What is Last Will and Testament?

A Last Will and Testament is a legal document detailing how to distribute your assets after passing. It's essential for ensuring your wishes are honored. Explore state-specific templates to get started.

A Last Will and Testament outlines your wishes after death. Attorney-drafted templates are quick and easy to complete.

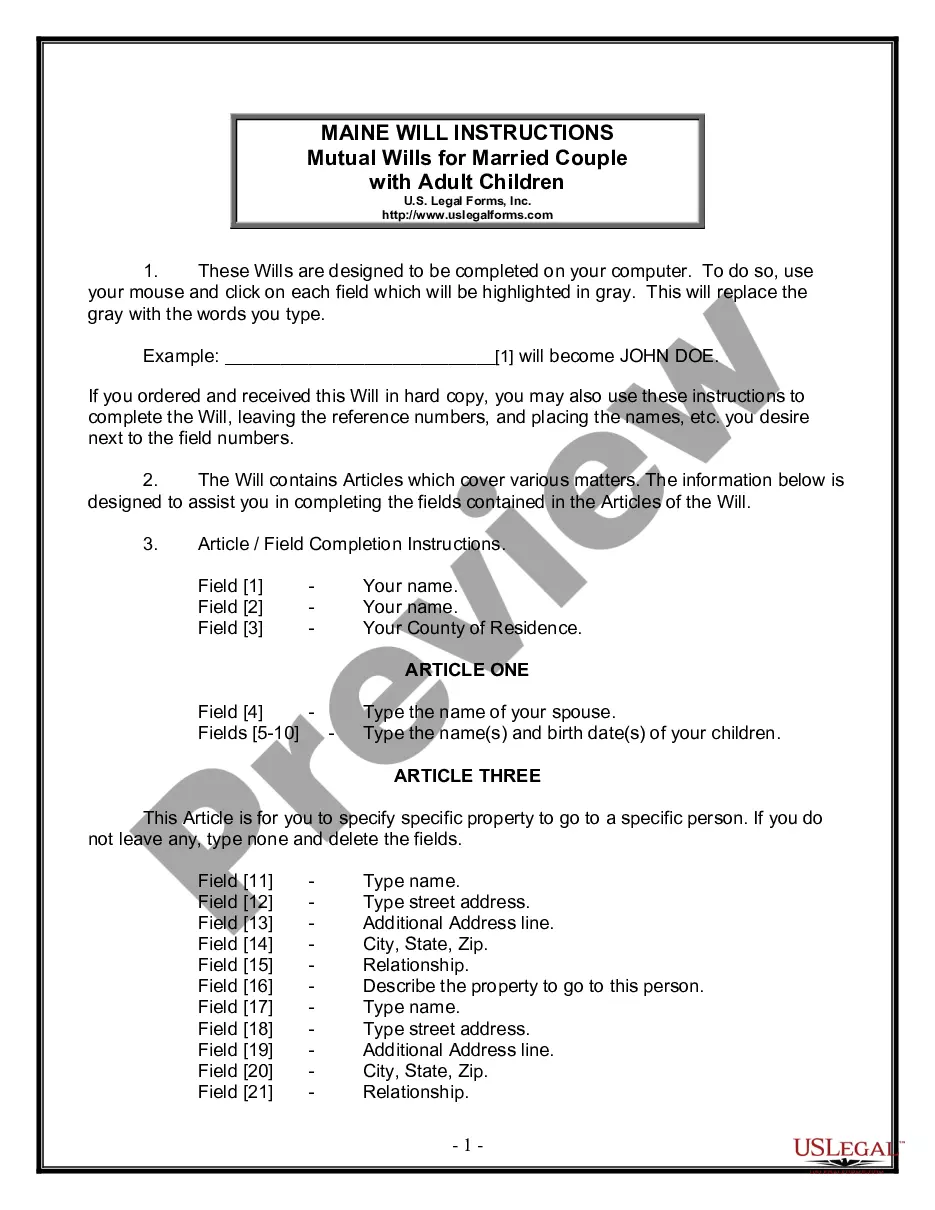

Ideal for married couples with adult children, ensuring property distribution and guardianship are clearly defined.

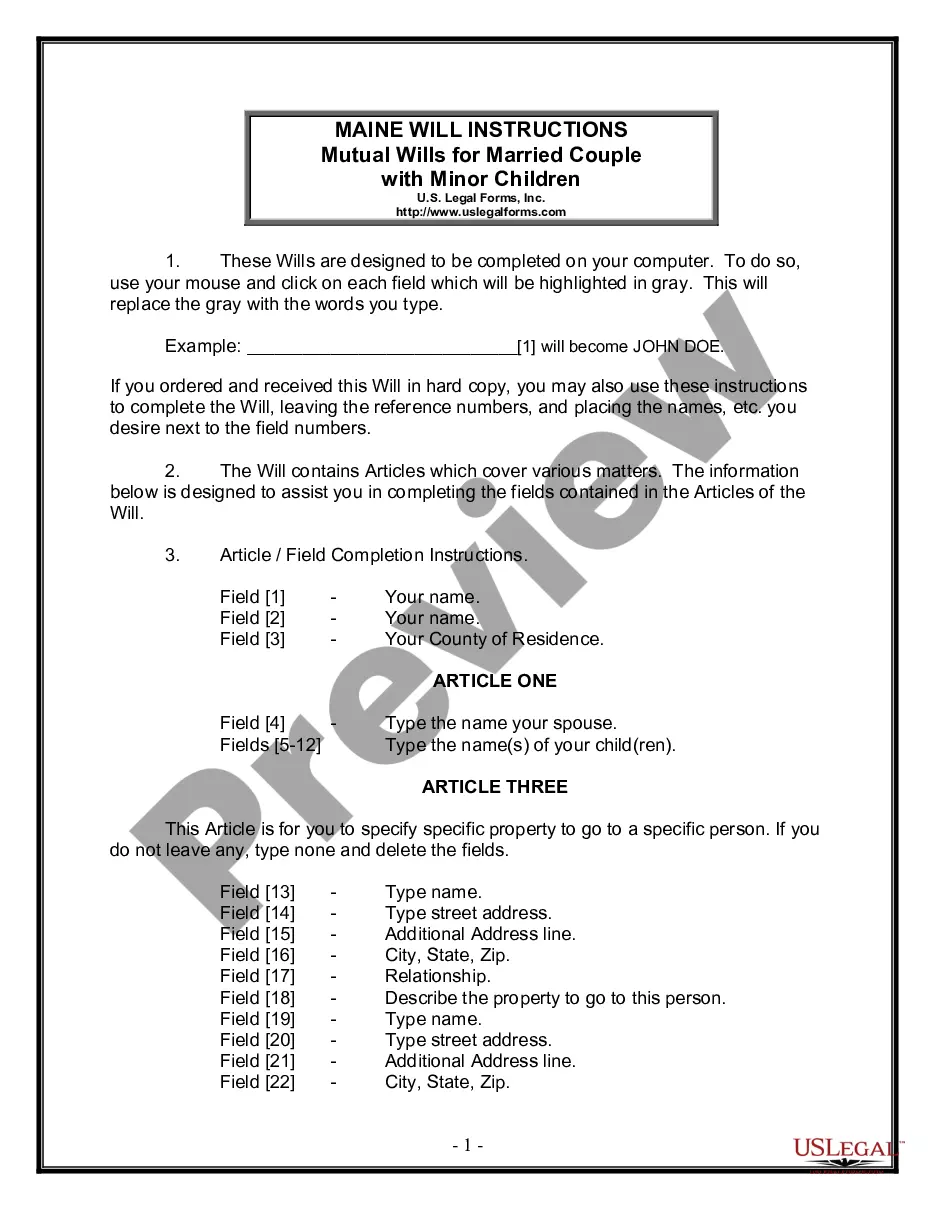

Create legally binding wills for married couples with minor children, ensuring your wishes are honored for property and guardianship.

Prepare vital estate documents with ease, ensuring your wishes are honored and your loved ones are protected.

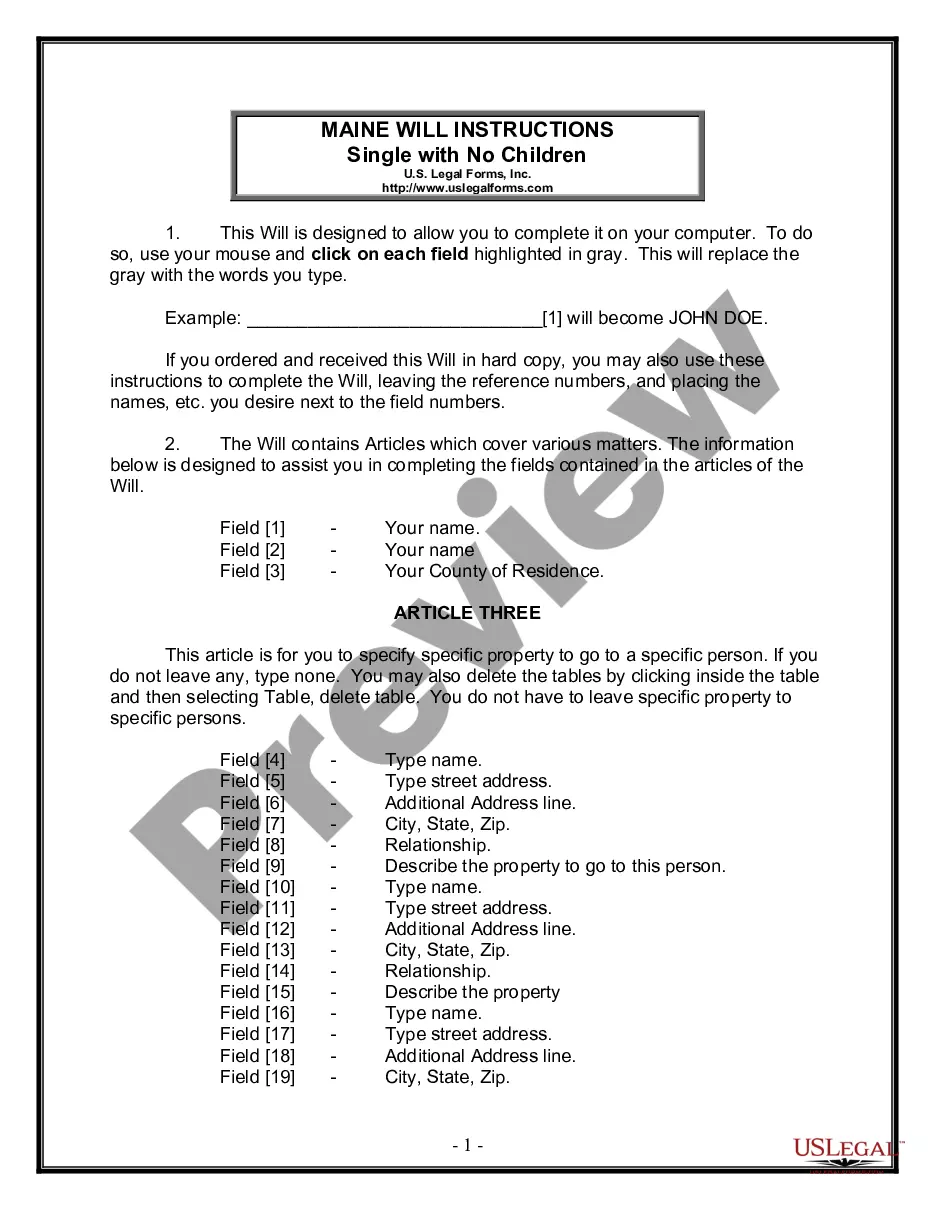

Plan your estate clearly and ensure your assets are distributed according to your wishes.

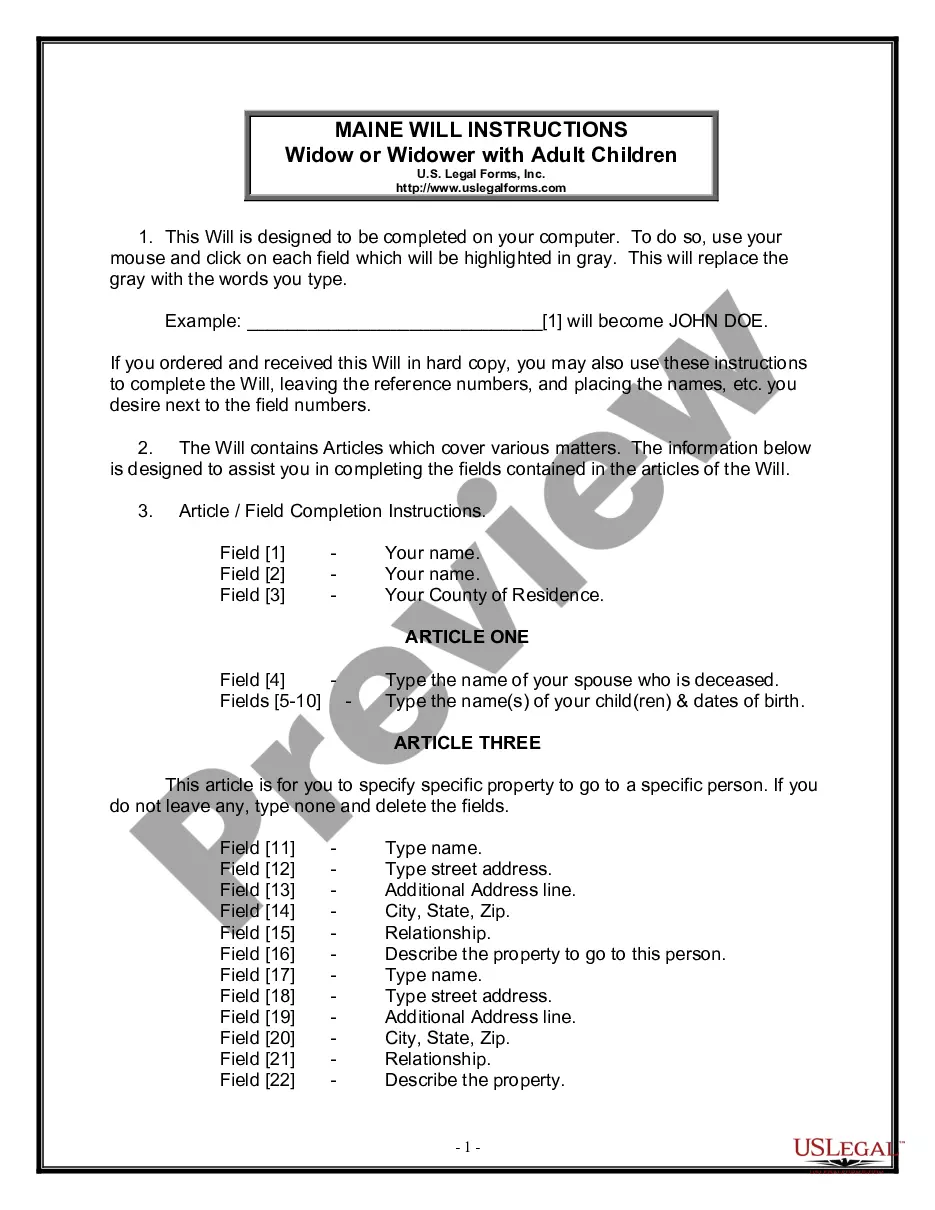

Create a legally binding document to define how your assets will be distributed after your death, specifically designed for widows or widowers with adult children.

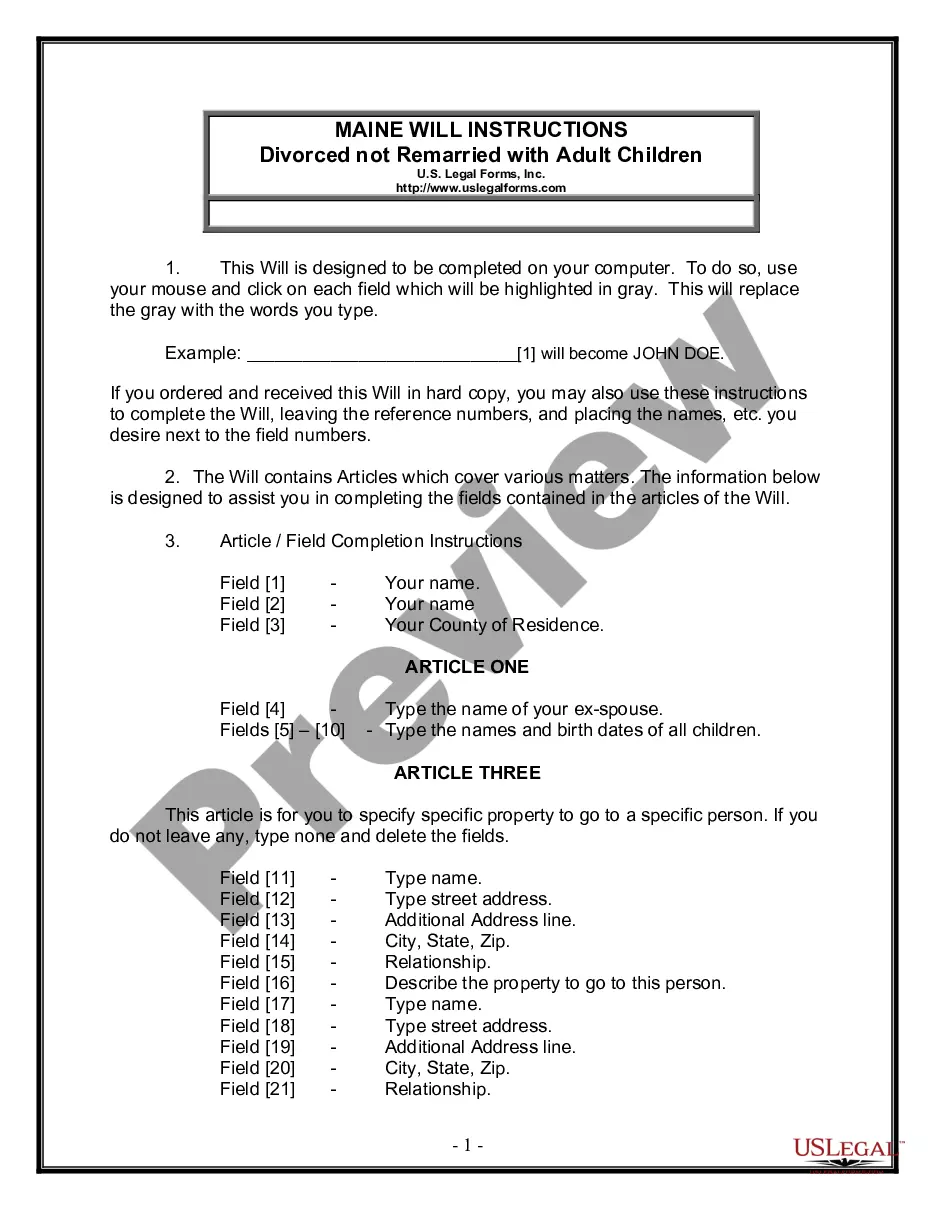

Plan your estate with a clear guide tailored for divorced individuals with adult children, ensuring your wishes are honored.

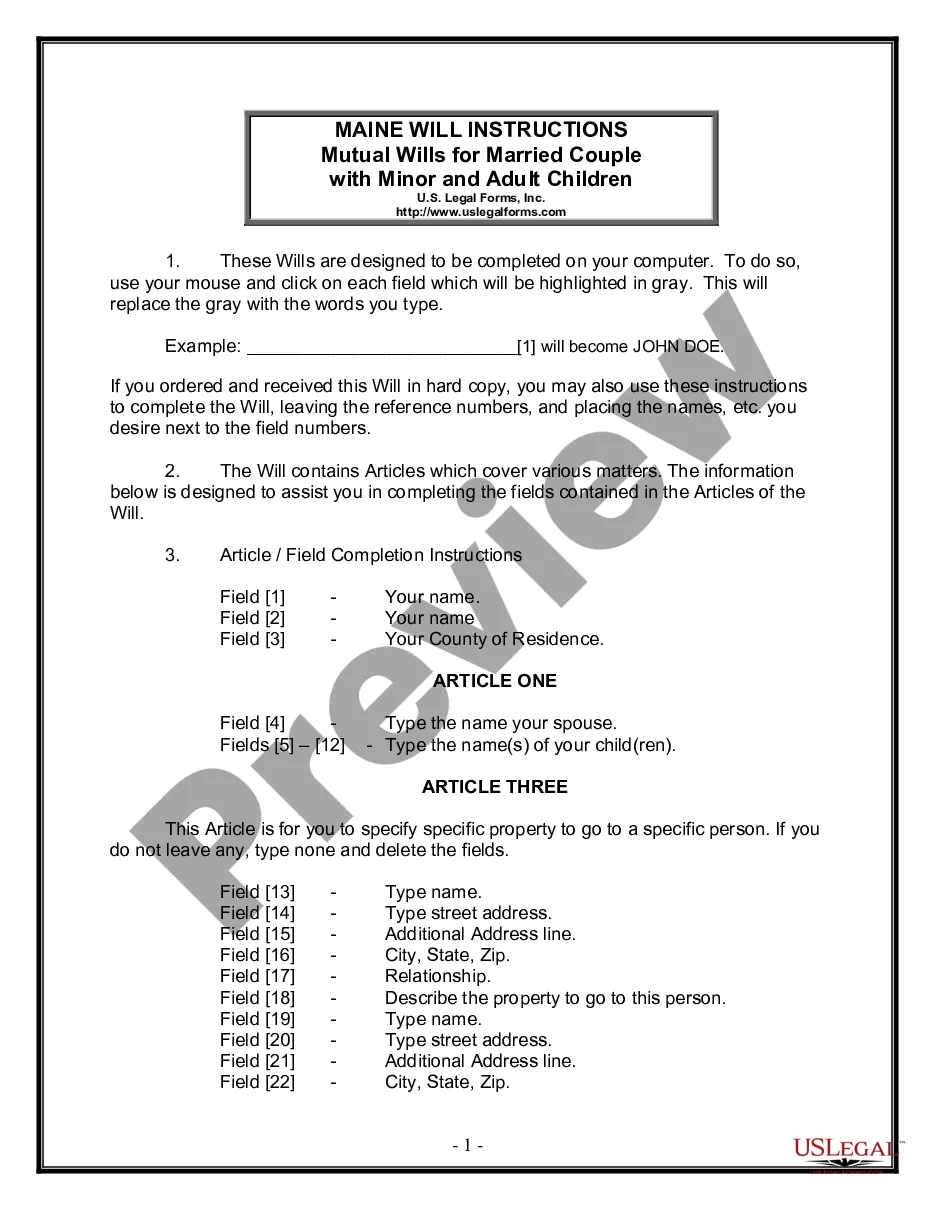

Create a comprehensive estate plan for a married couple, ensuring your wishes are honored for both minor and adult children.

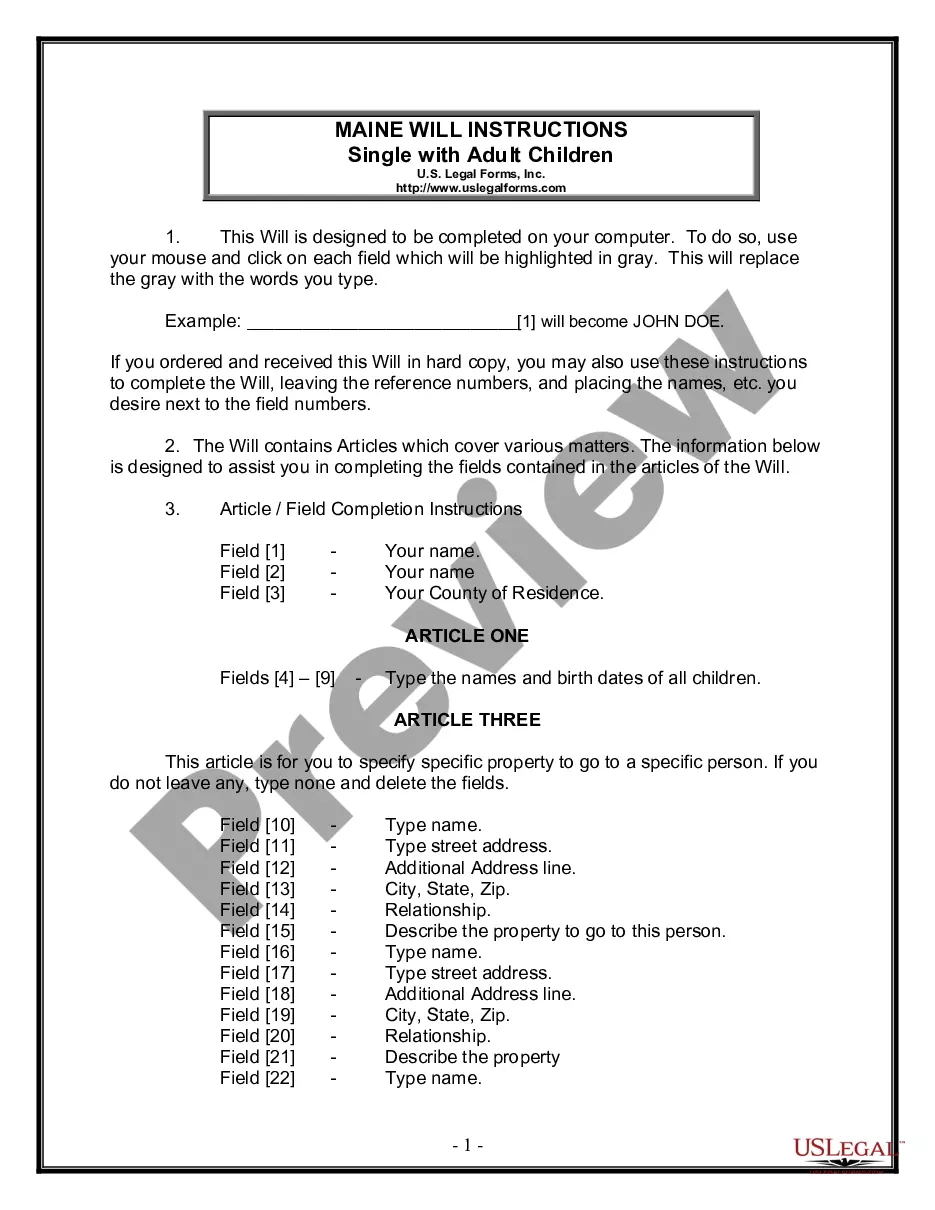

Plan for the future by outlining who inherits your assets and major wishes after your passing. Ideal for single parents with adult children.

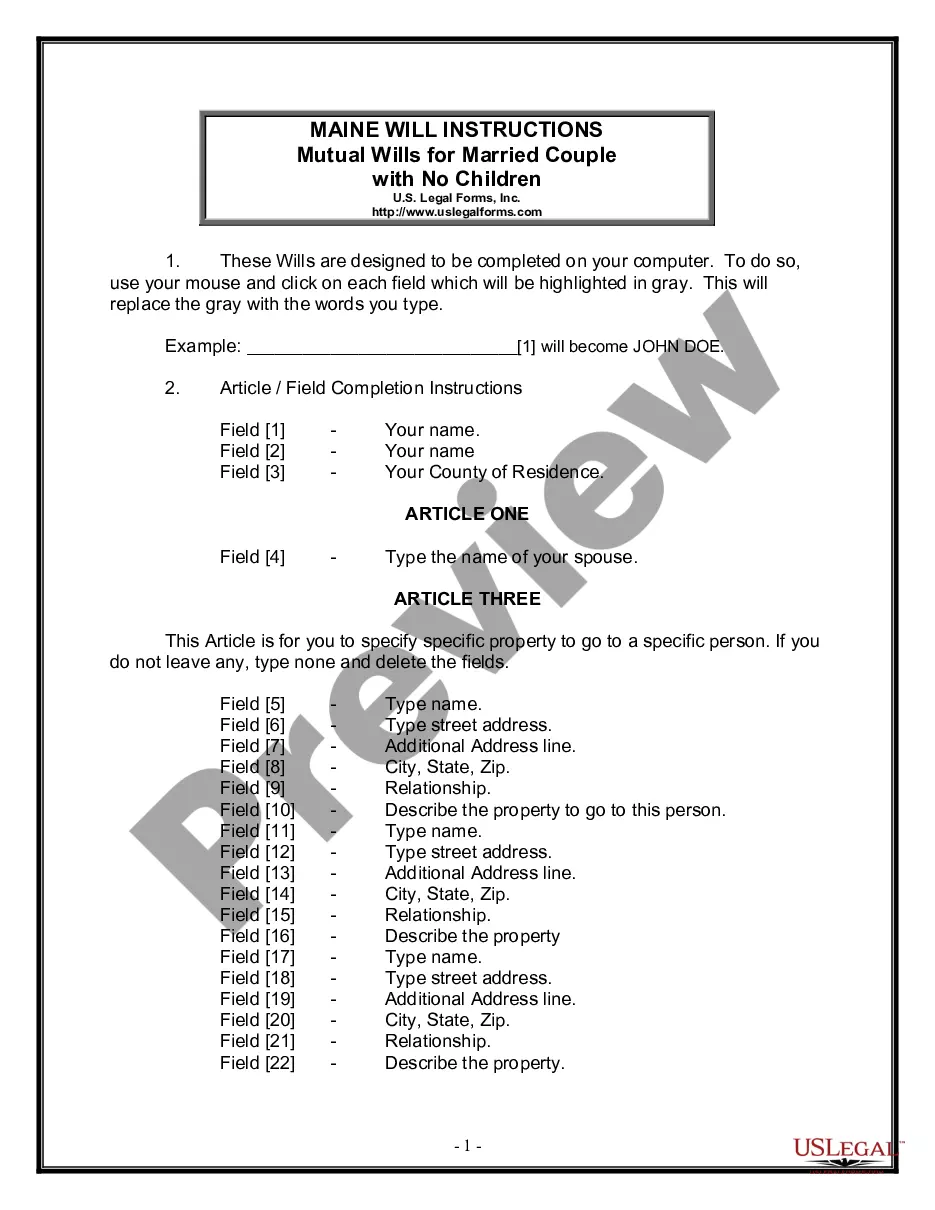

Create legally binding mutual wills designed for married couples without children to ensure clear asset distribution.

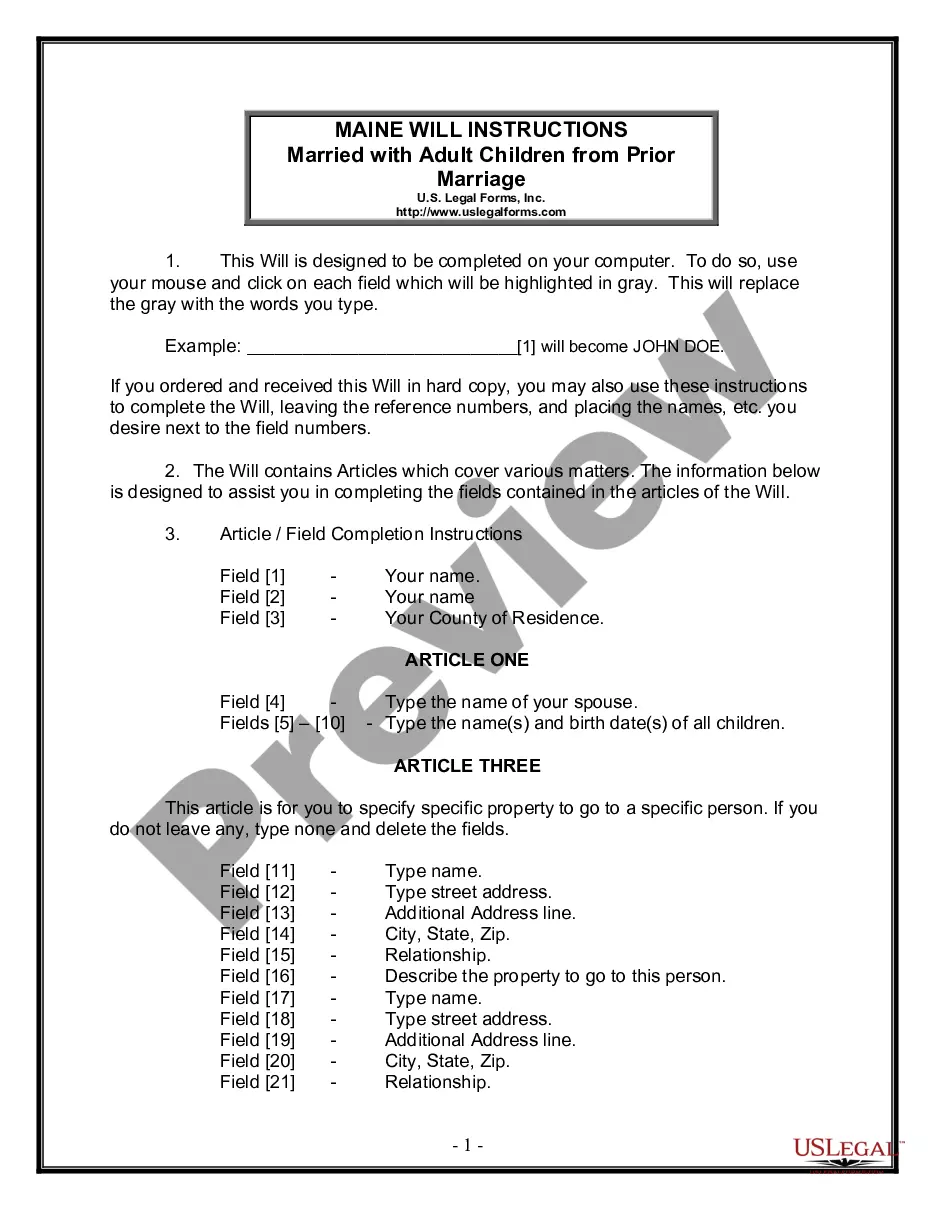

Create a customized will that ensures your spouse and adult children from a previous marriage are provided for, clarifying your wishes after death.

A will takes effect only after death.

Wills can be contested by heirs or beneficiaries.

Witnesses or notarization may be required for validity.

Beneficiaries can be individuals or organizations.

Updating a will ensures it reflects current wishes.

Begin your journey in just a few steps.

Not necessarily; a will covers asset distribution, while a trust can manage assets during life.

Without a will, state laws dictate asset distribution, which may not reflect your wishes.

Review your will every few years or after major life changes.

Beneficiary designations can override your will for specific accounts or assets.

Yes, you can designate different individuals for financial and healthcare decisions.