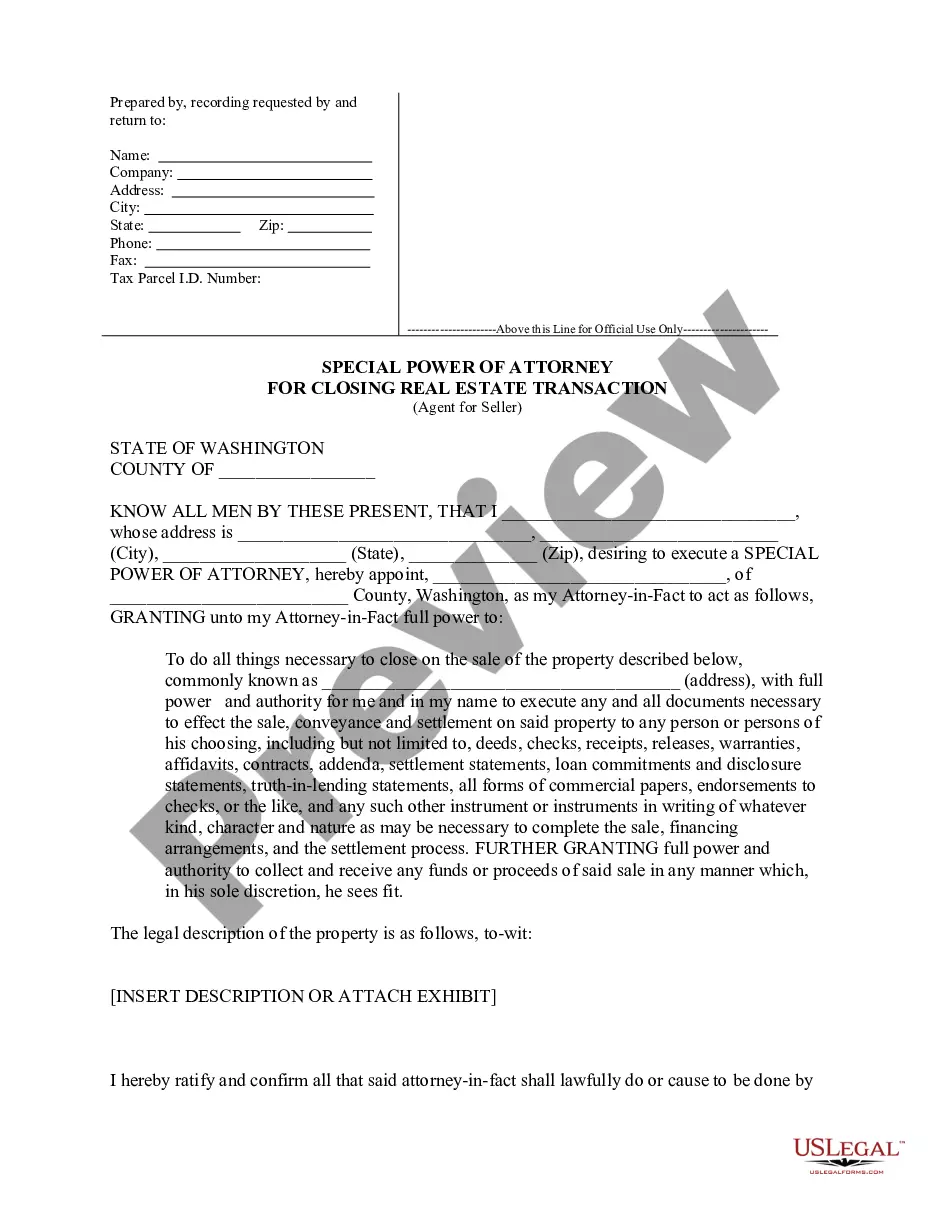

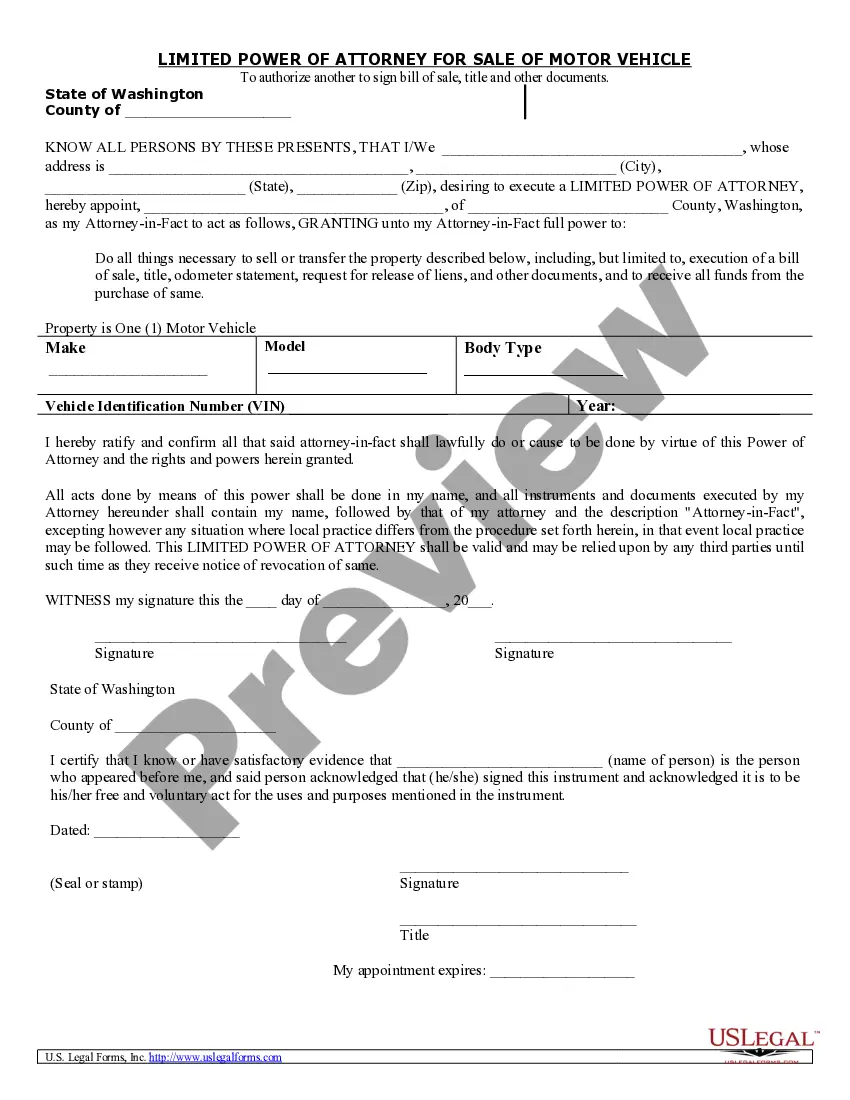

What is Power of Attorney?

Power of Attorney allows a person to designate another to manage their affairs. These documents are useful in various situations, from financial decisions to healthcare matters. Explore state-specific templates to find what's right for you.