What is Probate?

Probate refers to the legal process of validating a will and distributing assets. It involves specific documents that guide estate administration. Explore state-specific templates for your needs.

Probate is the process of settling an estate after someone passes away. Attorney-drafted templates are available, making the process straightforward and efficient.

Use this affidavit to claim insurance proceeds of $11,000 or less when there is no need for a formal estate procedure.

Ideal for managing small estates valued under $50,000, this package simplifies administration tasks for executors or heirs.

Request a copy of a deceased person's Will to ensure proper estate management and adherence to the law.

Resolve disputes among heirs without going to court, clarifying property ownership and responsibilities for an estate.

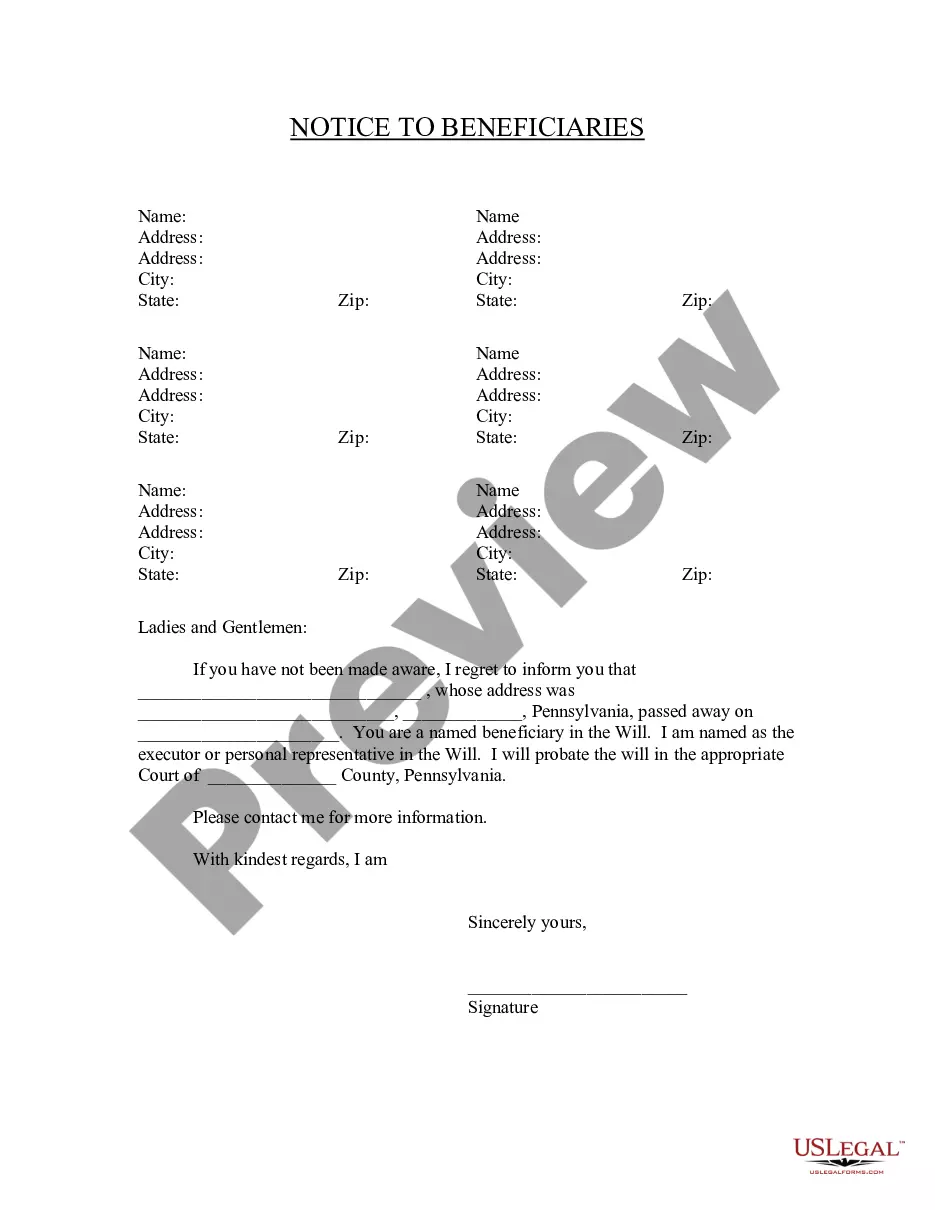

Notify named beneficiaries about their status in a will and the probate process following a person's death.

Use this form to initiate probate proceedings and request official authority to manage an estate after someone's death.

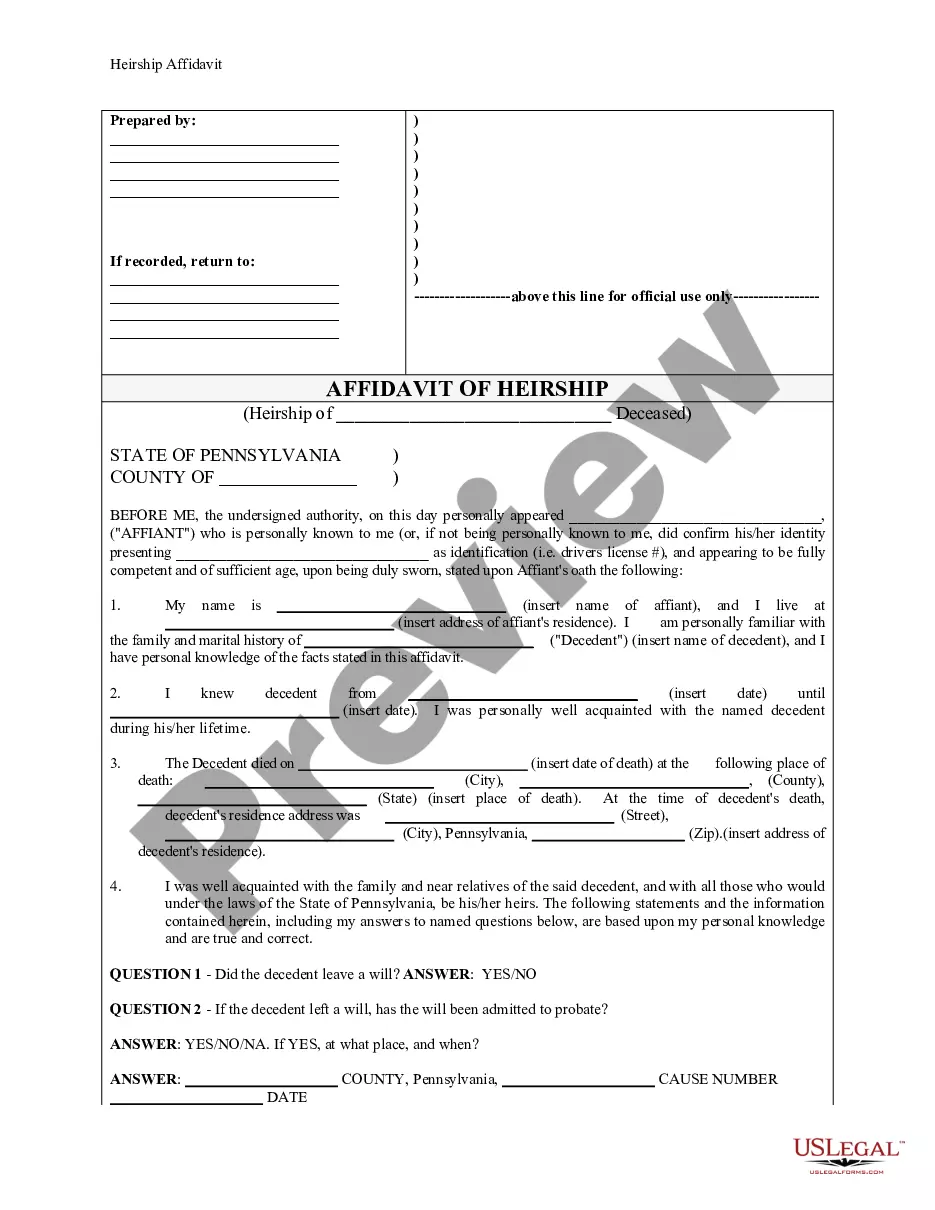

Essential for establishing legal heirs of a deceased person, this affidavit clarifies family relationships for estate matters.

Essential for confirming the presence of witnesses to a will, this document validates their signatures and the testator's intent.

Probate is necessary for asset distribution after death.

Wills must be validated in court for probate.

Not all assets require probate to transfer ownership.

Intestate succession laws apply when there is no will.

Probate can involve court hearings and filings.

The executor or administrator has a fiduciary duty to the estate.

Probate processes and timelines can vary by state.

Begin your probate journey with these easy steps.

A trust can help avoid probate and manage assets during your lifetime.

If you do nothing, state laws will determine how your assets are distributed.

Review your plan regularly, especially after major life changes.

Beneficiary designations can override your will, so ensure they align.

Yes, you can appoint separate agents for financial and healthcare decisions.