What is Probate?

Probate documents facilitate the administration of an estate, ensuring debts are settled and assets distributed. Explore state-specific templates to simplify this process.

Probate is the process of settling an estate after someone passes away. Attorney-drafted templates make it quick and easy to complete necessary forms.

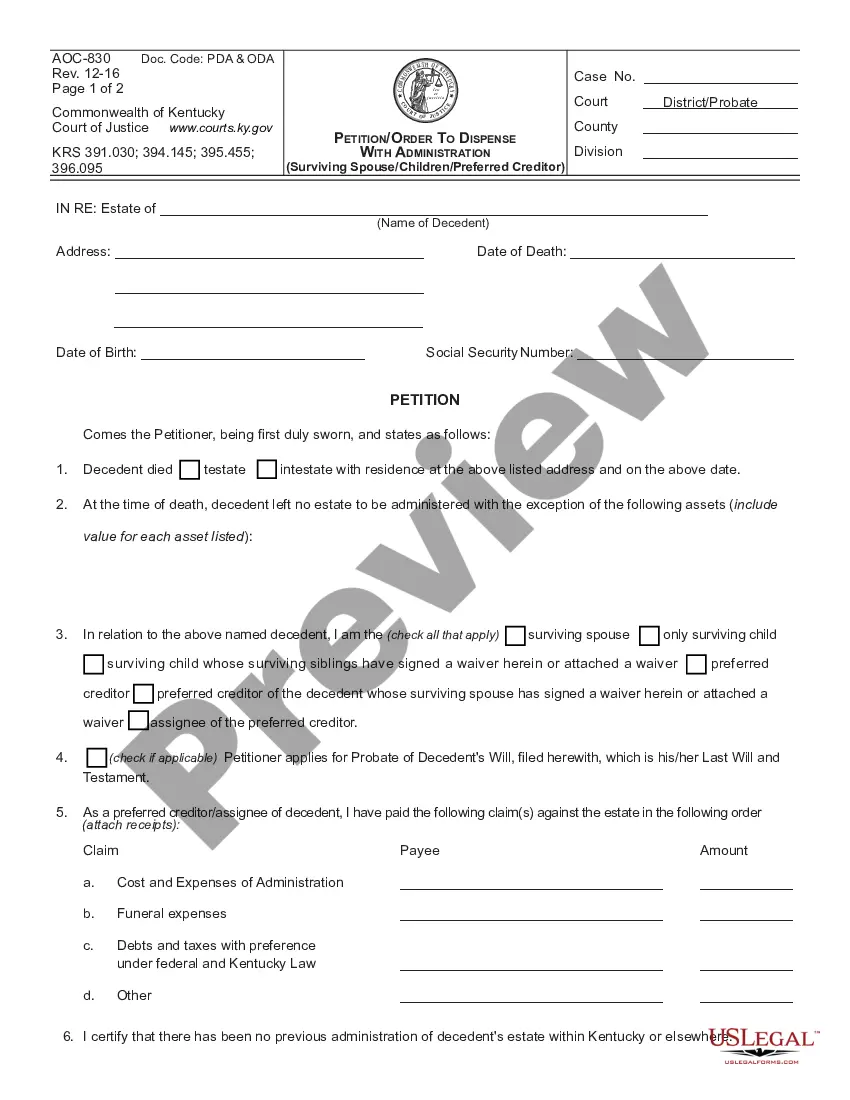

Streamline the transfer of assets without full administration of a small estate, ensuring quick access for family members or preferred creditors.

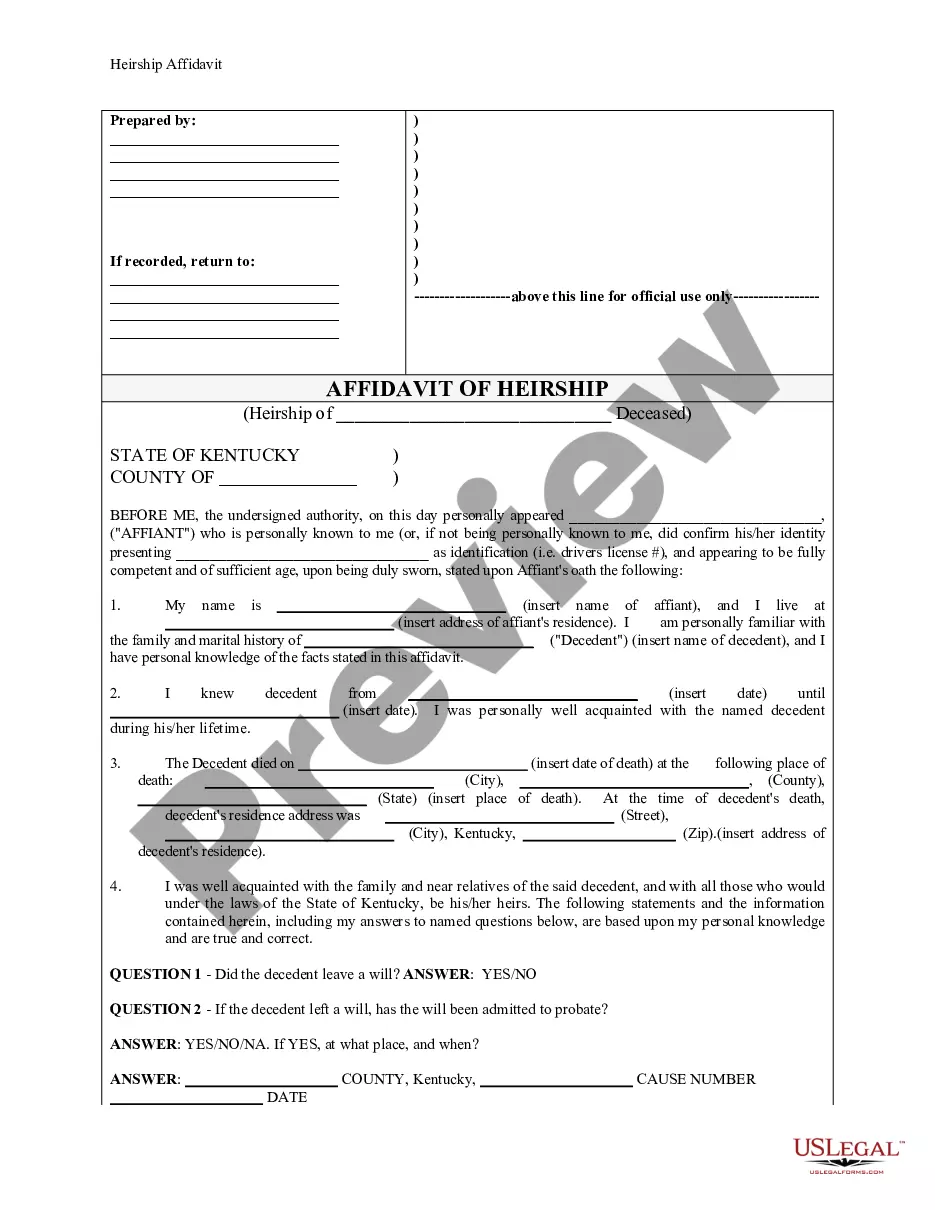

This document helps establish the legal heirs of a deceased person, essential for settling their estate and distributing assets.

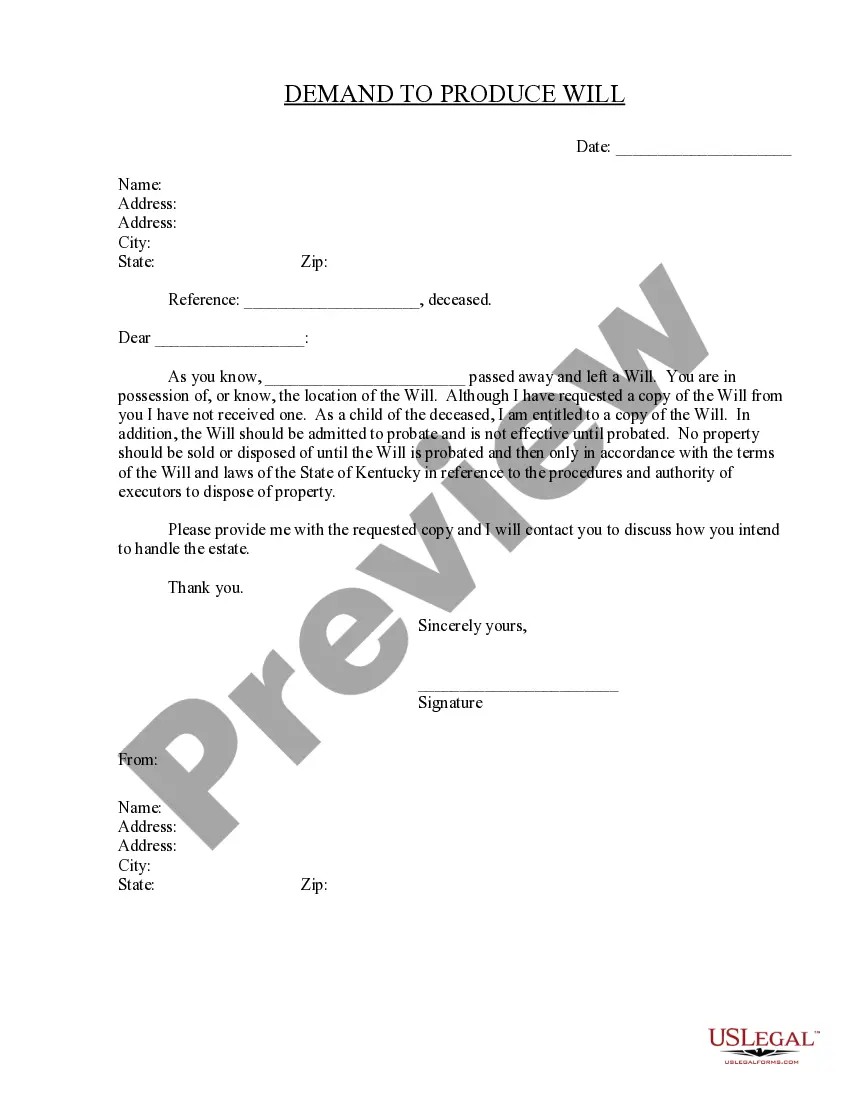

Request a copy of a deceased person's will from the executor or individual holding it to ensure your rights as an heir are protected.

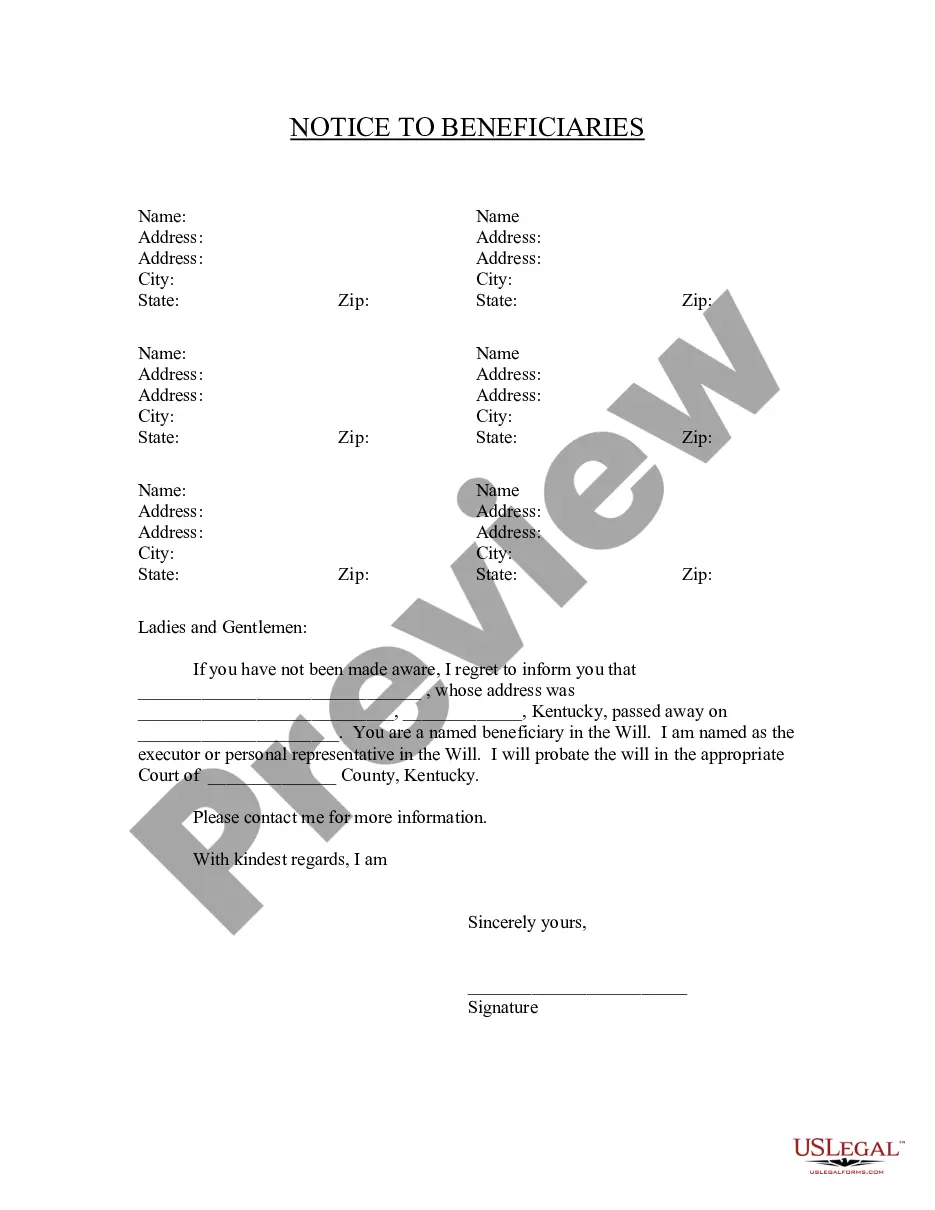

Reach out to beneficiaries named in a will, ensuring they are informed of their status and the probate process.

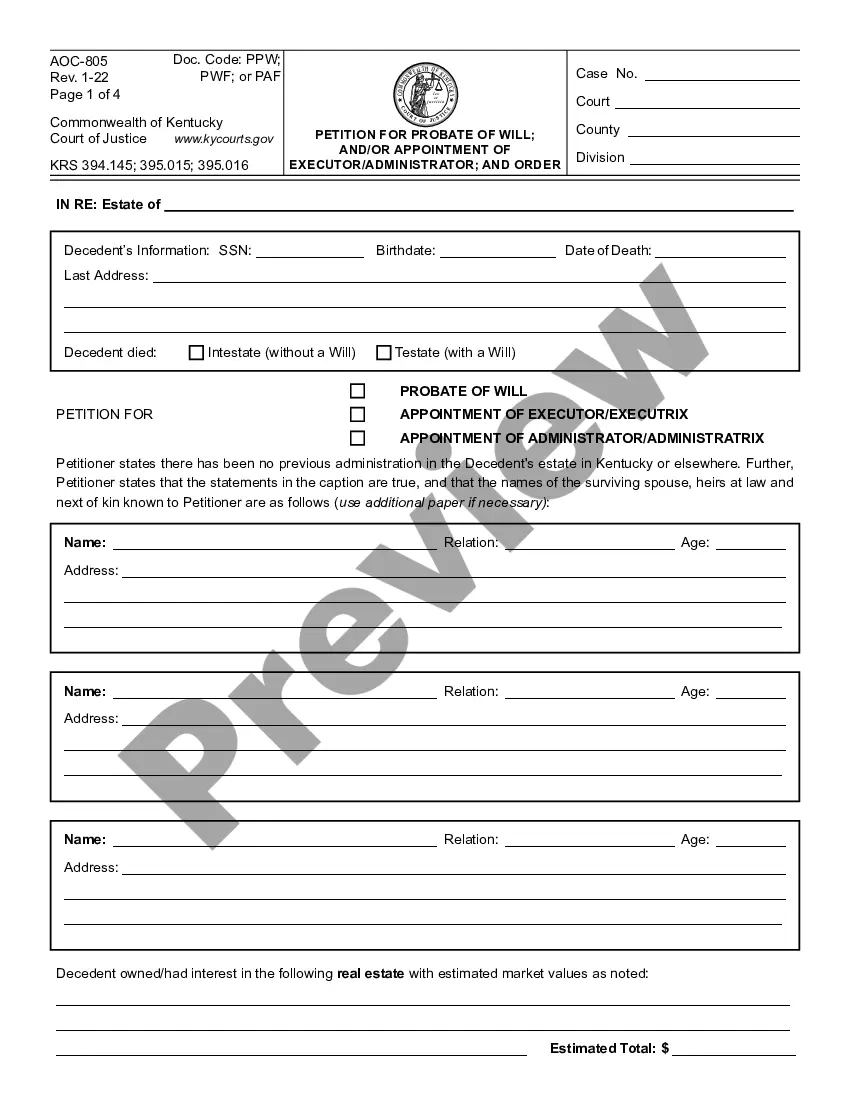

Finalize the probate process for a deceased individual's will and appoint an executor or administrator to manage the estate.

Use this form to declare your estate is eligible for a probate fee exemption due to qualifying military or public service death benefits.

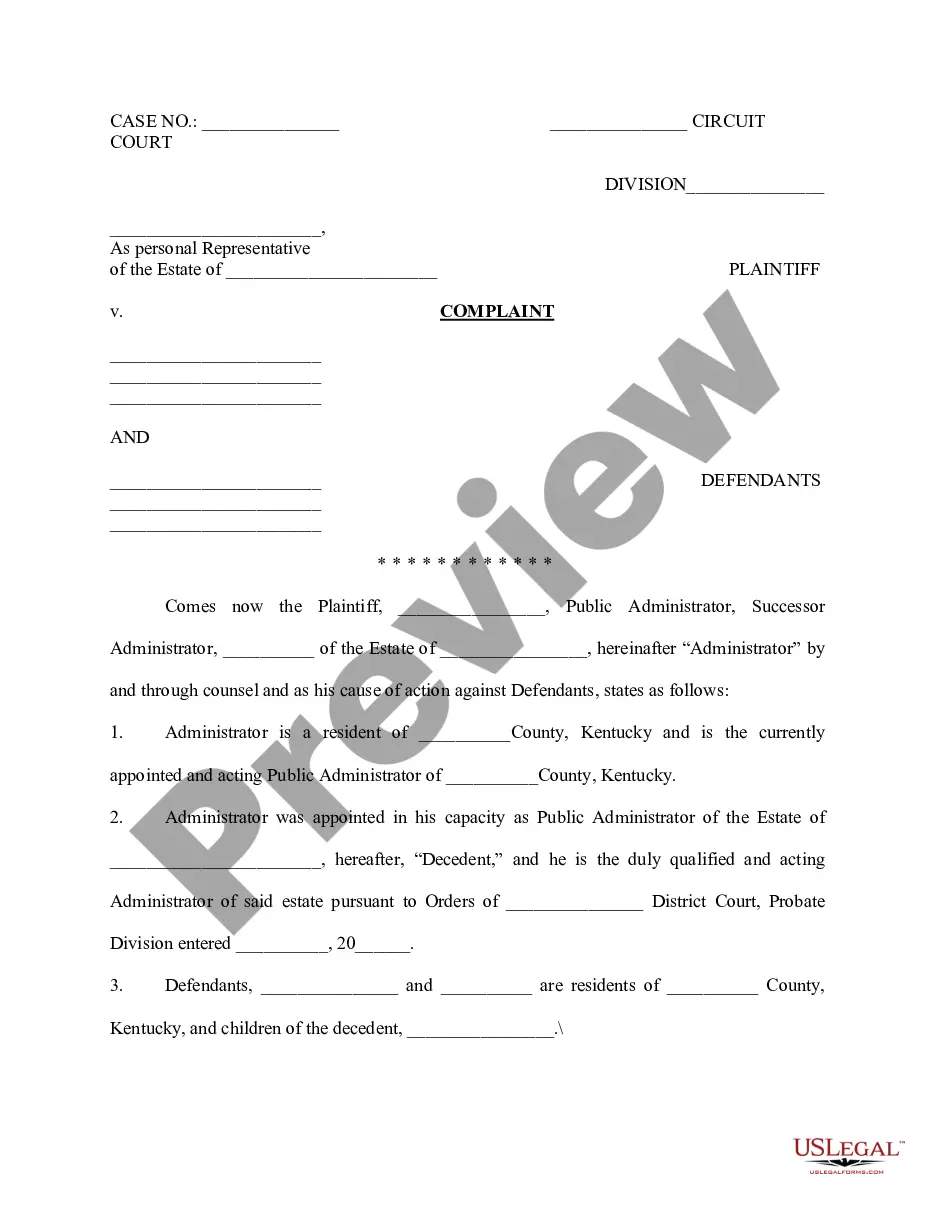

Initiate legal action against defendants for improper management of an estate and seek a complete accounting of assets.

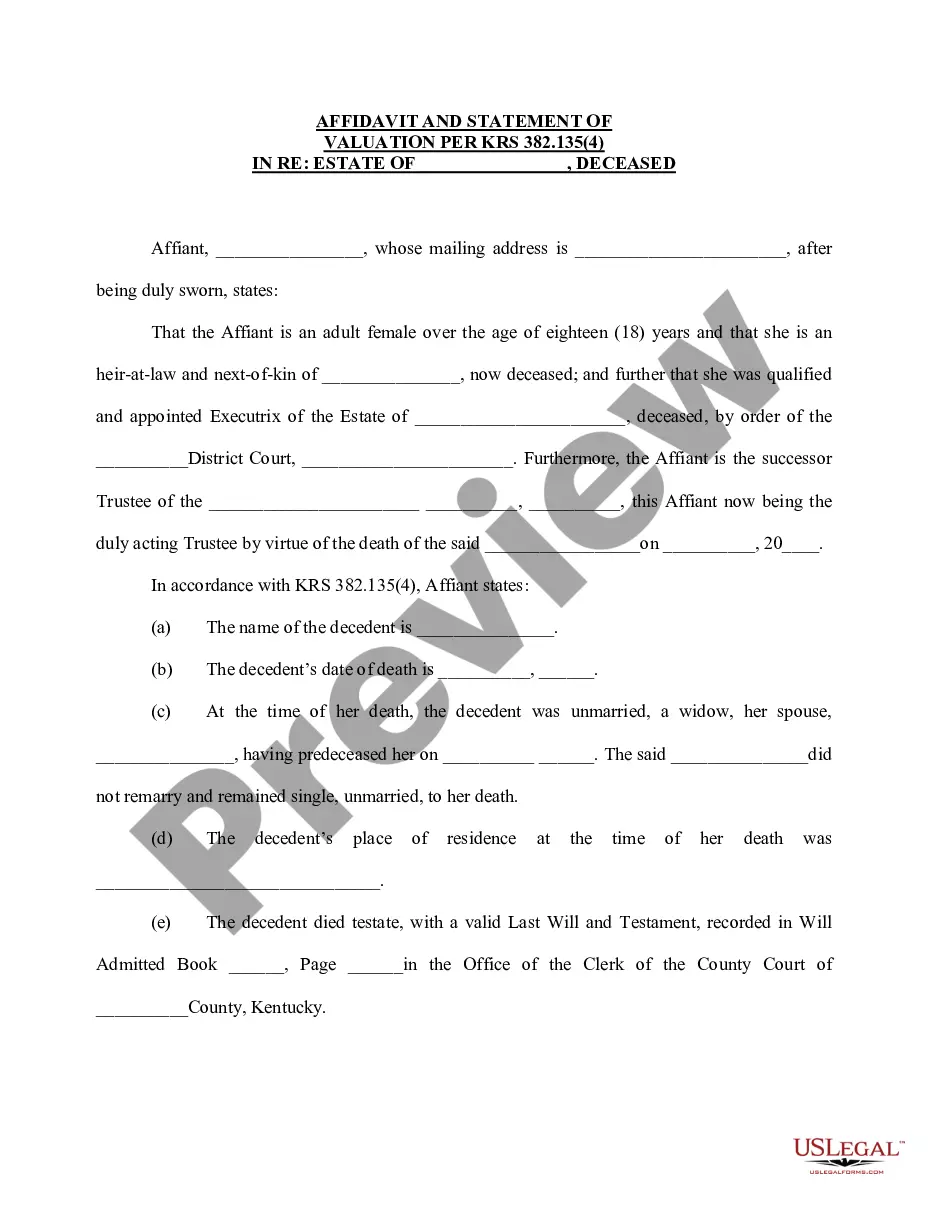

Use this form to declare the value of property within an estate, ensuring compliance with Kentucky regulations.

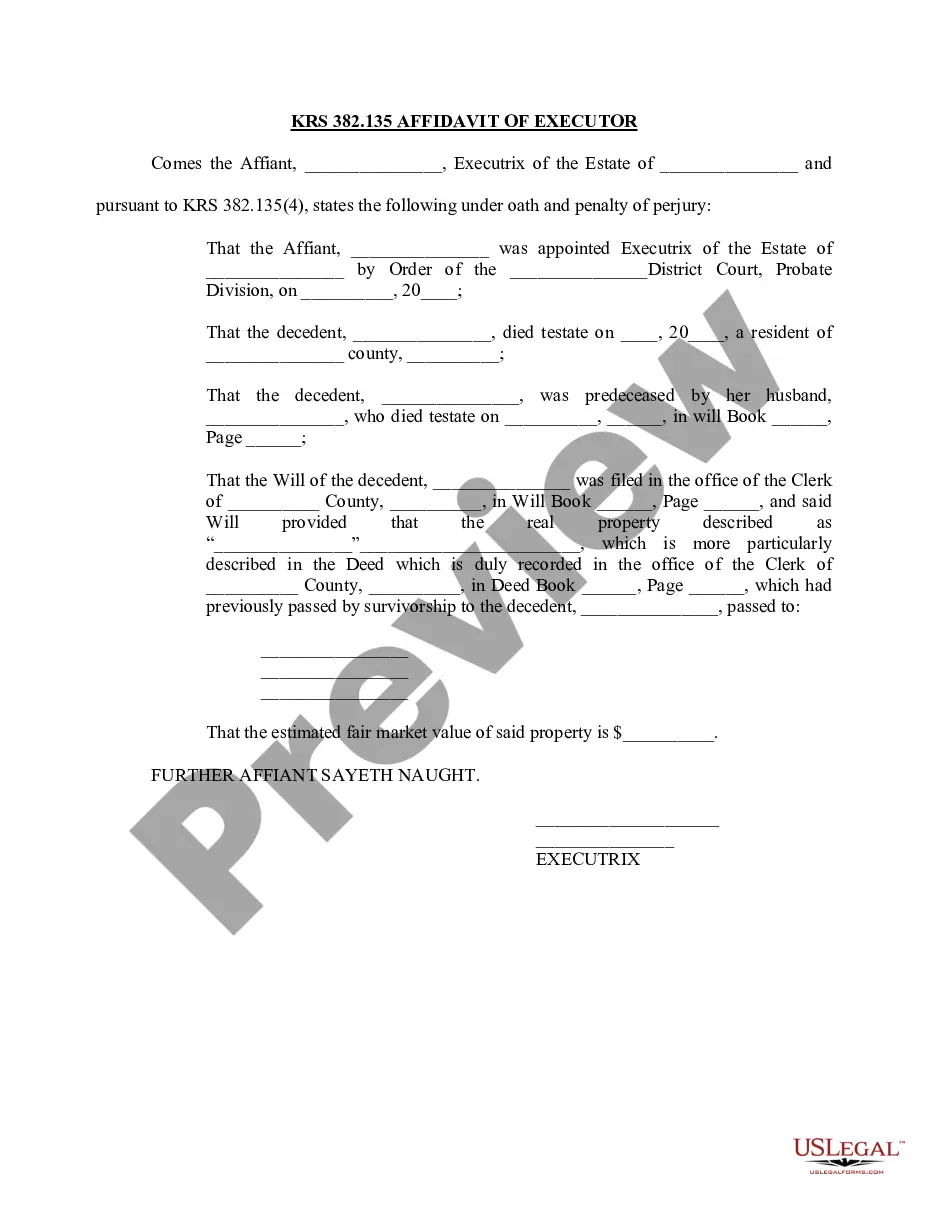

This document verifies the appointment of an estate's executrix and outlines the decedent's assets, essential for estate administration.

Use this form to finalize an estate settlement without formal court procedures, making it easier for beneficiaries to receive their shares.

Probate is necessary for transferring ownership of a deceased person's assets.

Every estate must go through probate if the individual had assets in their name.

Probate can take several months to years, depending on the estate's complexity.

Creditors can make claims against the estate during the probate process.

Beneficiaries receive their inheritance only after debts and taxes are settled.

Begin with these simple steps to manage probate effectively.

A trust can provide additional benefits, like avoiding probate, but is not necessary.

If no action is taken, the estate will still go through probate, potentially delaying asset distribution.

It's wise to review your estate plan every few years or after major life changes.

Beneficiary designations can supersede your will and are important for asset distribution.

Yes, you can designate separate individuals for financial and healthcare decisions in your plan.