What is Last Will and Testament?

A Last Will and Testament is a legal document that specifies how your assets will be distributed after your death. It can also appoint guardians for minor children. Explore state-specific templates to get started.

A Last Will and Testament outlines your wishes after passing. Attorney-drafted templates ensure a fast and straightforward process.

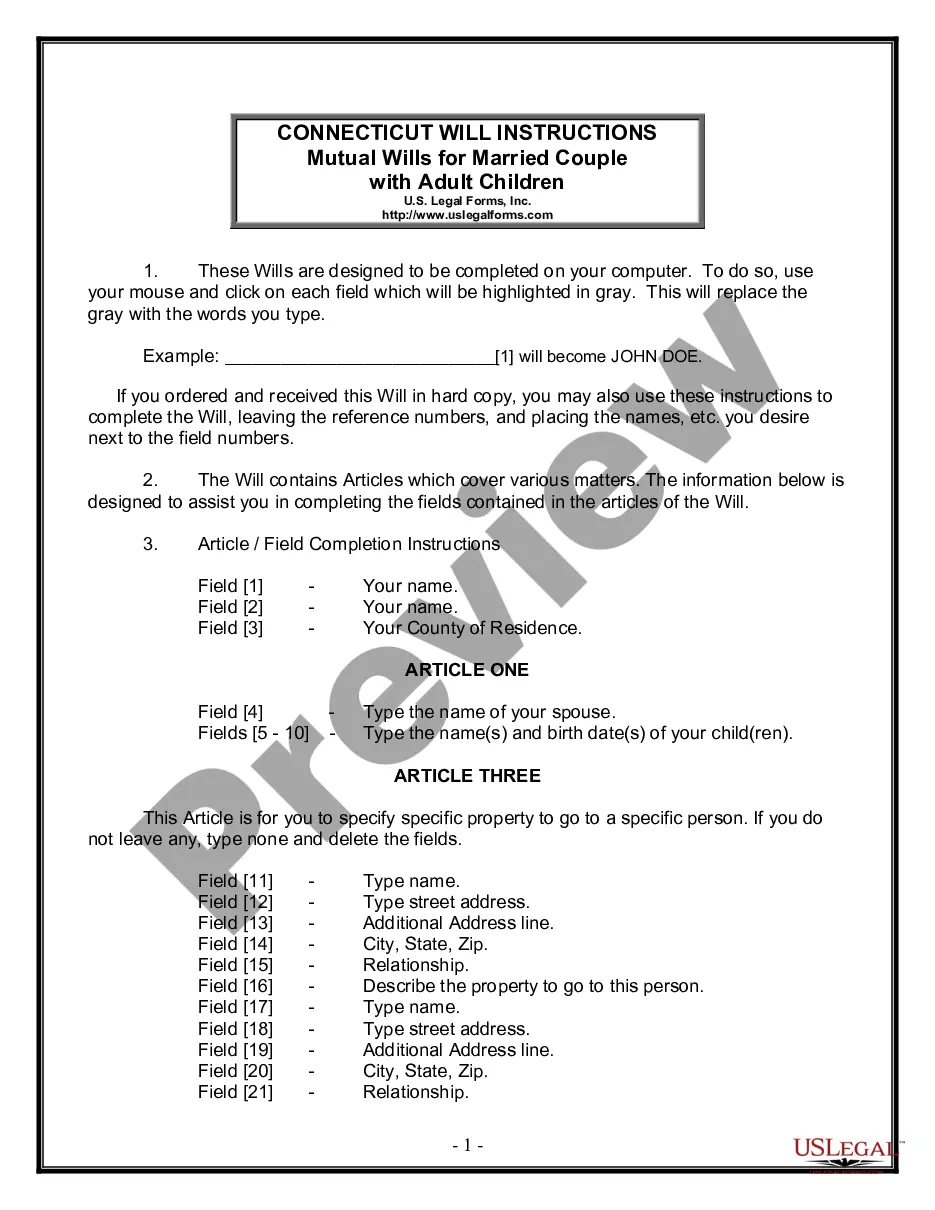

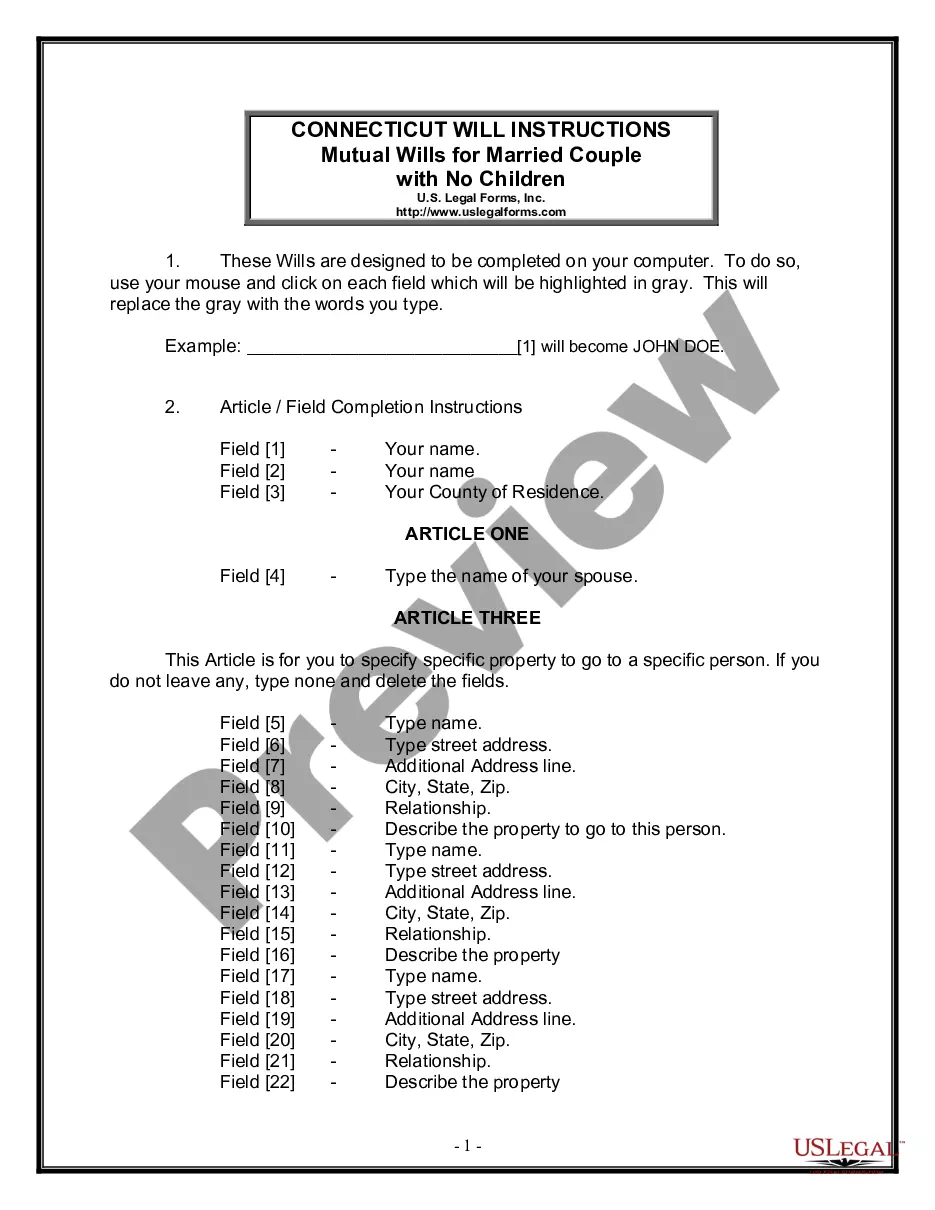

Create mutual wills that ensure your wishes are honored for both partners and provide clarity for adult children.

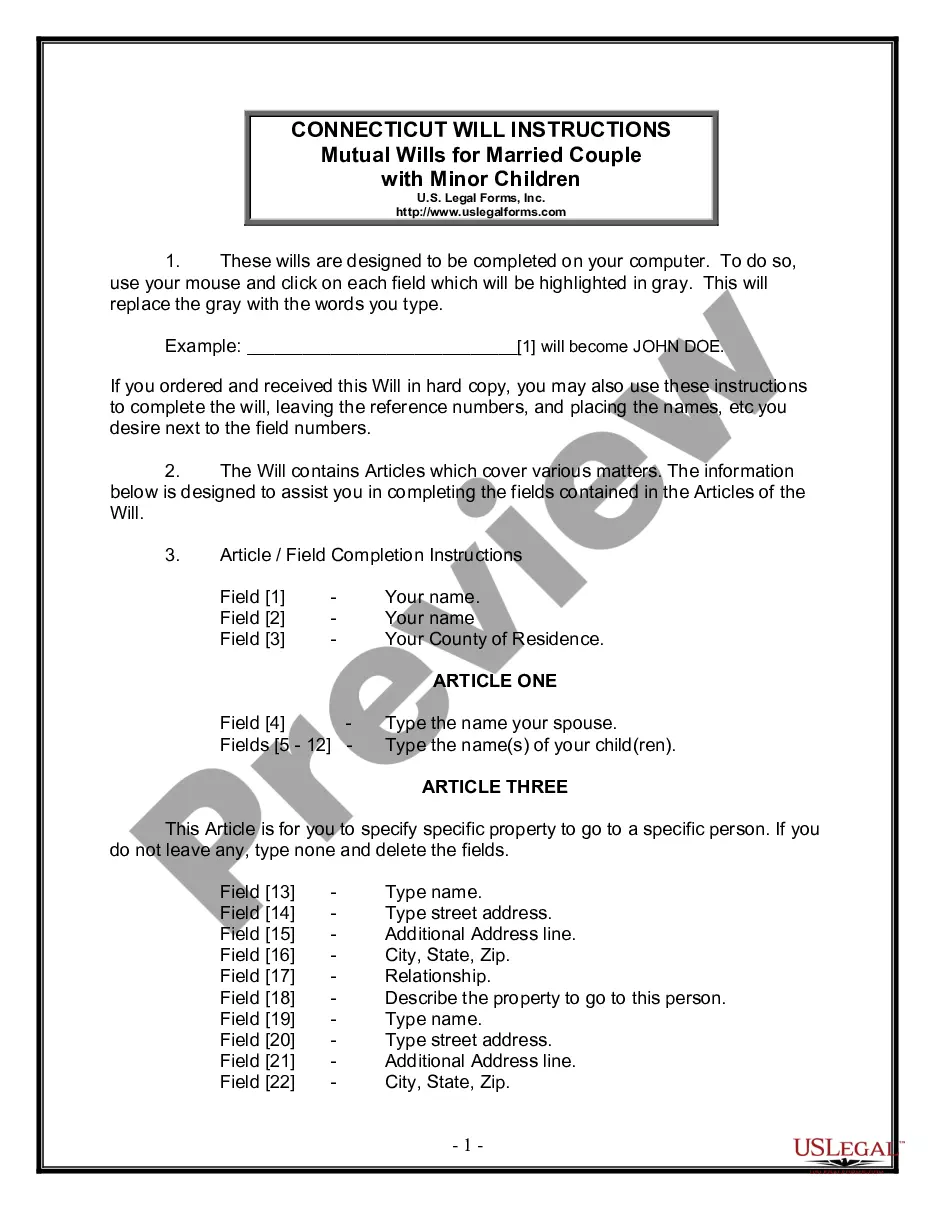

Ensure your wishes are honored and protect your minor children with comprehensive mutual wills tailored for married couples.

Get peace of mind with essential legal forms for managing your estate, all in one convenient package.

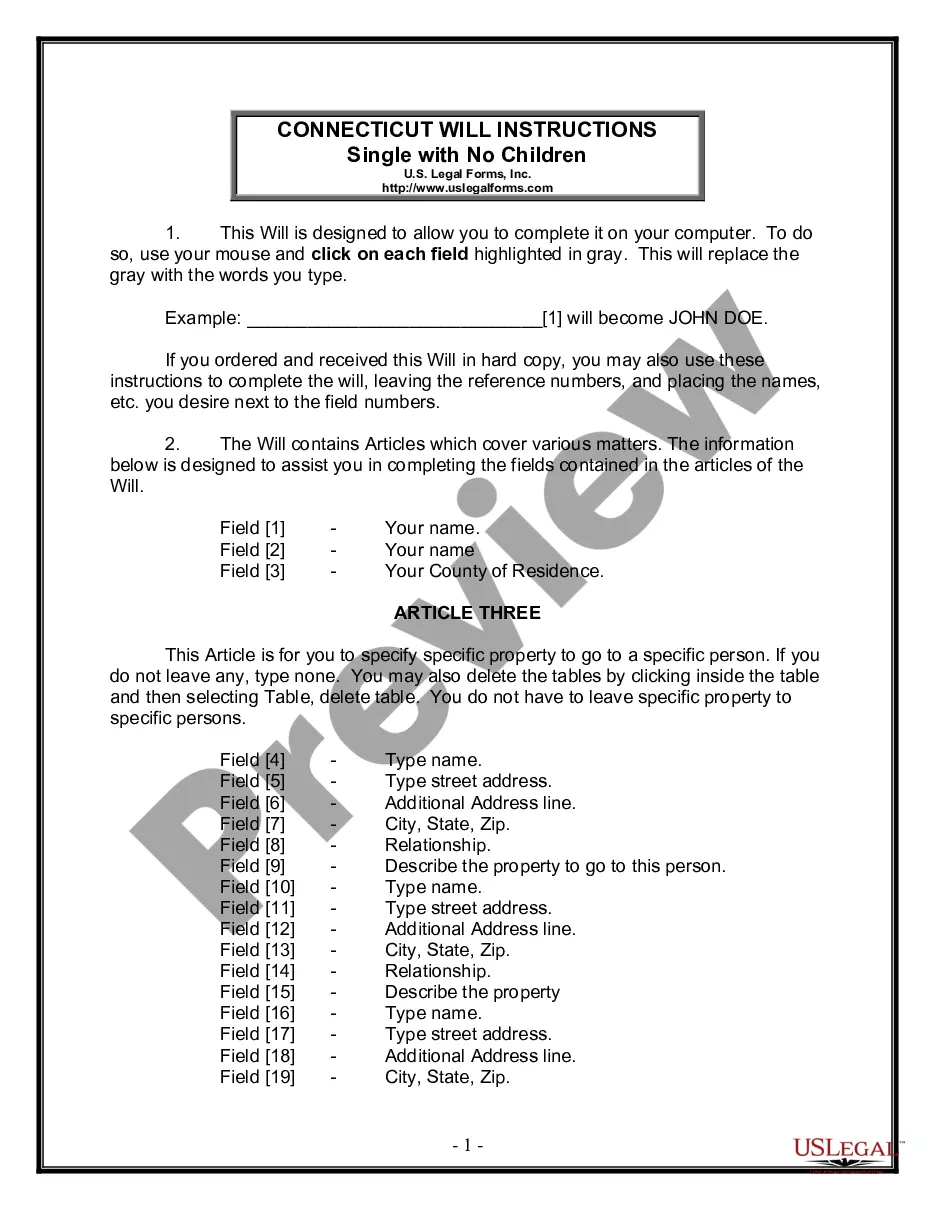

Protect your wishes after death by detailing how your assets will be distributed.

Create a comprehensive estate plan that distributes your assets and specifies your personal representative after your passing.

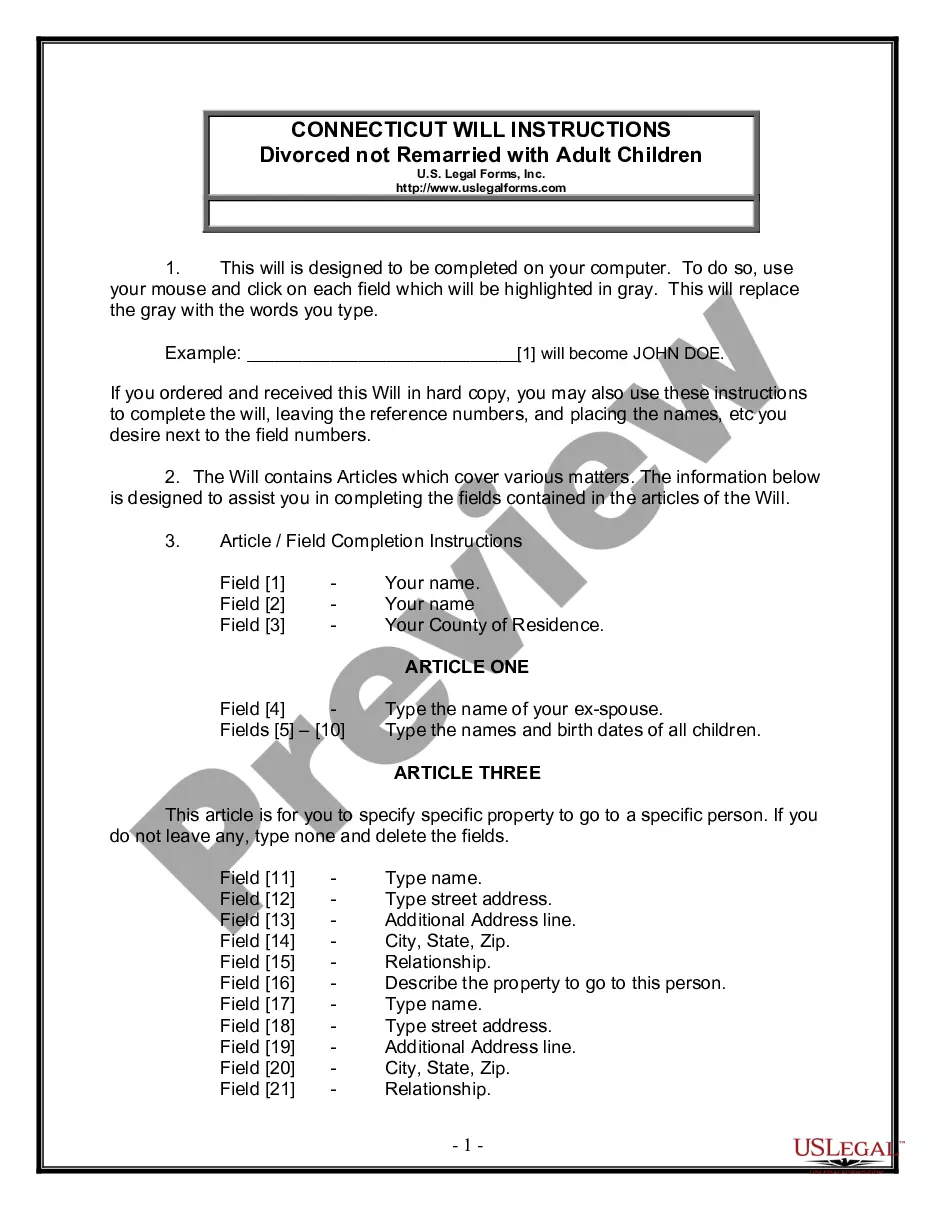

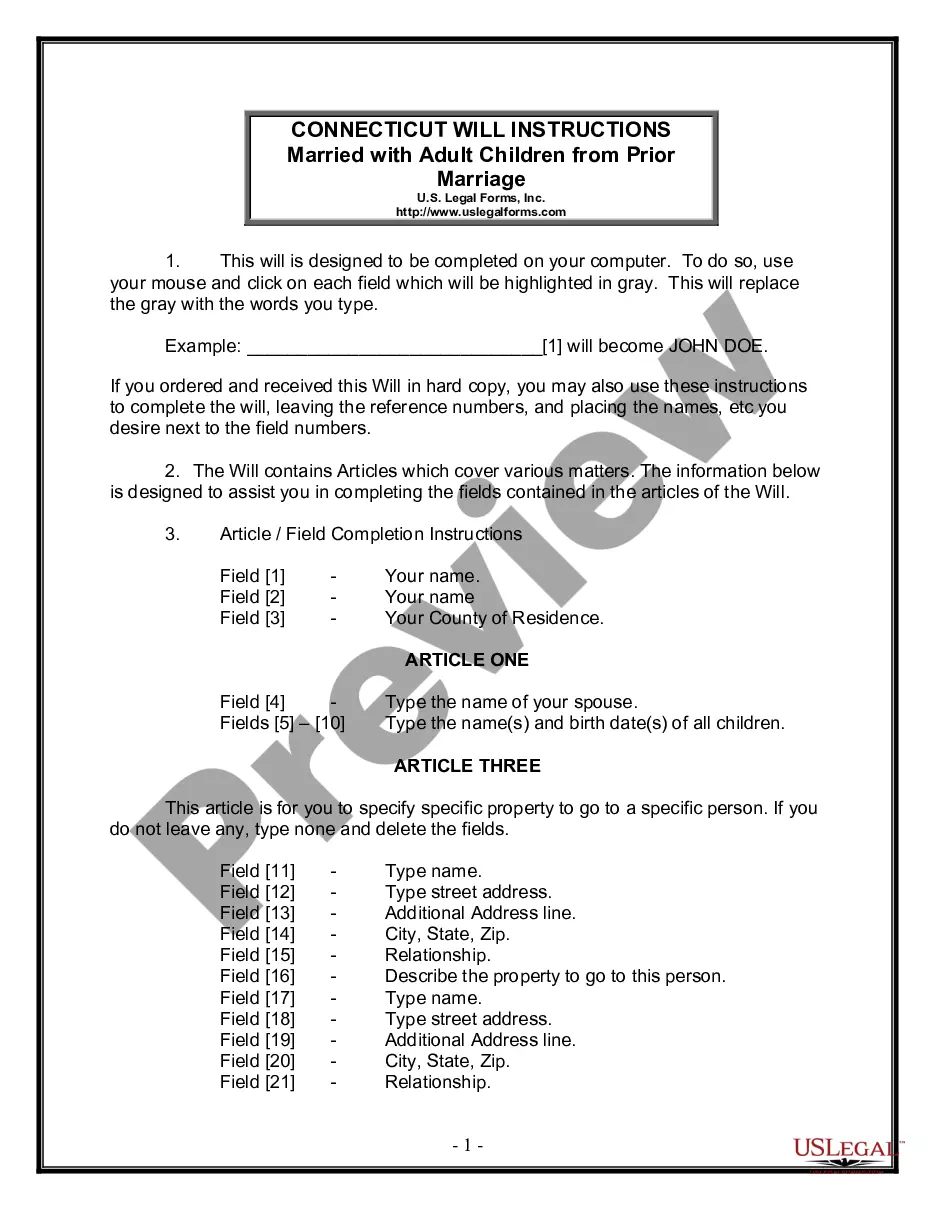

Create a personalized will to outline your wishes for property distribution, especially important for divorced individuals with adult children.

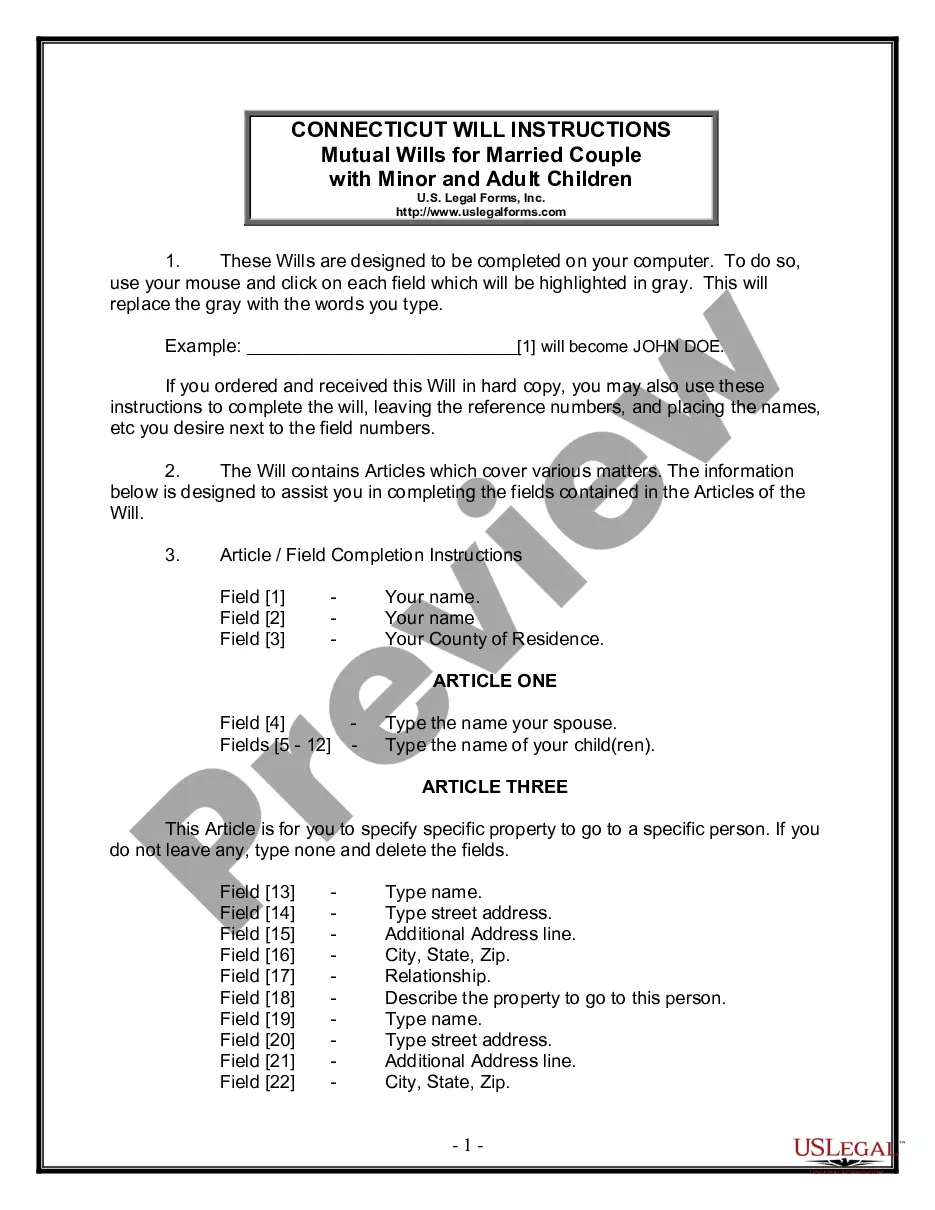

Create mutual wills that ensure your wishes are honored for both your minor and adult children, providing protection and clarity in your estate planning.

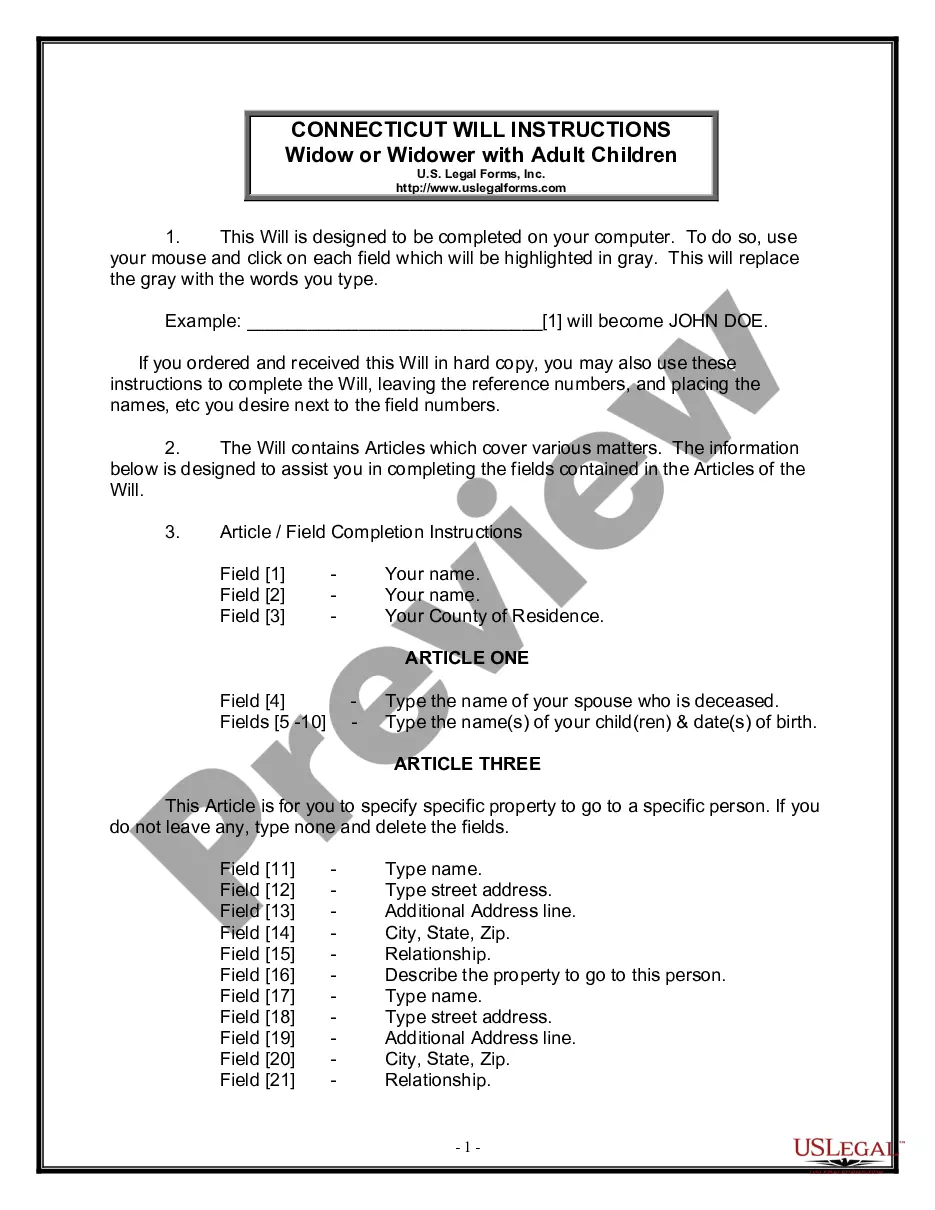

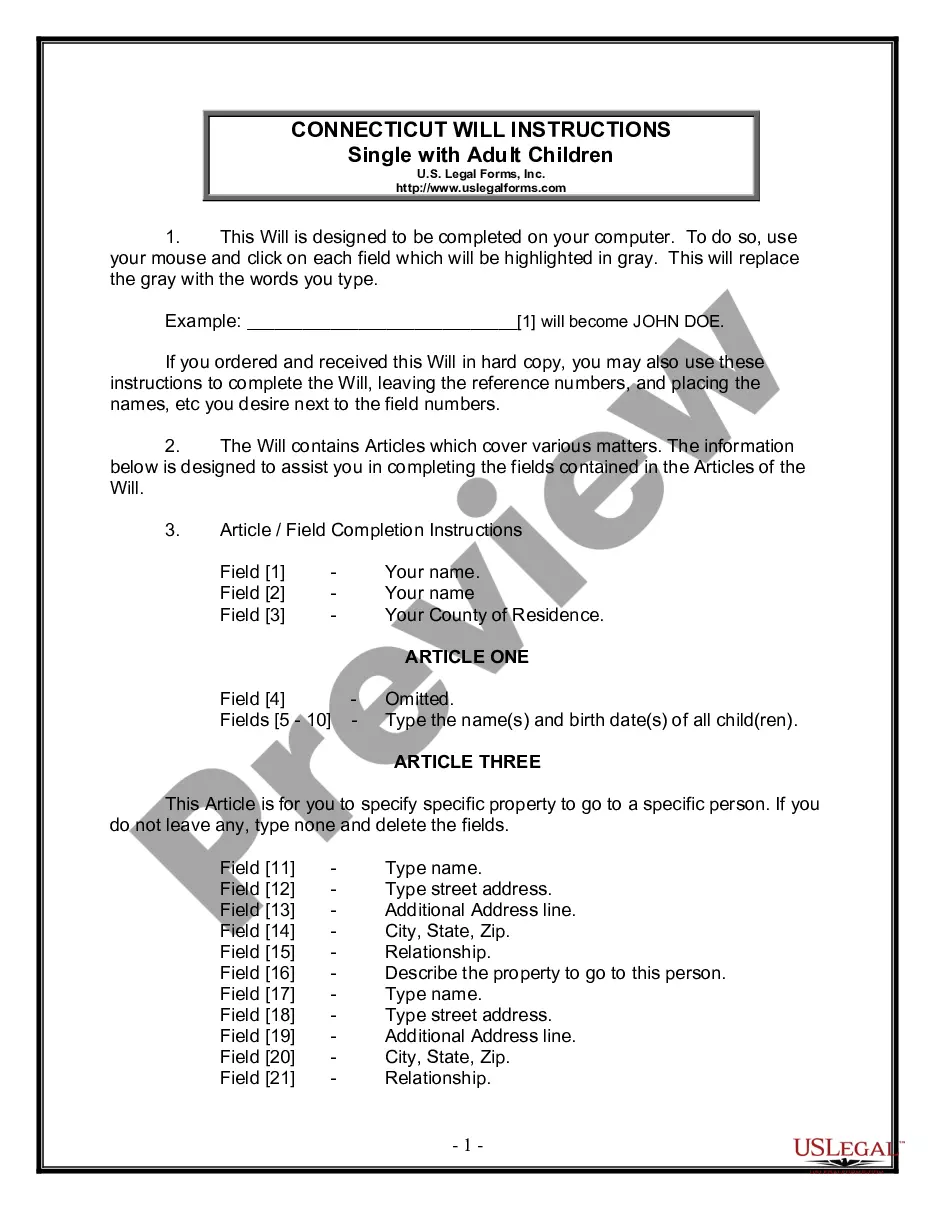

Create a personalized will to specify how your assets will be distributed to your adult children after your passing.

Create legally binding mutual wills for spouses without children, ensuring your intentions for asset distribution are clearly stated.

Ensure your assets are properly distributed to your spouse and adult children from a prior marriage with this comprehensive legal document.

A Last Will and Testament takes effect after your death.

Wills can name guardians for minor children.

Witnesses may be required for validity.

Wills can be contested in probate court.

Assets distributed by a will may go through probate.

Begin the process easily with these steps.

A trust may offer benefits such as avoiding probate, which a will does not.

Without a will, state laws determine how your assets will be distributed.

Review your will regularly, especially after major life changes.

Beneficiary designations override will instructions for assets like life insurance.

Yes, you can appoint separate individuals for financial and medical decisions.