What is Last Will and Testament?

A Last Will and Testament specifies how to distribute your assets after death. It is crucial for ensuring your wishes are followed. Explore state-specific templates for your needs.

A Last Will and Testament outlines your wishes for asset distribution. Attorney-drafted templates are quick and simple to complete.

Ensure your estate is distributed as intended with mutual wills that cater specifically to married couples with adult children.

Protect your family's future with mutual wills, designed for married couples with minor children to ensure your wishes are honored.

Prepare essential legal documents for your health and financial affairs, all in one easy-to-use package.

Plan your estate and define asset distribution with this essential legal document for individuals without dependents.

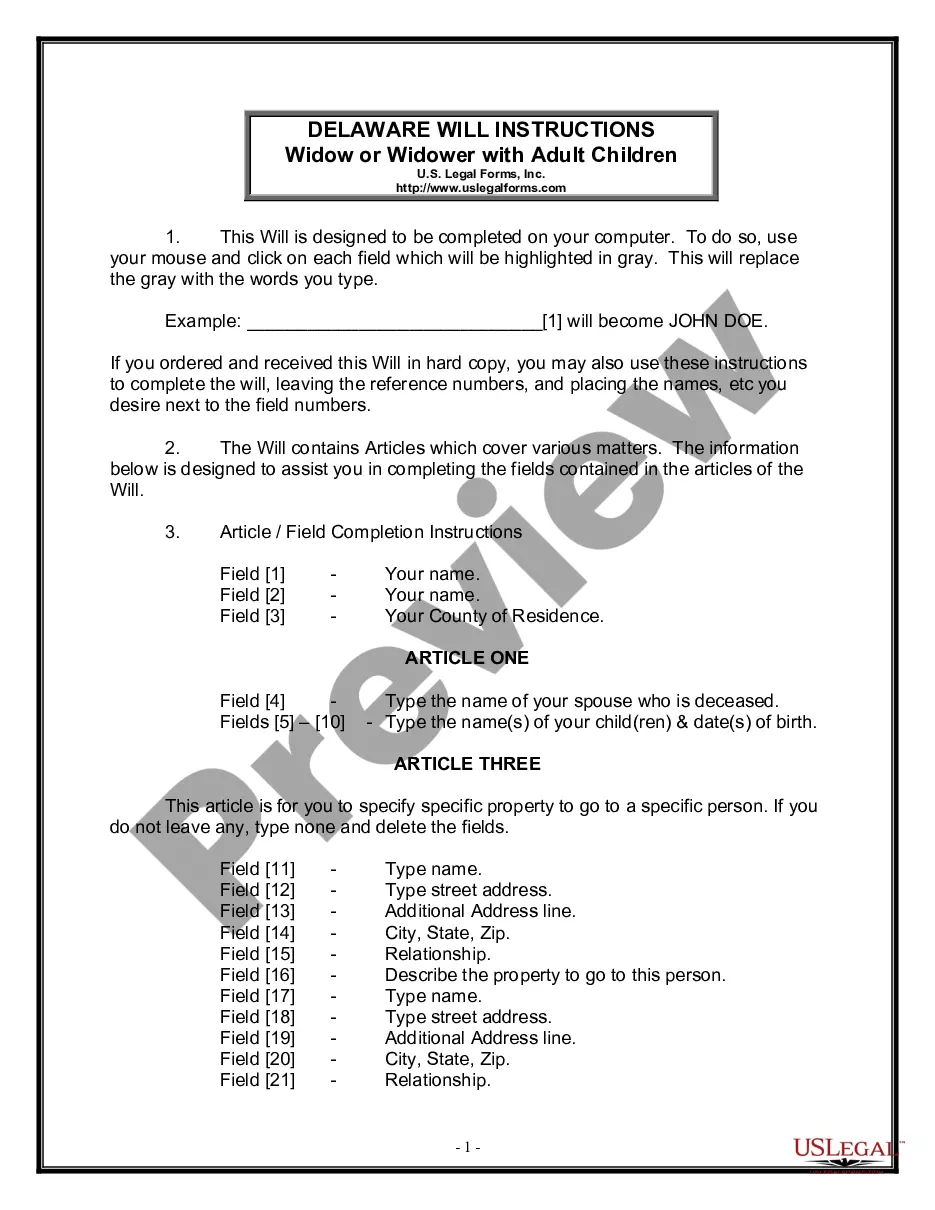

Plan your estate and specify desired distributions to your adult children with a comprehensive legal document tailored for widows and widowers.

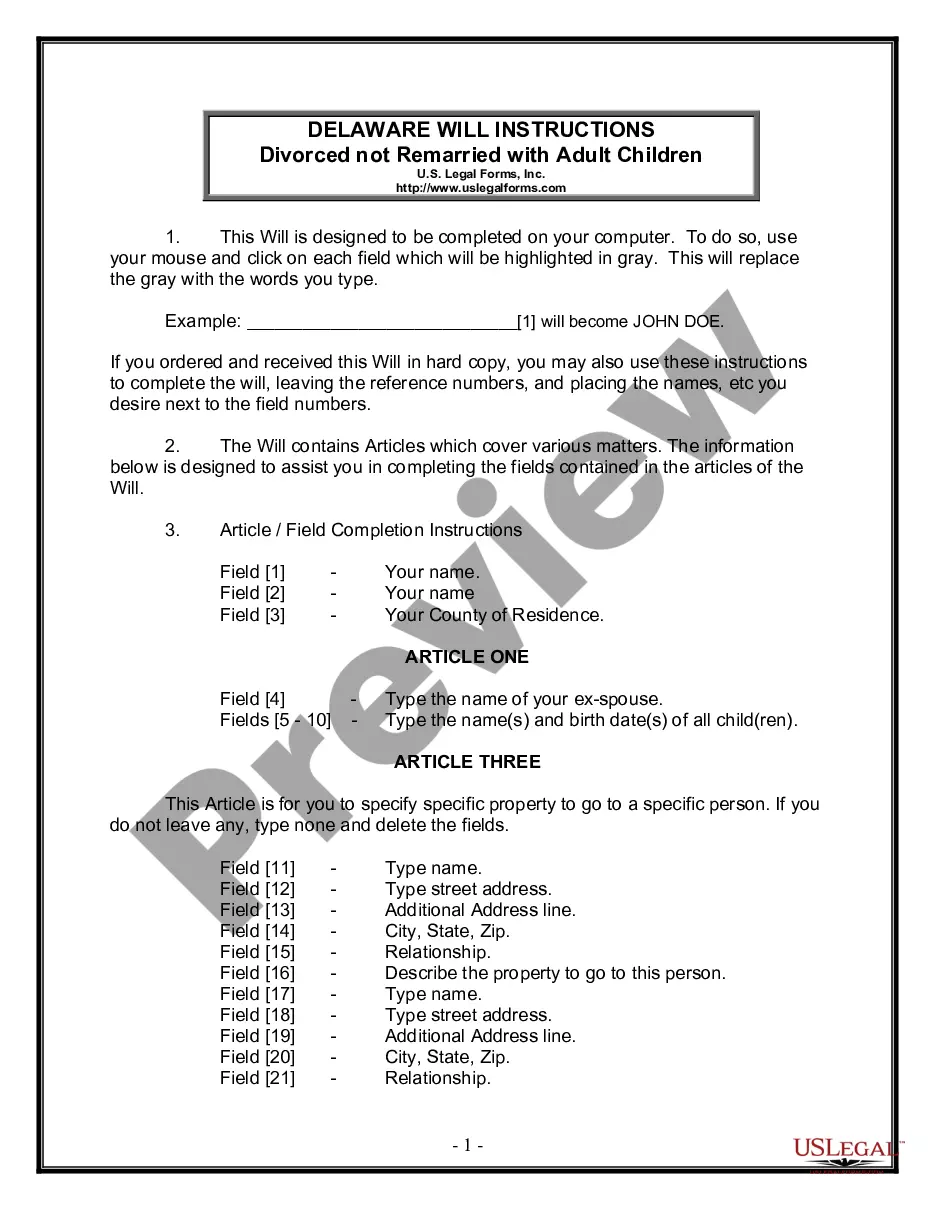

Create a will tailored for divorced individuals with adult children to specify asset distribution and personal wishes accurately.

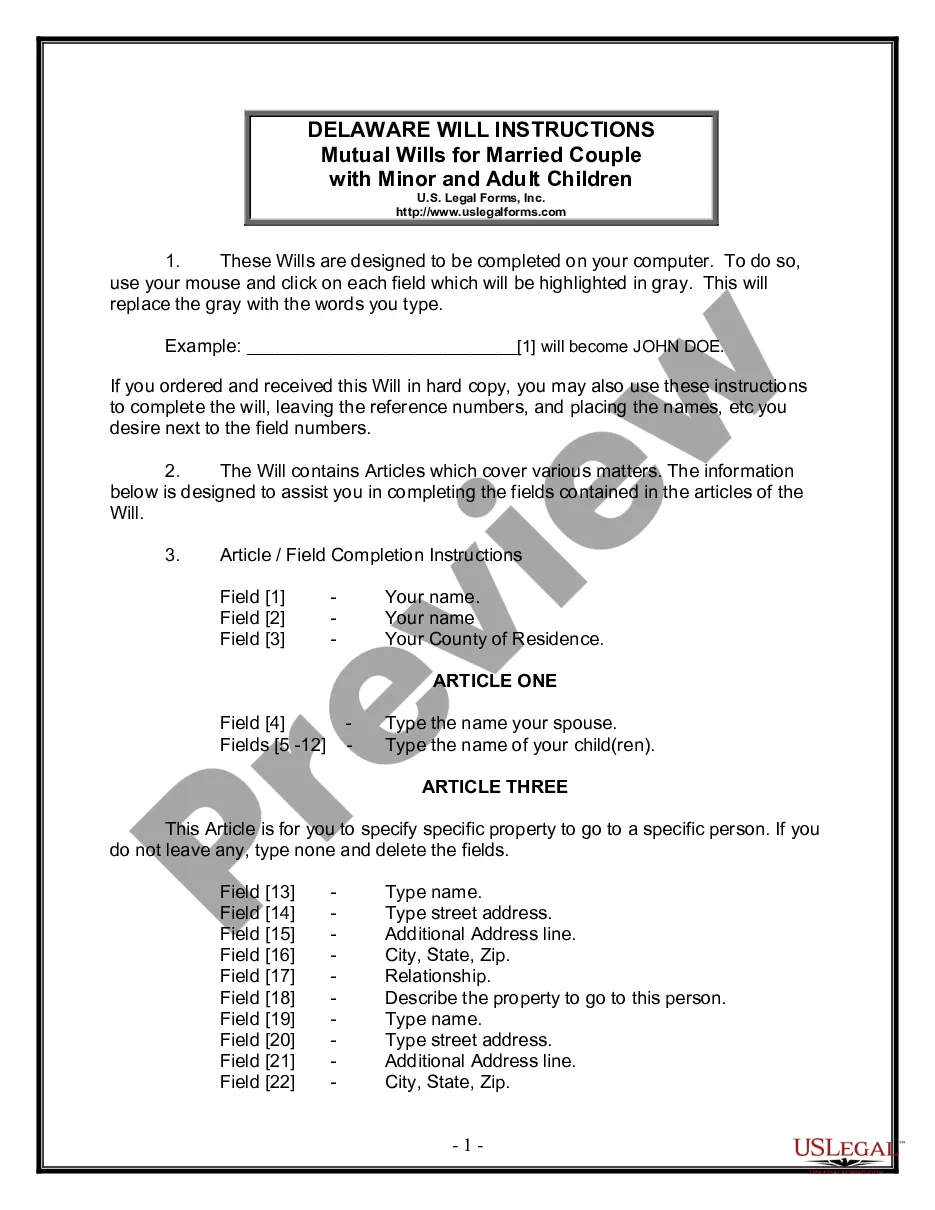

Create legally binding mutual wills tailored for a married couple with children to ensure your wishes are fulfilled after passing.

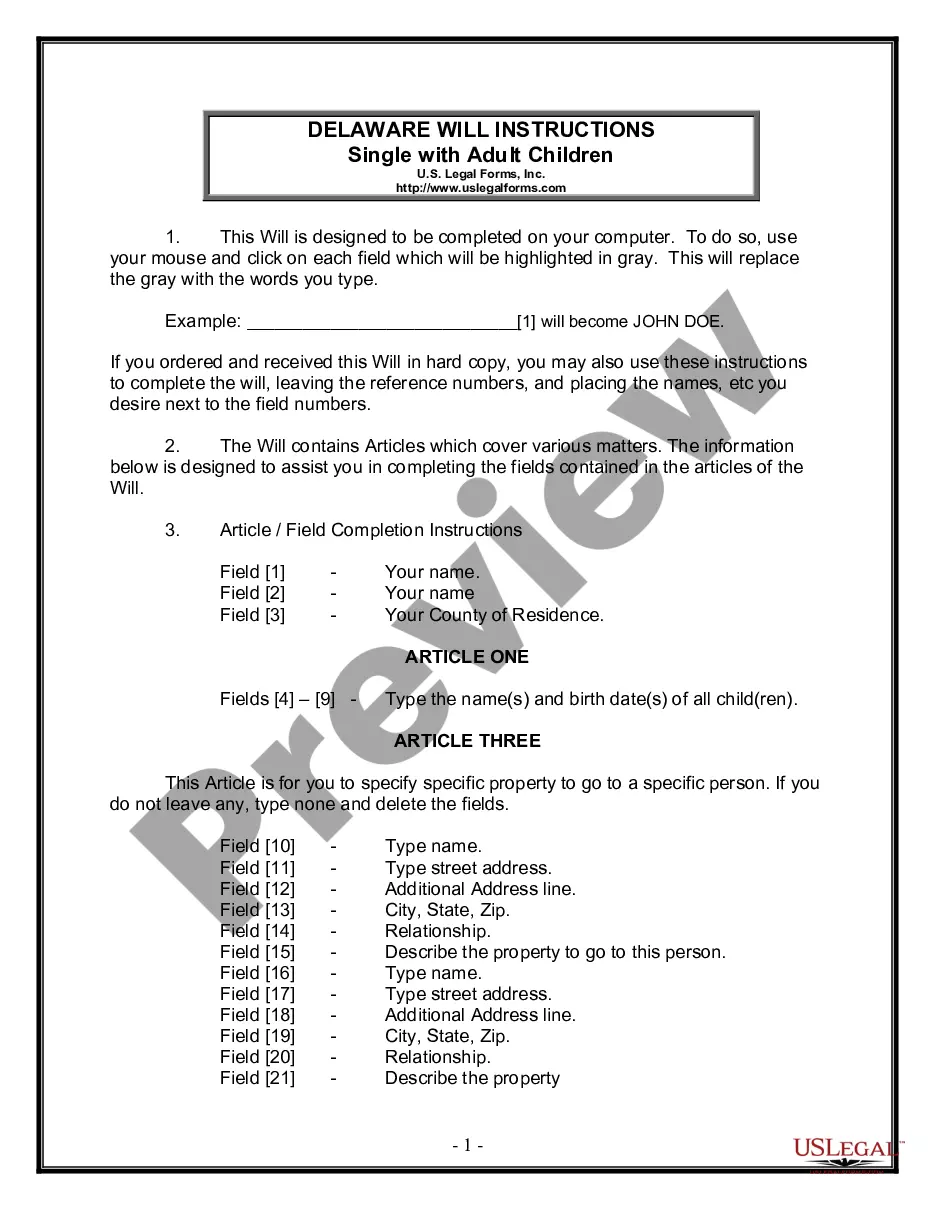

Create a legally binding document detailing your wishes for property distribution and guardianship for your adult children.

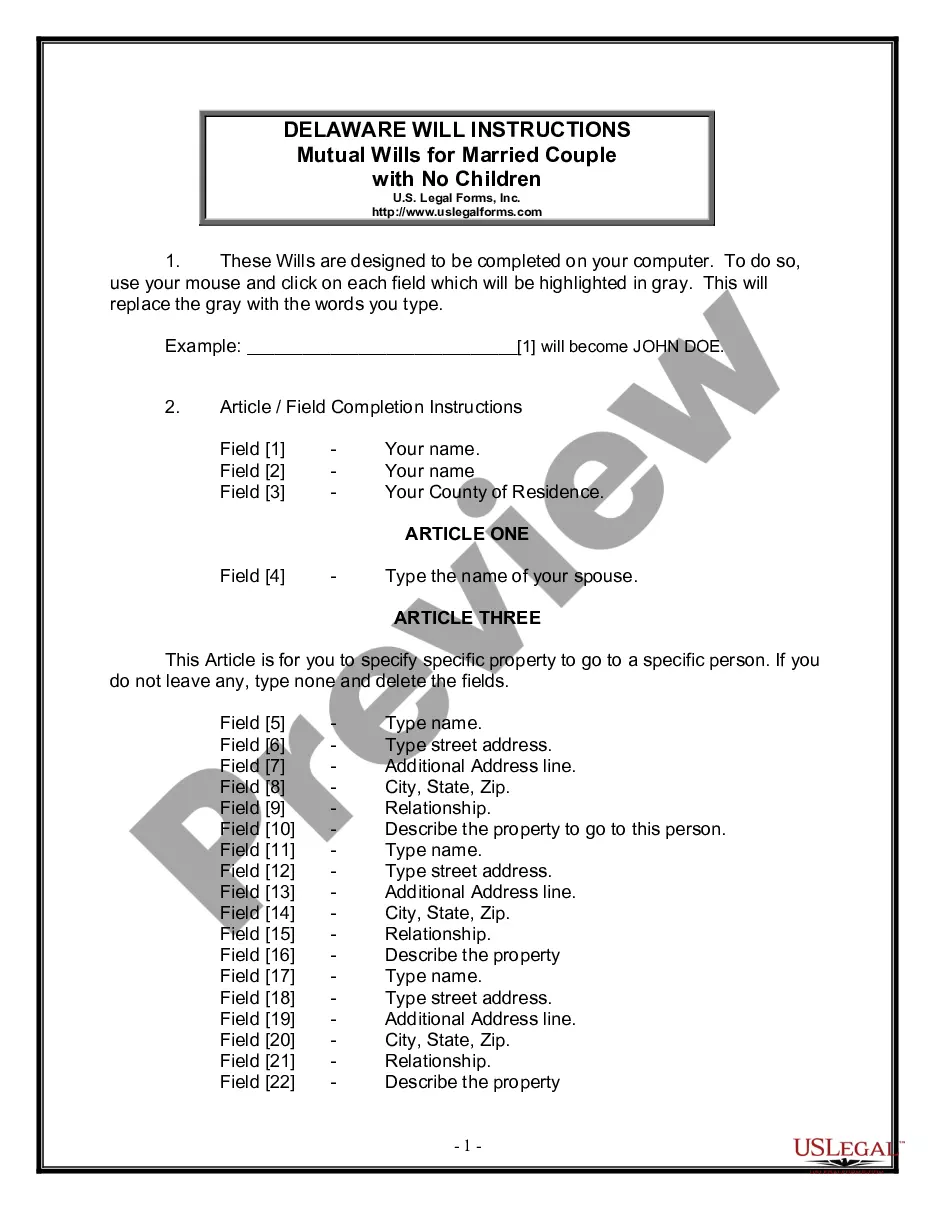

Secure your assets and provide for your spouse with legally binding wills designed for married couples without children.

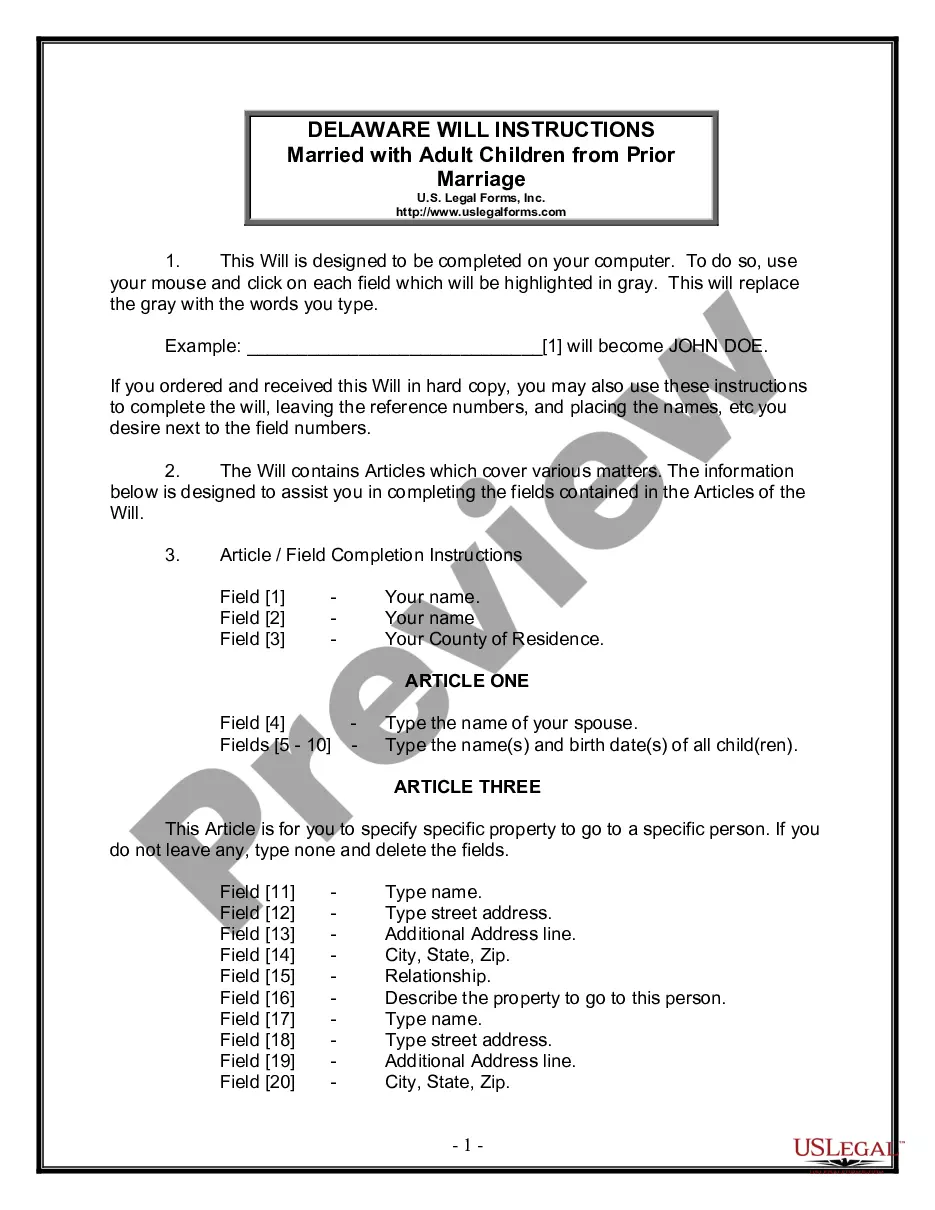

Outline your wishes for asset distribution and guardianship after passing, especially important for blended families.

A Last Will and Testament can be modified or revoked at any time.

Beneficiaries can be individuals or organizations, including charities.

Witnesses are often required to validate the will.

Probate is the process of validating a will in court.

A will does not cover all assets, such as life insurance or retirement accounts.

It's important to keep your will updated after major life changes.

Digital assets may also need to be addressed in your will.

Begin the process in just a few simple steps.

A trust may help manage assets during your lifetime and avoid probate.

Without a will, state laws dictate asset distribution, which may not align with your wishes.

It's wise to review your will after significant life changes, like marriage or children.

Beneficiary designations can supersede your will, so keep them updated.

Yes, you can designate separate individuals for financial and medical decisions in your documents.