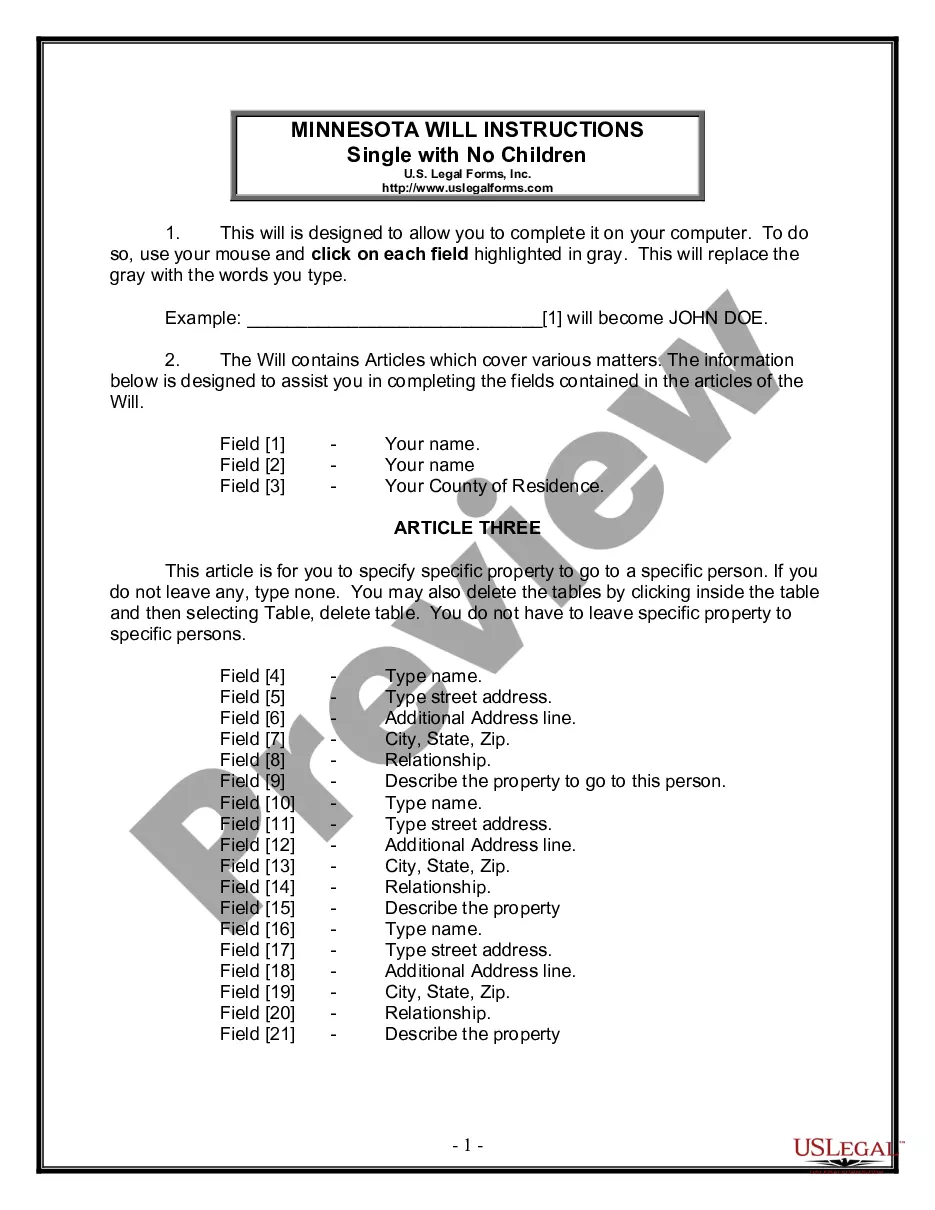

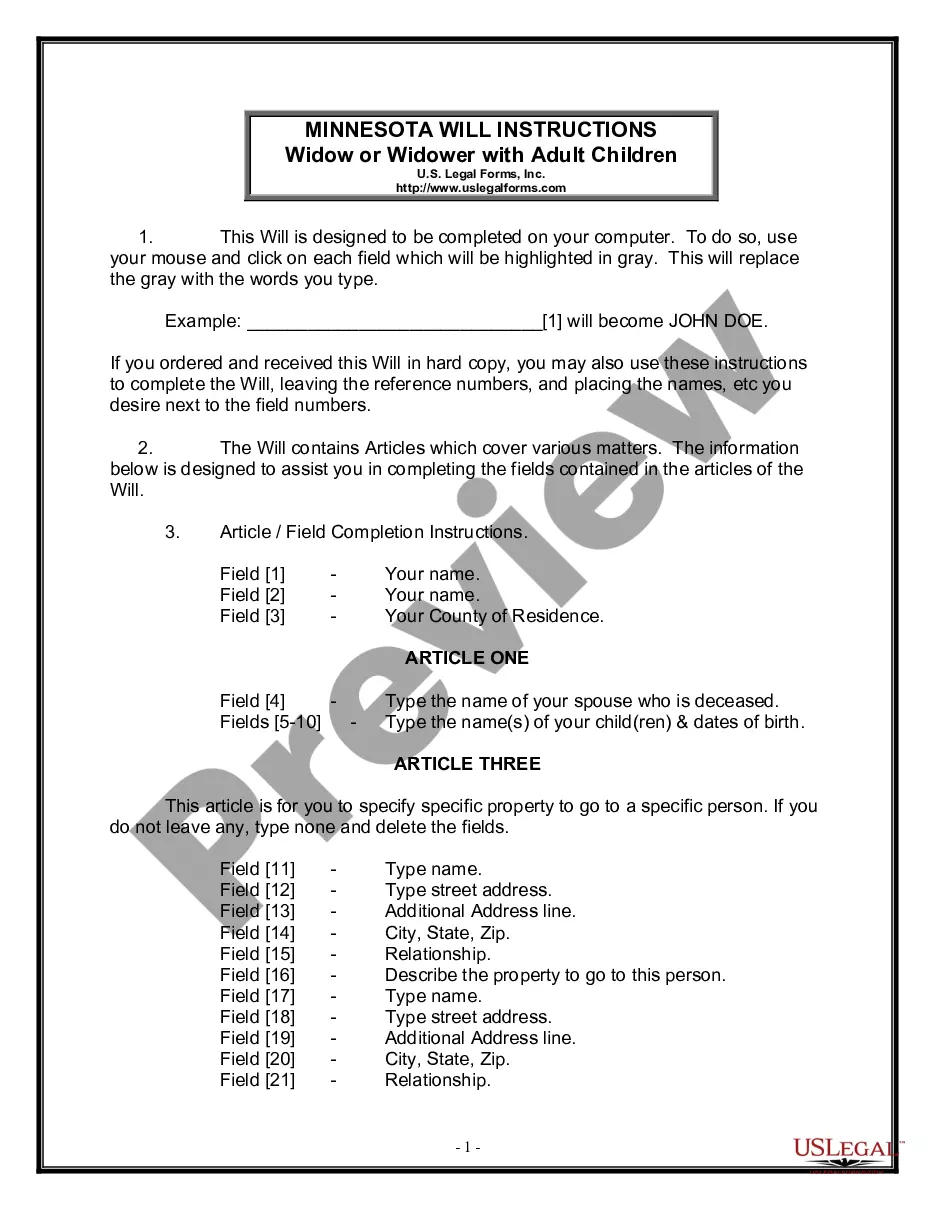

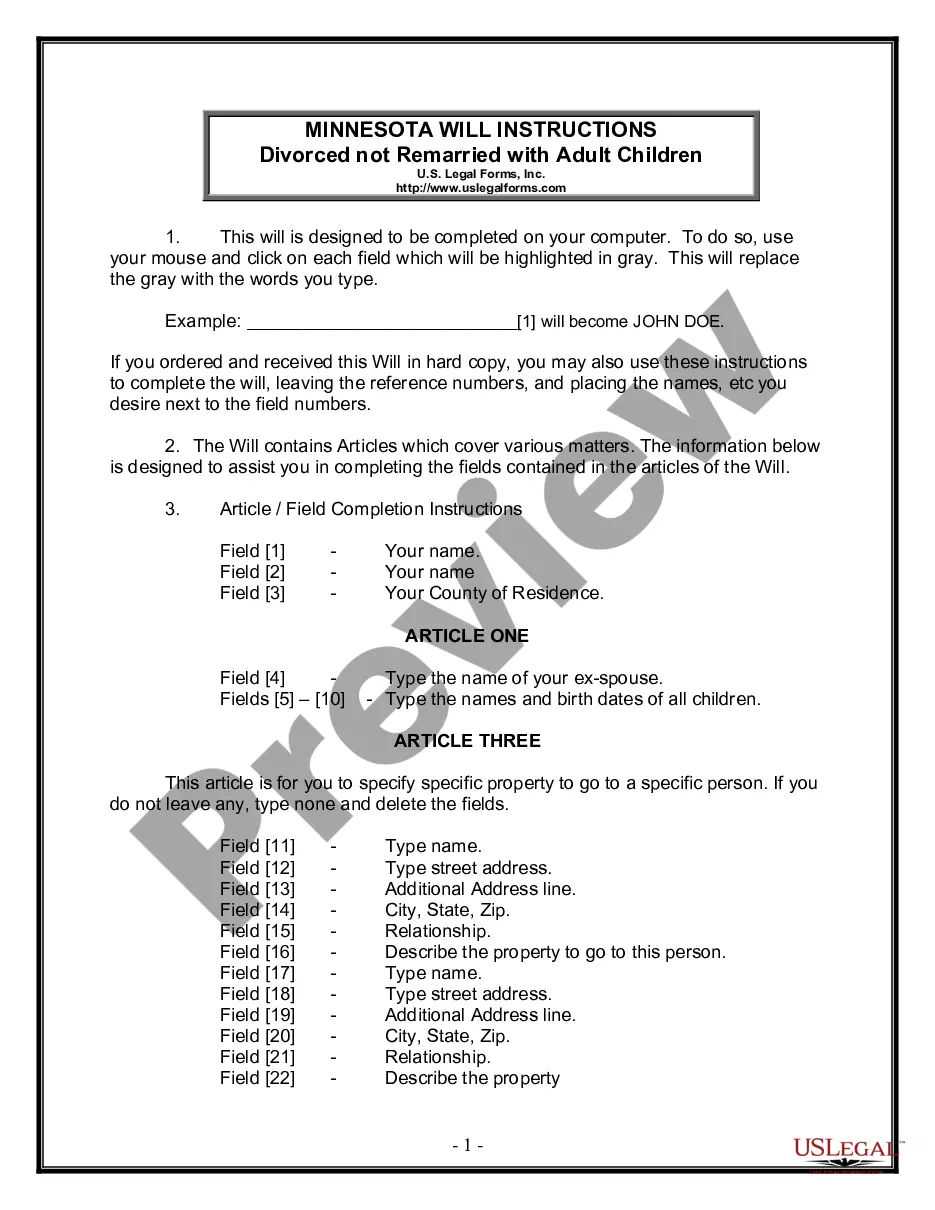

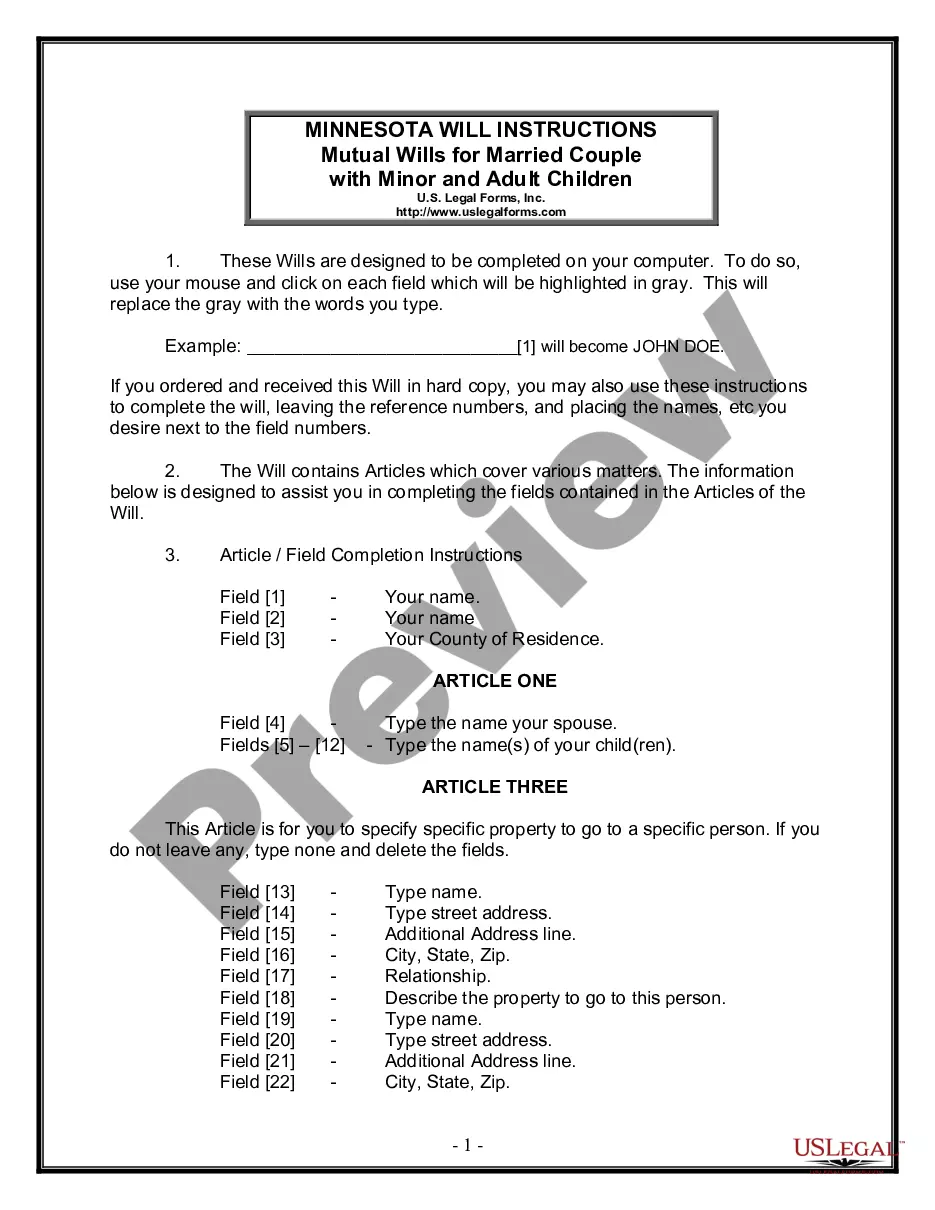

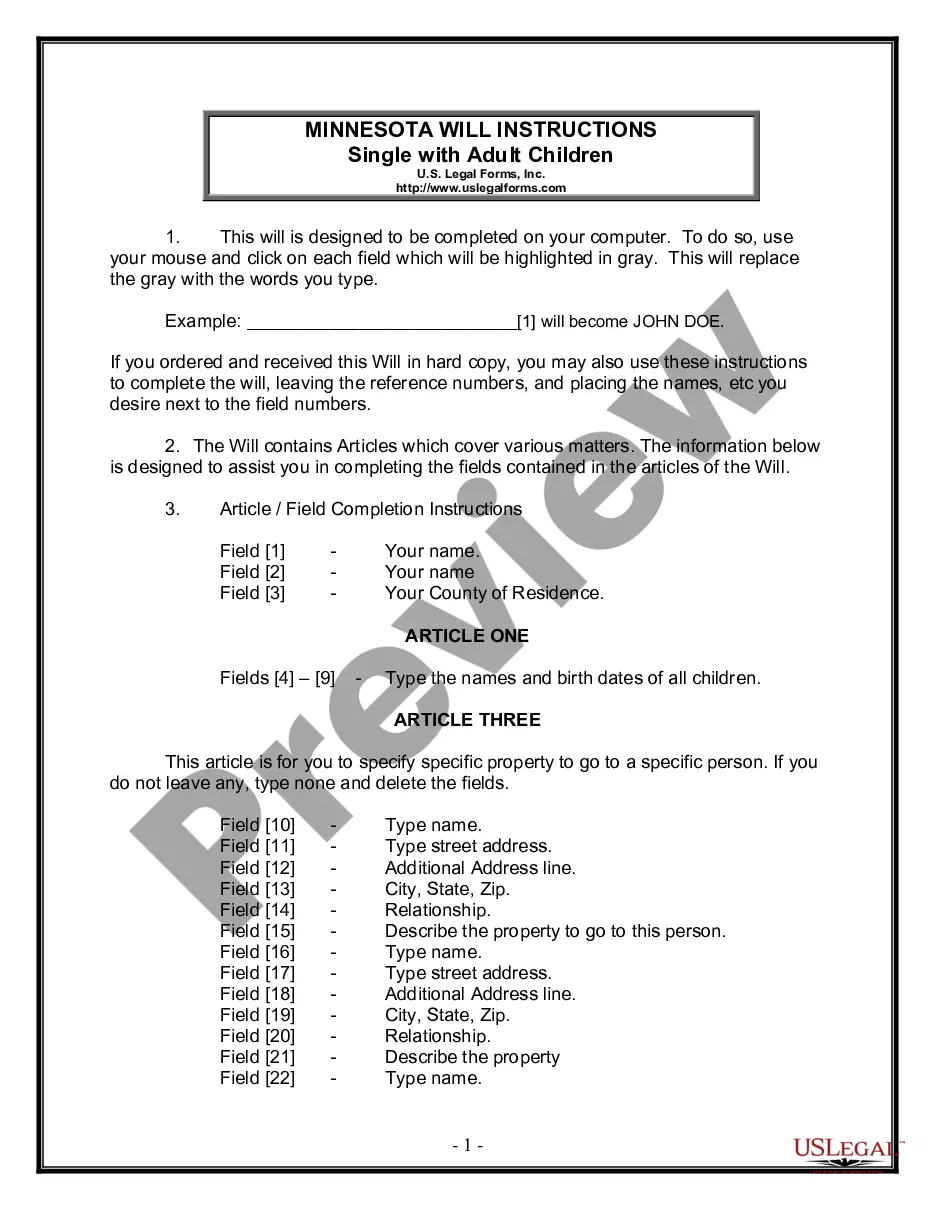

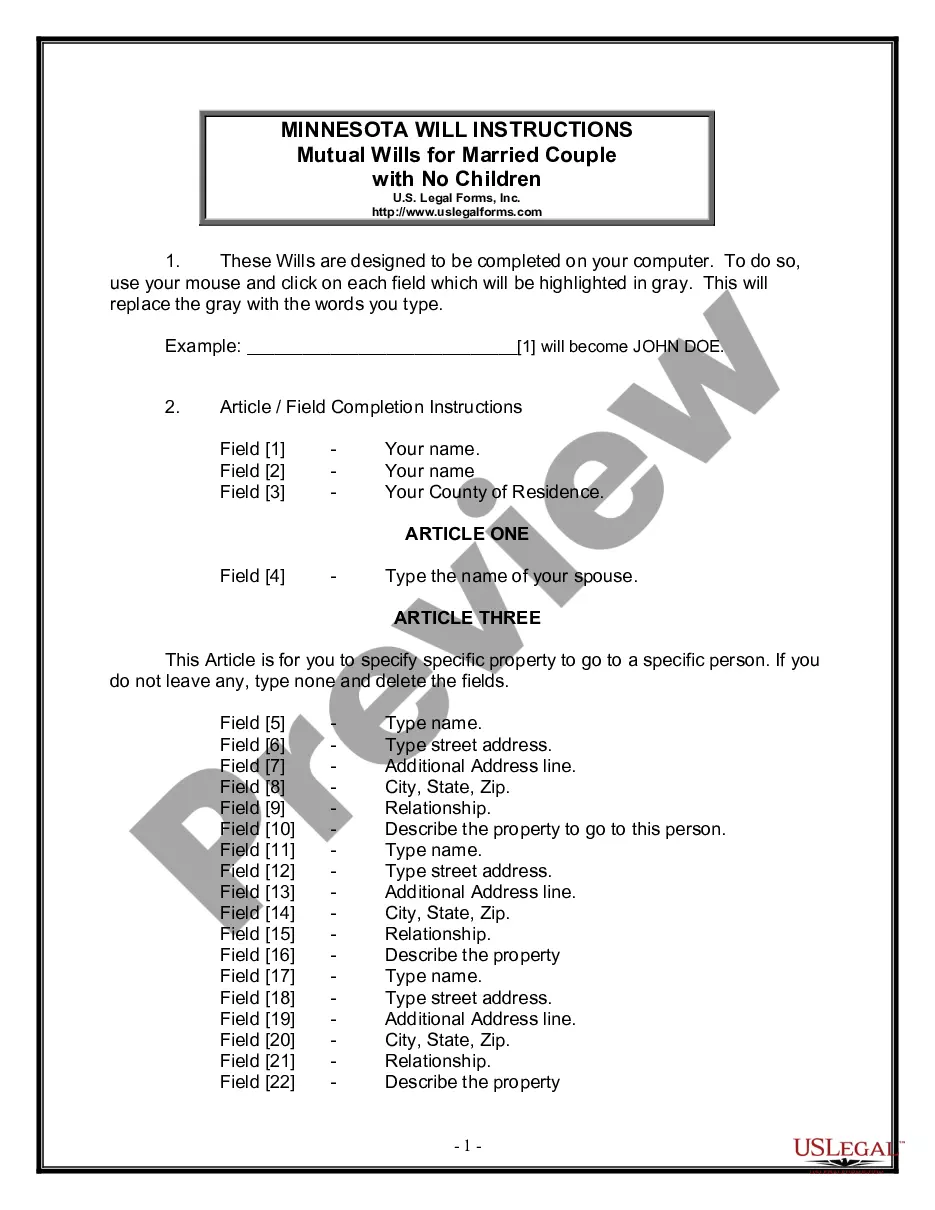

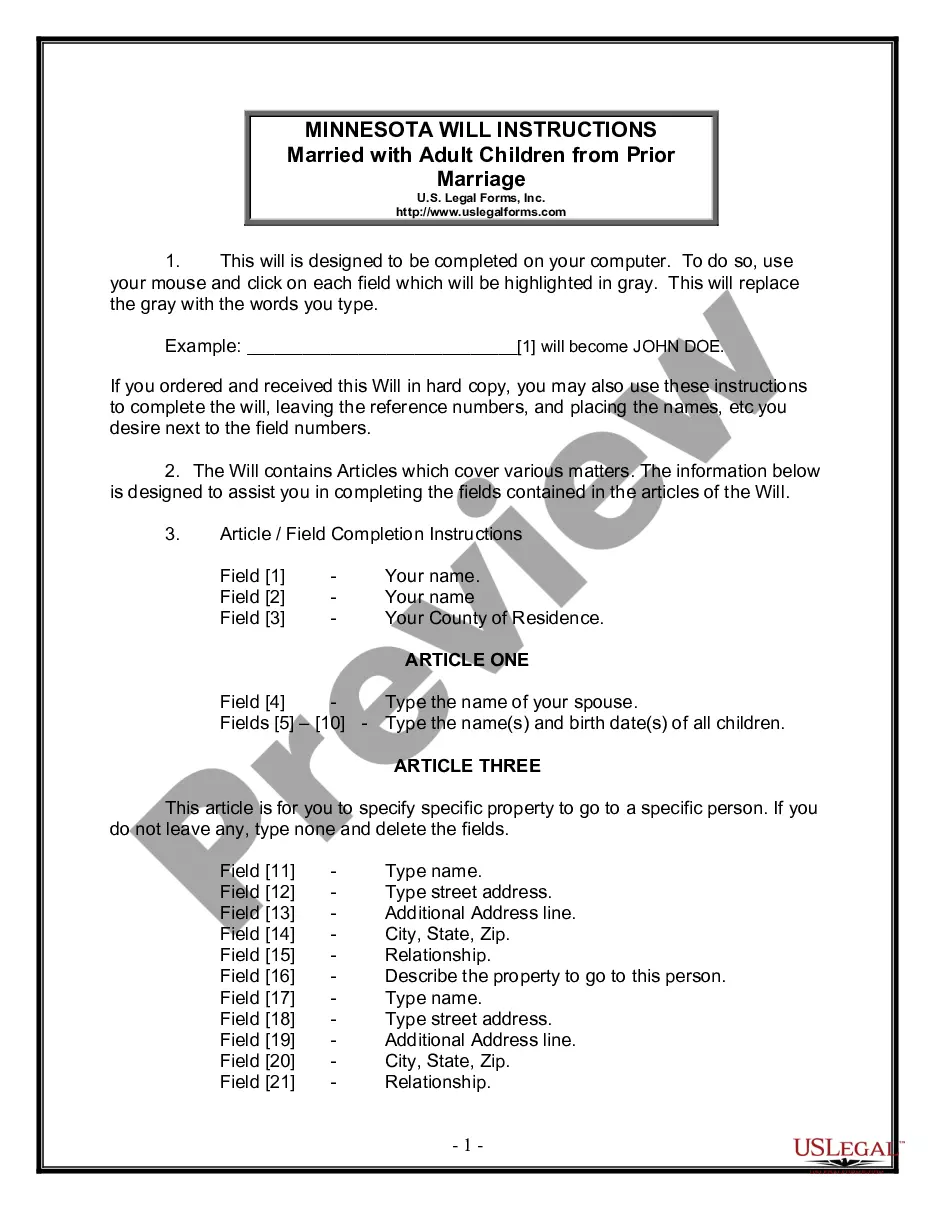

What is Last Will and Testament?

A Last Will and Testament is a legal document that specifies how your property and affairs should be handled after your death. It is commonly used to ensure your wishes are honored. Explore state-specific templates for your needs.