What is Power of Attorney?

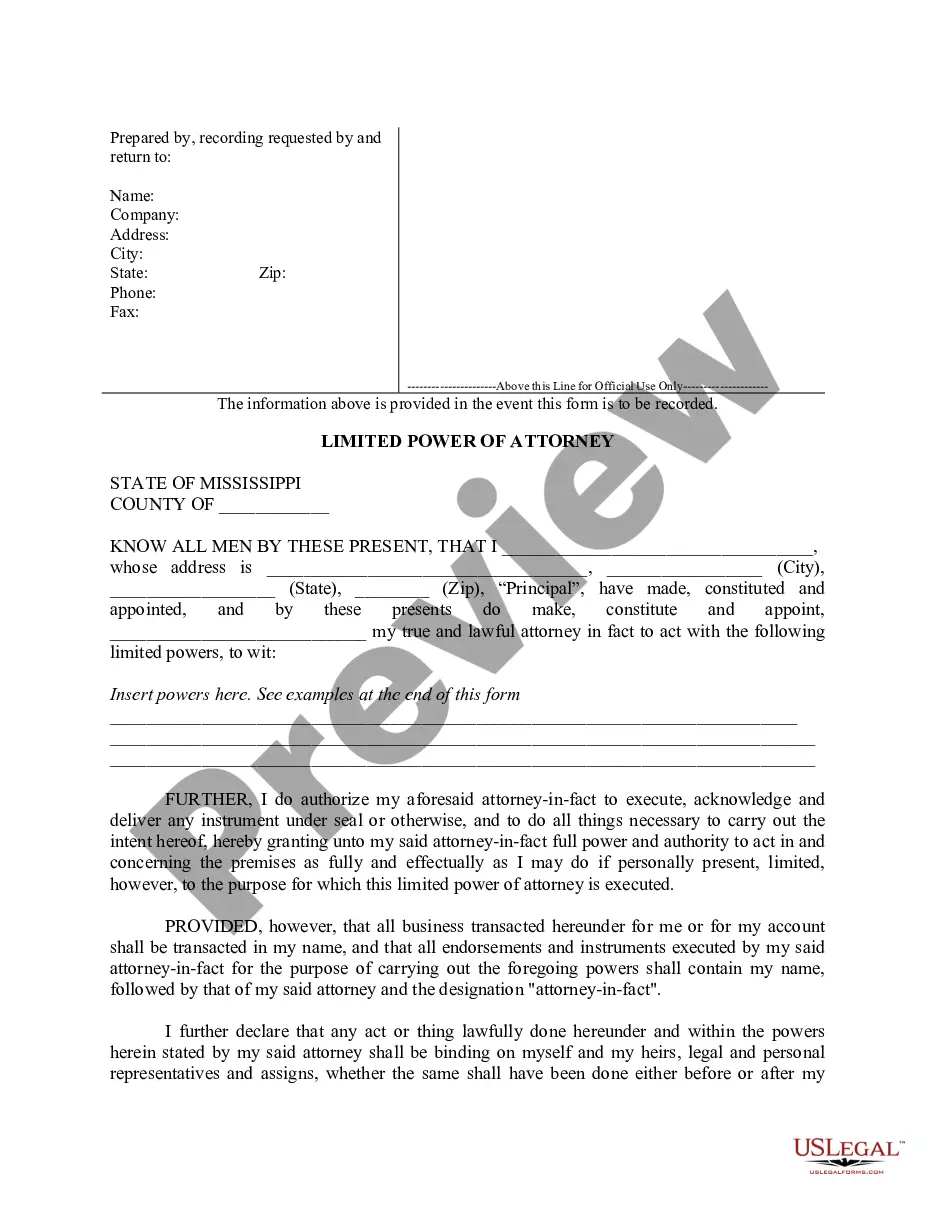

Power of Attorney (POA) allows a person to grant authority to another to make decisions on their behalf. These documents are used in various situations, such as managing finances or healthcare. Explore state-specific templates for your needs.