What is Last Will and Testament?

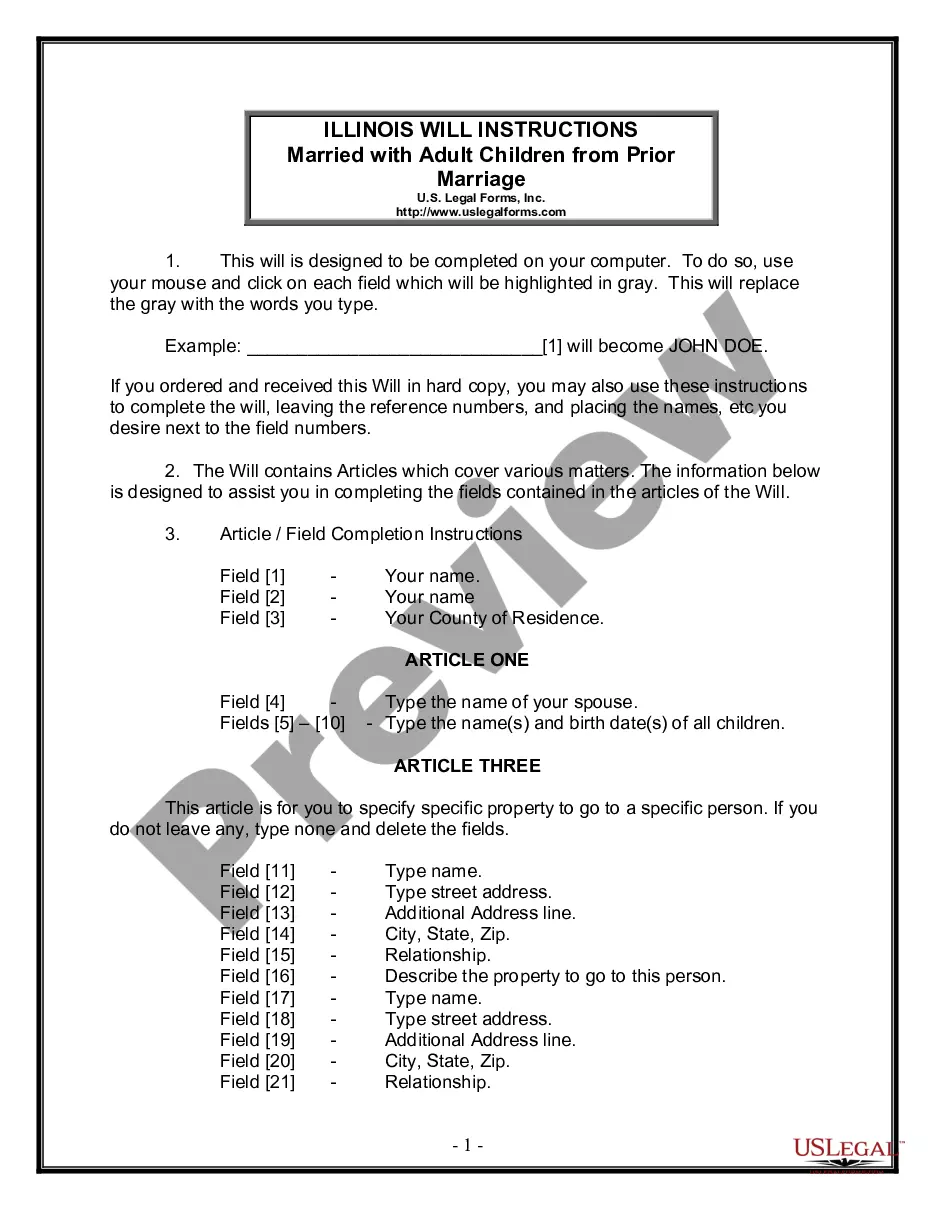

A Last Will and Testament is a legal document that specifies how your assets are distributed after death. It names guardians for minors and can appoint an executor. Choose state-specific templates for Illinois.

A Last Will and Testament outlines your wishes for after you pass. Attorney-drafted templates are quick and user-friendly.

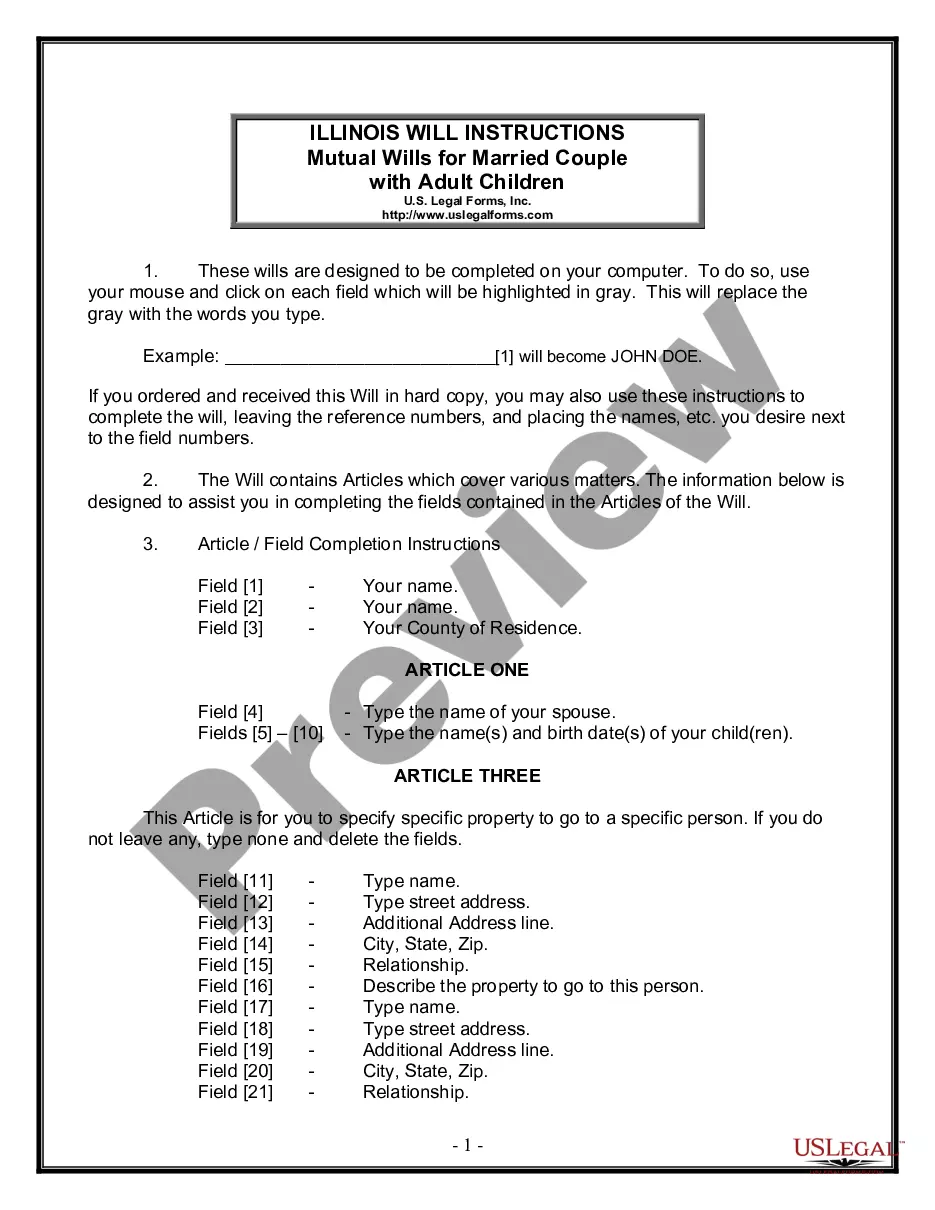

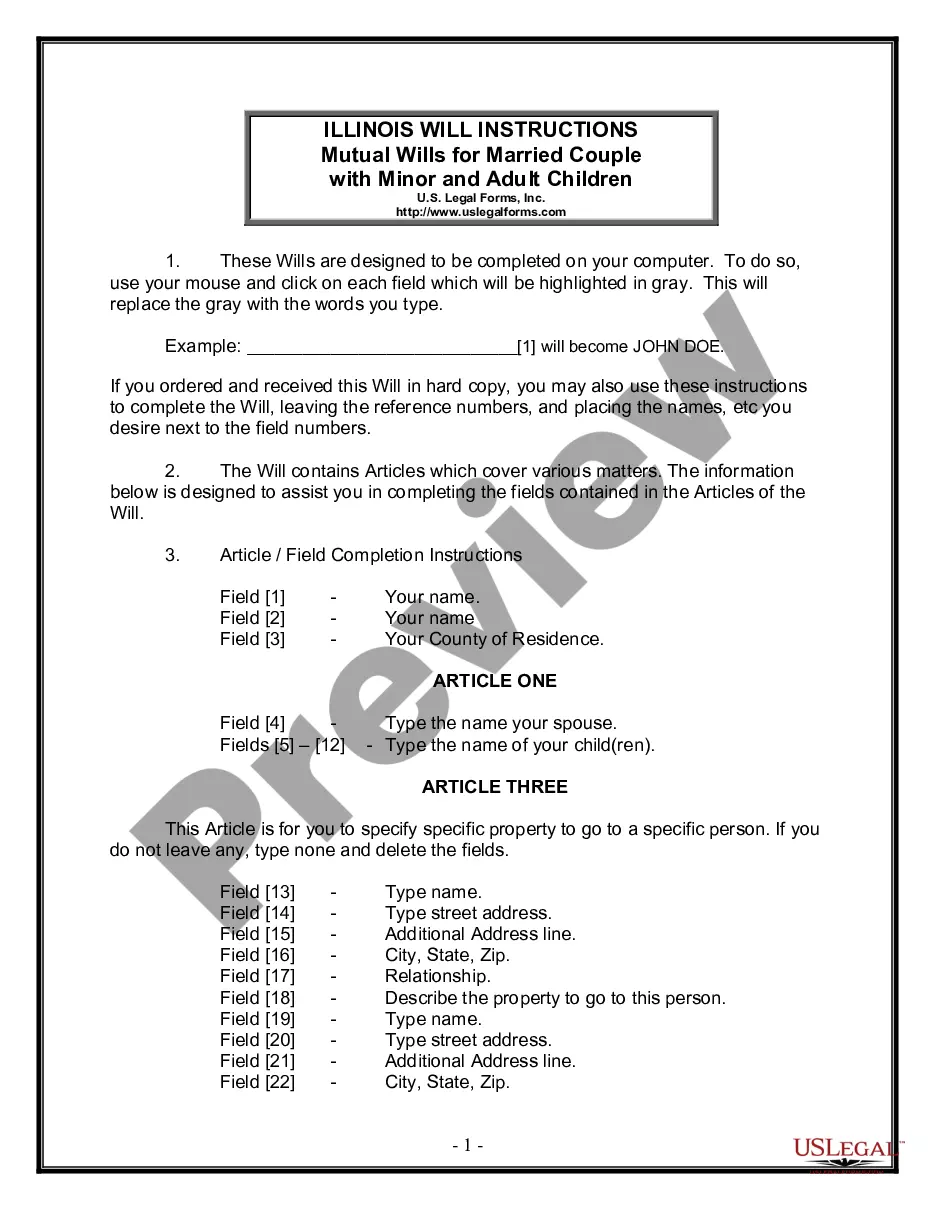

Protect your estate with mutual wills, essential for married couples with adult children to ensure property distribution.

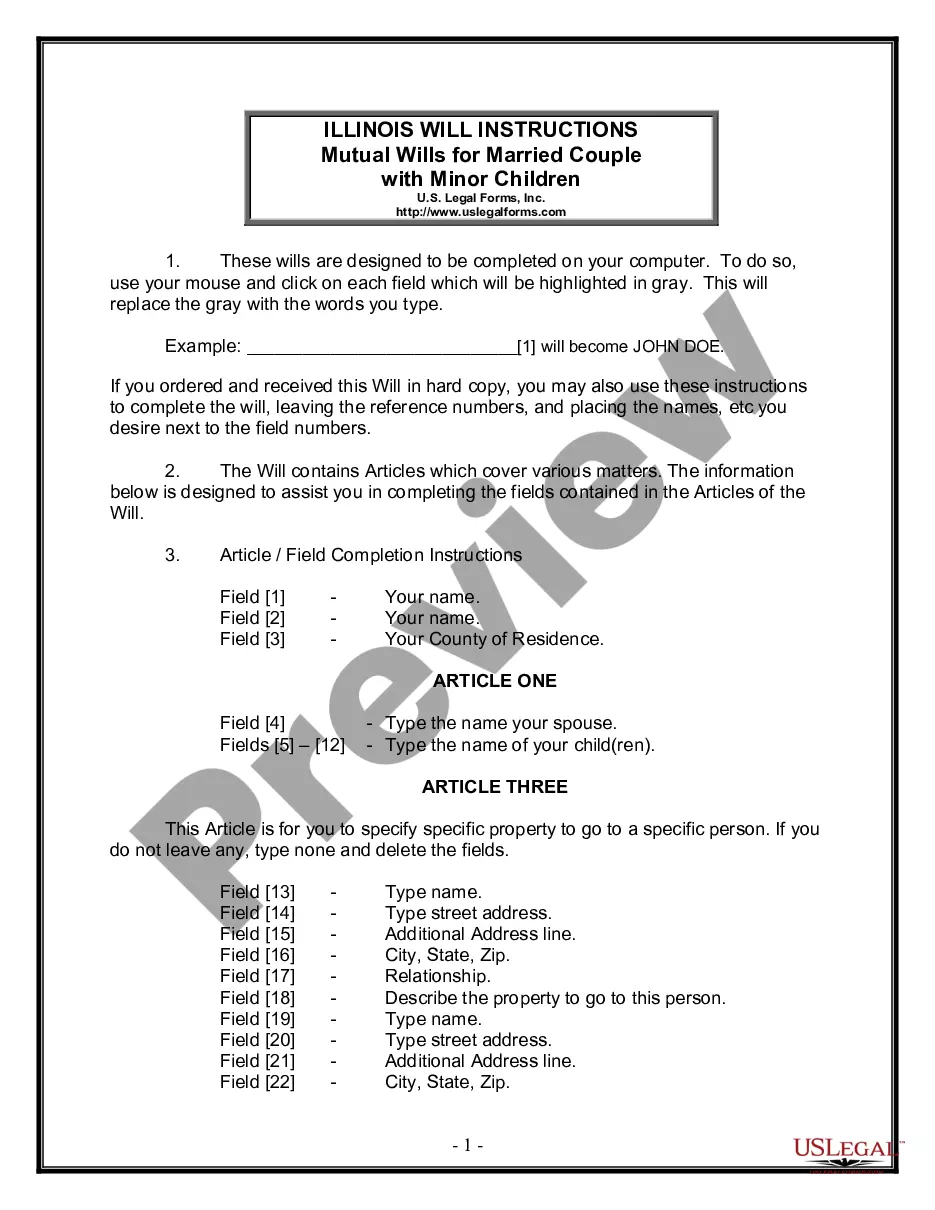

Create mutual wills to ensure both partners designate guardians for minor children and specify asset distribution after death.

Prepare essential estate planning documents to safeguard your future and your loved ones' well-being, all in one convenient package.

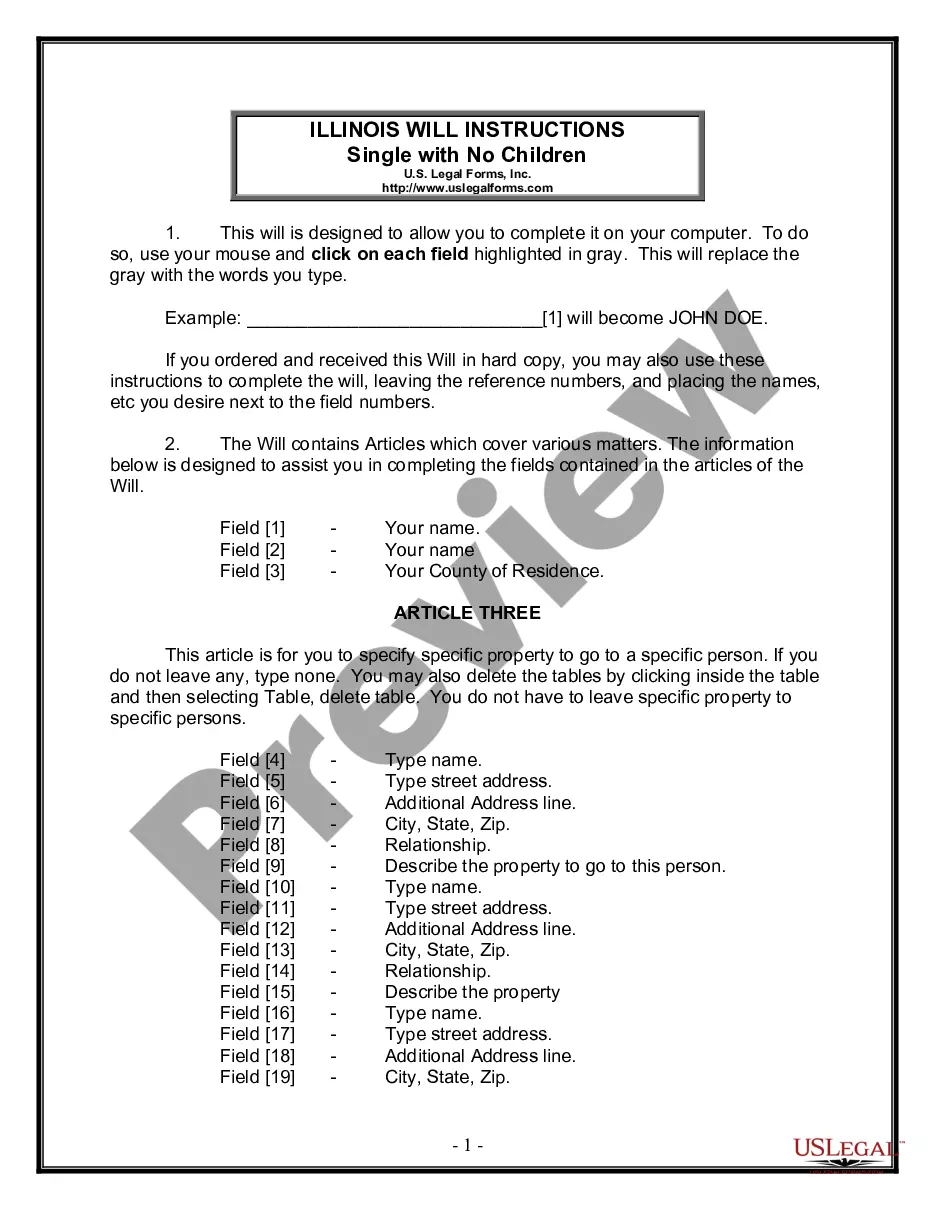

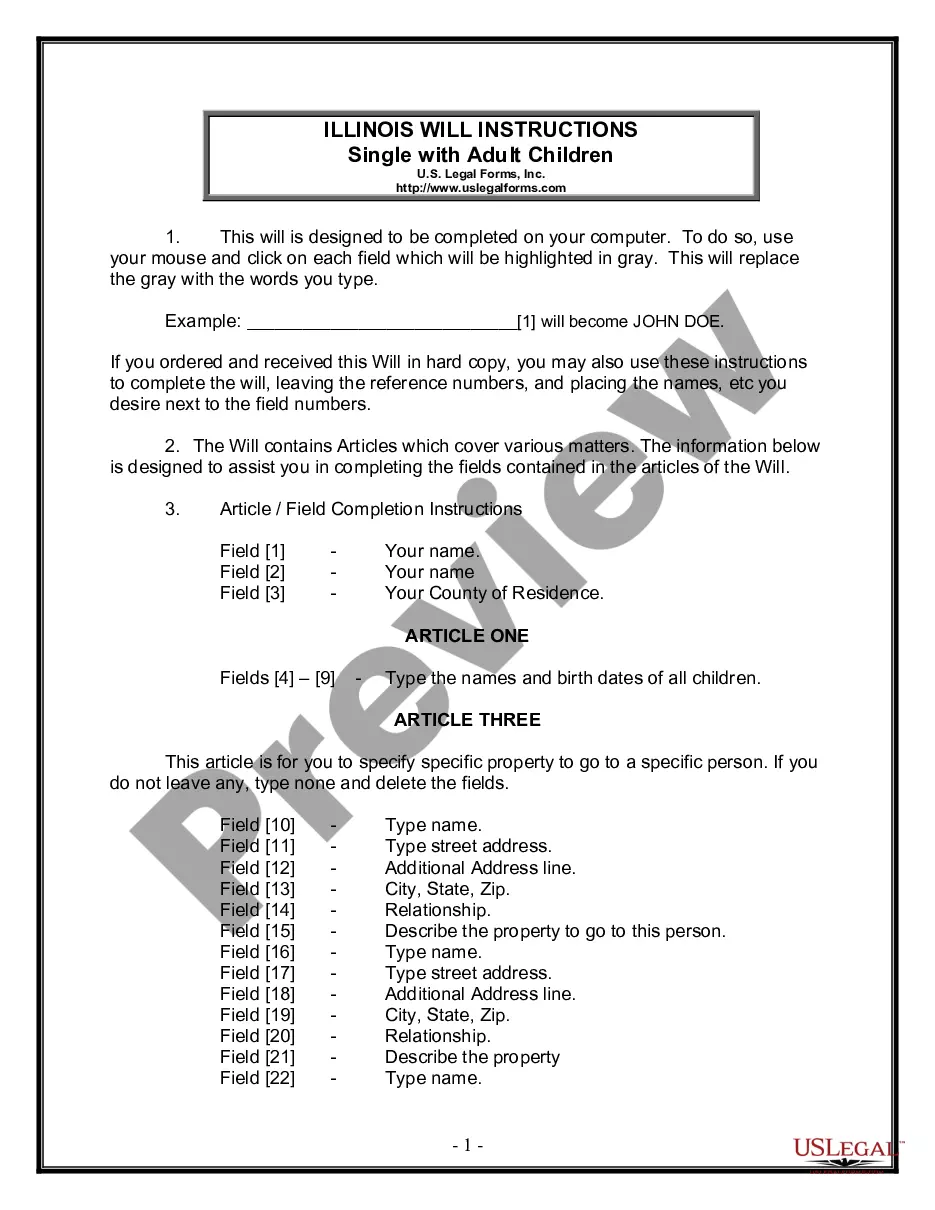

A vital document for singles without children, ensuring clear distribution of assets upon death.

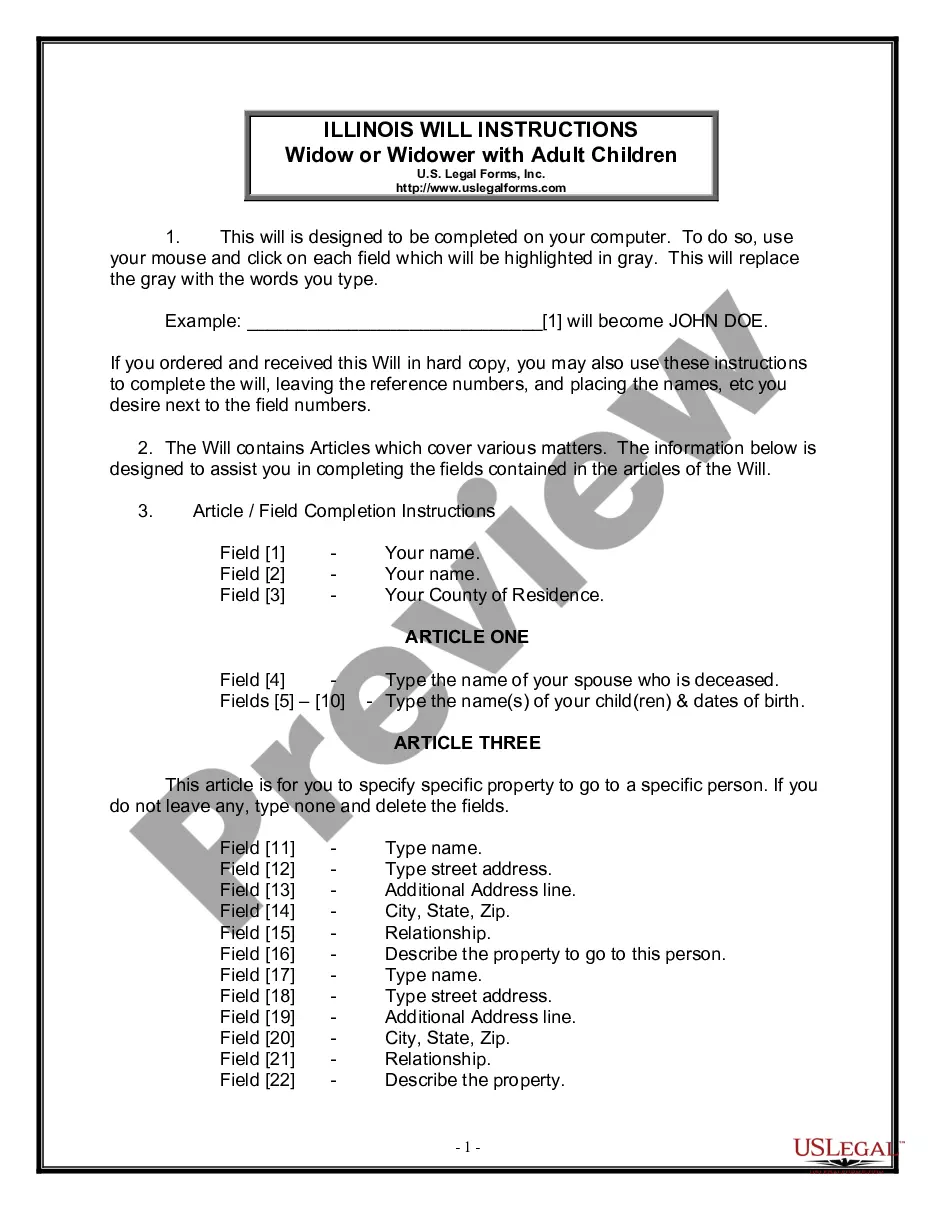

Ensure your wishes are legally documented and easily executed, protecting your family's future after your passing.

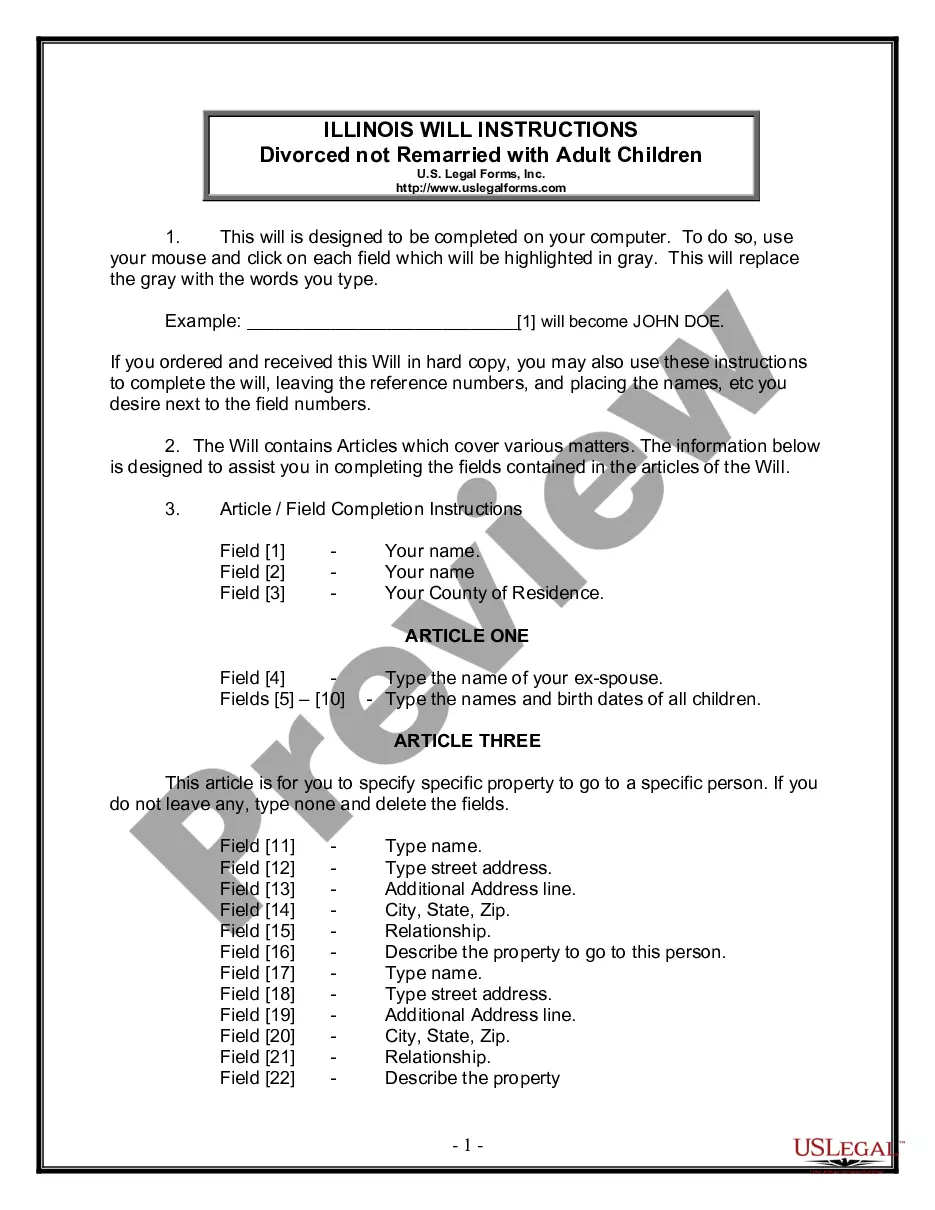

Ensure your wishes are honored after passing with a legally binding document tailored for those who are divorced with adult children.

Create legally binding mutual wills to outline property distribution and guardianship for your family.

Create a detailed estate plan to specify who receives your assets, ensuring your adult children are included appropriately.

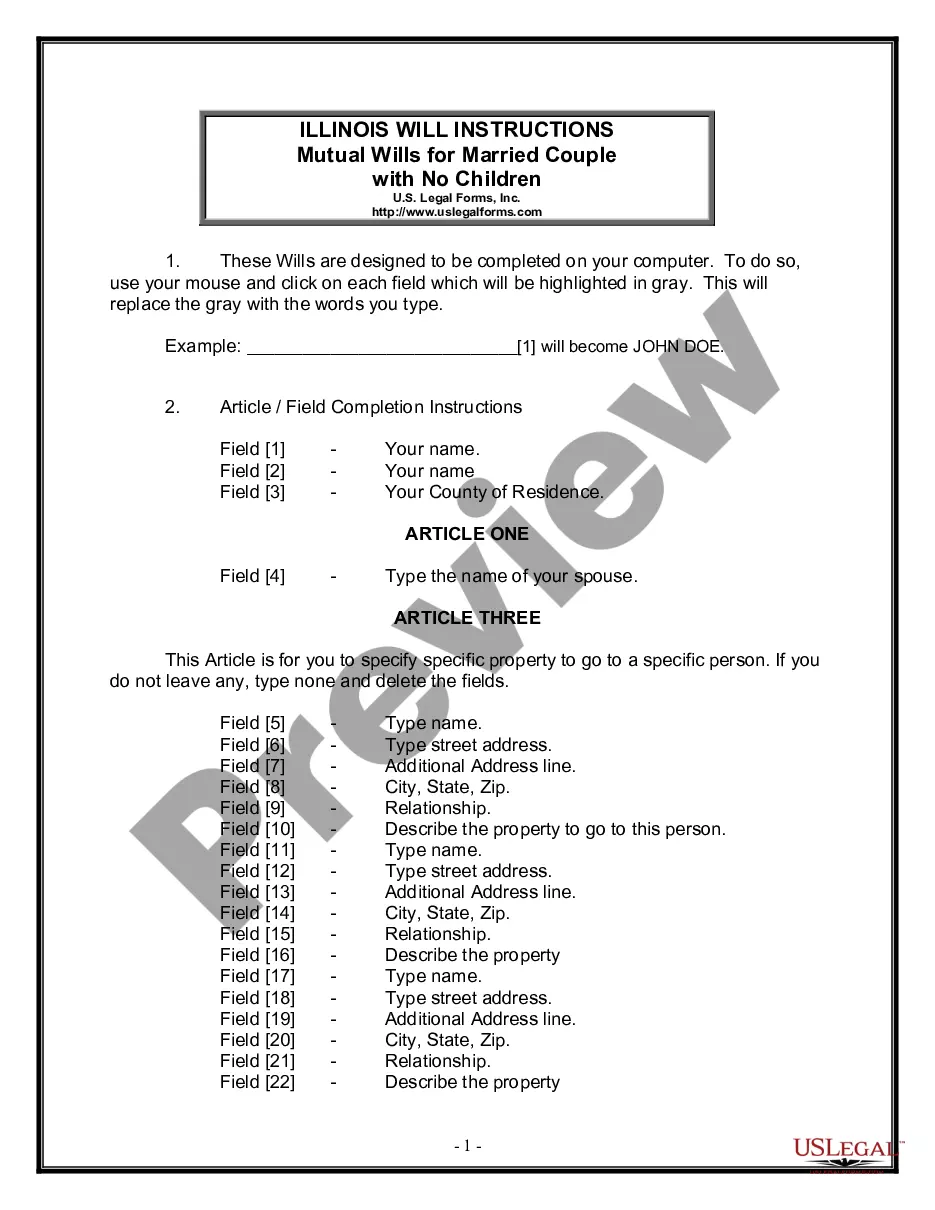

Create legally binding wills that clearly outline your and your spouse's wishes for property distribution without children.

Prepare a legally binding document to outline how your assets will be distributed, especially when you have adult children from a previous marriage.

A Last Will and Testament is essential for asset distribution.

It allows for the appointment of guardians for minor children.

Wills can be contested in probate court if not properly executed.

Updating your will is important after major life changes.

Beneficiary designations may override will instructions.

Multiple wills can create confusion; keep it simple and clear.

Many states, including Illinois, require witnesses for validity.

Begin your estate planning with these simple steps.

A trust can provide additional benefits, like avoiding probate, but is not mandatory.

Without a will, state laws determine asset distribution, which may not align with your wishes.

Review and update your plan after major life events, such as marriage or having children.

Beneficiary designations generally take precedence over your will regarding asset distribution.

Yes, you can designate separate agents for financial and healthcare decisions in your planning.