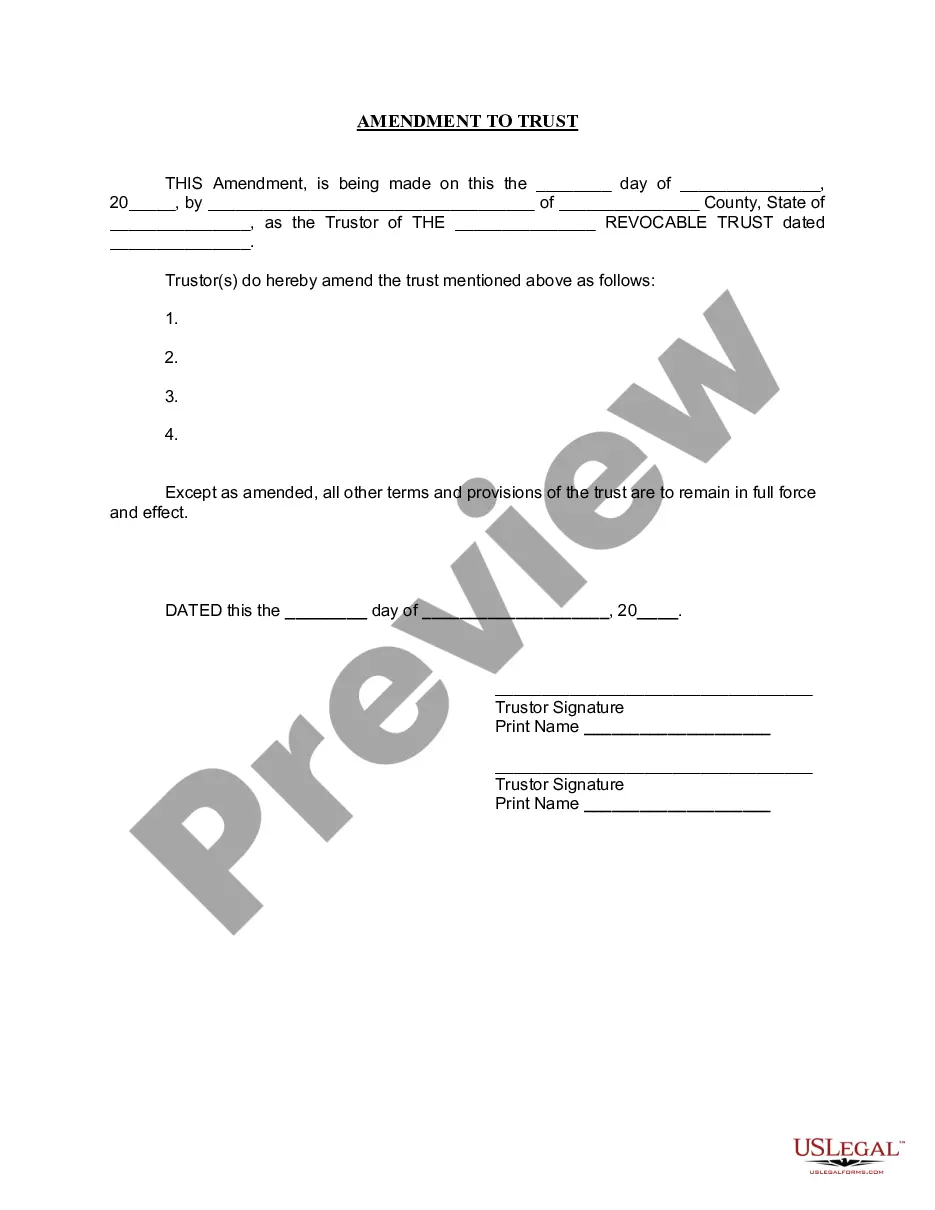

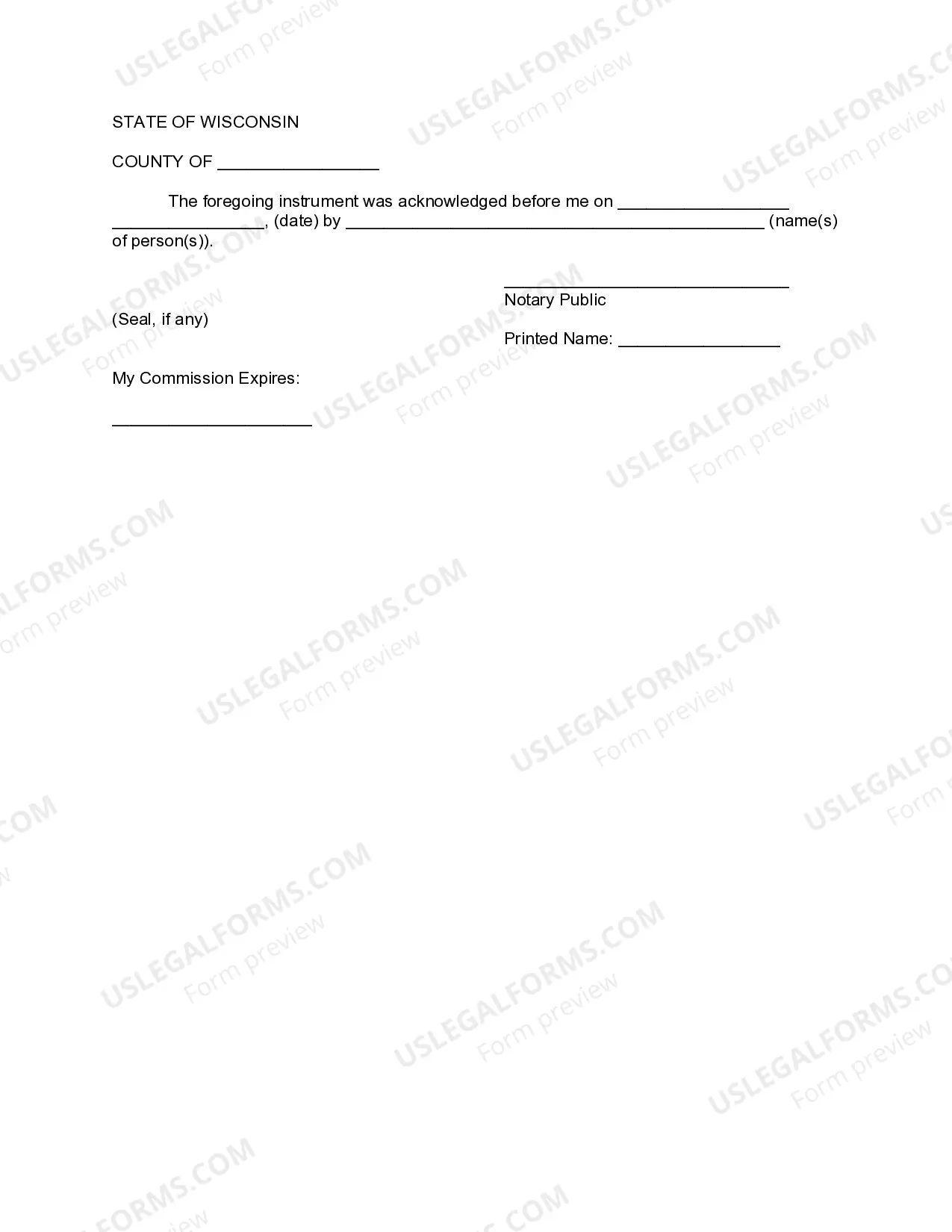

This form is for amending a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form permits the Trustor to amend certain properties of the trust without changing the purpose or nature of the trust. Except for the amended provisions, all other parts of the trust will remain in full force and effect. The Trustor(s) signature(s) is needed, and it must be signed in front of a notary public.

Green Bay Wisconsin Amendment to Living Trust

Description

How to fill out Wisconsin Amendment To Living Trust?

If you have previously utilized our service, sign in to your account and retrieve the Green Bay Wisconsin Amendment to Living Trust on your device by clicking the Download button. Ensure your subscription is active. If it is not, renew it as per your payment arrangement.

If this is your inaugural interaction with our service, adhere to these straightforward steps to acquire your document.

You have continuous access to every document you have acquired: you can find it in your profile under the My documents section whenever you need to use it again. Leverage the US Legal Forms service to swiftly find and save any template for your personal or business requirements!

- Ensure you’ve found the correct document. Review the description and utilize the Preview option, if available, to confirm it aligns with your requirements. If it does not suit you, employ the Search tab above to find the applicable one.

- Buy the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Create an account and process your payment. Use your credit card information or the PayPal alternative to finalize the transaction.

- Acquire your Green Bay Wisconsin Amendment to Living Trust. Choose the file format for your document and store it on your device.

- Complete your sample. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

While handwriting changes to a trust might seem convenient, it can create legal issues. For a Green Bay Wisconsin Amendment to Living Trust, it's advisable to create formal amendments rather than rely on informal handwritten notes. Using platforms like UsLegalForms ensures your modifications are clear, enforceable, and meet all legal requirements.

One common mistake parents make is failing to fund the trust adequately. Without proper funding, the trust cannot serve its intended purpose of safeguarding assets for beneficiaries. When establishing a trust fund, ensure you include sufficient assets and regularly update your Green Bay Wisconsin Amendment to Living Trust as circumstances change.

To write an amendment to a living trust, you should draft a formal document that outlines the desired changes. Specify the original trust's name and date, followed by detailed instructions on what you want to modify. Using UsLegalForms can simplify this process, helping you create a precise Green Bay Wisconsin Amendment to Living Trust that adheres to legal standards.

Writing a codicil to a trust involves clearly stating your intent to modify the existing trust terms. Begin by identifying the trust and the specific changes you wish to make. For a seamless process, consider utilizing services like UsLegalForms, ensuring your Green Bay Wisconsin Amendment to Living Trust is legally binding and correctly executed.

A codicil updates a will, while an amendment modifies specific terms of a living trust. When you make a Green Bay Wisconsin Amendment to Living Trust, you typically adjust provisions or beneficiaries directly within the trust document. Essentially, an amendment integrates changes into the trust, ensuring your estate plan remains current.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

In scenarios where the founder of the trust deed is still alive, then it can be amended through the powers afforded to the trustee in terms of the deed itself or in terms of the law of contract by which a later agreement between the founder and trustees amend substitute an earlier agreement between the same parties.

In scenarios where the founder of the trust deed is still alive, then it can be amended through the powers afforded to the trustee in terms of the deed itself or in terms of the law of contract by which a later agreement between the founder and trustees amend substitute an earlier agreement between the same parties.

(1) A noncharitable irrevocable trust may be modified or terminated, with or without court approval, upon consent of the settlor and all beneficiaries, even if the modification or termination is inconsistent with a material purpose of the trust.

4 Steps to Securely Transfer Real Estate into a Trust Wisconsin Estate Planning Law Getting the Deed Ready for Transfer. To begin, your attorney will obtain a deed form.Making a Record of the Deed Before Transferring.Paying Taxes on Deed Transfers.Reporting Changes to Real Estate for Insurance Coverage.