how to quickly prepare 199 Respectfully Client For Windows without having a specialized set of skills. Putting together legal documents is a long process requiring a particular training and skills. So why not leave the creation of the 199 Respectfully Client For Windows to the specialists?

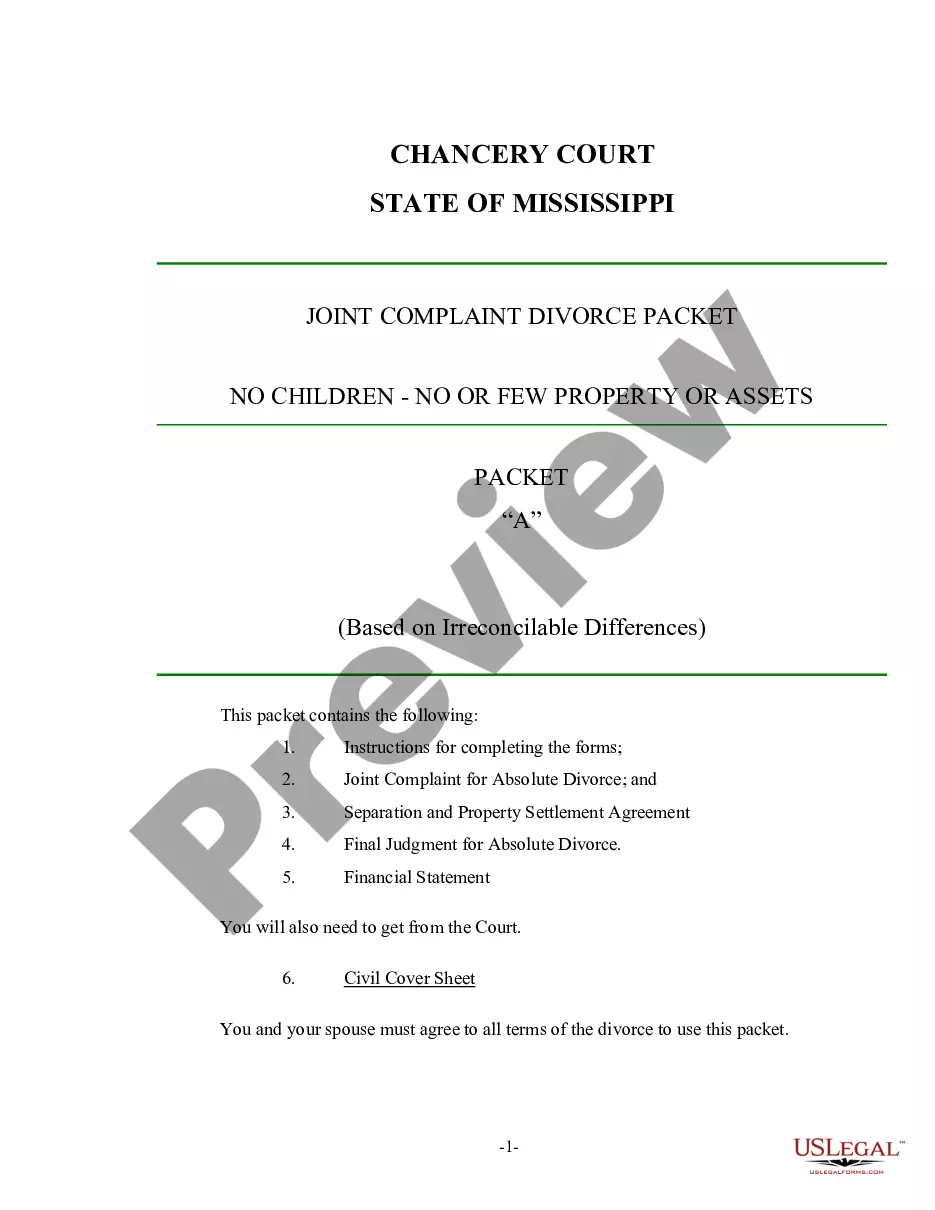

With US Legal Forms, one of the most extensive legal template libraries, you can find anything from court papers to templates for internal corporate communication. We know how crucial compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all templates are location specific and up to date.

Here’s start off with our website and get the form you require in mere minutes:

- Find the document you need by using the search bar at the top of the page.

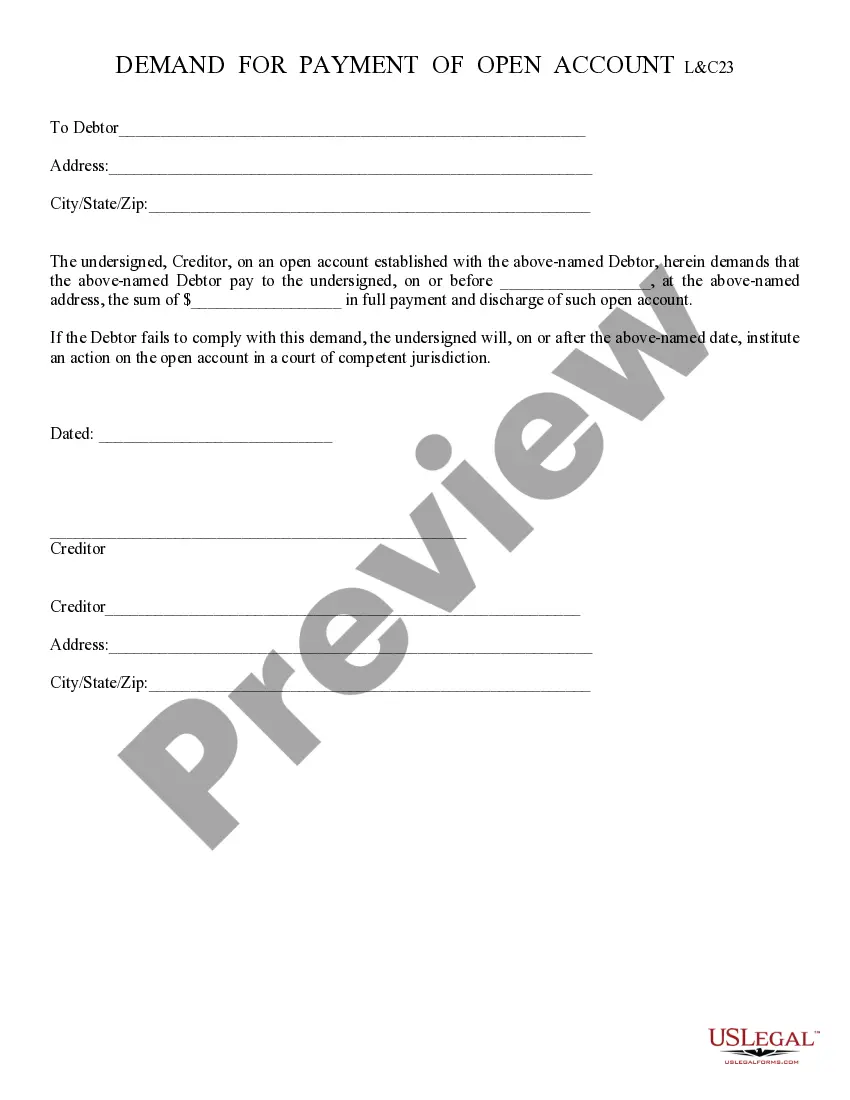

- Preview it (if this option provided) and check the supporting description to figure out whether 199 Respectfully Client For Windows is what you’re looking for.

- Begin your search again if you need any other template.

- Set up a free account and choose a subscription option to purchase the template.

- Pick Buy now. Once the transaction is through, you can download the 199 Respectfully Client For Windows, complete it, print it, and send or mail it to the designated individuals or entities.

You can re-access your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your forms-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

If you have not received an expected 1099 by a few days after that, contact the payer. If you still do not get the form by February 15, call the IRS for help at 1-800- 829-1040. In some cases, you may obtain the information that would be on the 1099 from other sources. IRS Tax Tip 2003-25 What to do if You haven't received a form 1099 irs.gov ? pub ? irs-news irs.gov ? pub ? irs-news

Yes, you can handwrite a 1099 or W2, but be very cautious when doing so. The handwriting must be completely legible using black ink block letters to avoid processing errors. The IRS says, ?Although handwritten forms are acceptable, they must be completely legible and accurate to avoid processing errors. Can You Handwrite a 1099 Form? And Other Tax Form Questions ... bluesummitsupplies.com ? tax-resources ? c... bluesummitsupplies.com ? tax-resources ? c...

How is Form 1099-NEC completed? Obtain a copy of Form 1099-NEC from the IRS or a payroll service provider. Provide the name and address of both the payer and the recipient. Calculate the total compensation paid. Note the amount of taxes withheld if backup withholding applied. 1099 Payroll - How to Pay Independent Contractors - ADP adp.com ? articles-and-insights ? articles ? 1... adp.com ? articles-and-insights ? articles ? 1...

Enter the name and TIN of the payment recipient on Form 1099-MISC. For example, if the recipient is an individual beneficiary, enter the name and social security number of the individual; if the recipient is the estate, enter the name and employer identification number of the estate.

1099 Explained: Step by step, line by line Payer information box. Located in the top left corner of the form, this is where you enter your company information. ... Payer TIN. ... Recipient's TIN. ... Recipient's name and address. ... FATCA filing requirement. ... Account number. ... Box 1: Non-Employee Compensation. ... Box 2: (Blank) How to Fill Out a 1099 & Not Mess it Up - Keeper Tax keepertax.com ? posts ? how-to-fill-out-a-1... keepertax.com ? posts ? how-to-fill-out-a-1...