Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee

Overview of this form

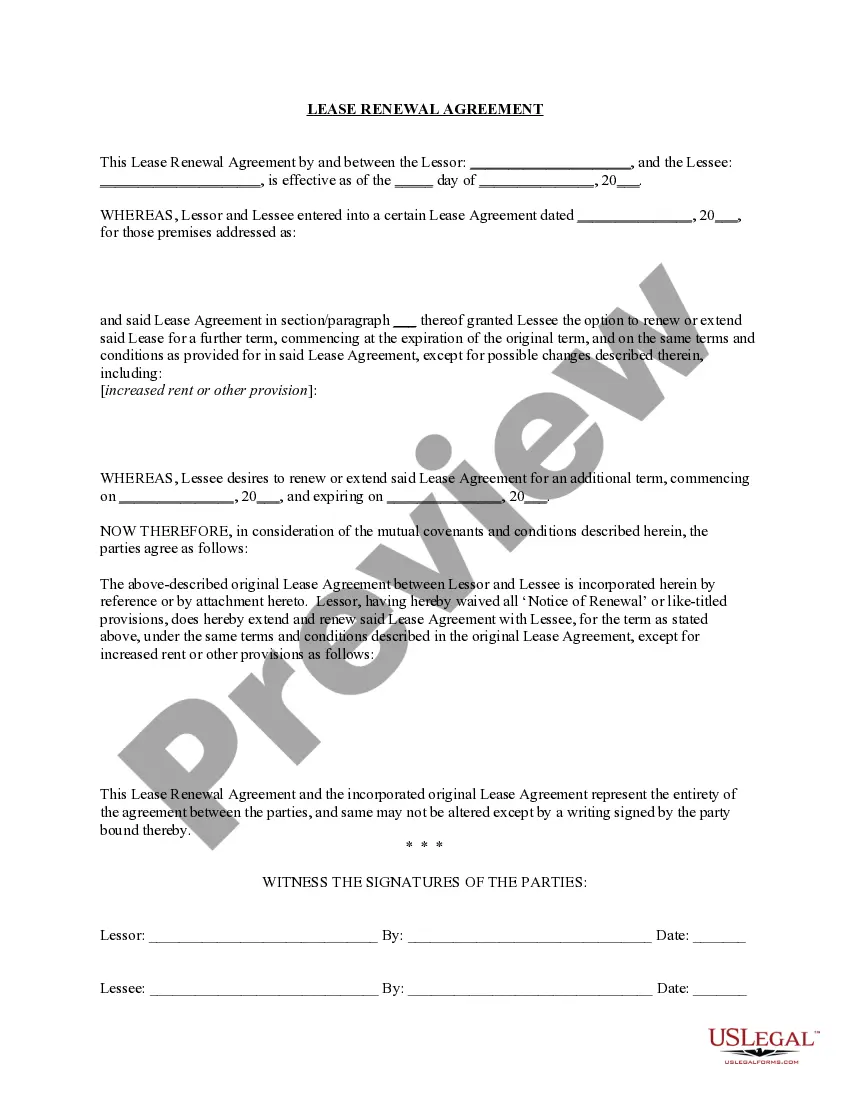

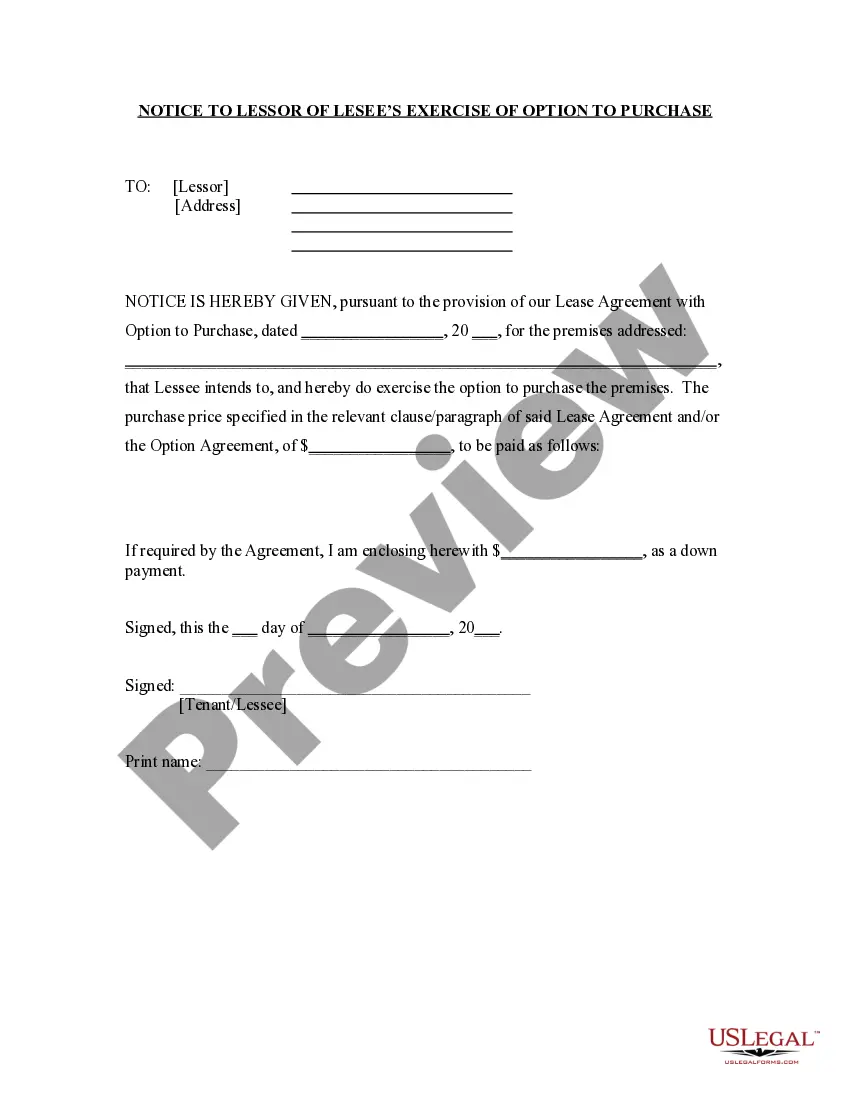

The Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legal document that allows a beneficiary to renounce their rights and interest in a trust. This form differs from other estate planning tools by focusing specifically on the beneficiary's decision to disclaim their entitlements, which can affect the distribution of trust assets and protect the interests of other beneficiaries.

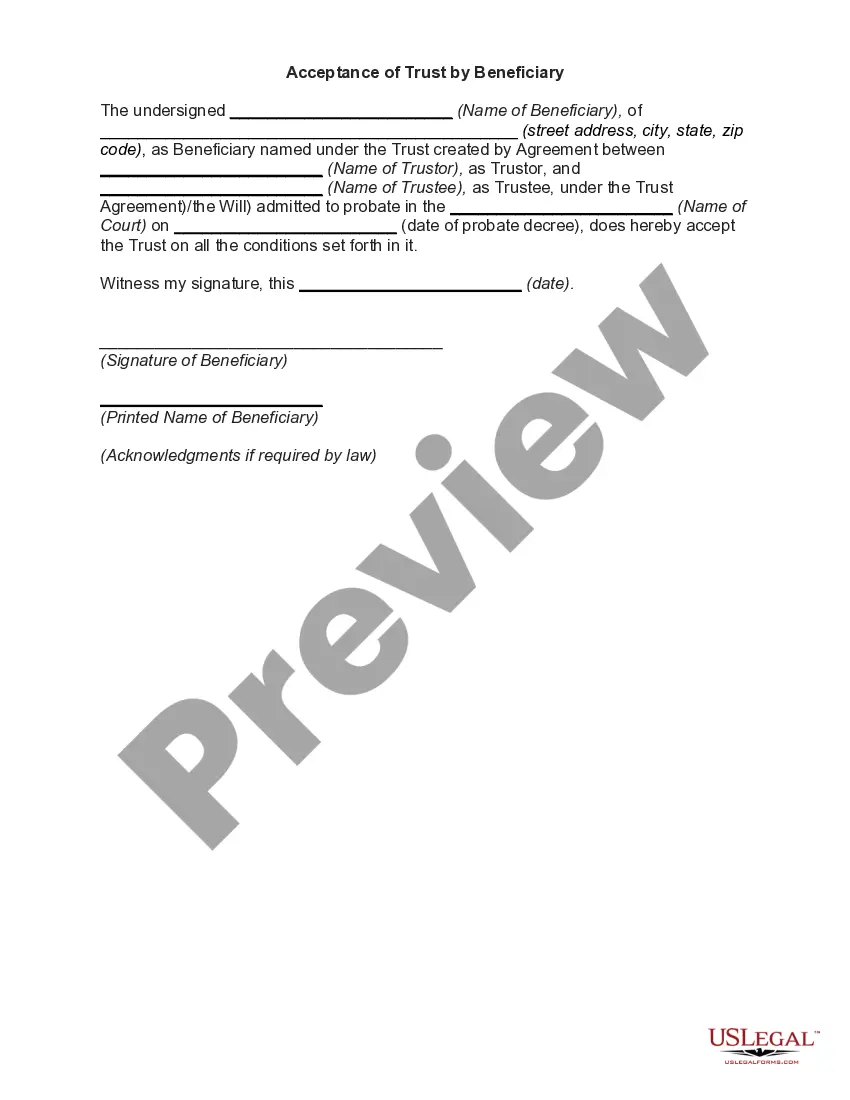

Key components of this form

- Identification of the trustee and trustor involved in the trust

- Detailed description of the beneficiary's interest being disclaimed

- A declaration confirming the beneficiary's refusal to accept any part of the trust

- Acknowledgment of receipt by the trustee

- Signature lines for both the beneficiary and the trustee

When to use this form

This form is used when a beneficiary wishes to formally refuse their rights or benefits under a trust. Situations may include when a beneficiary does not want an inheritance due to personal reasons, financial implications, or to allow the trust property to pass to other beneficiaries without their involvement. This legal disclaimer helps in clarifying the intentions of the beneficiary and ensuring proper handling of the trust estate.

Intended users of this form

- Beneficiaries of a trust who wish to renounce their rights

- Trustees who need formal documentation of a beneficiary's disclaimer

- Individuals involved in estate planning under trusts looking to clarify intentions

- Legal professionals assisting clients with trust management

How to prepare this document

- Identify the parties involved by entering the names and addresses of the trustee and trustor.

- Provide the name of the trust and the date of the trust document.

- Fill in the name of the beneficiary who is disclaiming their rights.

- Clearly describe the interest that is being disclaimed.

- Have both the beneficiary and trustee sign and date the form.

Is notarization required?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to provide complete information about the trust or the involved parties.

- Not having both signatures on the form, which is necessary for validity.

- Entering the wrong date of the trust document, which could create legal issues.

Benefits of using this form online

- Immediate access to legal forms drafted by licensed attorneys.

- Edit and customize the document as needed before downloading.

- A simple and convenient way to manage legal paperwork without needing in-person appointments.

Looking for another form?

Form popularity

FAQ

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest. Silence or otherwise passive behaviour will not suffice.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

Specifically, the IRS requires that: You make your disclaimer in writing.You disclaim the assets within nine months of the death of the person you inherited them from. (Note: There's an exception for minor beneficiaries; they have until nine months after they reach the age of majority to disclaim.)

A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them.

No, a disclaimer does not need to be notarized.To get the most legal protection out of your disclaimers, display them in accessible places for users to see, such as linking to the disclaimer page in the website footer, and including it in the terms and conditions.