Alaska Property Agreement With No Property Tax

Description

How to fill out Alaska Postnuptial Property Agreement?

There's no further justification to squander time searching for legal documents to adhere to your local state mandates.

US Legal Forms has compiled all of them in a single location and enhanced their availability.

Our site offers over 85k templates for any business and individual legal situations categorized by state and purpose.

Utilize the Search field above to look for another sample if the previous one didn't meet your needs. Click Buy Now next to the template name once you identify the correct one. Choose the desired pricing plan and register for an account or Log In. Complete your subscription payment with a credit card or via PayPal to proceed. Choose the file format for your Alaska Property Agreement With No Property Tax and download it to your device. Print your document to fill it out by hand or upload the sample if you prefer to work with an online editor. Creating official paperwork under federal and state regulations is fast and straightforward with our platform. Try US Legal Forms now to maintain your documentation in order!

- All documents are properly drafted and verified for accuracy, so you can be assured of acquiring an up-to-date Alaska Property Agreement With No Property Tax.

- If you are acquainted with our platform and already possess an account, ensure your subscription is active prior to acquiring any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents whenever necessary by accessing the My documents tab in your profile.

- If you've never engaged with our platform before, the procedure will involve additional steps to finish.

- Here's how new users can locate the Alaska Property Agreement With No Property Tax in our catalog.

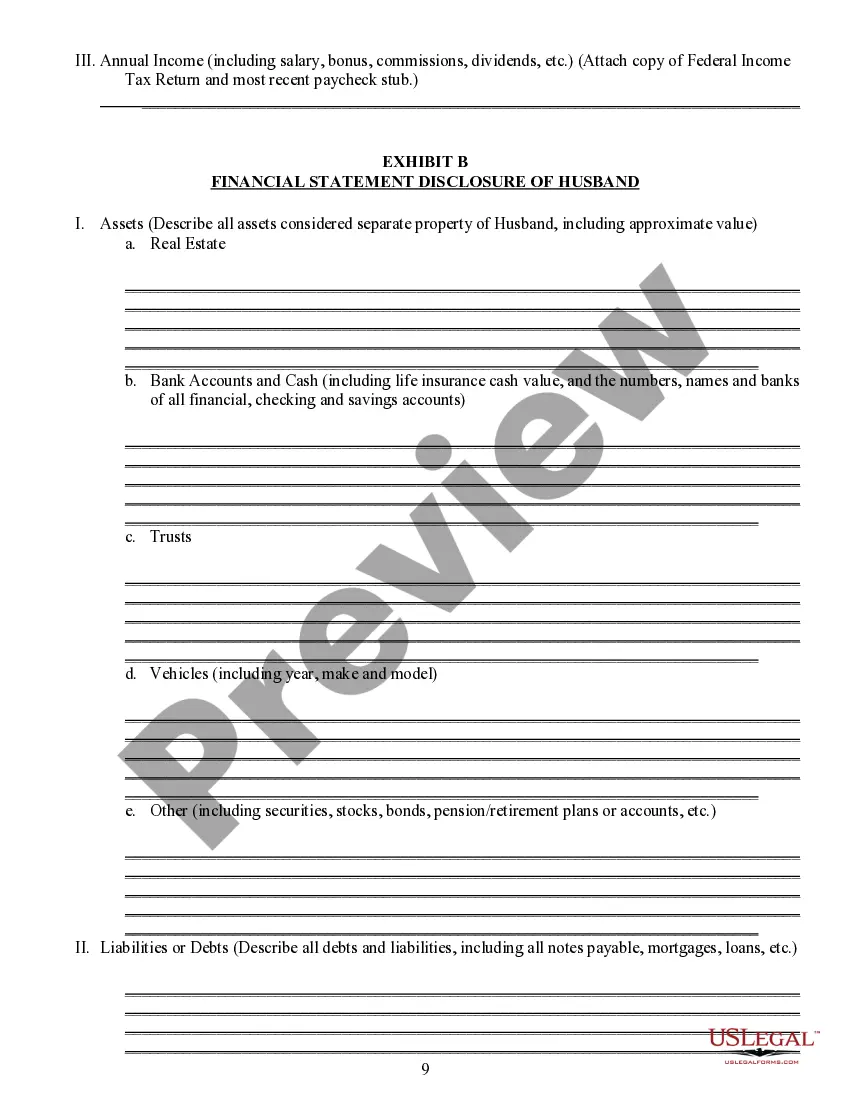

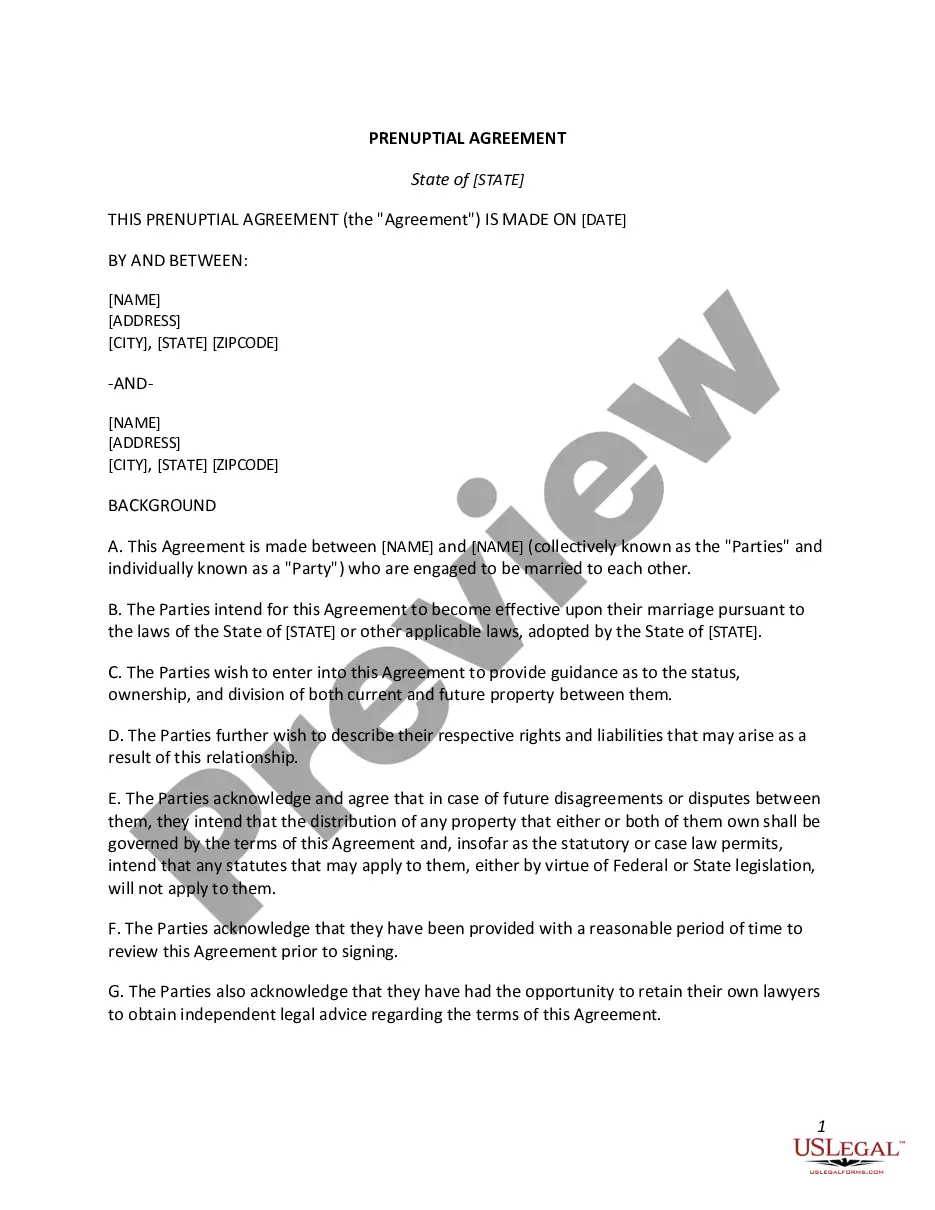

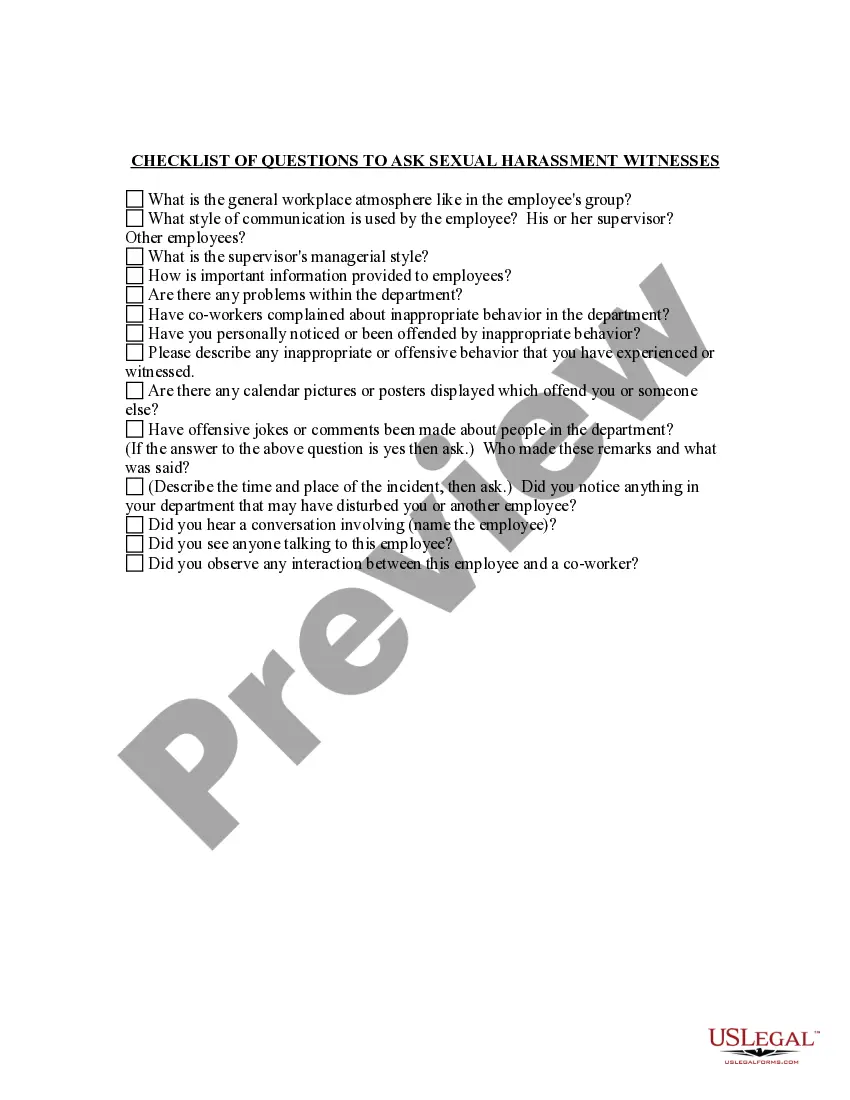

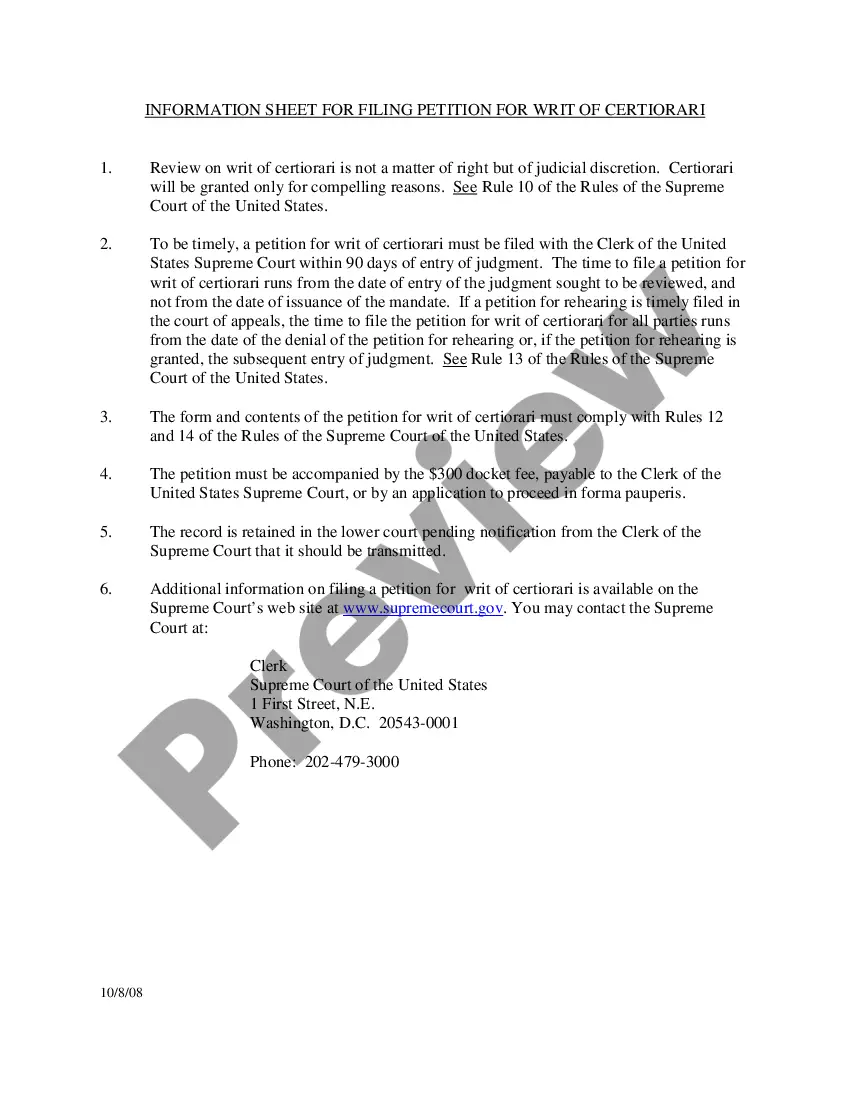

- Examine the page content meticulously to ensure it contains the sample you require.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

Alaska Property Taxes The average effective property tax rate in the state is 1.18%, which is 0.11% higher than the 1.07% national average.

Port Alexander: The Town In Alaska Without Property Taxes.

Alaska is the only state in the United States where a large part of the land mass of the state is not subject to a property tax. Although property tax is the primary method of raising revenues for the majority of the larger municipalities in the state, smaller municipalities favor a sales tax.

Unlike most states, Alaska does not impose an acreage limit for homestead exemptions. The state allows homestead exemptions of up to $72,900, but does not allow married couples to double that amount. Alaska's homestead exemption applies to one's primary residence (not a vacation home or second property).

Alaska exempts from property taxes the first $150,000 of assessed value for all senior citizens (65 years of age and over) and disabled veterans (50% or more service connected disability).