Odometer Disclosure Statement Arkansas Without Pay

Description

How to fill out Arkansas Bill Of Sale Of Automobile And Odometer Statement For As-Is Sale?

It’s well known that you cannot instantly turn into a legal authority, nor can you quickly learn how to effortlessly create the Odometer Disclosure Statement Arkansas Without Pay without having an expert set of abilities.

Drafting legal documents is a lengthy process that necessitates certain education and expertise. Therefore, why not let the professionals handle the creation of the Odometer Disclosure Statement Arkansas Without Pay.

With US Legal Forms, boasting one of the most comprehensive collections of legal documents, you can discover everything from court forms to templates for internal communication.

You can regain access to your documents from the My documents section at any time. If you are a current client, you can simply Log In, and find and download the template from the same section.

Regardless of your paperwork's objective—be it financial, legal, or personal—our platform has you covered. Experience US Legal Forms today!

- Use the search bar located at the top of the page to find the form you need.

- View the document (if this option is available) and read the accompanying description to determine if the Odometer Disclosure Statement Arkansas Without Pay is what you are looking for.

- Restart your search if you require another template.

- Create a complimentary account and select a subscription tier to acquire the template.

- Click Buy now. Once the payment is processed, you can obtain the Odometer Disclosure Statement Arkansas Without Pay, fill it out, print it, and deliver it or mail it to the intended recipients.

Form popularity

FAQ

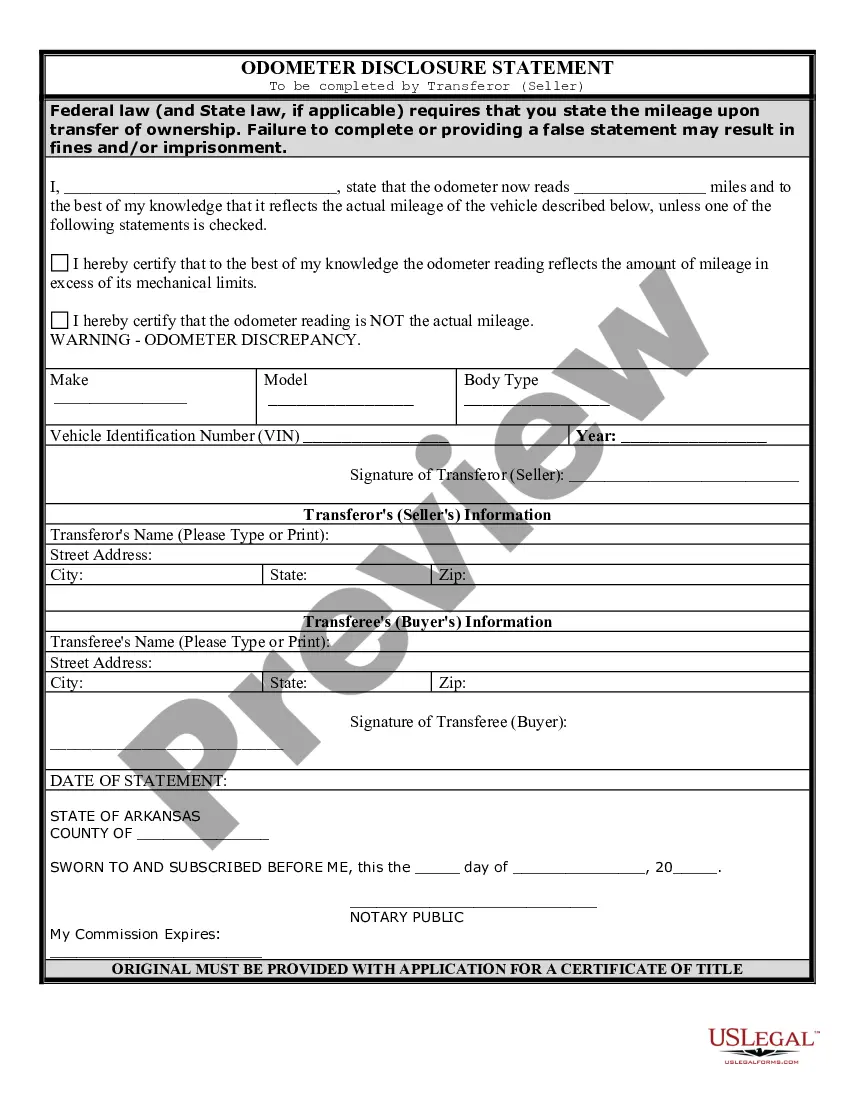

An odometer disclosure statement in California is a legal document required during the sale of a vehicle to confirm the odometer reading at the time of transfer. This statement protects both the buyer and seller from fraud by ensuring that the odometer is not altered or tampered with. In the context of an odometer disclosure statement Arkansas without pay, familiarizing yourself with its purpose and requirements can help streamline the sale process and safeguard your transaction.

To fill out the odometer disclosure statement in North Carolina, you need to provide specific information about the vehicle and its odometer reading. Begin by completing the section that identifies the vehicle, including its VIN and description. The seller must accurately report the current odometer reading, ensuring it matches the vehicle's condition, and then sign the document. Understanding the odometer disclosure statement Arkansas without pay can help you ensure compliance with legal requirements across states.

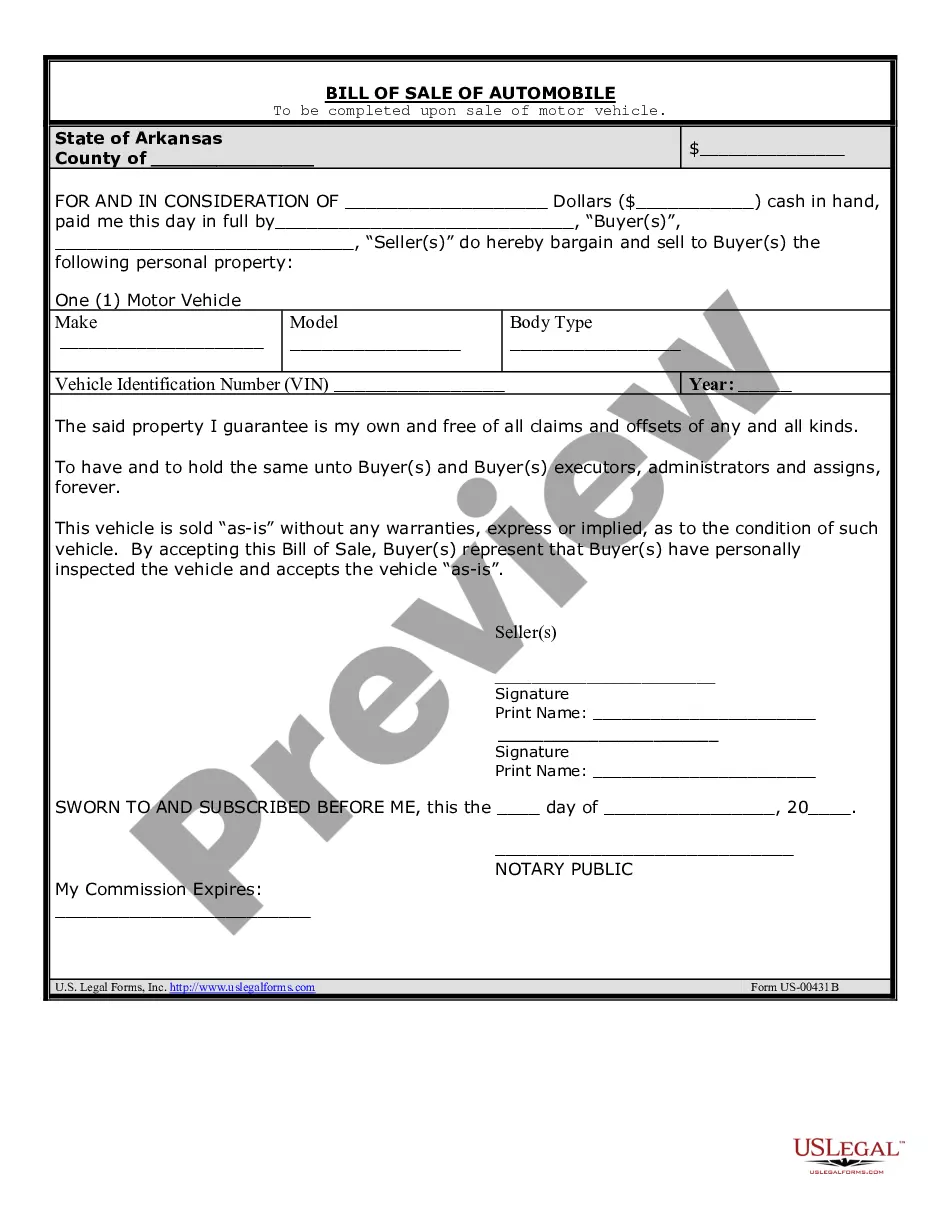

A vehicle bill of sale in Arkansas serves as a legal document that outlines the sale of a vehicle between a buyer and a seller. It includes important details such as the vehicle's make, model, year, and vehicle identification number (VIN). This document is crucial for proving ownership transfer and is often needed for registration purposes. When discussing the odometer disclosure statement Arkansas without pay, remember that the bill of sale should also include the odometer reading at the time of sale.

Yes, Texas does require an odometer disclosure statement for vehicle sales. This statement helps ensure that buyers are aware of the vehicle's mileage and helps prevent odometer fraud. When dealing with vehicle transactions, it is important to have proper documentation. If you're looking for information on an odometer disclosure statement in Arkansas without pay, USLegalForms can provide valuable resources and completed forms to streamline the process.

What is the Affidavit of Non Use agreement appearing on my Renewal? If your vehicle license plate has expired you are charged a late fee penalty. If you have not driven the vehicle during the lapsed renewal time you have the option to agree to the "Affidavit of Non-use" and the late fee penalty will be revoked.

In Arkansas, the seller of a motor vehicle is required to file a federal odometer statement with the Arkansas Office of Motor Vehicle. The statement must be filed at the time of sale or transfer of ownership of a motor vehicle with a model year of 10 years old or newer.

How to Fill in the Vehicle Bill of Sale Section 1. Vehicle Identification Number (VIN) Section 2. Buyer's Name. ... Section 3. Seller's Information. ... Section 4. In an Individual ? Dealer/Seller's Name, Address, City, State, and Zip. Section 5. Purchase Date. Section 6. Description of Vehicle including. Make. ... Section 7.

What is the Affidavit of Non Use agreement appearing on my Renewal? If your vehicle license plate has expired you are charged a late fee penalty. If you have not driven the vehicle during the lapsed renewal time you have the option to agree to the "Affidavit of Non-use" and the late fee penalty will be revoked.

Box one should be used if the vehicle's odometer has ?rolled over.? Years past this was common when most vehicles only had an odometer that went up to 100,000 miles, but nowadays it is very uncommon to use this box. Box two should be used if the odometer is inaccurate.