Limited Business

Description

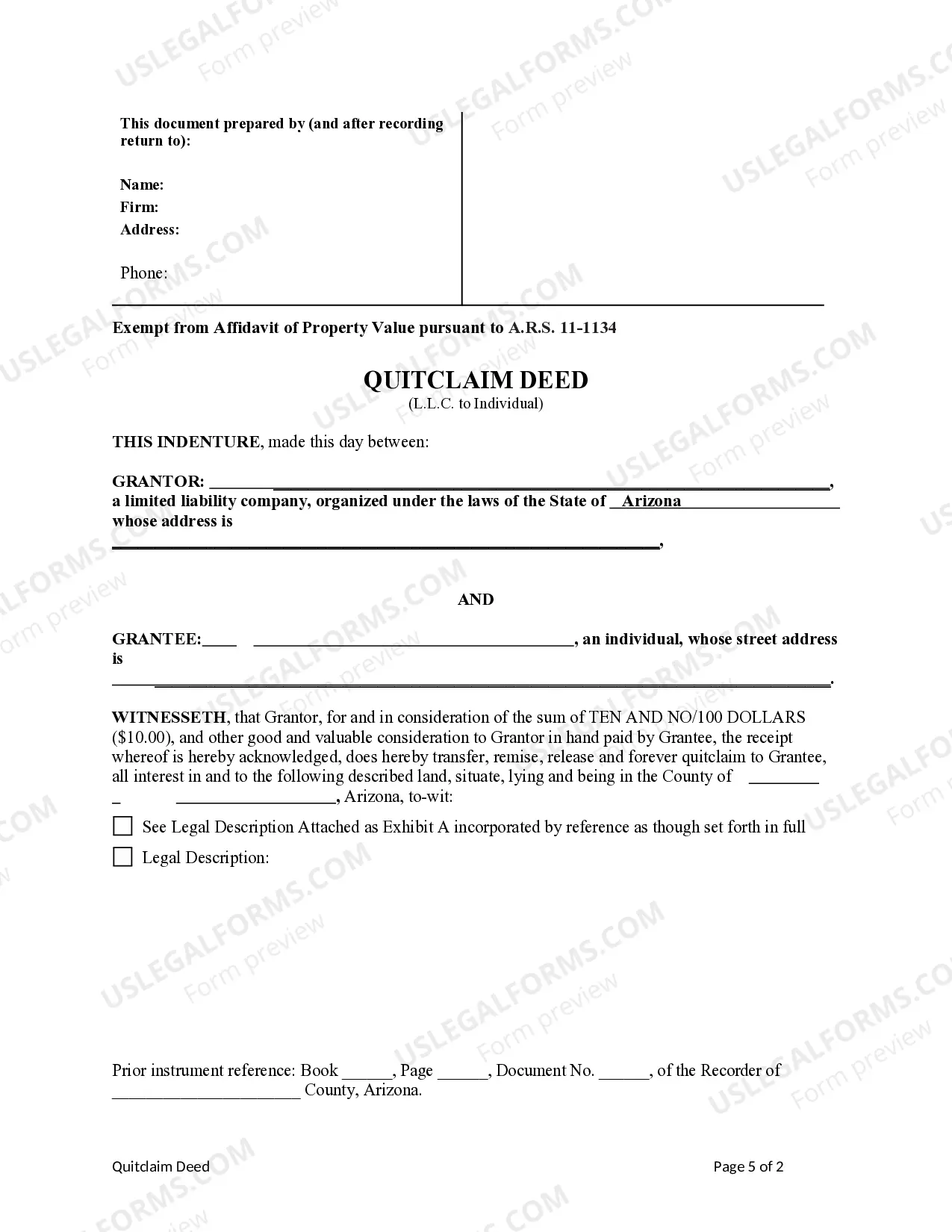

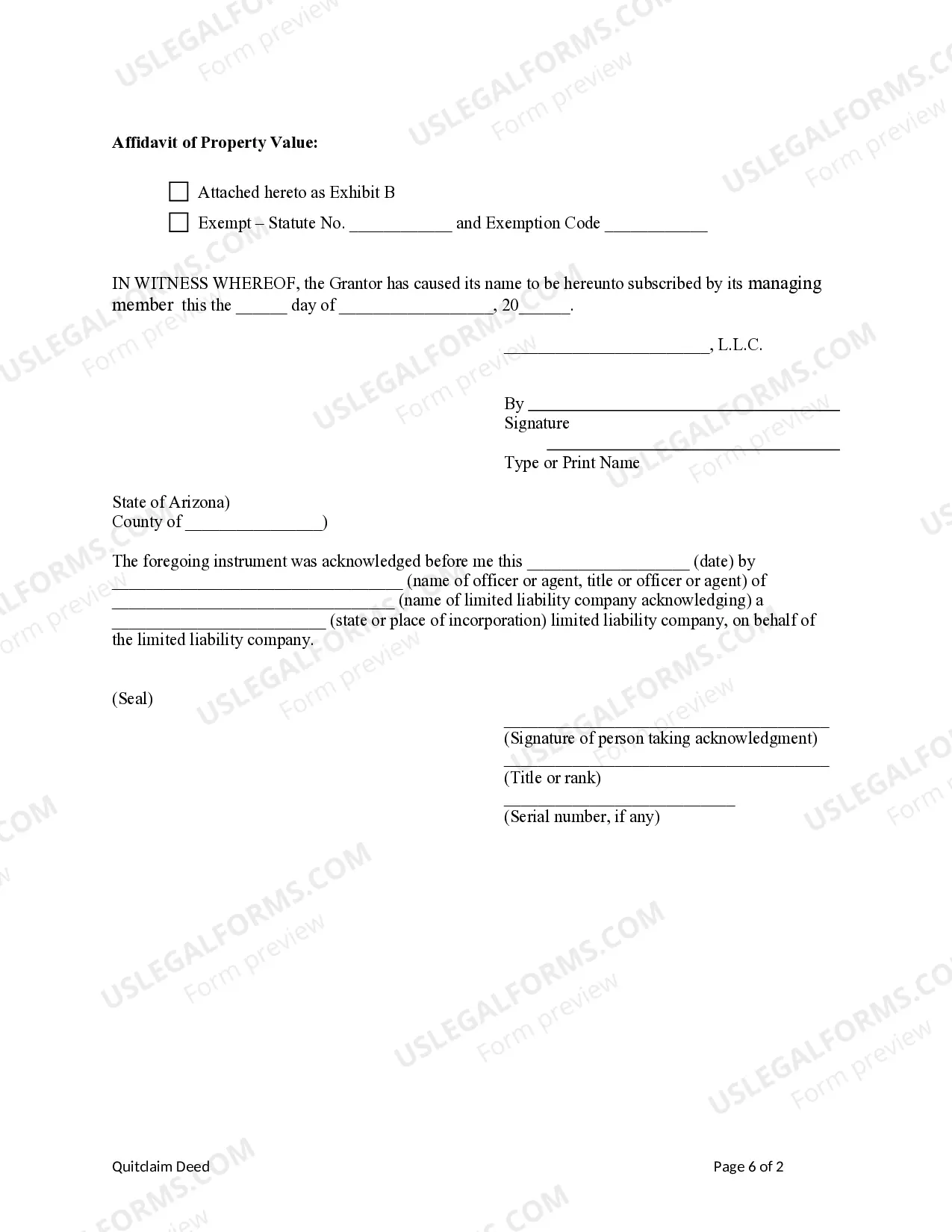

How to fill out Arizona Quitclaim Deed From A Limited Liability Company To An Individual?

- If you're a returning user, log into your account and check if your subscription is active. If not, renew it based on your preferred payment plan.

- For first-time users, start by checking the Preview mode and the form description. Make sure to select the template that meets your specific needs and complies with your local jurisdictions.

- If you find the desired form isn't quite right, use the Search tab above to locate the appropriate document.

- Once you've identified the correct form, click on the Buy Now button and select a suitable subscription plan. You'll need to register for an account to access all resources.

- Proceed with your purchase by entering your payment information via credit card or PayPal.

- Finally, download the form to your device, and you can access it anytime through the My Forms section of your profile.

With US Legal Forms, users gain access to a vast collection of legal documents, providing a one-stop solution for all your limited business needs.

Don’t hesitate to leverage the resources available on US Legal Forms to ensure your business remains compliant. Start today and harness the power of our legal form library!

Form popularity

FAQ

No, you do not need an LLC to run a small business, but forming one provides significant advantages. An LLC offers personal liability protection and can enhance your business’s credibility. It is a popular choice for those running limited businesses due to the flexibility it provides. Consider reviewing the benefits of LLC formation through uslegalforms to determine the best path for your small business.

Small businesses, including those classified as limited businesses, need to report income to the IRS as soon as they earn any revenue. There is no minimum earning threshold; all income should be reported annually. Keeping track of your income allows for better financial planning and compliance with tax regulations. Use uslegalforms resources to assist you in tracking and filing your taxes.

Yes, regardless of the income amount, including business income under $600, reporting is necessary. The IRS requires that all income be reported, as failing to do so can lead to penalties. If you have any concerns, accessing resources from platforms like uslegalforms can help ensure you meet tax reporting requirements correctly.

An LLC must file taxes once it earns any income, regardless of the amount. The requirement to report income ensures compliance with federal and state tax laws. Even if your limited business earns a small amount, accurate reporting is crucial for both tax compliance and potential future growth. Consult uslegalforms for assistance in understanding your filing obligations.

Yes, you file taxes separately from your LLC to maintain clear financial boundaries between your business and personal finances. This is particularly important for limited businesses to benefit from legal protections. Filing separately also helps to keep your accounting organized. Remember to maintain detailed records of your LLC's income and expenditures.

When you operate a limited business through an LLC, you typically file your LLC taxes separately from your personal taxes. This separation can provide legal protection and potential tax benefits. It is essential to ensure proper categorization of income and expenses related to your LLC. If you have questions, engaging with platforms like uslegalforms can guide you through the filing requirements.

Filing your personal and business taxes together can simplify your tax process, especially if you're operating a limited business as a sole proprietorship. However, this may not always be the most advantageous option. Tax laws can vary by state and your specific situation can affect your decision. Consulting with a tax professional can provide clarity on the best approach for your needs.

The choice between LTD and LLC primarily depends on your business goals. An LLC offers a flexible structure and fewer formalities, making it suitable for many small businesses. On the other hand, an LTD might be more suitable for companies looking to attract investors. To make an informed decision for your limited business, consider consulting resources from US Legal Forms.

A limited company is defined by its ability to limit its owners' liabilities to what they have invested in the business. Typically, a limited company must be registered with the state and adhere to specific regulations. This structure allows for flexibility in management and can be a great option for your limited business. Check out US Legal Forms to learn how to set up your company correctly.

No, you cannot simply replace 'LLC' with 'limited' as each term denotes a different business entity. An LLC, or limited liability company, has specific legal requirements that protect its owners. Using the proper designation is essential for your limited business to comply with regulations. For assistance, US Legal Forms provides guidance on choosing the right entity for your needs.