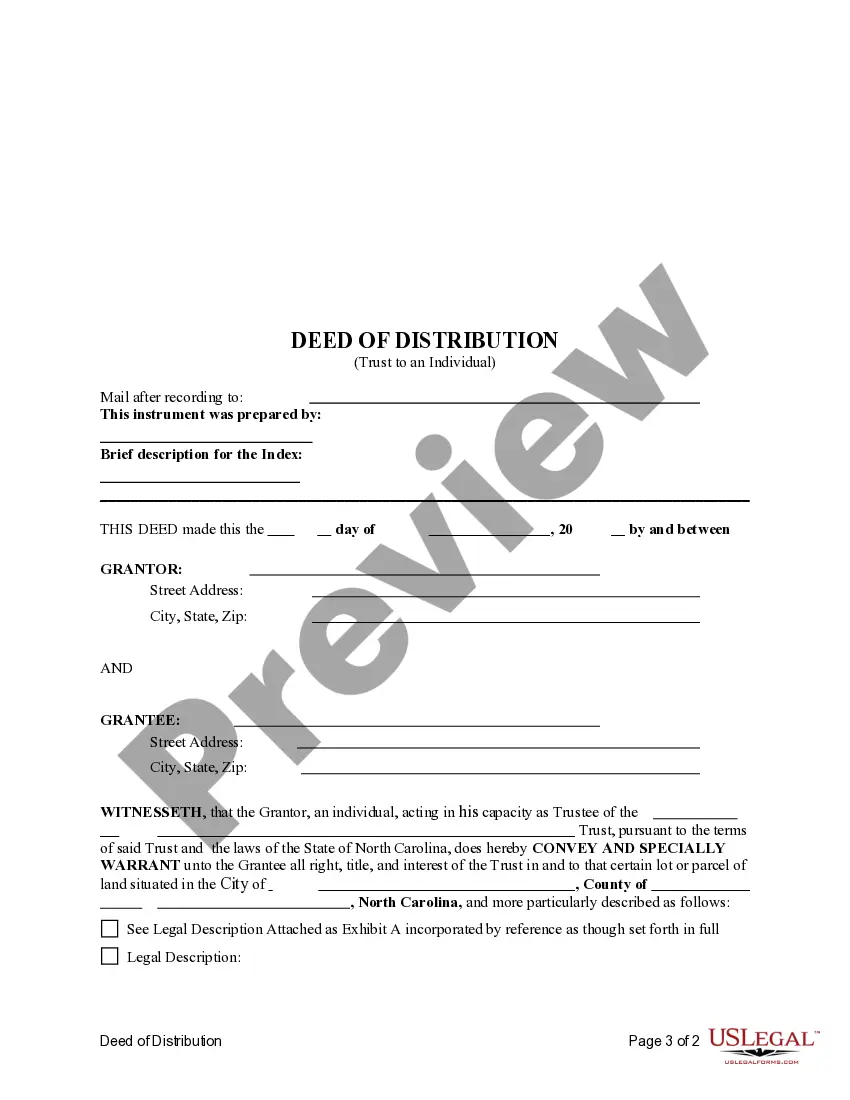

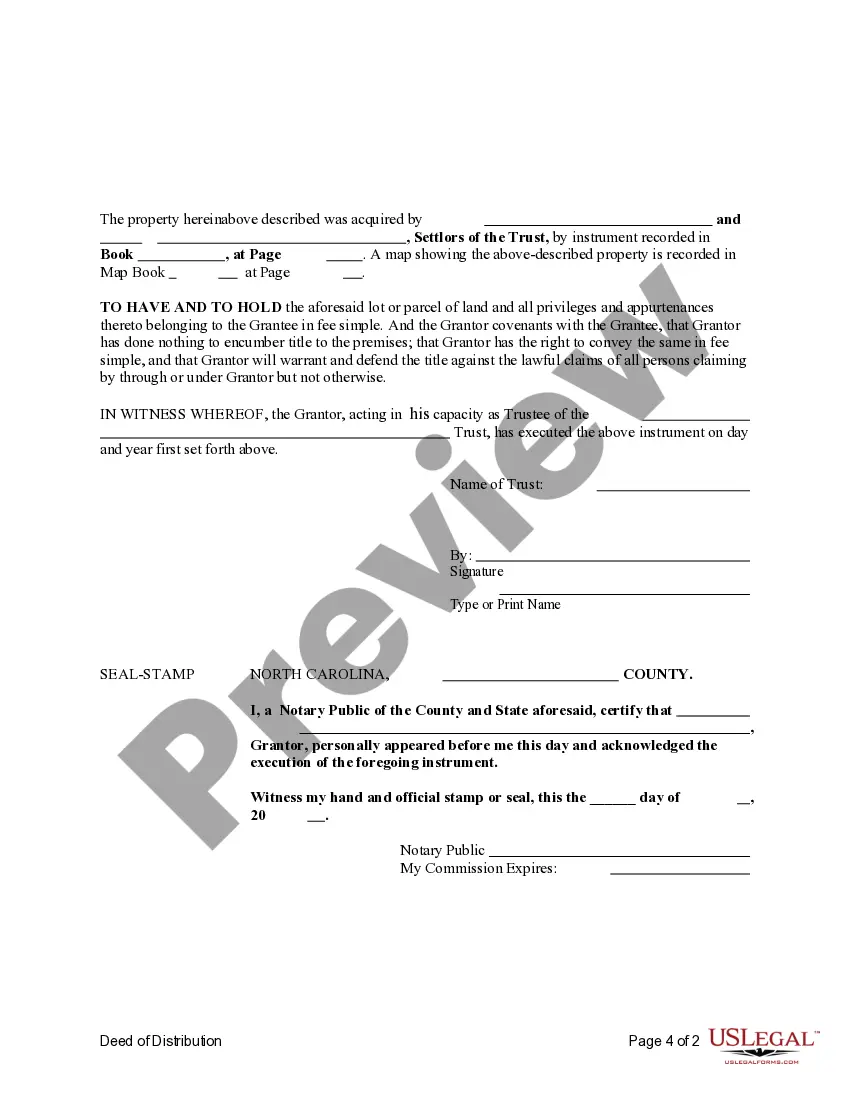

This form is a Deed of Distribution where the Grantor is the Trustee of a trust and the Grantee is the beneficiary of the Trust . Grantor conveys the described property to the Grantee. This deed complies with all state statutory laws.

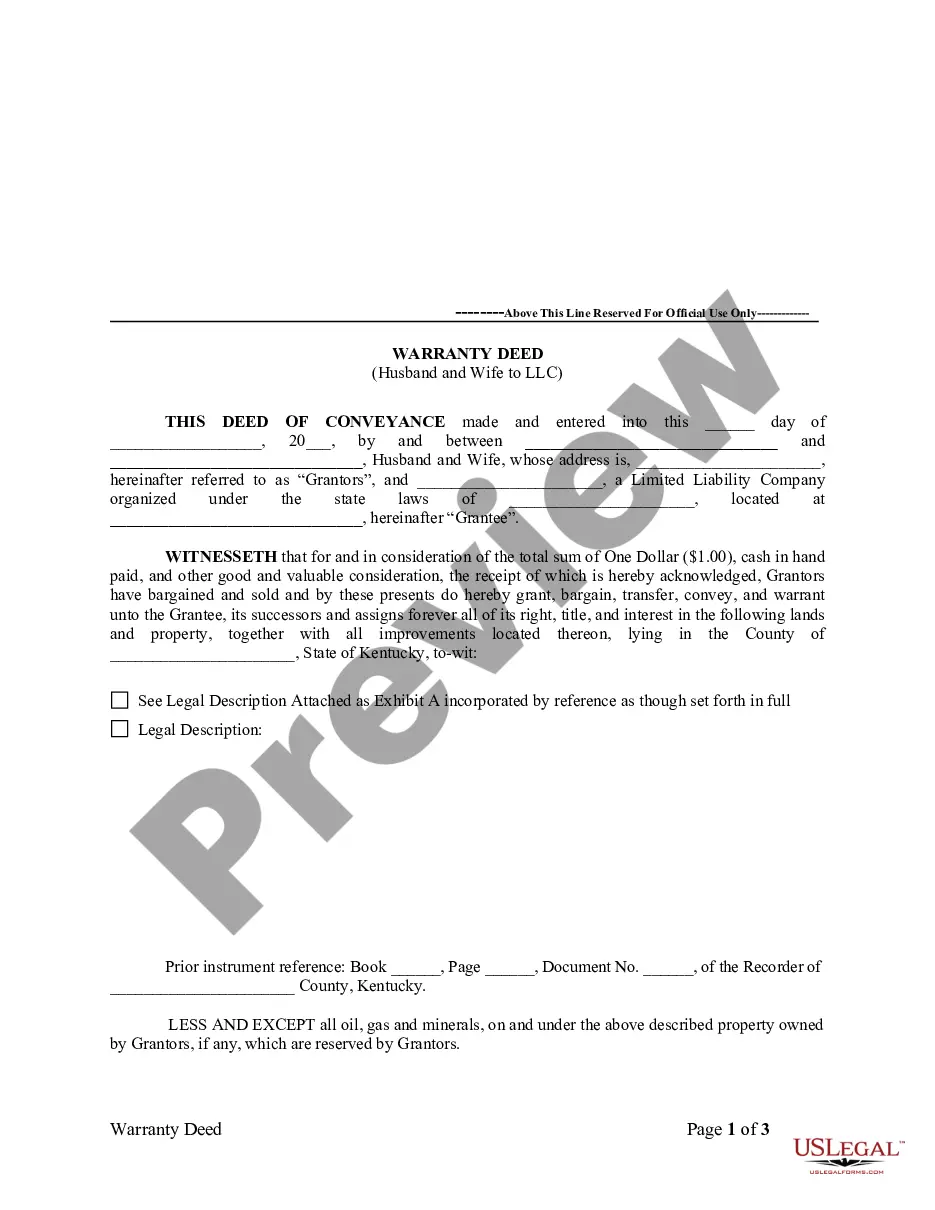

The North Carolina Deed of Distribution — Trust to an Individual is a legal document used to transfer real property from a Trust or (the person who created the trust) to a Beneficiary (the person who will receive the property). This document is used to transfer real property from a trust to an individual, also known as a beneficiary, in accordance with the terms of the trust. This document is signed by the Trust or, the Beneficiary, and the Trustee (the person who manages the trust). The North Carolina Deed of Distribution — Trust to an Individual comes in two types: a Quitclaim Deed and a Warranty Deed. A Quitclaim Deed is used to transfer real property without any warranties or guarantees and is used when there are no title issues. A Warranty Deed is used to transfer real property with warranties or guarantees and is used when there are potential title issues. Both types of deeds must be signed by the Trust or, the Beneficiary, and the Trustee and must include the following information: the names and addresses of the parties, a description of the property being transferred, and the amount of consideration (if any) being paid. The deed must also be notarized and filed with the Register of Deeds in the county where the property is located.