What is Power of Attorney?

Power of Attorney documents allow individuals to appoint someone to make decisions on their behalf. They are commonly used for financial and healthcare purposes. Explore state-specific templates for your needs.

In North Carolina, Power of Attorney documents help manage personal and financial affairs. Attorney-drafted templates are quick and easy to complete.

Get everything you need to manage your legal affairs in one convenient package, designed for those planning for the future.

Prepare for unforeseen events with essential legal forms to protect your health, finances, and loved ones—all in one convenient package.

Authorize someone to make crucial decisions regarding your child's education, health care, and welfare, especially when you're unavailable.

Confirm your authority to act on behalf of someone else with this certification of a power of attorney.

Authorize someone you trust to manage your financial affairs, even when you can't. This gives broad powers over your property.

Get all essential forms to document your medical treatment preferences and healthcare decisions in one convenient package.

Empower someone to manage your bank account affairs, even if you become incapacitated. Ideal for ensuring your financial needs are handled effectively.

Authorize someone to manage your real estate transactions when you can't be present, ensuring a smooth sales process.

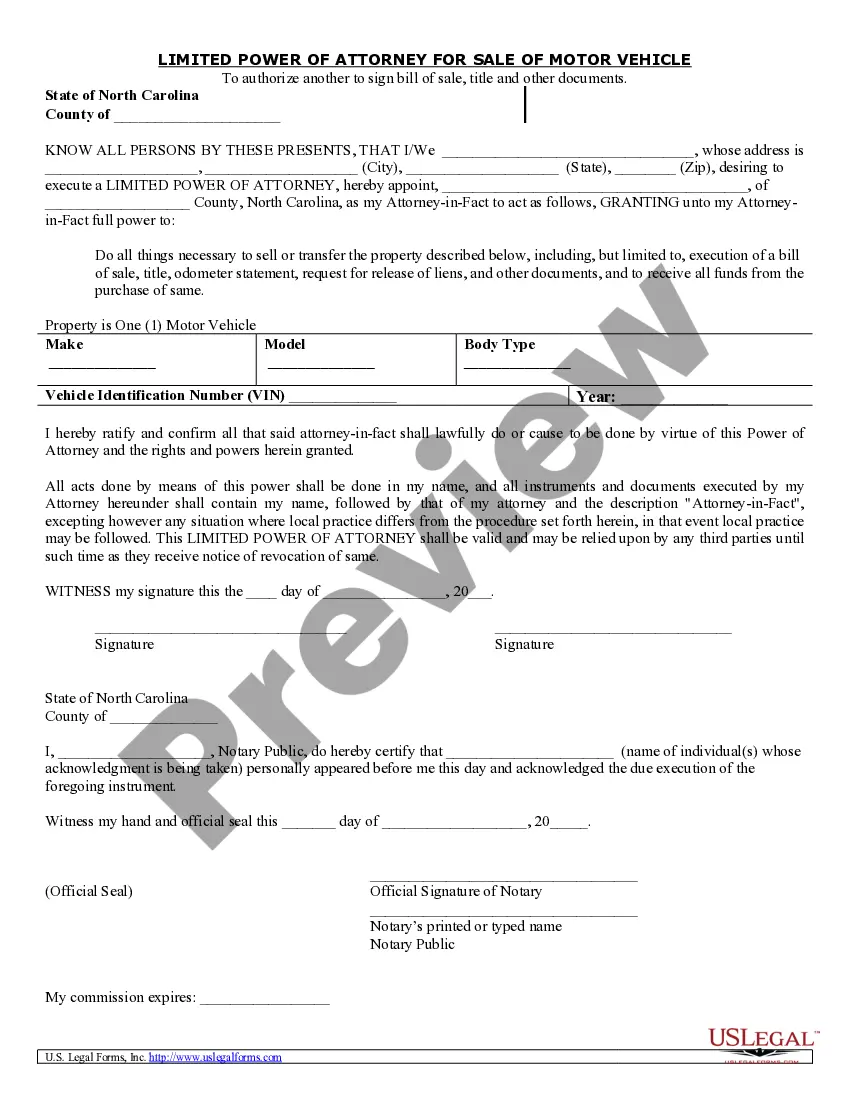

Authorize someone to handle the sale of your motor vehicle, ensuring all necessary documents are signed on your behalf.

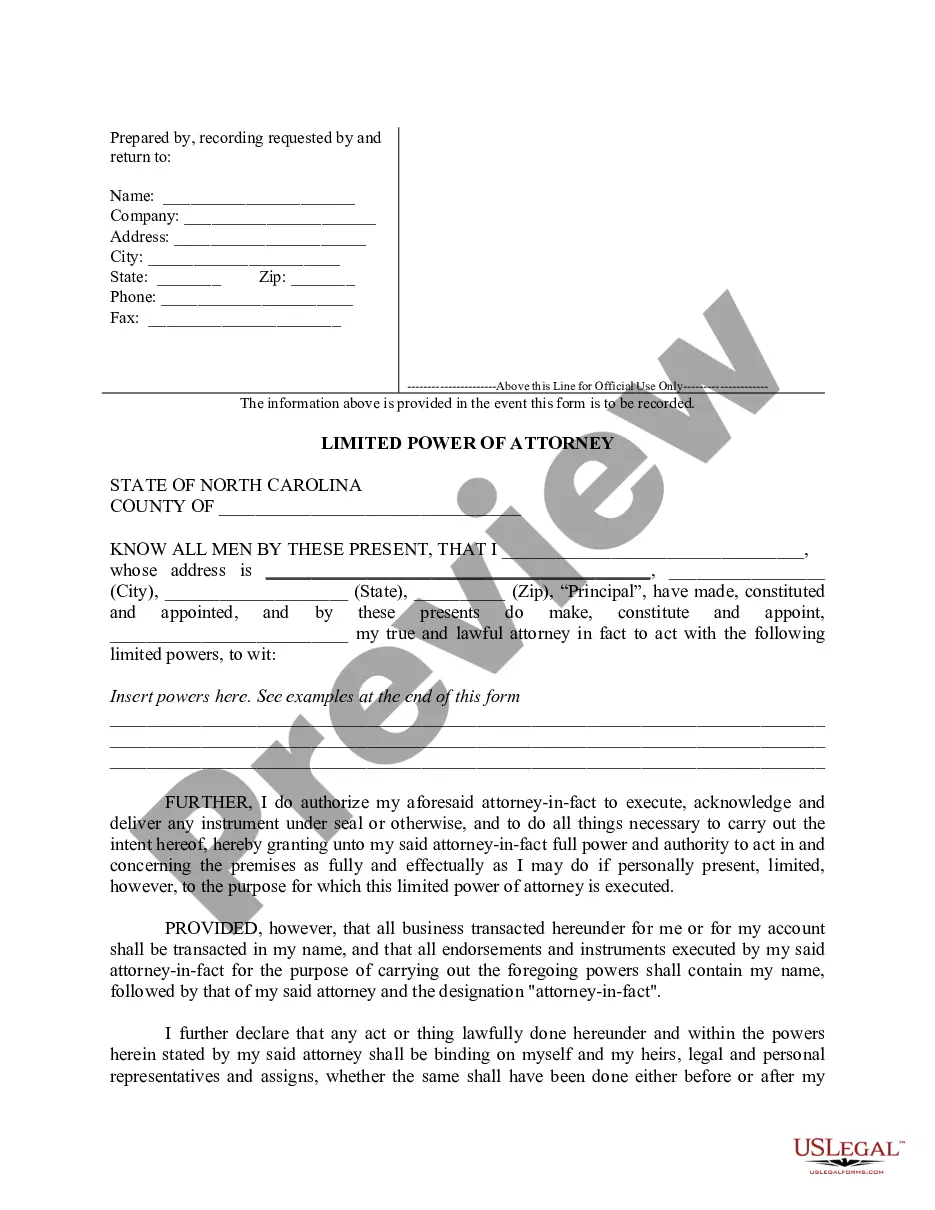

Set clear limitations on your attorney's powers to manage specific affairs. Ideal for temporary situations or defined tasks.

A Power of Attorney can be tailored to fit specific needs.

The appointed individual is known as the agent or attorney-in-fact.

Documents often require signatures, and may need notarization.

Powers granted can be broad or limited based on the principal's wishes.

A Power of Attorney can be revoked at any time by the principal.

Healthcare decisions can be covered under a Medical Power of Attorney.

It's important to choose a trustworthy agent.

Start in minutes with these steps.

A trust can help manage assets outside of probate, while a will only takes effect after death.

Without a Power of Attorney, decisions may need to be made by the court.

Review your Power of Attorney regularly, especially after major life changes.

Beneficiary designations typically override wills and trusts for specific assets.

Yes, you can appoint separate agents for financial and healthcare decisions.