Maryland Child Support Guidelines Worksheet B

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

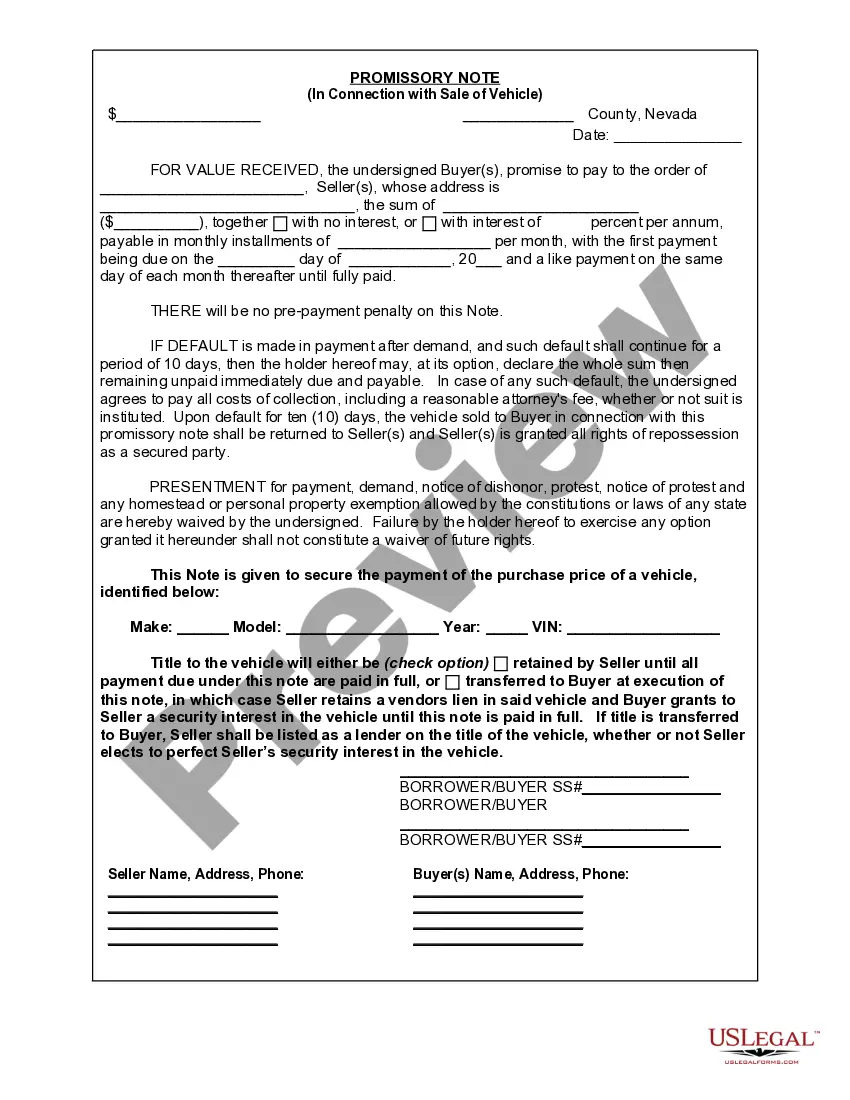

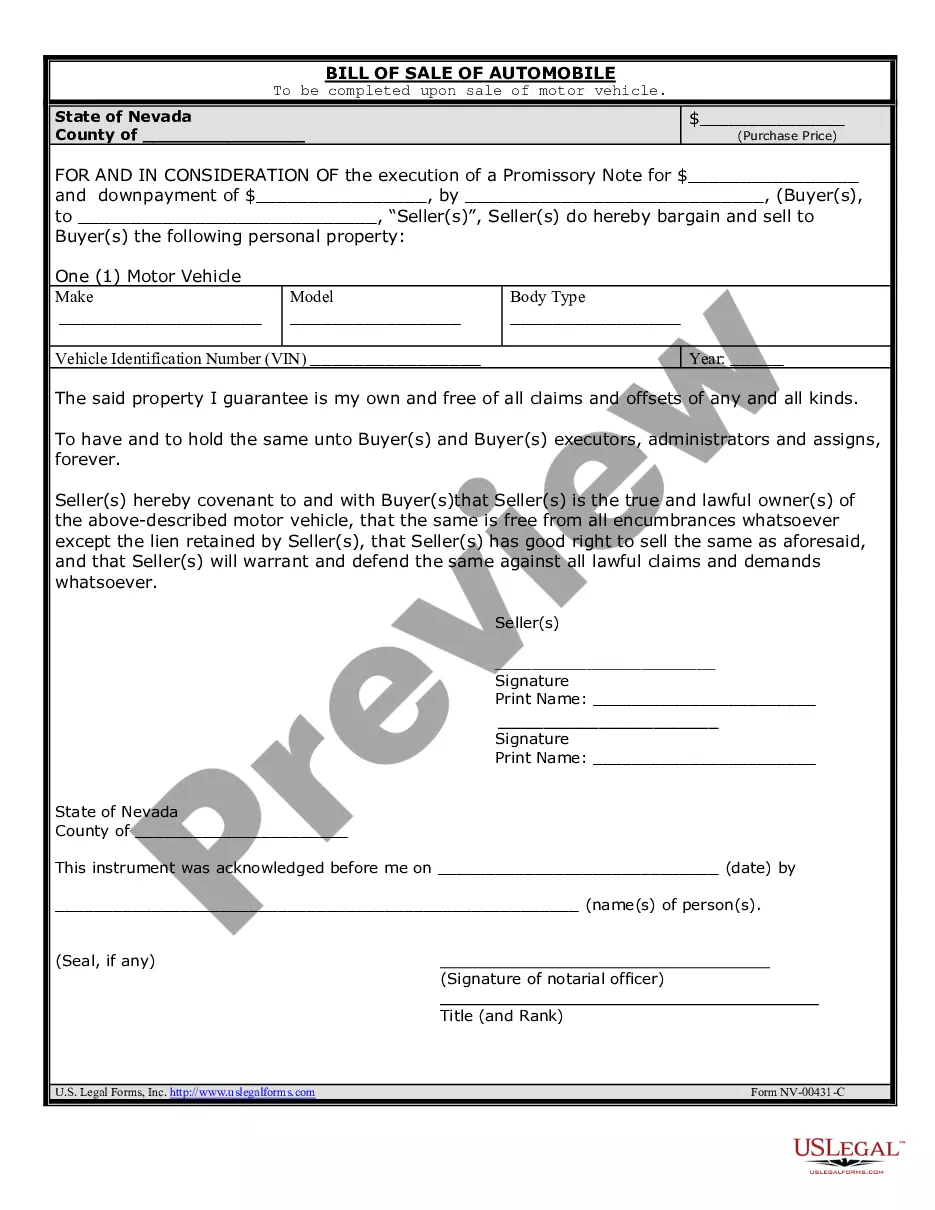

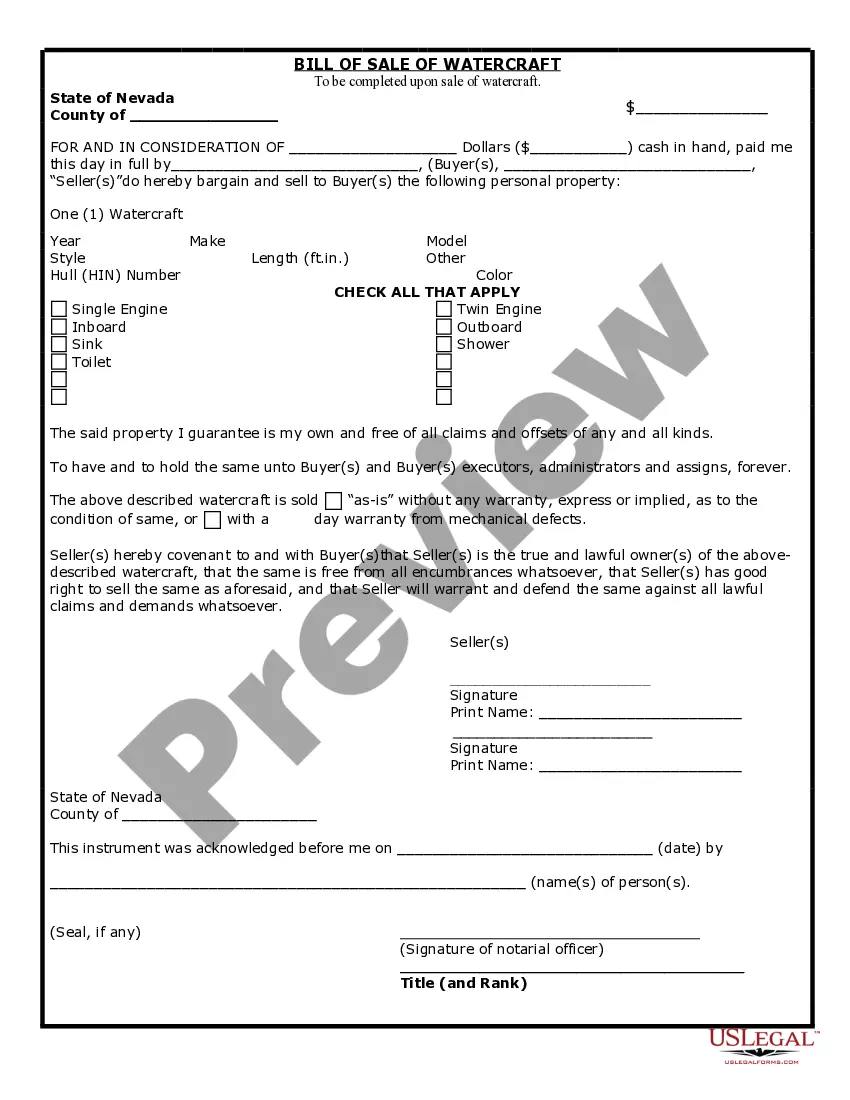

Child Support Guidelines Worksheet B is a tool used in the United States to calculate the amount of child support one parent should pay to another. This calculation considers several factors including both parents' income, health insurance, daycare costs, and the number of children involved. It is typically used when parents share custody of their children to a significant extent.

Step-by-Step Guide

- Gather Financial Information: Collect all relevant financial documents such as recent pay stubs, tax returns, and expenses related to child care and health care.

- Identify Appropriate Worksheet: Ensure that Worksheet B is appropriate for your custody arrangement, usually applicable when each parent has at least 123 overnights per year with the children.

- Fill Out the Worksheet: Record each parent's income and adjust for pre-determined expenses and deductions as specified by the guidelines.

- Calculate Proportional Share: Use the worksheet to determine each parent's share of the total child support amount based on their incomes and time shared with the children.

- Review and Adjust: Consider any special circumstances that might affect the child support amount and adjust the final figure if necessary.

Risk Analysis

Miscalculations in the child support guidelines worksheet B can lead to incorrect child support payments, potentially resulting in legal consequences or financial instability. Both overpayments and underpayments pose risks, such as strained family relationships and legal disputes. Accuracy in data input and a clear understanding of the guidelines are crucial to prevent these risks.

Key Takeaways

- The child support guidelines worksheet B is essential for calculating fair support amounts in shared custody situations.

- Accuracy in entering financial data is crucial for reliable calculations.

- Regular updates to the worksheet are necessary to reflect changes in income or living circumstances.

- Legal advice may be beneficial when interpreting complex financial situations.

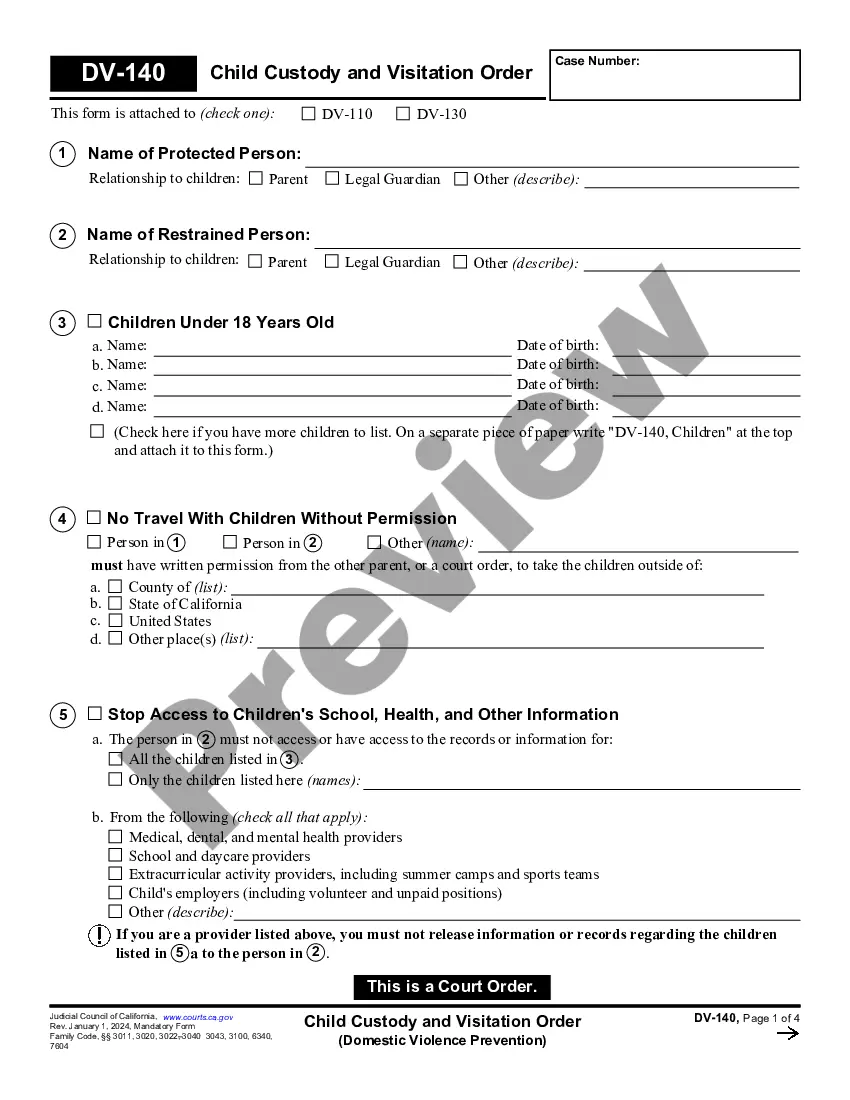

How to fill out Maryland Child Support Guidelines Worksheet B?

Among thousands of paid and free designs available online, you cannot guarantee their accuracy and dependability.

For instance, who designed them or if they possess the expertise to manage the matter you need them for.

Stay composed and utilize US Legal Forms!

Review the file by checking the description using the Preview feature. Click Buy Now to initiate the purchasing process or seek another template using the Search field found in the header. Select a pricing plan and establish an account. Pay for the subscription with your credit/debit card or PayPal. Download the form in the desired file format. Once you have registered and purchased your subscription, you can utilize your Maryland Child Support Guidelines Worksheet B as many times as you require or as long as it remains valid in your area. Modify it with your preferred offline or online editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- Find Maryland Child Support Guidelines Worksheet B templates crafted by experienced attorneys.

- Steer clear of the expensive and time-consuming process of searching for a lawyer and subsequently compensating them to draft documents for you that you can obtain independently.

- If you already hold a subscription, Log In to your account and locate the Download button beside the file you require.

- You will also gain access to your previously saved documents in the My documents section.

- If you are using our platform for the first time, follow the steps outlined below to quickly obtain your Maryland Child Support Guidelines Worksheet B.

- Ensure that the document you find is legitimate in your state.

Form popularity

FAQ

Maryland law requires continuation of child support payments for children who turn 18 while still enrolled in high school. The court can order a parent to pay for his or her children's college expenses as child support if the parents have made an agreement and that agreement is incorporated into a court order.

Maryland's child support guidelines allow parents to calculate their support obligation by inputting their combined incomes and the number of children they have together. A percentage of the total support obligation is assigned to each parent based on that parent's income percentage.

The new MD child support guidelines provide for $2,847 per month in basic child support for an aggregate monthly income of $15,000. As with the old guidelines, the Court will have discretion in setting the support level for parties and individuals with income above the maximum under the guidelines of $15,000 per month.

In determining a parent's income for child support purposes, courts typically look at the parent's gross income from all sources. They then subtract certain obligatory deductions, like income taxes, Social Security, health care, and mandatory union dues.

Under Maryland law, a person cannot agree with a spouse in order to avoid a court-ordered obligation to pay child support. Rather, there is a worksheet provided by the State of Maryland that allows you to input your own unique factors in order to estimate the amount the court will order you to pay.

The new MD child support guidelines provide for $2,847 per month in basic child support for an aggregate monthly income of $15,000. As with the old guidelines, the Court will have discretion in setting the support level for parties and individuals with income above the maximum under the guidelines of $15,000 per month.

Under Maryland law, child support continues until the minor child reaches the age of 18. It may be extended to age 19 if the child is still enrolled in high school. If there is past-due child support, the agency will continue to enforce payment until the arrears are paid in full, regardless of the age of the child.

Maryland's child support guidelines allow parents to calculate their support obligation by inputting their combined incomes and the number of children they have together. A percentage of the total support obligation is assigned to each parent based on that parent's income percentage.