Mortgage Release Form Withdrawal

Description

How to fill out Alabama Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

There's no further justification to squander time searching for legal documents to adhere to your local state laws.

US Legal Forms has gathered all of them in one location and simplified their accessibility.

Our platform offers over 85k templates for any business and personal legal situations organized by state and area of application.

Using the search field above to look for another sample if the current one doesn't suit you.

- All forms are expertly prepared and verified for accuracy, so you can feel confident in acquiring an up-to-date Mortgage Release Form Withdrawal.

- If you are acquainted with our platform and already possess an account, make sure your subscription is current before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documentation anytime needed by accessing the My documents tab in your profile.

- If you've never utilized our platform previously, the process will involve a few more steps to accomplish.

- Here's how new users can locate the Mortgage Release Form Withdrawal in our library.

- Read the page content carefully to ensure it includes the sample you seek.

- To do so, utilize the form description and preview options if available.

Form popularity

FAQ

Taxpayers generally request the withdrawal using Form 12277, Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien; however, any written request that provides sufficient information may by used. Requests for withdrawals should be considered regardless of the date the NFTL was filed.

Withdrawn Loan Balance means the amounts of the Loan withdrawn from the Loan Account and outstanding from time to time.

This means the applicant needs to tell the lender they wish to withdraw their application. Sometimes a lender will consider an application withdrawn because the applicant has not responded to contact attempts. If the application is not expressly withdrawn, it cannot be considered withdrawn.

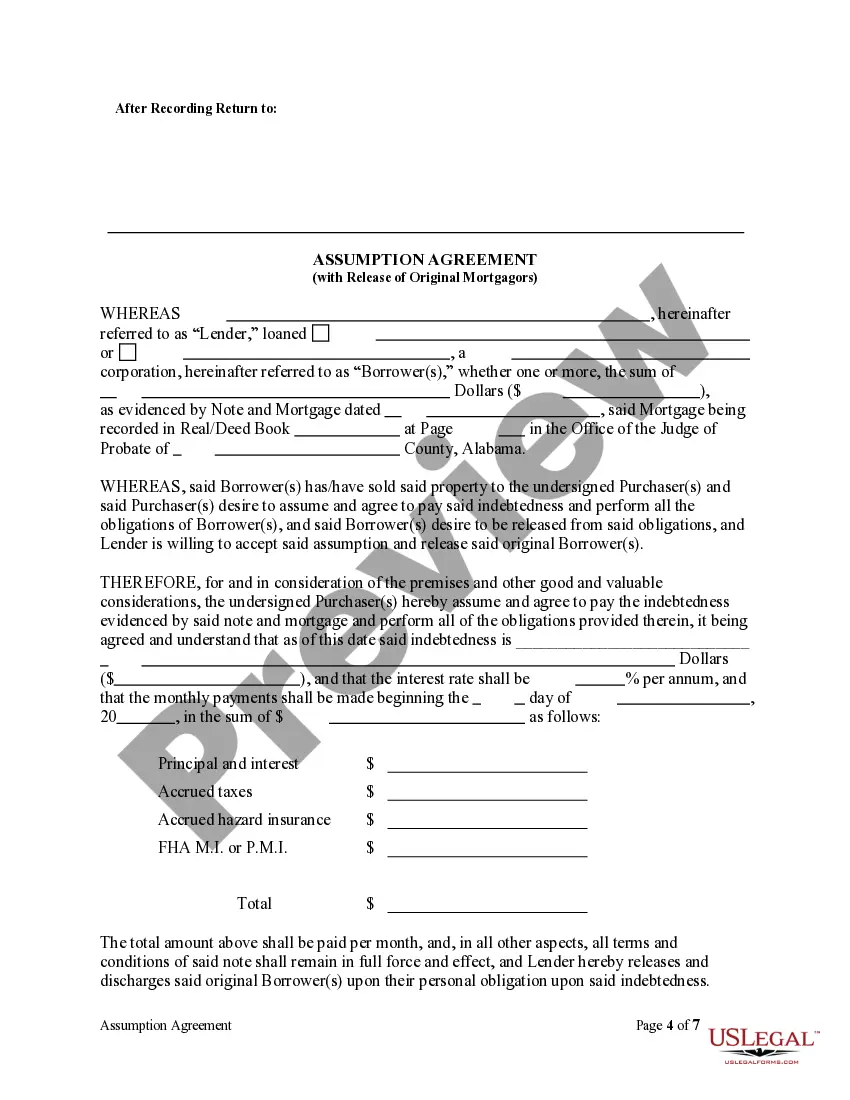

In addition the following information should be included:The Payee Name.The Owner(s) of the mortgage holder.Total amount of mortgage.Mortgage date of execution.Full and legal description of the property to include tax parcel number.Acknowledgement that all payments have been made in full.More items...?

When you pay off your loan and you have a mortgage, the lender will send you or the local recorder of deeds or office that handles the filing of real estate documents a release of mortgage. This release of mortgage is recorded or filed and gives notice to the world that the lien is no more.