This form is a Quitclaim Deed where the grantor is an individual and the grantee is a trust.

Alaska Quitclaim Deed for Individual to a Trust

Description

How to fill out Alaska Quitclaim Deed For Individual To A Trust?

Amidst numerous complimentary and paid templates accessible online, you cannot be assured of their dependability.

For instance, who created them or whether they possess the necessary expertise to meet your needs.

Always remain composed and make use of US Legal Forms!

If you hold a subscription, Log In to your account and look for the Download button next to the form you need. You can also retrieve your previously purchased documents in the My documents section. If you're using our service for the first time, adhere to the guidelines below to easily obtain your Alaska Quitclaim Deed for Individual to a Trust: Ensure the document you view is applicable in your residing state. Review the document by utilizing the Preview function. Click Buy Now to initiate the purchasing procedure or search for an alternative example using the Search bar located in the header. Select a payment plan and establish an account. Complete the subscription payment using your credit/debit card or PayPal. Download the document in the necessary format. Once you have registered and purchased your subscription, you can utilize your Alaska Quitclaim Deed for Individual to a Trust as often as required or for as long as it is valid in your state. Modify it in your preferred editor, fill it out, sign it, and print a copy of it. Achieve much more for less with US Legal Forms!

- Find Alaska Quitclaim Deed for Individual to a Trust templates crafted by expert attorneys.

- and avoid the costly and time-intensive task of searching for a lawyer.

- and then paying them to prepare a document for you that you can locate by yourself.

Form popularity

FAQ

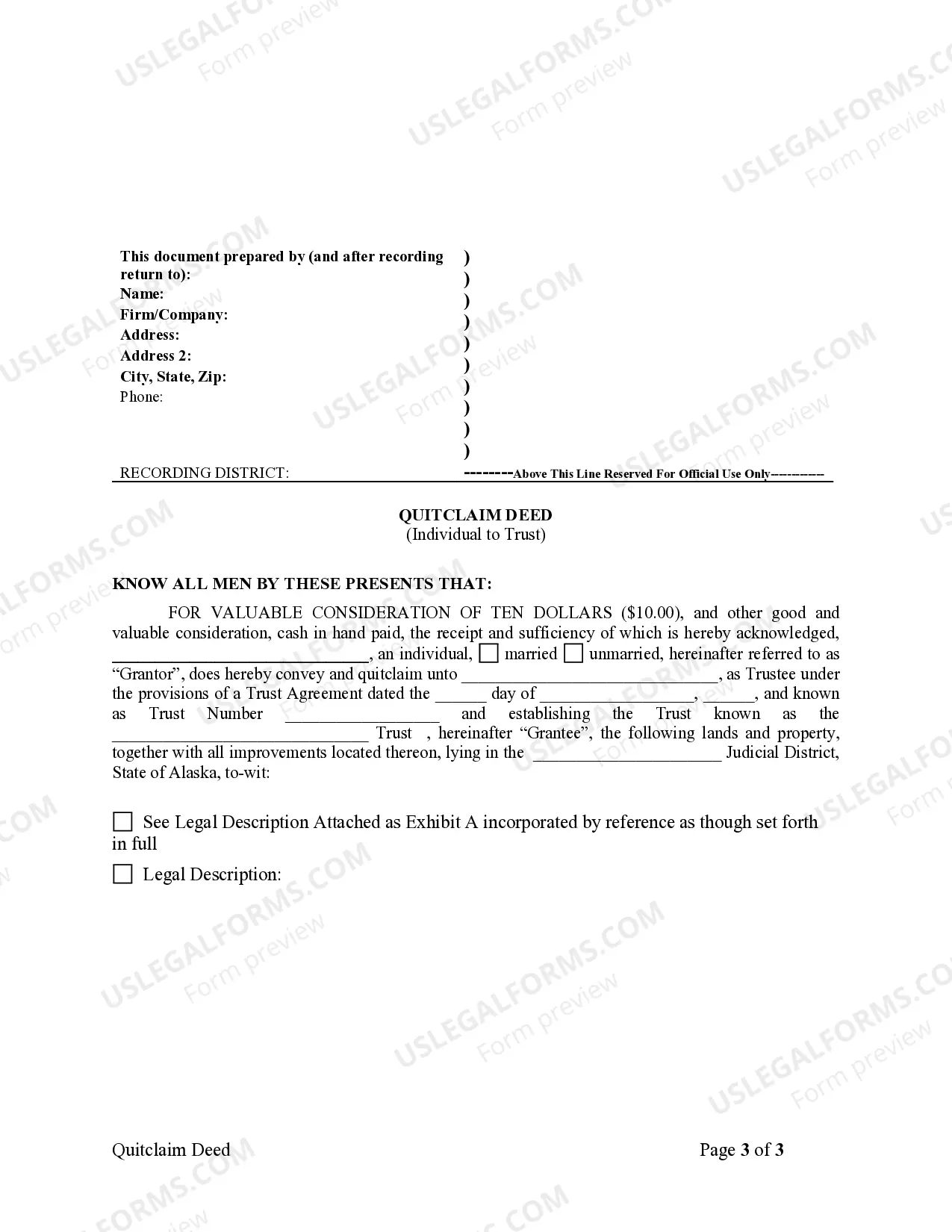

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

Take the signed and notarized quitclaim deed to your county recorder's office to complete the transfer of title into your revocable trust. Check in two to four weeks to ensure it has been recorded. Include the address of the property on the asset list addendum attached to your trust.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

It's usually a very straightforward transaction, but it's possible for a quitclaim deed to be challenged. If a quitclaim deed is challenged in court, the issue becomes whether the property was legally transferred and if the grantor had the legal right to transfer the property.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

You must actually transfer or place property in the trust. That means the trust, with you as trustee, owns the property in it.You can also take property out of the trust if your needs change or if you want to give it to your beneficiary.

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.