What is Last Will and Testament?

A Last Will and Testament is a legal document that specifies how your assets will be distributed upon your death. It is used to ensure your wishes are honored. Explore state-specific templates to meet your needs.

A Last Will and Testament outlines your wishes for after your passing. Attorney-drafted templates are quick and user-friendly.

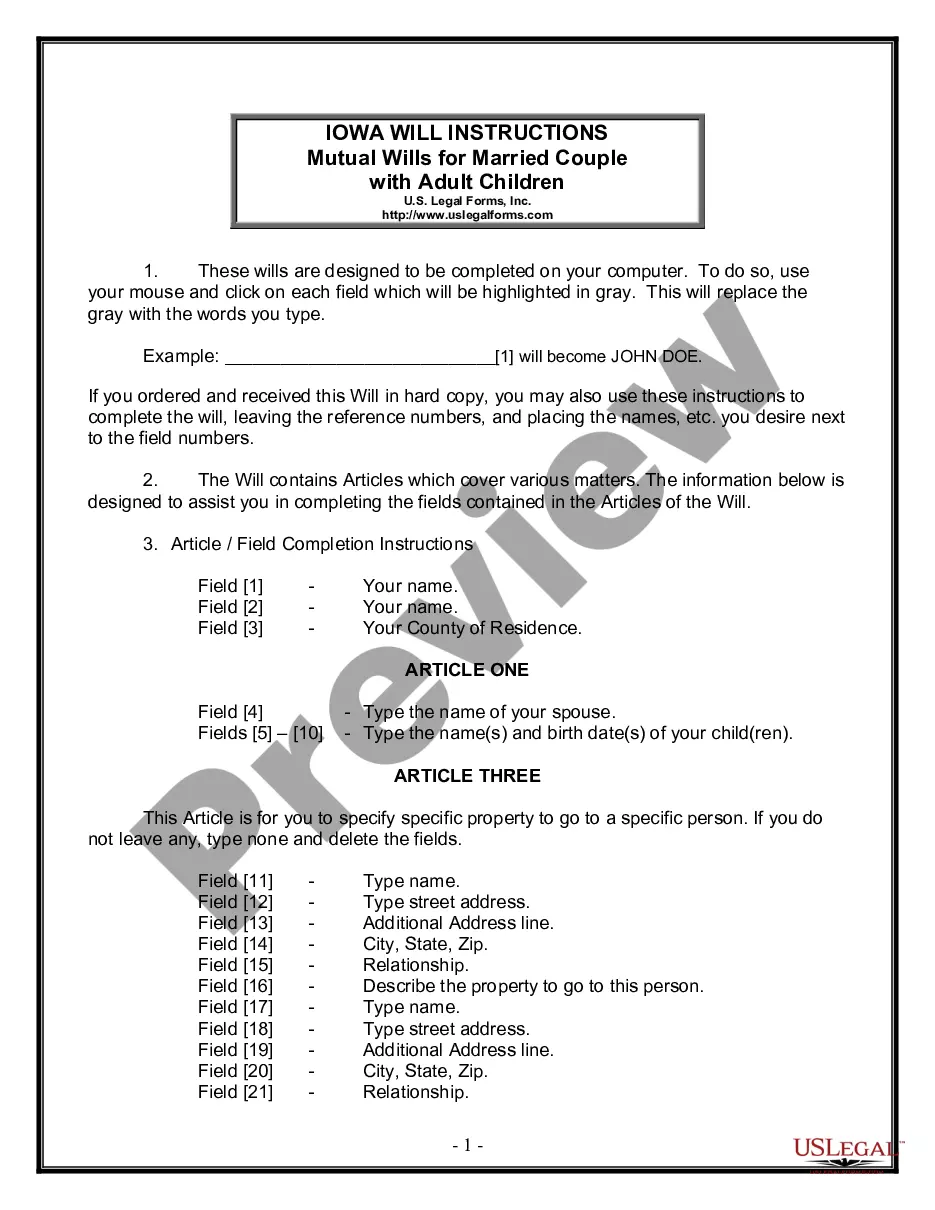

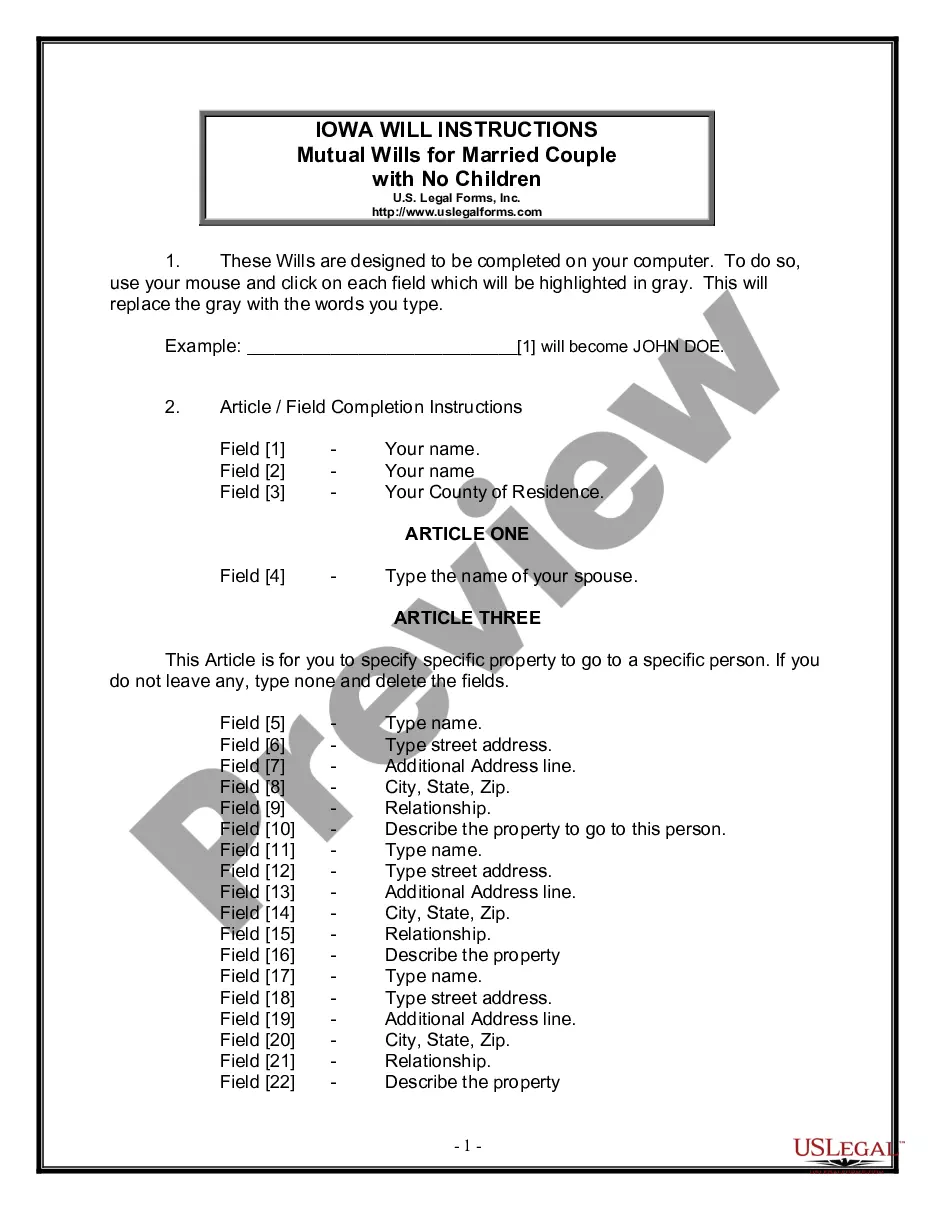

Create legally binding wills for a married couple, ensuring your wishes are honored after death.

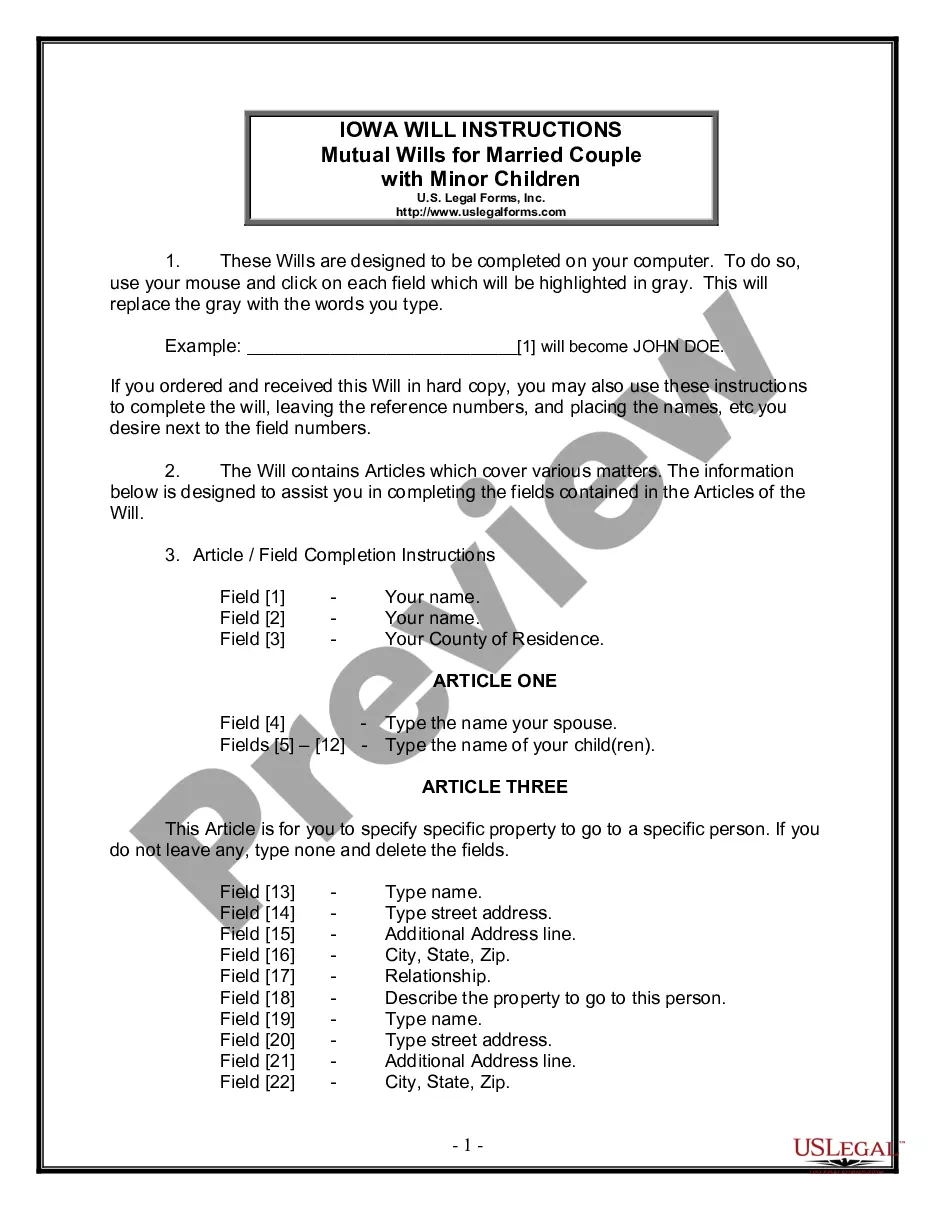

Create a comprehensive estate plan for married couples with minor children, ensuring your wishes are honored.

Prepare for the future with all essential estate planning forms in one convenient package.

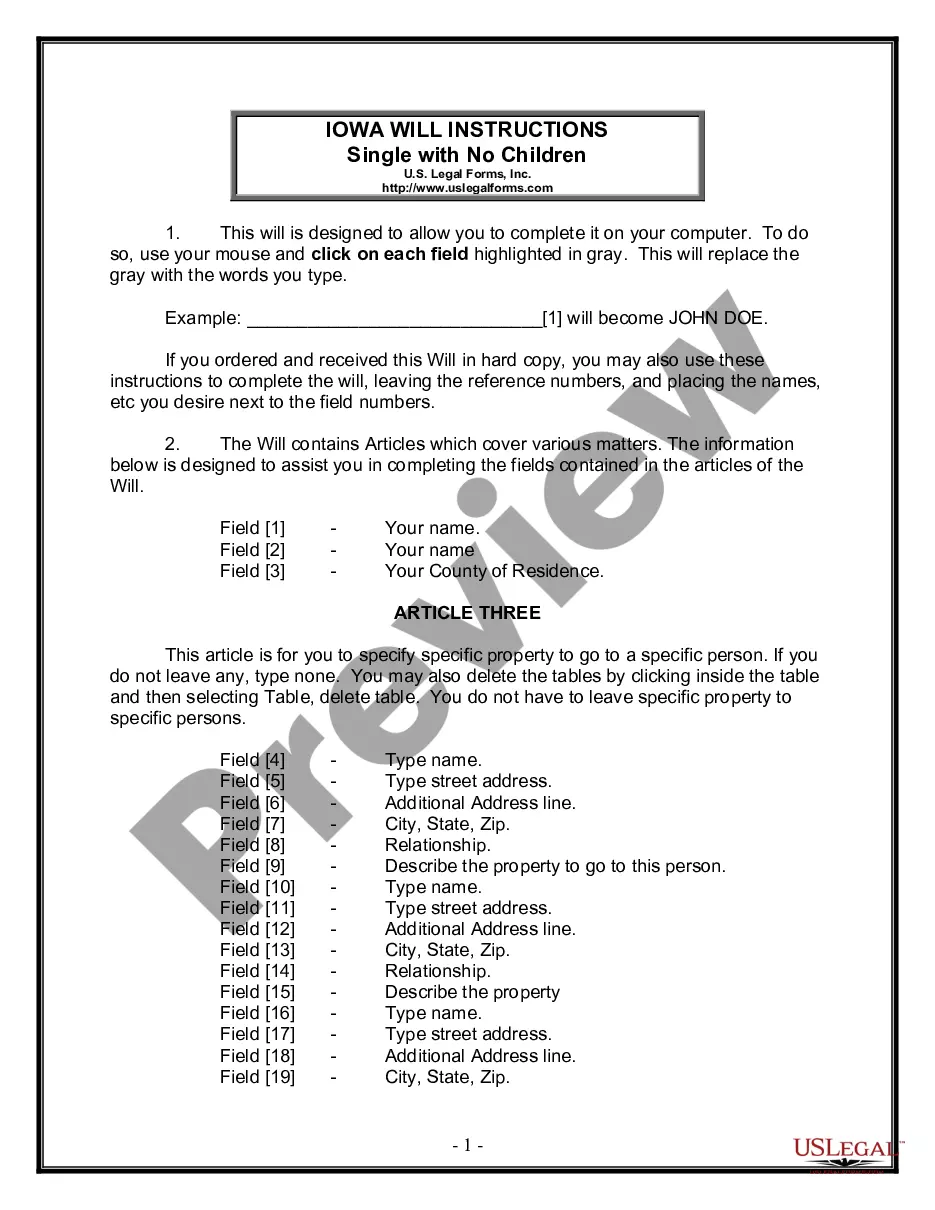

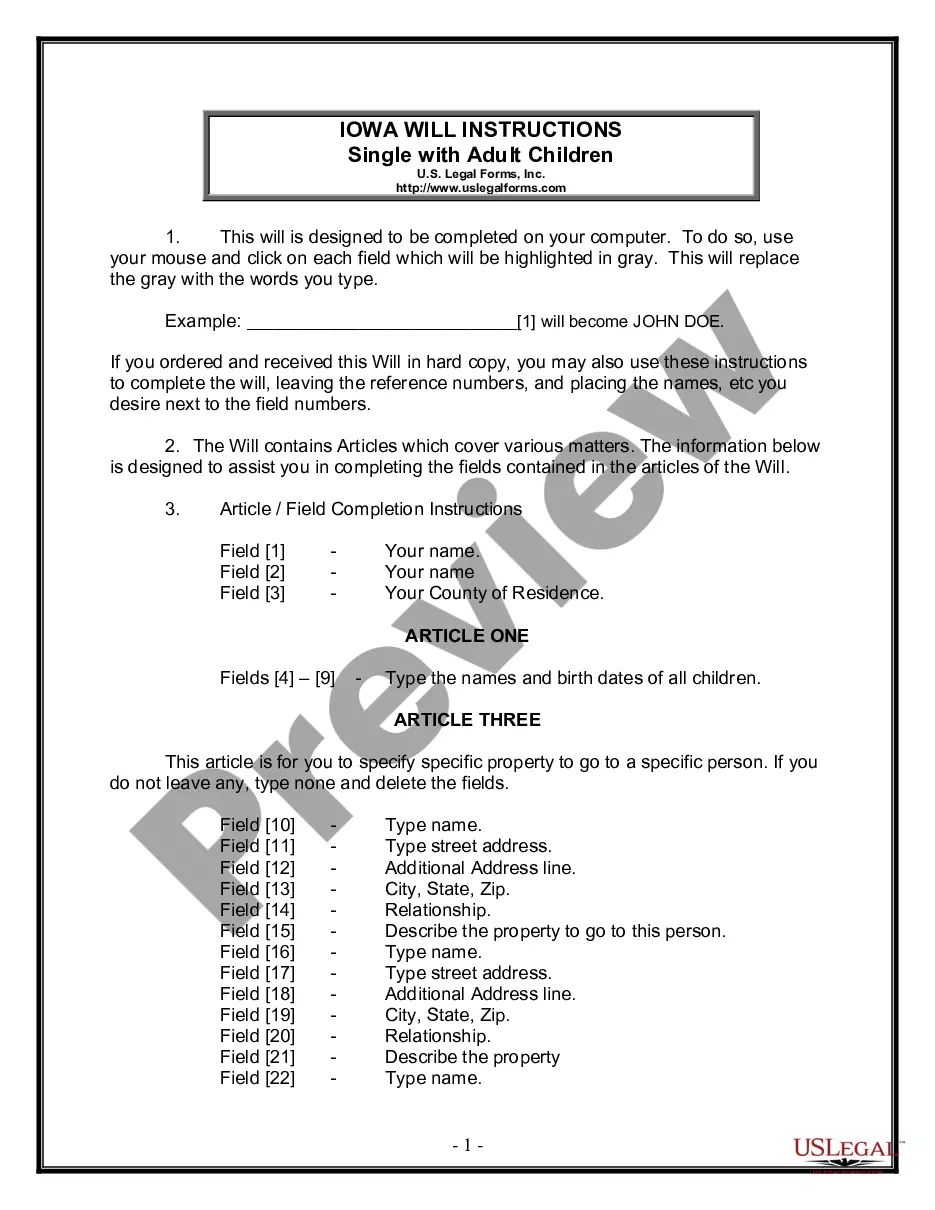

Plan your estate and designate beneficiaries with a comprehensive will suited for single individuals without children.

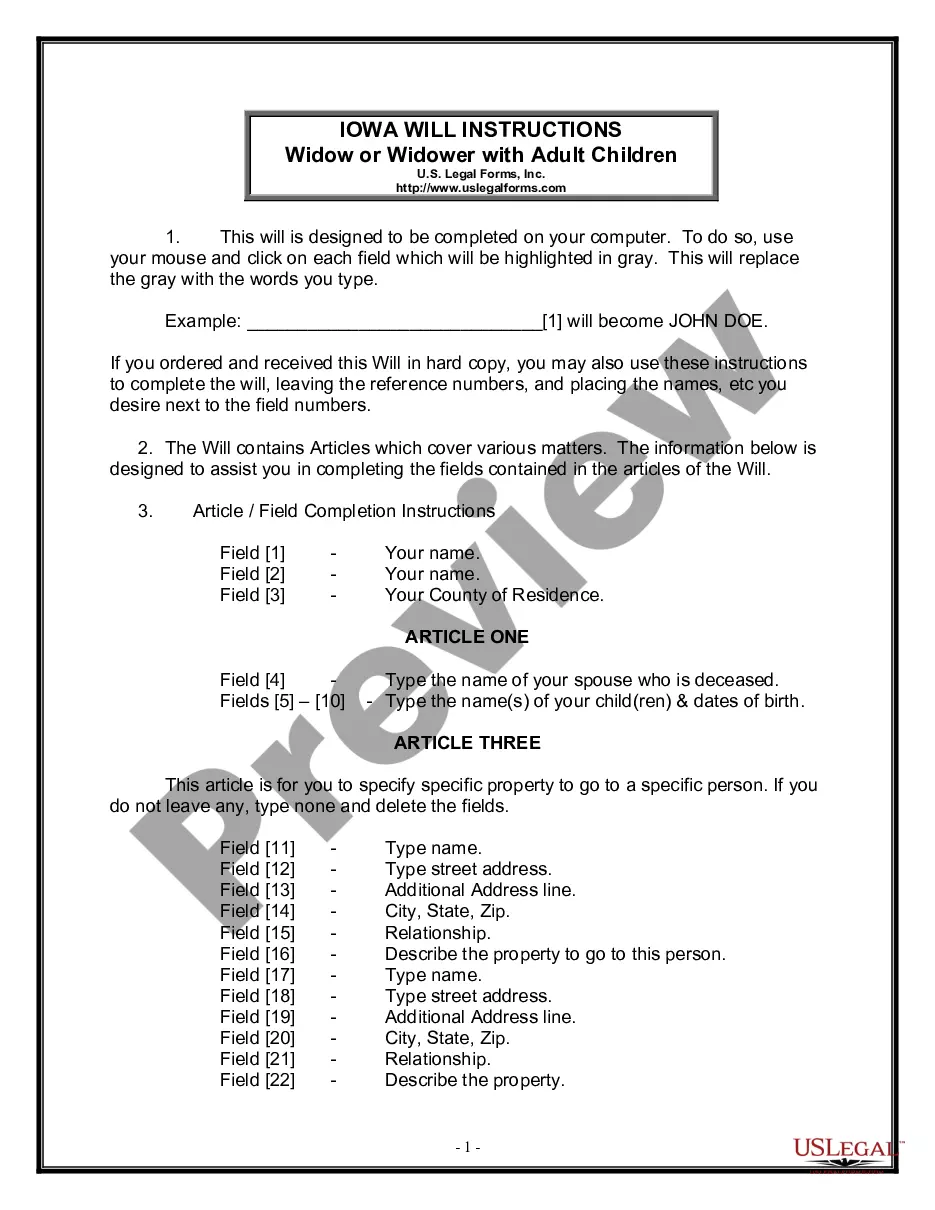

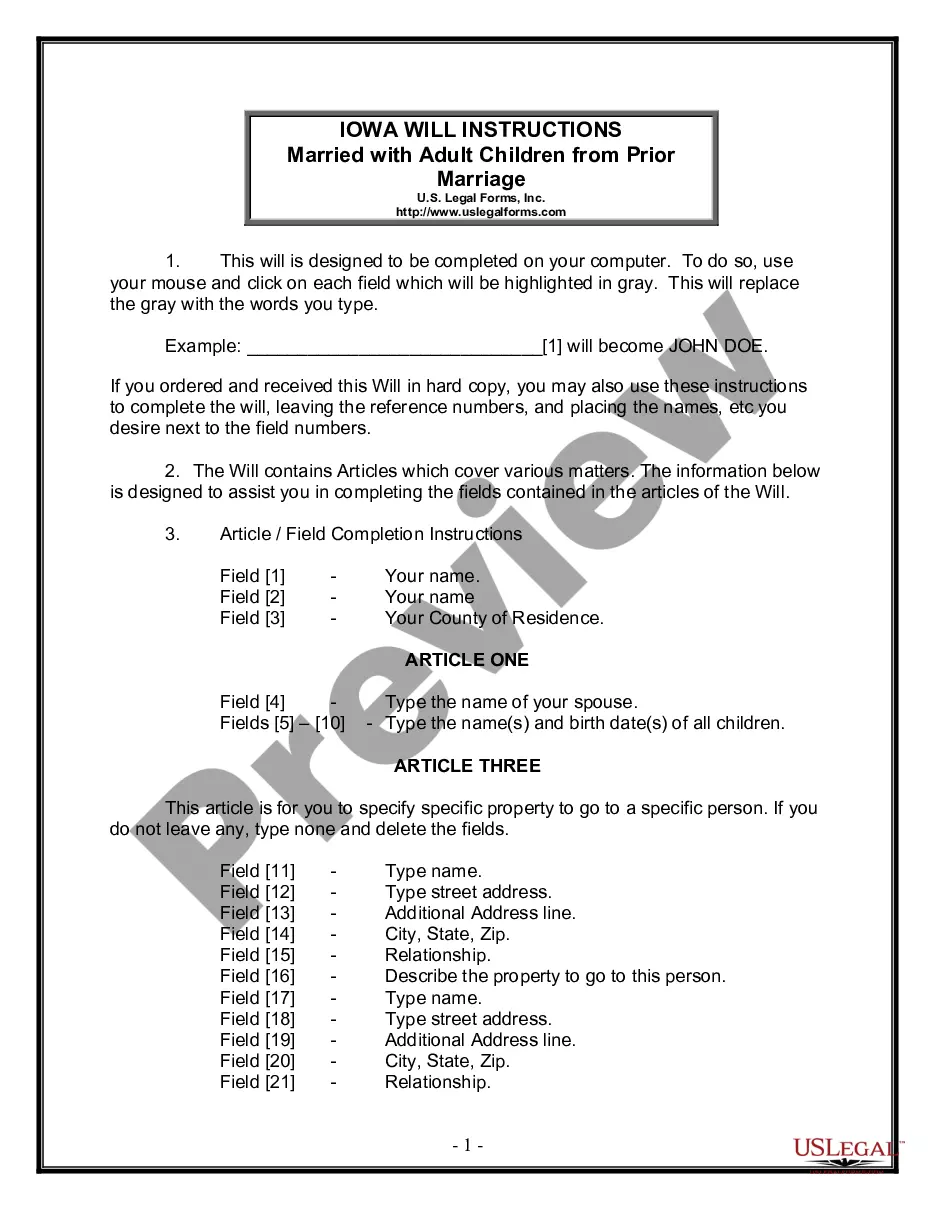

Prepare a comprehensive estate plan that reflects your wishes after your passing, focusing on your adult children and remaining assets.

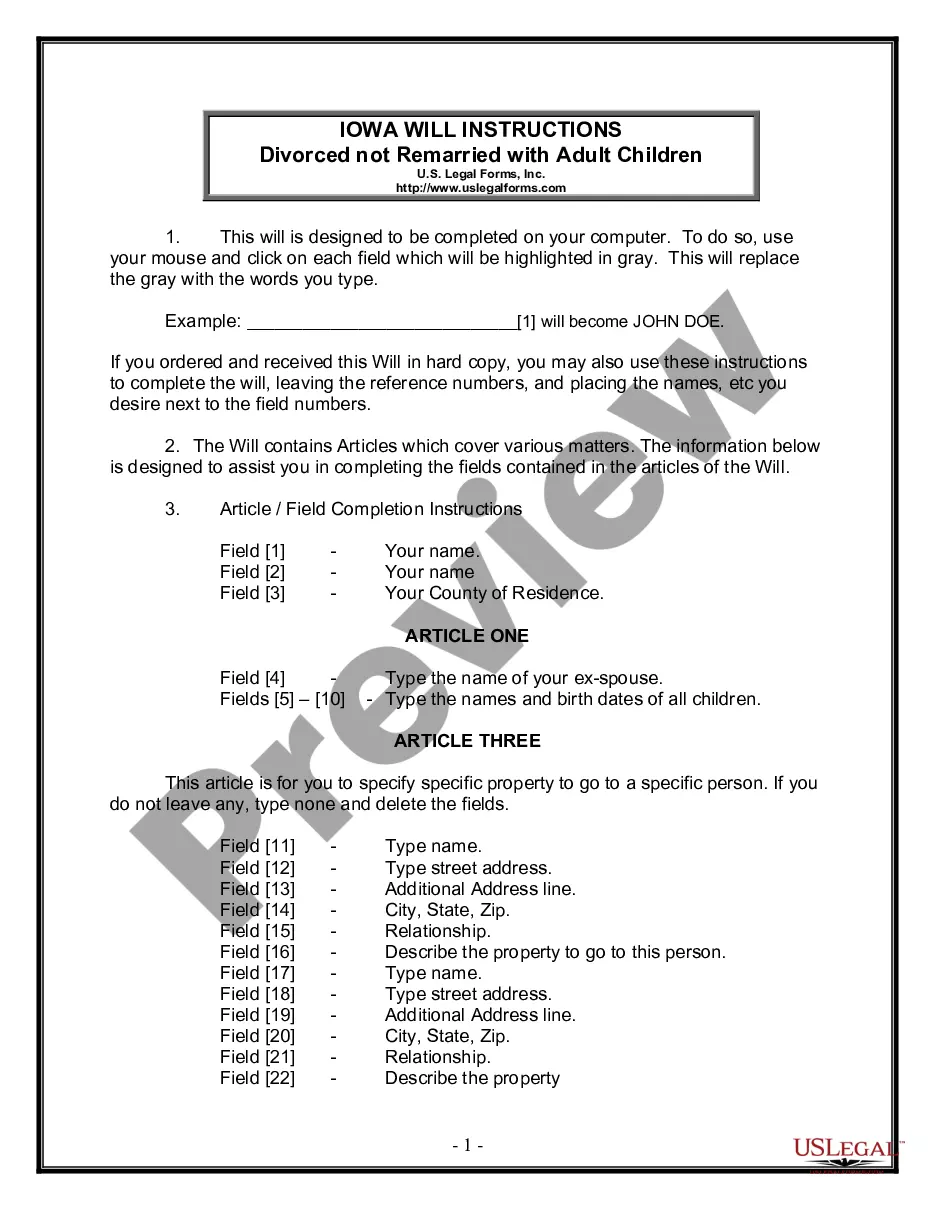

Prepare a legal document that outlines your wishes for property distribution after death, specifically for divorced individuals with adult children.

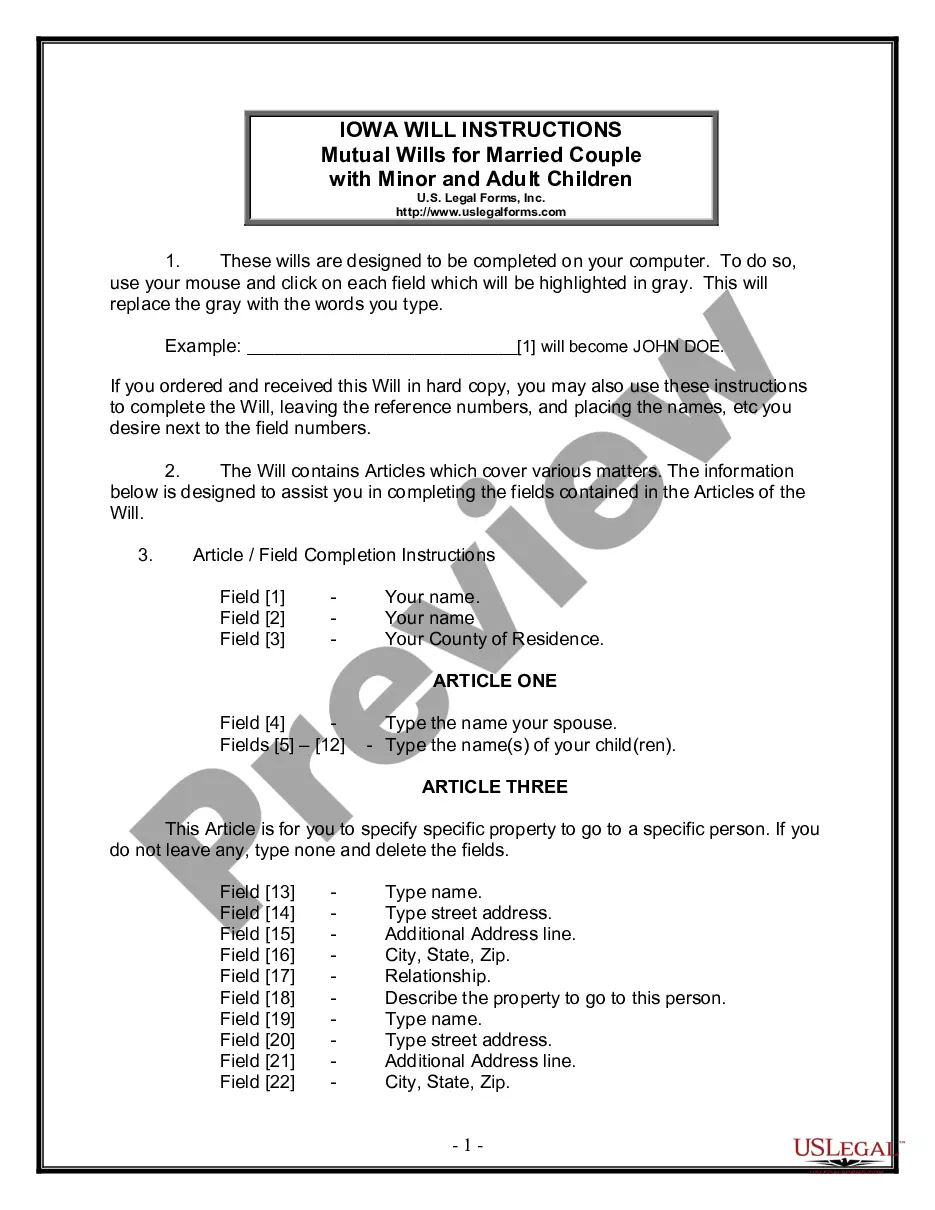

Create a comprehensive plan for asset distribution and guardianship with mutual wills for couples, ensuring protection for children.

Create a detailed will to specify how your property and assets are distributed among your adult children after your passing.

Create legally binding wills for a married couple without children, ensuring both partners' wishes are respected.

Create a legally binding document to specify how your assets will be divided after your passing, especially for married individuals with adult children from previous relationships.

A Last Will and Testament manages asset distribution after death.

Wills can appoint guardians for minor children.

Probate may be required to validate the will.

Witnesses are often needed for the will to be valid.

Wills can be contested by heirs if they believe it is invalid.

Updating a will is essential after major life changes.

A will does not cover all assets, such as those in a trust.

Begin creating your Last Will and Testament in a few simple steps.

A trust can provide benefits like avoiding probate, but a will suffices for basic distribution.

If no will is created, state laws determine asset distribution, which may not reflect your wishes.

Regular updates are recommended after major life events like marriage, divorce, or the birth of children.

Beneficiary designations on accounts generally override will instructions, so it’s essential to ensure they align.

Yes, you can appoint separate individuals for financial and healthcare decisions in your will or other documents.