What is Deed?

Deeds are legal documents that transfer ownership of property. They are commonly used when buying or selling real estate. Explore state-specific templates for your needs.

Deeds are essential documents for property transfers. Attorney-drafted templates are quick and easy to complete.

Access multiple essential forms for owner-financed real estate transactions, providing everything needed in one convenient package.

Access multiple essential forms for owner-financed real estate transactions, providing everything needed in one convenient package.

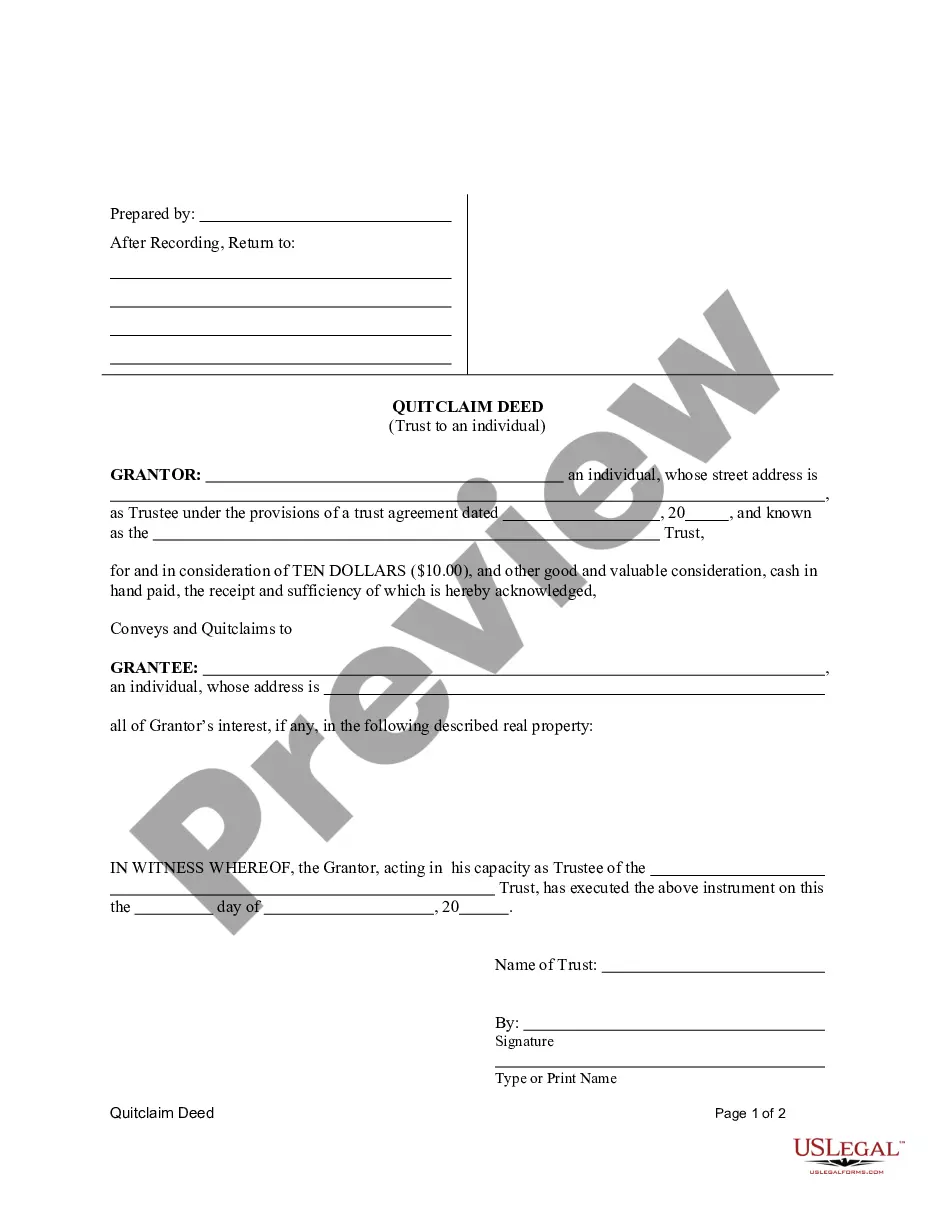

Transfer property ownership from a trust to an individual, simplifying the process without the need for a formal sale.

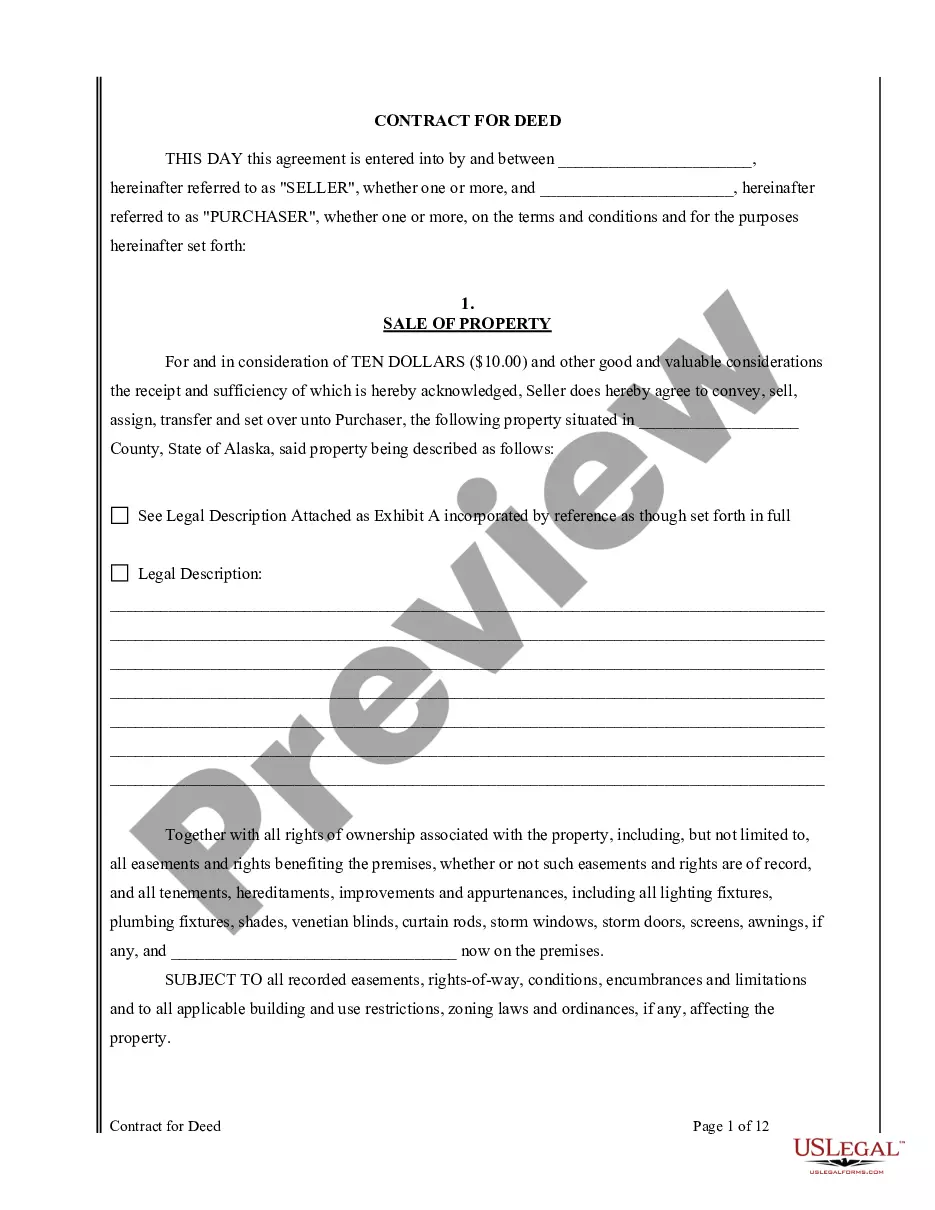

Secure sales of real estate with flexible payment terms, protecting both buyers and sellers.

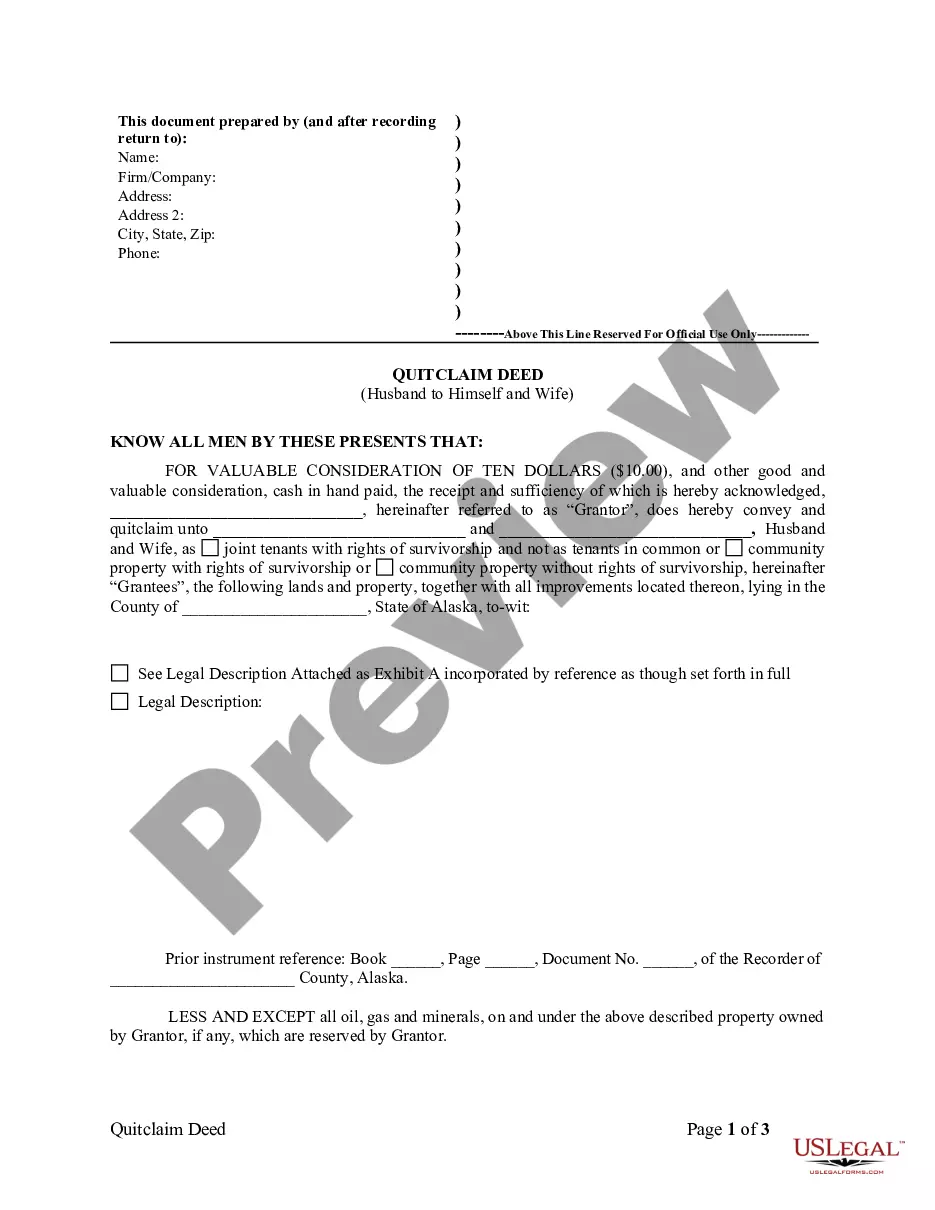

Used to transfer property rights between individuals, this form simplifies the process of conveying ownership without warranties.

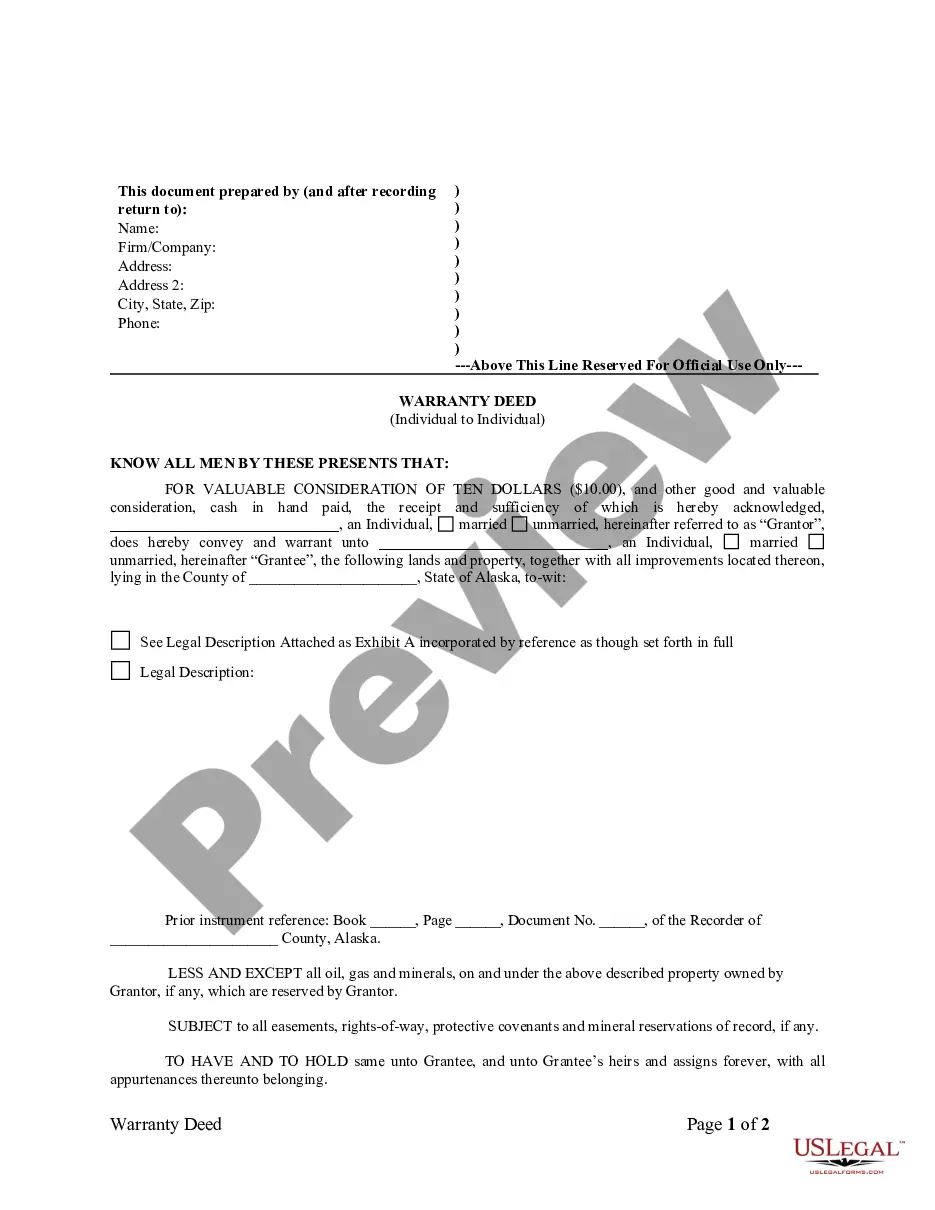

Transfer property ownership between individuals while ensuring clear title and legal protections.

Transfer property ownership between a partner and themselves, ensuring clear title while addressing any existing claims or easements.

Transfer property to your child while retaining a life estate, ensuring you maintain rights to the property during your lifetime.

Use this document to transfer property from an individual to a trust, streamlining estate management and ensuring secure asset allocation.

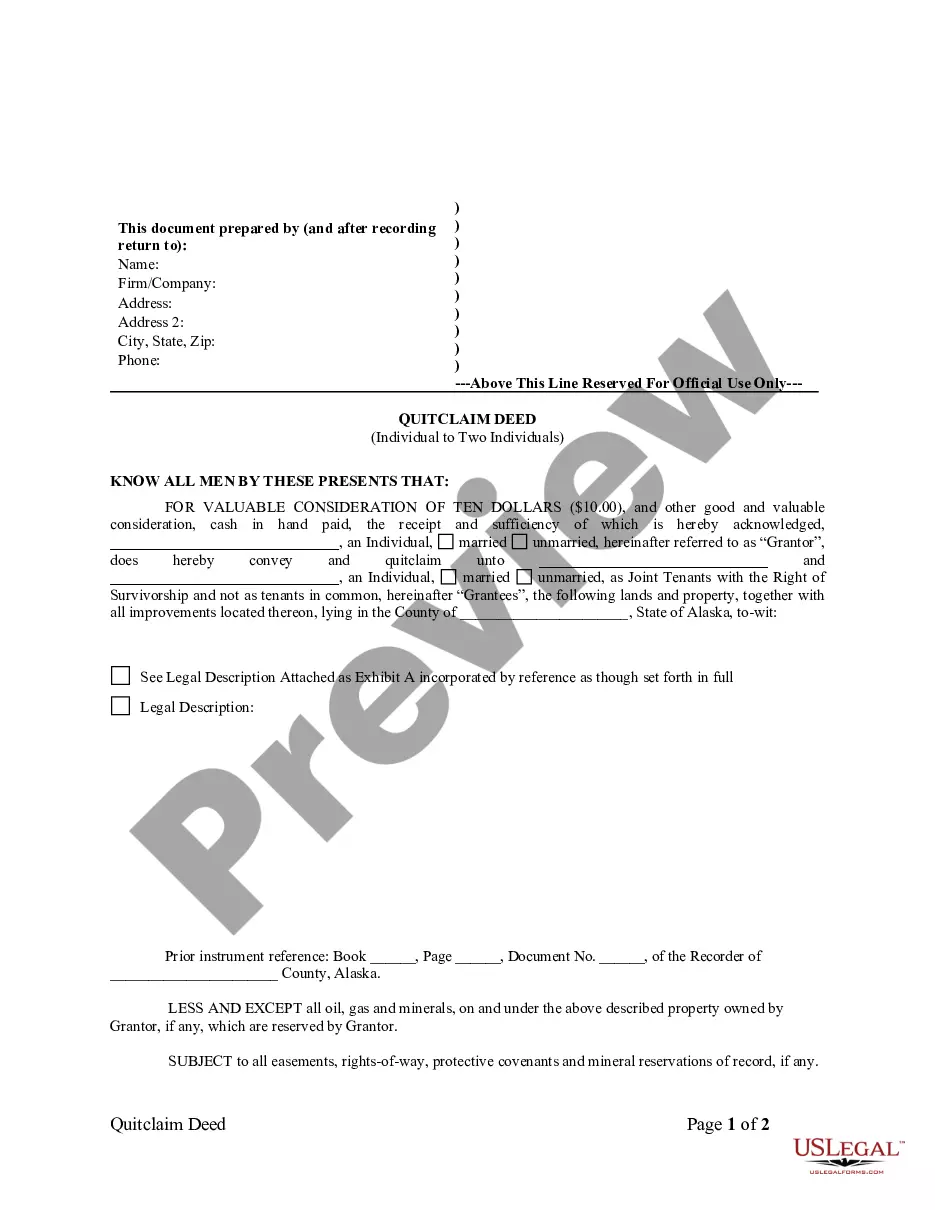

Easily transfer property ownership to two individuals as joint tenants, ensuring rights of survivorship.

Use this legal document to transfer property with a guarantee from a fiduciary, ensuring all obligations were met.

Deeds must be signed, often requiring notarization.

Different types of deeds offer varying levels of protection.

Property transfers require clear identification of the parties involved.

Deeds may need to be recorded with local authorities.

Certain deeds can have tax implications.

Begin your process in just a few steps.

A trust can manage assets during your lifetime, while a will takes effect after death.

Assets may be distributed according to state laws, which may not reflect your wishes.

Review your plan regularly, especially after major life events or changes in circumstances.

Beneficiary designations typically override instructions in your will or trust.

Yes, you can designate separate agents for financial and healthcare matters.