Limited Lliability

Description

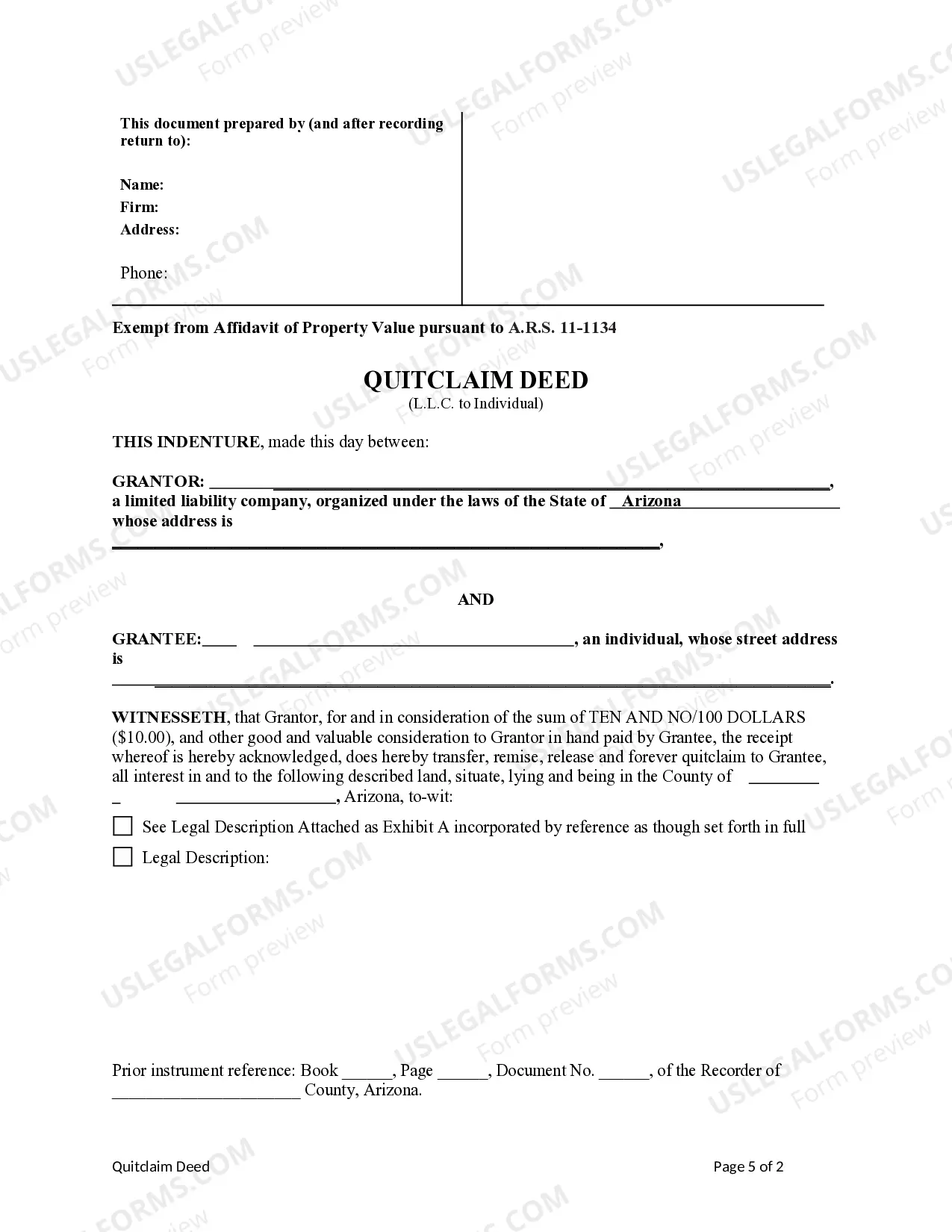

How to fill out Arizona Quitclaim Deed From A Limited Liability Company To An Individual?

- Log into your US Legal Forms account. If you are a returning user, just log in and ensure your subscription is active to access the documents you need.

- Preview potential templates. Check the description and preview mode of each form to ensure it aligns with your requirements and meets your local jurisdiction criteria.

- Search for alternatives if necessary. If you find any discrepancies, use the search function to explore other templates that fit your needs.

- Purchase your selected document. Click the 'Buy Now' button, choose an appropriate subscription plan, and create an account for library access if you are a first-time user.

- Complete your payment. Provide your credit card or PayPal information to finalize the subscription.

- Download and save your form. Access the template from the 'My Forms' section of your profile whenever you need it.

US Legal Forms provides an extensive collection of legal documents, empowering individuals and attorneys to quickly execute forms tailored to their needs. With over 85,000 fillable and editable forms available, it’s a one-stop destination for all your legal documentation.

Start protecting your business today by exploring the vast resources available through US Legal Forms. Don’t hesitate—visit their site and gain the legal peace of mind you deserve!

Form popularity

FAQ

A classic example of limited liability is when a person forms an LLC to run a retail store. If the store accumulates debt or faces a lawsuit, the owner’s personal home or savings cannot be claimed by creditors. This scenario illustrates how limited liability encourages entrepreneurship by minimizing personal financial risk.

A limited liability company (LLC) combines the characteristics of a corporation and a partnership. This structure protects personal assets while allowing for flexibility in management and taxation. By choosing an LLC, business owners can enjoy the benefits of limited liability along with operational simplicity.

The key difference lies in the degree of personal financial protection. Limited liability protects owners from being personally accountable for business debts, while unlimited liability exposes them to the risk of losing personal assets for any company obligations. Choosing the right structure is important for managing financial risks effectively.

Limited liability refers to a legal structure where the company's debts do not extend to the owners’ personal finances. This concept allows entrepreneurs to operate their businesses with reduced financial anxiety, as their private property is usually safe from creditors. Essentially, it enables individuals to take positive business steps without facing unnecessary personal risk.

Limited liability provides protection for owners, ensuring their personal assets are shielded from business debts. In contrast, unlimited liability means that owners are personally responsible for all business obligations, which can put their personal wealth at risk. Understanding the difference helps individuals choose the right business structure suited for their needs.

Limited liability means that a business owner's personal assets are protected from any debts or liabilities incurred by the business. In other words, if your company faces financial trouble, creditors cannot pursue your personal property. This structure helps individuals take business risks without fearing personal financial loss.

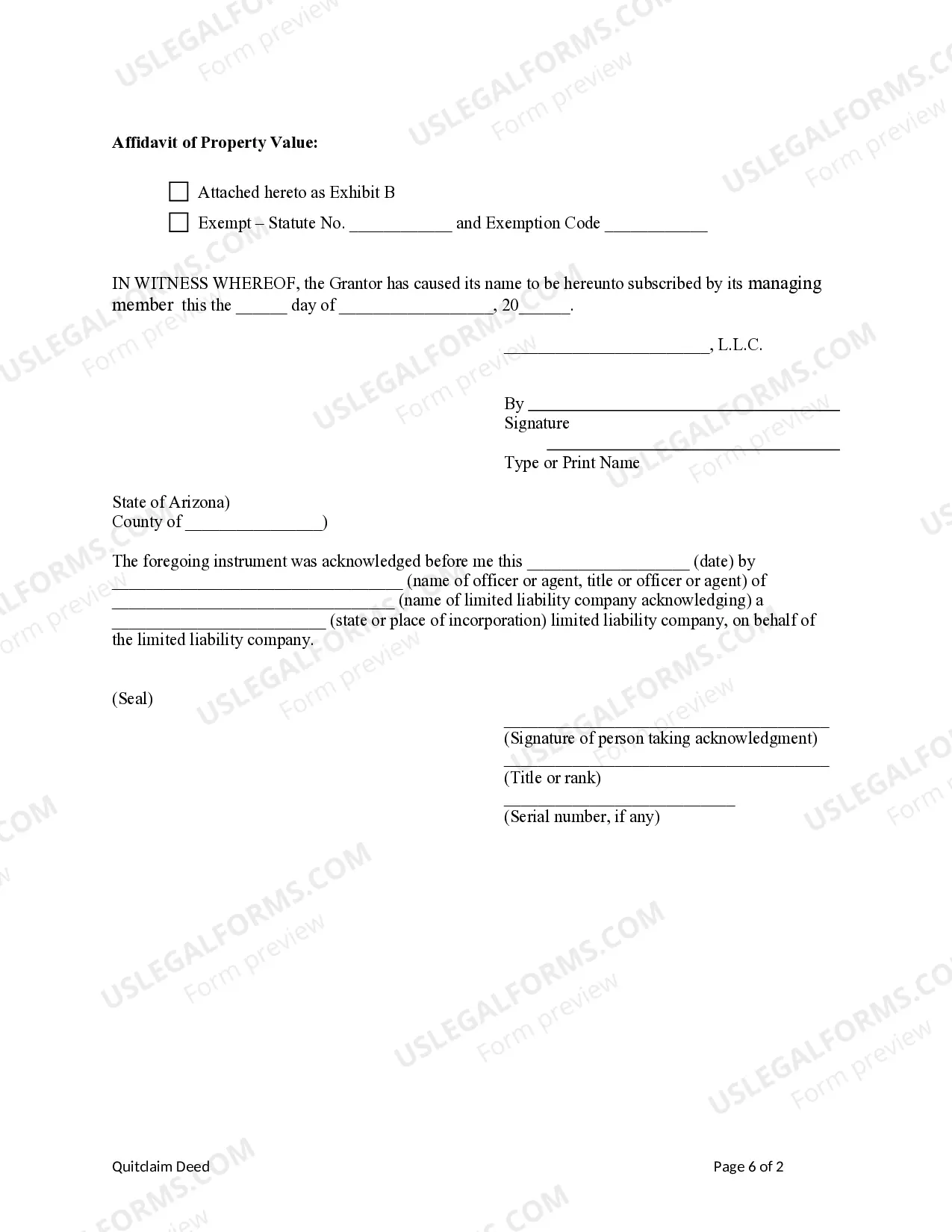

Writing a limited liability company involves drafting a clear and concise operating agreement, which outlines the management structure, roles, and responsibilities of the members. The agreement should reflect the need for limited liability protection, explaining how it safeguards personal assets. Be sure to include the process for resolving disputes and making decisions. USLegalForms provides customizable templates to simplify creating this essential document.

To write an LLC example, start with the introductory statement, specifying that this is an example of a Limited Liability Company. Include details like a fictitious company name, the purpose of the business, and the registered agent's information. Ensure that the example showcases the key elements that highlight the benefits of limited liability, such as protection from personal liability. Using templates from USLegalForms can streamline this process.

Filling out an LLC involves creating a legal document called Articles of Organization. You can gather necessary information such as the LLC's name, address, and the names of the members. It's essential to ensure that the chosen name reflects the limited liability status, as this can provide additional legal benefits. You can complete this process efficiently through platforms like USLegalForms, which offer guided assistance.

Creating an LLC for your side hustle can be a smart move to protect your personal assets. By forming an LLC, you gain limited liability protection against potential business debts and legal claims. Additionally, having an LLC can enhance your professionalism, making it easier to attract clients. Using platforms like USLegalForms can streamline the process of setting up your LLC effectively.