What is Last Will and Testament?

A Last Will and Testament outlines how you want your assets distributed after passing. It also names guardians for minor children. Explore state-specific templates for your needs.

Last Will and Testament documents help manage your estate after death. Attorney-drafted templates are quick and easy to complete.

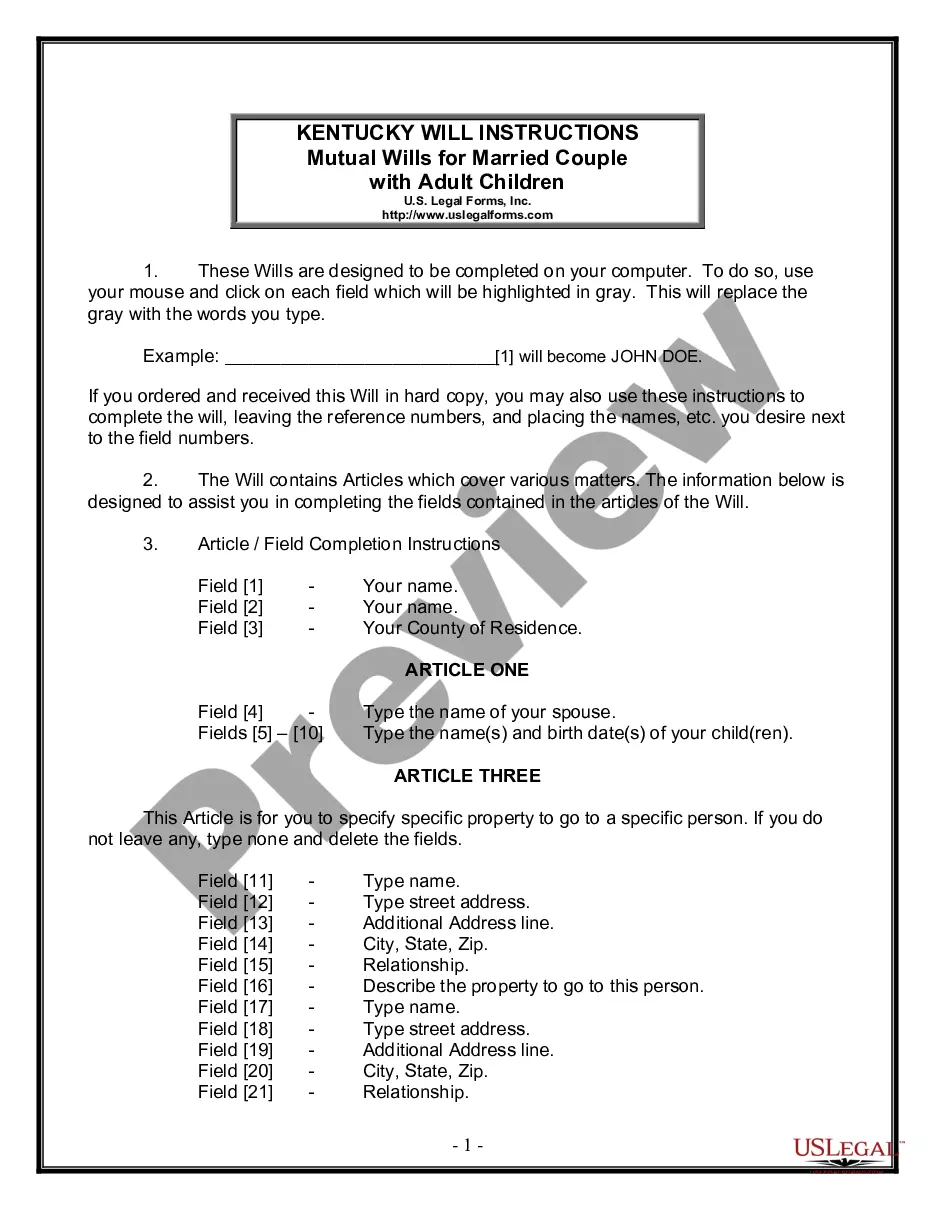

Plan for the future with a customized estate plan, designed specifically for married couples with adult children.

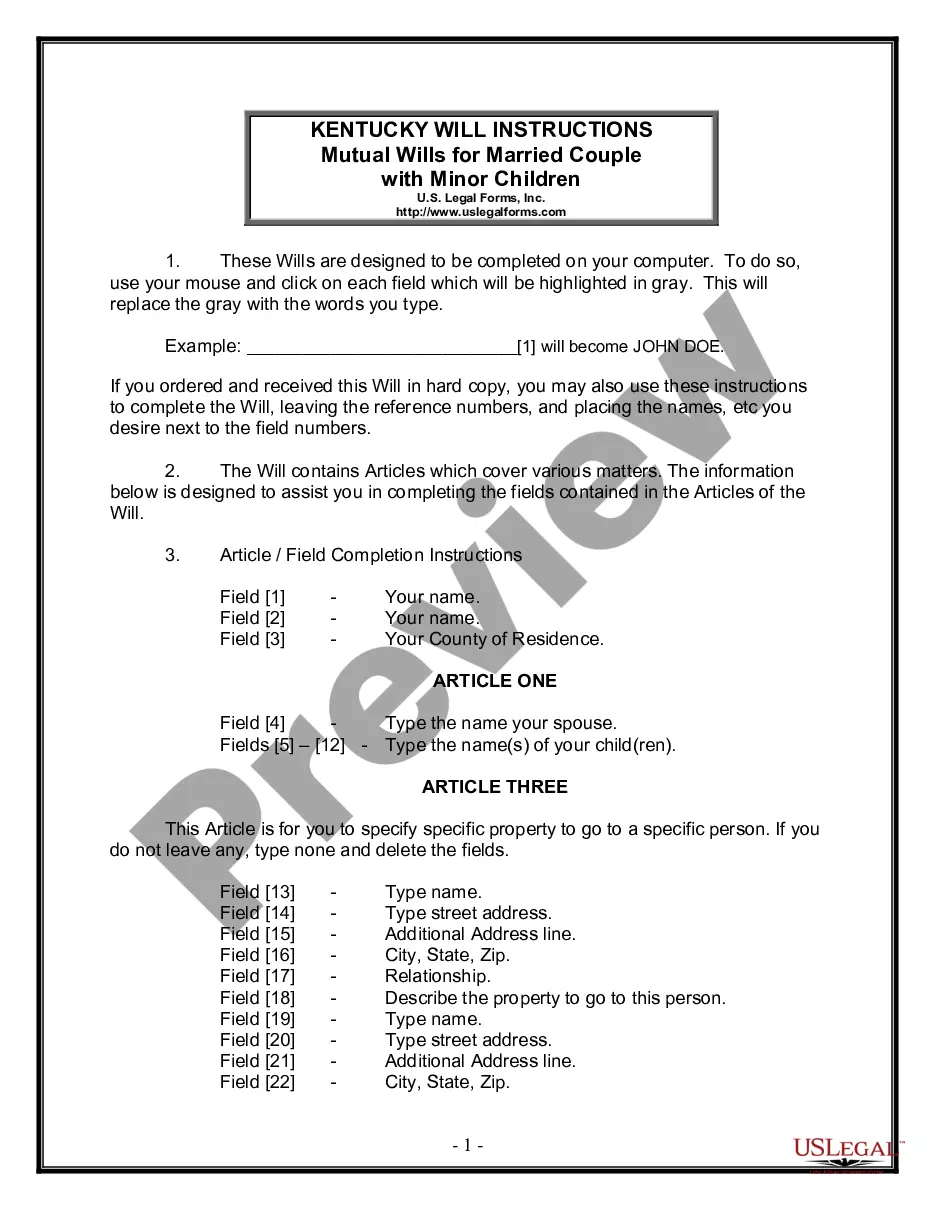

Protect your family's future with wills designed for married couples with minor children, ensuring that your heirs are provided for.

Prepare for the future with essential estate planning forms, providing peace of mind for you and your loved ones.

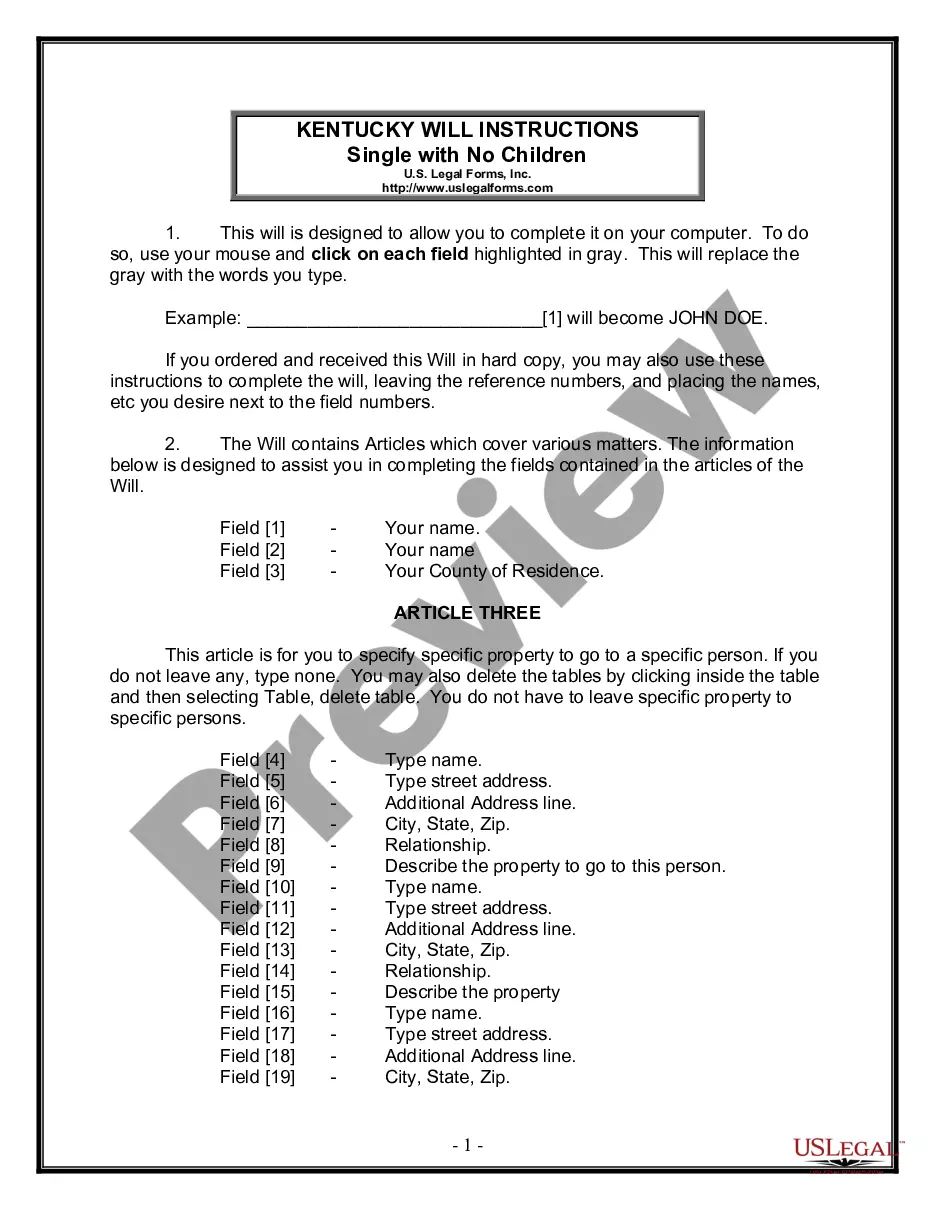

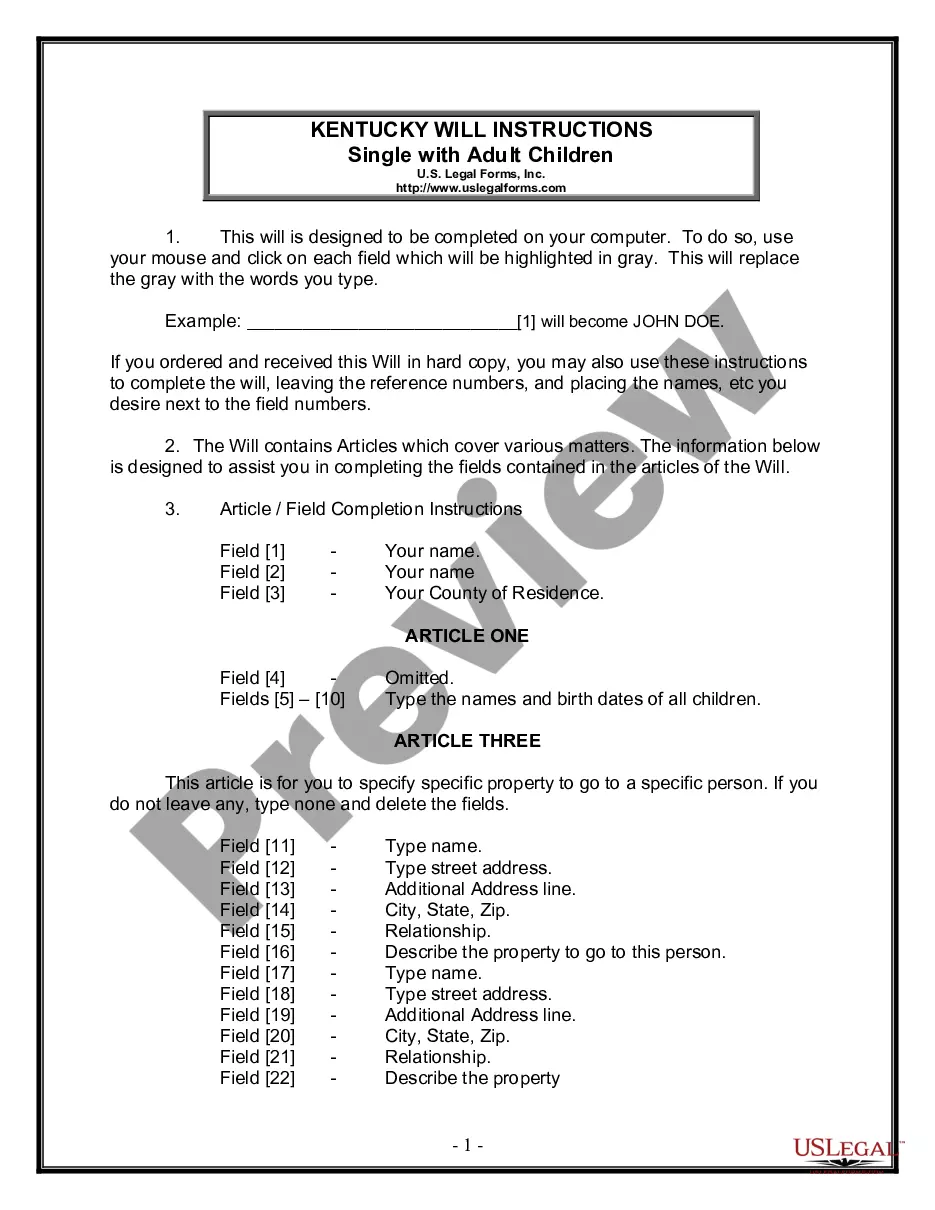

Create a legally binding will to specify how your belongings are distributed after your death, tailored for single individuals without children.

Create a legally binding will to outline property distribution and appoint an executor, ensuring your wishes are honored after your passing.

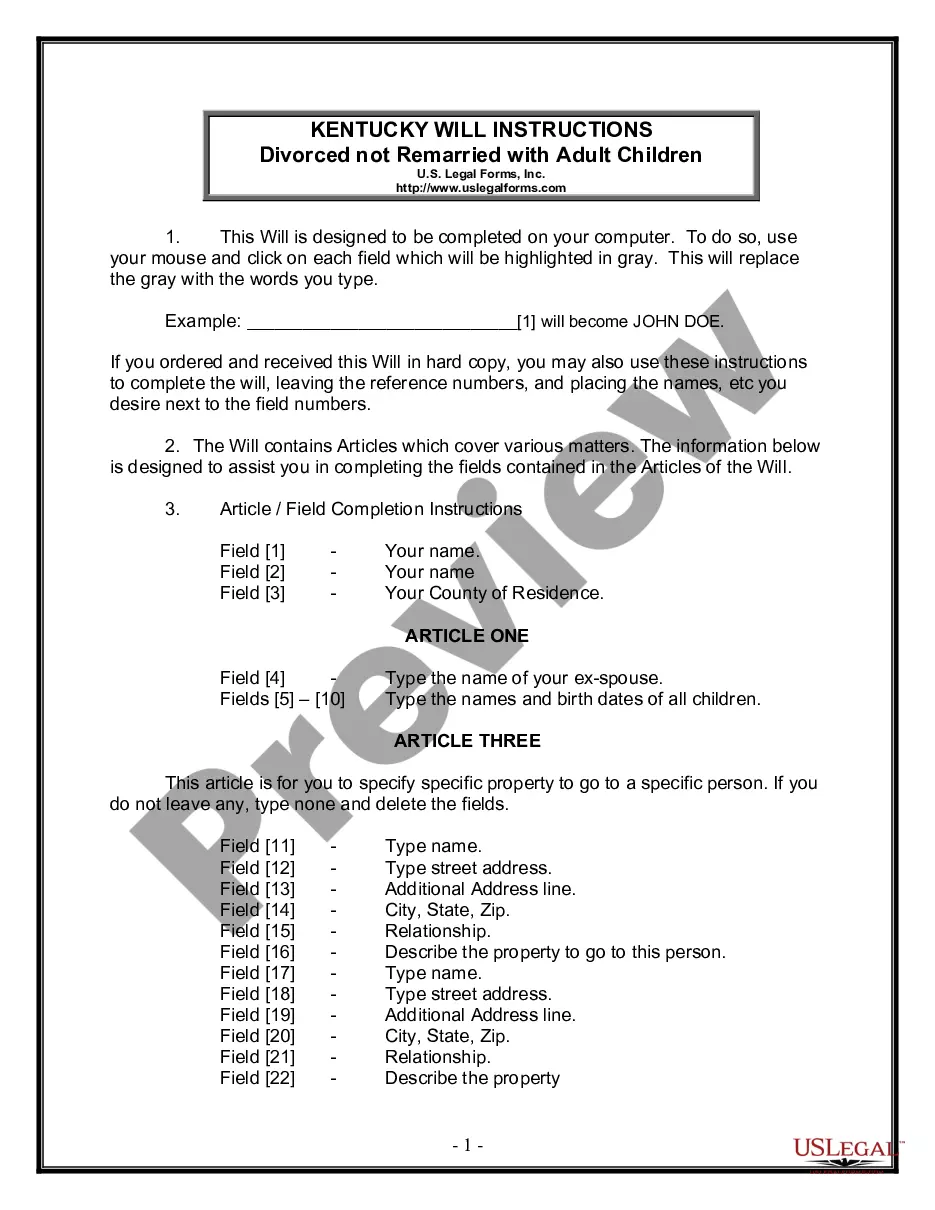

Create a legally binding Will to specify how your estate is distributed when you pass away, tailored for divorced individuals with adult children.

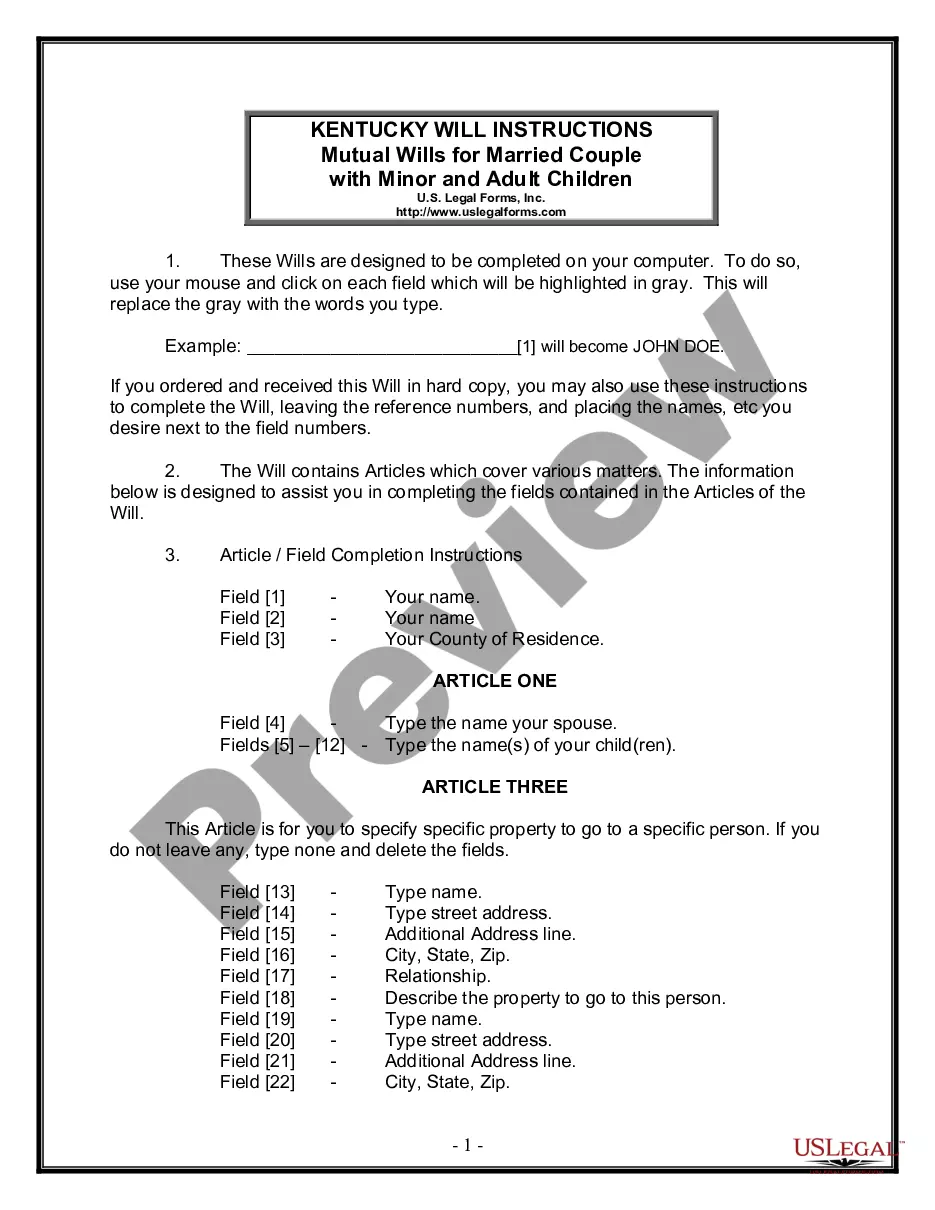

Craft comprehensive mutual wills for couples managing both adult and minor children, ensuring clear distribution of assets and guardianship plans.

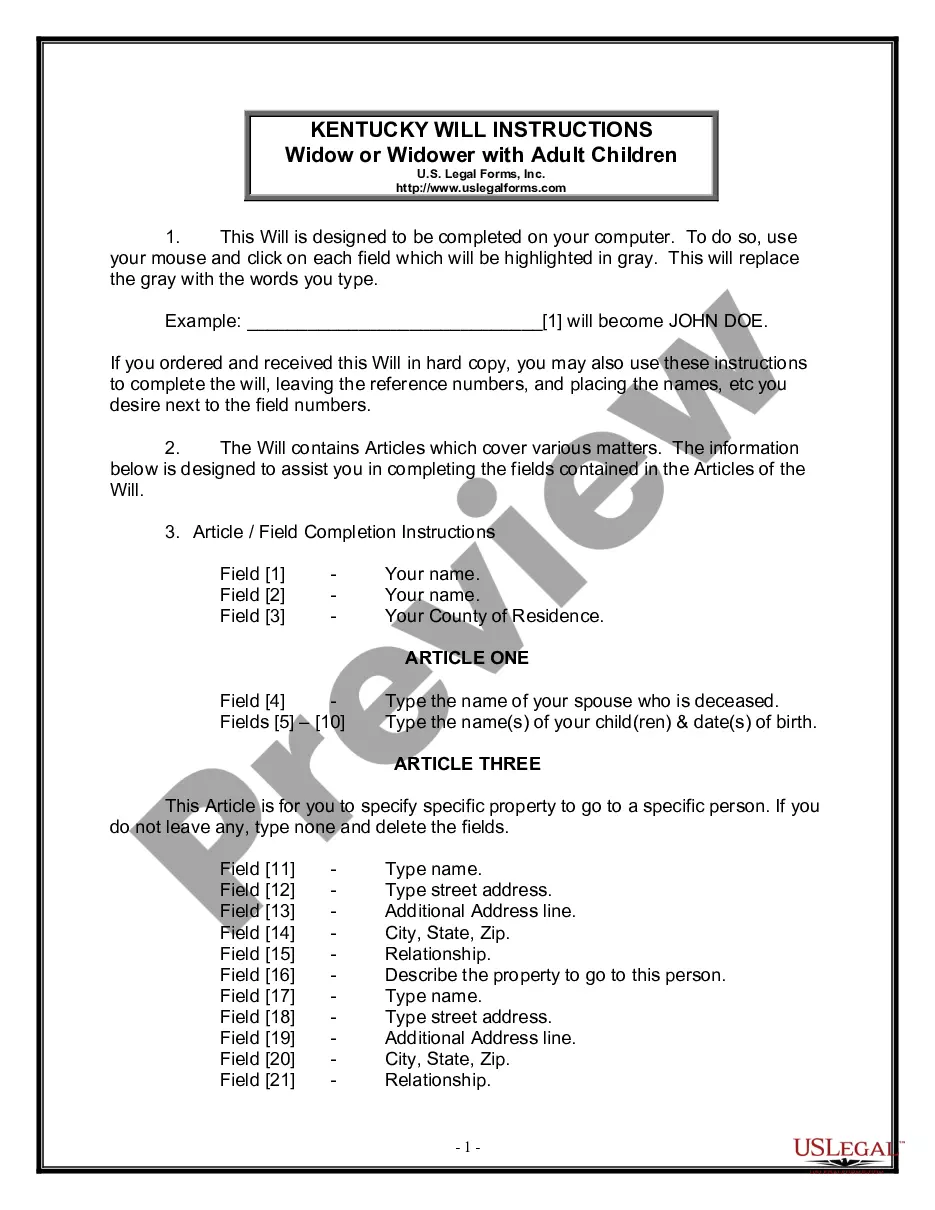

Create a legally binding will to specify the distribution of your assets and appoint a personal representative after your passing.

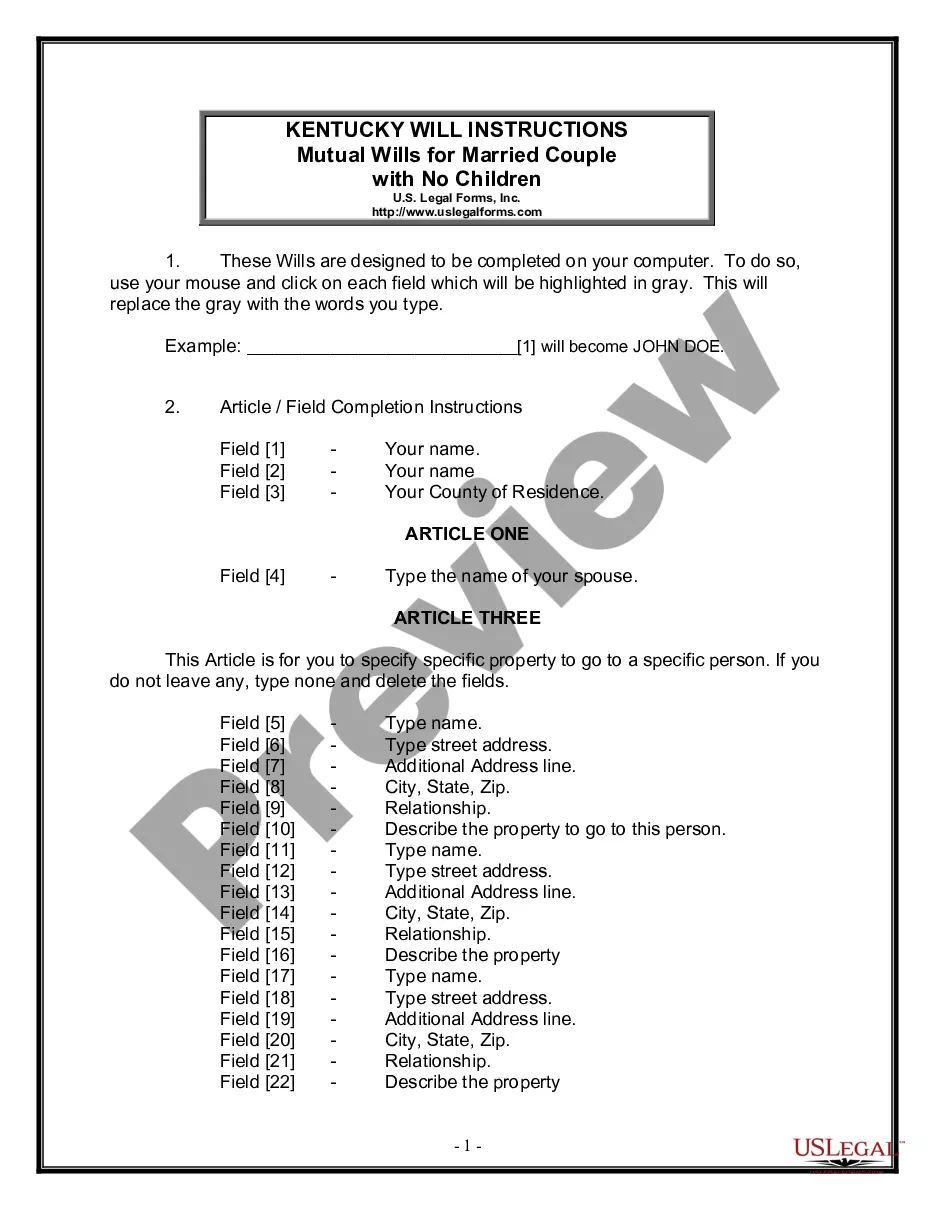

Protect your assets and ensure your wishes are honored with mutual wills, specifically designed for married couples without children.

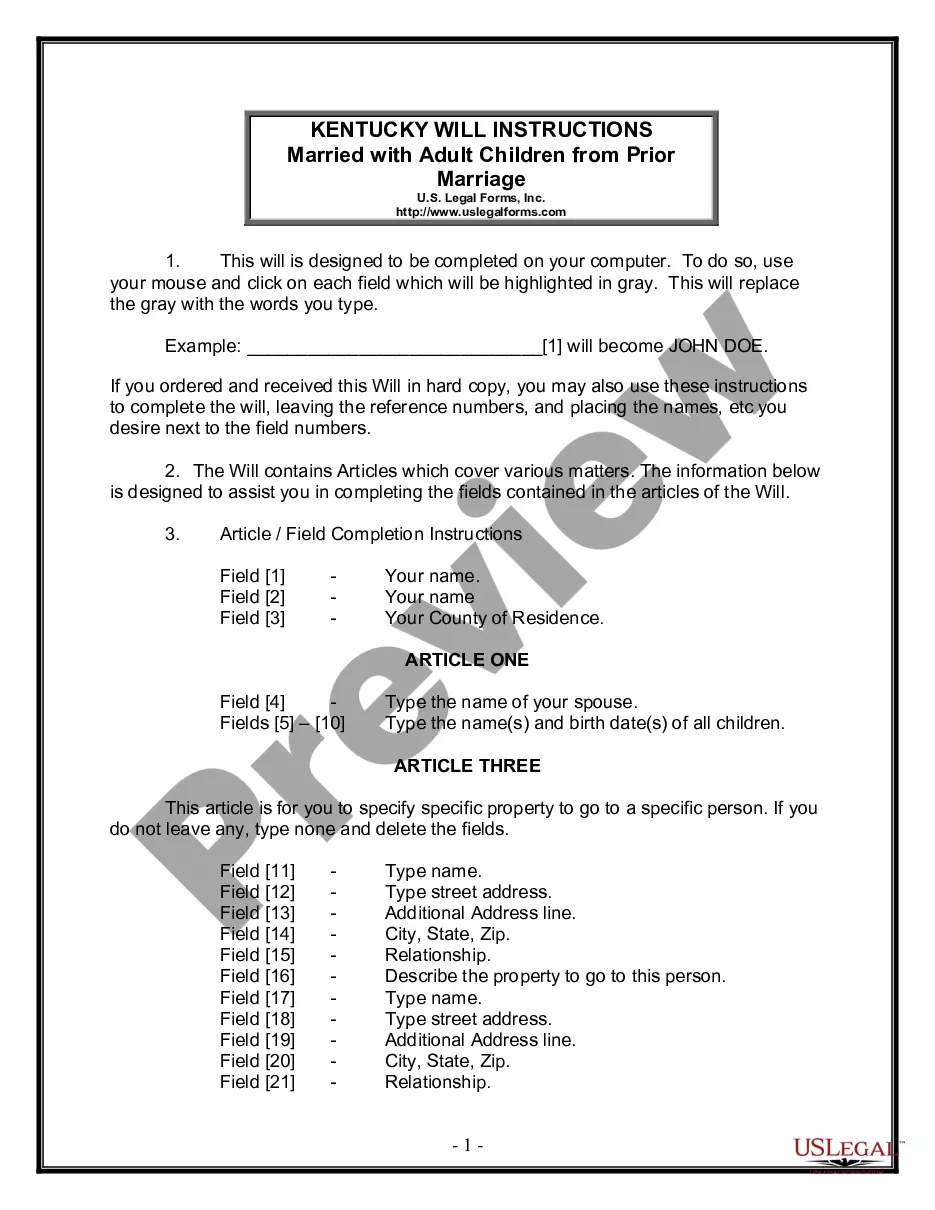

Create a comprehensive estate plan to ensure your wishes are honored after your passing, particularly as a married individual with adult children from a prior relationship.

A Last Will and Testament is crucial for outlining your wishes.

Witnesses may be required for validity in many states.

Beneficiaries can be individuals or organizations.

Updating your will is important after major life changes.

Probate is the process of validating a will in court.

Begin the process with these easy steps.

A trust can provide benefits like avoiding probate, but is not mandatory.

Without a will, state laws dictate asset distribution, which may not reflect your wishes.

Review your will every few years or after major life changes.

Beneficiary designations usually override will provisions for assets like insurance.

Yes, you can appoint different agents for financial and healthcare decisions.