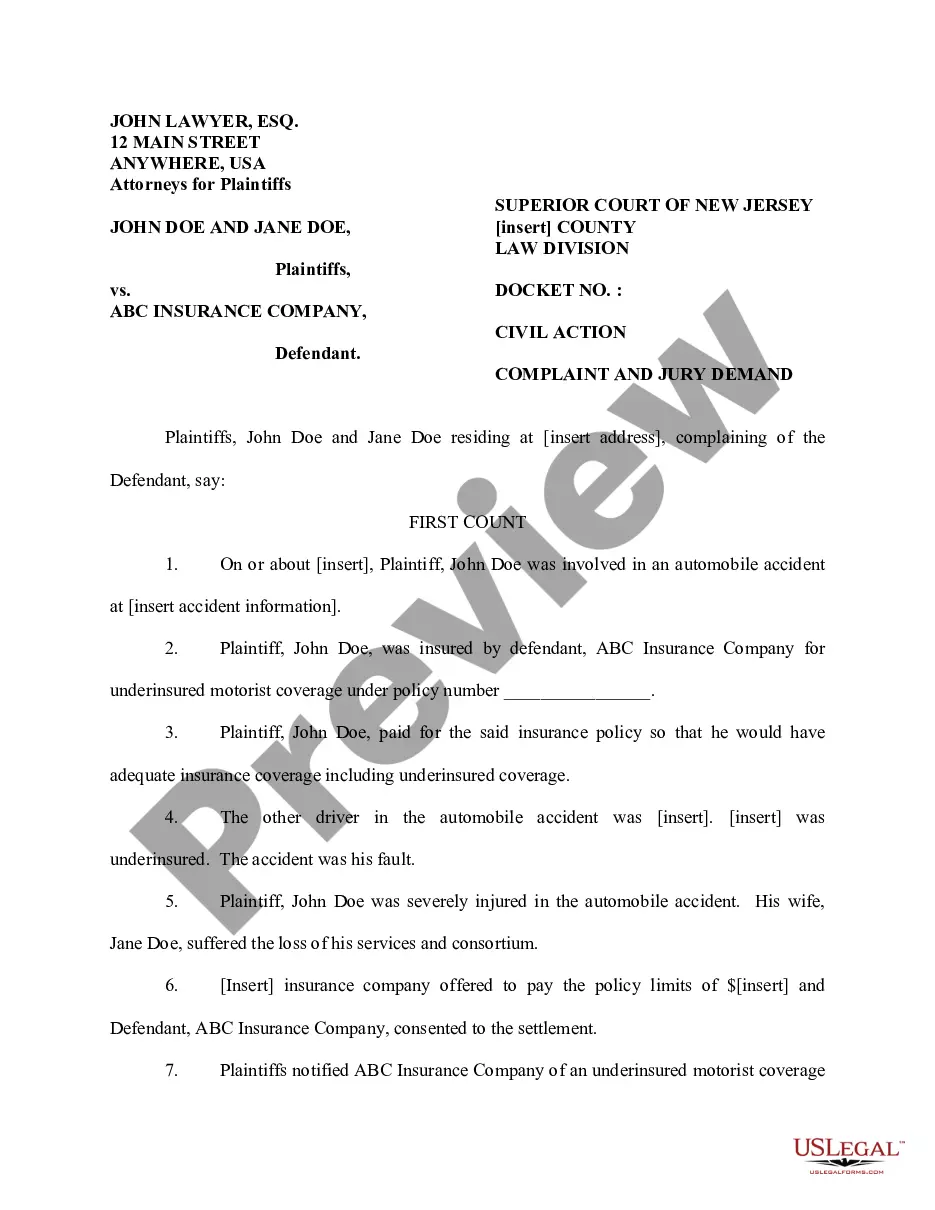

New Jersey Complaint Seeking Underinsured Motorist Coverage

Understanding this form

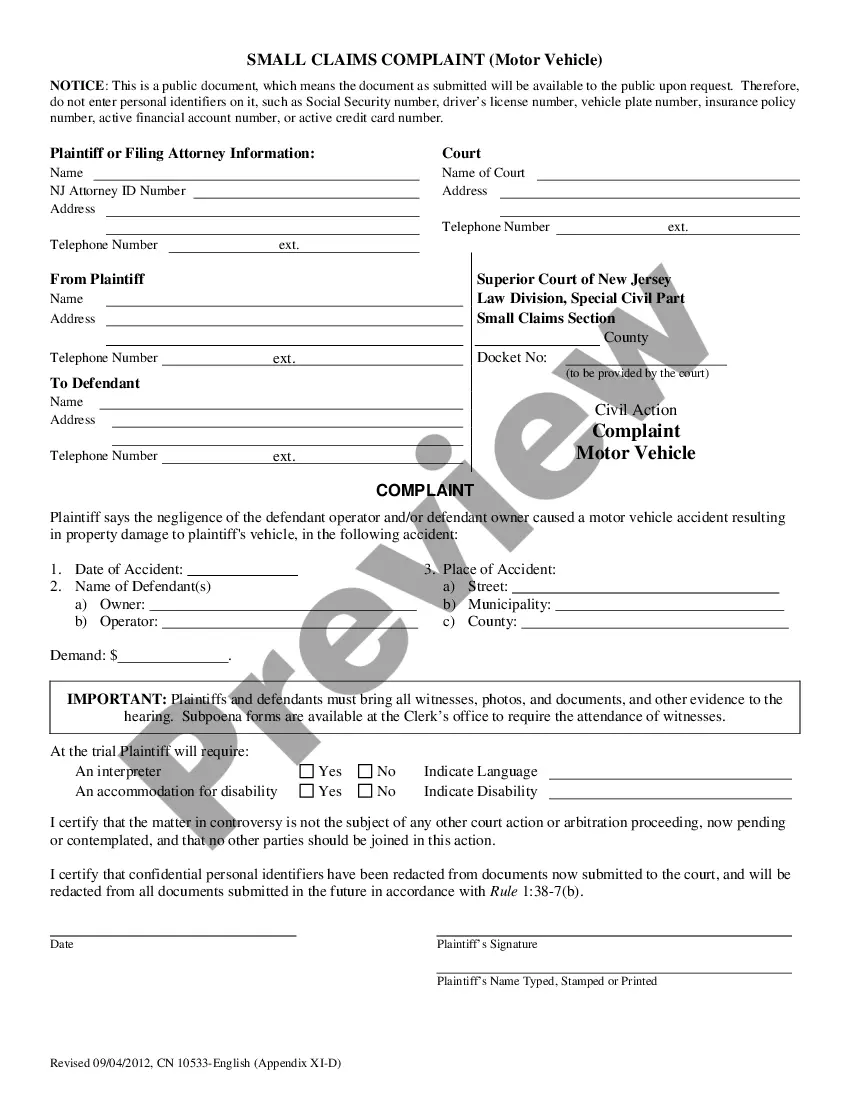

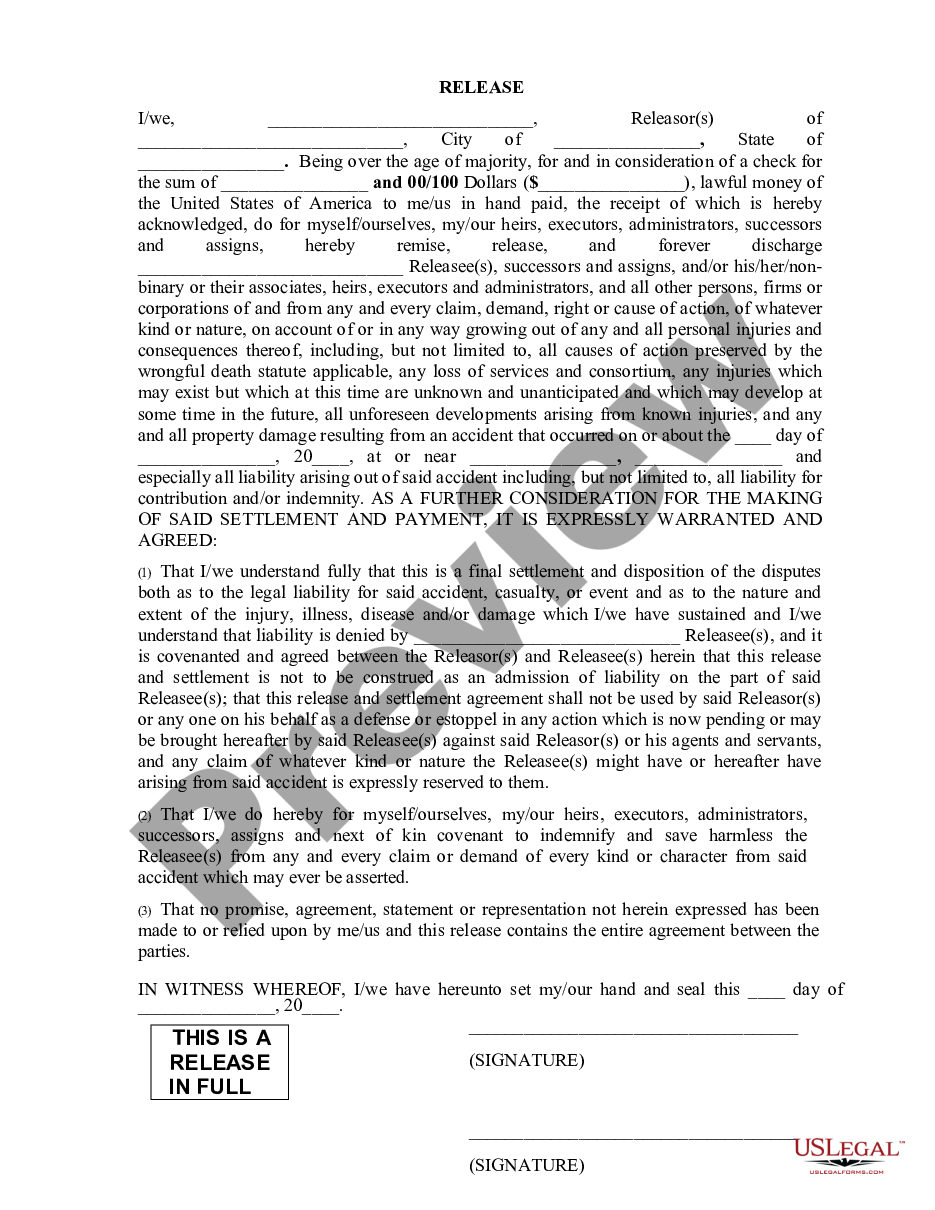

This form is a Complaint Seeking Underinsured Motorist Coverage that individuals in New Jersey can use to initiate legal proceedings against an insurance company when the other party involved in an accident does not have adequate insurance coverage. This form is distinct from other types of complaints as it specifically addresses underinsured motorist claims, allowing plaintiffs to recover damages when their insurance company fails to fulfill its obligations.

What’s included in this form

- Identification of plaintiffs and defendant, including basic contact information.

- Details of the automobile accident, including the date, location, and circumstances.

- Policy information regarding underinsured motorist coverage, including policy numbers.

- Allegations against the insurance company, including claims of bad faith and breach of contract.

- Claims for damages, including medical expenses, punitive damages, and legal fees.

- Certification of no other related legal actions pending.

When to use this form

This form should be used when an insured person is involved in a car accident caused by another driver who is underinsured. If the claimant has already settled with the other party's insurance but feels the compensation is insufficient due to their injuries or losses, this complaint can help pursue additional coverage through their own underinsured motorist policy.

Who this form is for

- Individuals who have been injured in a car accident caused by an underinsured driver.

- Policyholders who believe their insurance company has failed to adequately compensate them for their injuries.

- Spouses or dependents of the injured party seeking damages for loss of consortium or services.

Steps to complete this form

- Identify the parties involved: Fill in the names and addresses of the plaintiffs and the defendant.

- Provide details of the accident: Enter the date, location, and description of the events surrounding the accident.

- Specify insurance information: Include the policy number and details about the underinsured motorist coverage.

- State your claims: Clearly outline the allegations against the insurance company and the damages being sought.

- Sign and date the document: Ensure all parties involved sign the complaint and date it appropriately.

Does this document require notarization?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Typical mistakes to avoid

- Failing to include all necessary details about the accident and the insurance policy.

- Not stating the claims against the insurance company clearly, leading to confusion.

- Missing signatures or dates which could render the complaint invalid.

Why use this form online

- Convenience of accessing and downloading the form anytime, anywhere.

- Ability to fill out the form easily and review it before submission.

- Assurance that the form is drafted by licensed attorneys familiar with New Jersey law.

Form popularity

FAQ

When a person has an accident which is not their fault, and the other motorist does not have enough insurance to cover the damages, underinsured coverage kicks in. Once you file a claim with your provider, it will contact the other driver's insurance for payment.The other driver has insurance to cover only $100,000.

Yes, underinsured motorist coverage should pay compensation for pain and suffering.

In New Jersey, approximately 15 percent of motorists are underinsured or lack auto insurance altogether, according to the Insurance Research Council. For this reason, it is imperative that motorists in New Jersey purchase uninsured motorist coverage with their auto insurance policy for additional protection.

Similar to uninsured motorist coverage, underinsured motorist coverage will pay for damages sustained in an accident with a driver who has a car insurance policy in place, but not enough coverage to pay for your injuries stemming from the accident.

Uninsured and underinsured motorist coverages are policy add-ons that you can choose when you purchase insurance. If you've included uninsured or underinsured motorist coverage, your insurance will pay the claim after a collision with an uninsured driver.

Typically, the time for such claims is limited (sometimes a policyholder is given as little as 30 days to discover the need for the claim).

Since car insurance can be expensive, many drivers only buy the minimum coverage required by state laws. Your costs might not be covered by another driver's policy.But underinsured motorist coverage (UIM) protects you when you're in an accident that's not caused by you.

Yes, underinsured motorist coverage should pay compensation for pain and suffering.

1Call the police. If you get into a car accident, regardless if the other person has insurance or not, it's always a good idea to call the police.2Don't accept money.3Swap information.4Gather details.5Take pictures.