This mortgage is a form that can be used in a transaction between one individual and another as opposed to an individual and lender bank.

Green Bay Wisconsin Mortgage

Description

How to fill out Wisconsin Mortgage?

Regardless of social or occupational standing, filling out legal documentation is an unfortunate requirement in the modern world.

It's often nearly impossible for someone without a legal education to generate such documents from scratch, largely because of the intricate terminology and legal subtleties they entail.

This is where US Legal Forms can be a lifesaver.

Ensure that the template you've selected corresponds to your location, as the laws of one area do not apply to another.

Inspect the form and review a brief description (if present) of scenarios for which the document can be utilized.

- Our platform offers an extensive range of over 85,000 pre-prepared state-specific forms that cater to nearly any legal circumstance.

- US Legal Forms also proves to be a valuable resource for associates or legal advisors aiming to enhance their time efficiency with our DIY forms.

- Whether you need the Green Bay Wisconsin Mortgage or any other document valid in your locality, US Legal Forms has everything readily available.

- Here's how you can quickly obtain the Green Bay Wisconsin Mortgage in minutes using our trustworthy service.

- If you are currently a subscriber, you can simply Log In to your account to download the requisite form.

- However, if you are new to our platform, be sure to follow these instructions before acquiring the Green Bay Wisconsin Mortgage.

Form popularity

FAQ

Mortgage rates in Green Bay, WI can vary based on several factors including your financial profile and the type of mortgage you seek. Generally, these rates are aligned with national trends but can offer unique local opportunities. To find the right rate for your Green Bay Wisconsin mortgage, utilize platforms like USLegalForms, which provide resources and tools to help you make informed decisions.

Mortgage rates in Wisconsin are competitive, but they change frequently due to economic factors. As of now, you can expect rates that reflect national averages, though local markets might differ slightly. To secure the best rates for your Green Bay Wisconsin mortgage, consider reaching out to local lenders or using online tools to compare current mortgage offers.

The interest rate for a mortgage in Green Bay, Wisconsin can fluctuate based on market conditions and individual circumstances. Currently, rates may vary depending on your credit score and the lender you choose. It is always wise to shop around and compare offers to get the best deal available. Stay informed by checking reliable sources to find the most accurate rates for your Green Bay Wisconsin mortgage.

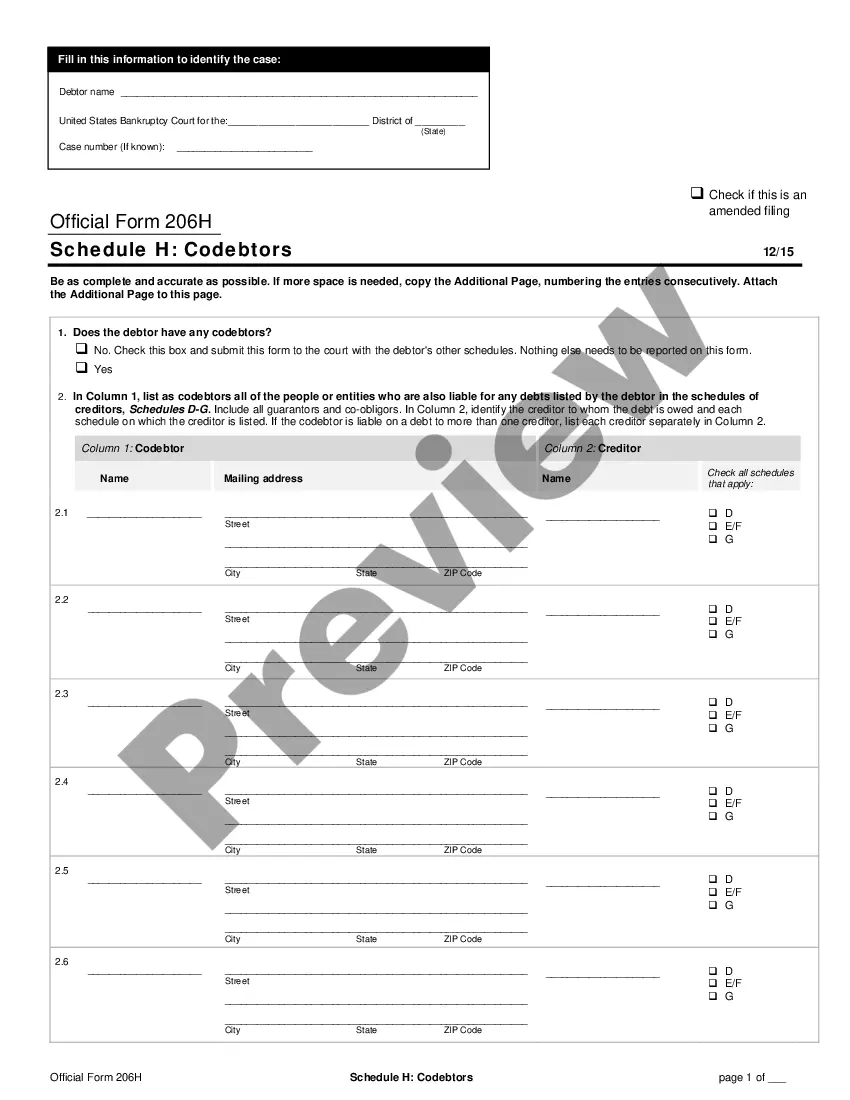

It is primarily the responsibility of the lender to record the mortgage once it is executed in Green Bay, Wisconsin. Property owners should ensure that their deed is also recorded after a transfer. By utilizing platforms like uslegalforms, you can simplify the process of preparing and filing these documents correctly.

Yes, recording a mortgage is necessary in Green Bay, Wisconsin, to secure your interest in the property. When you record your mortgage, it provides public notice and establishes priority over other claims. Failing to record could leave your rights vulnerable, especially if the property changes ownership.

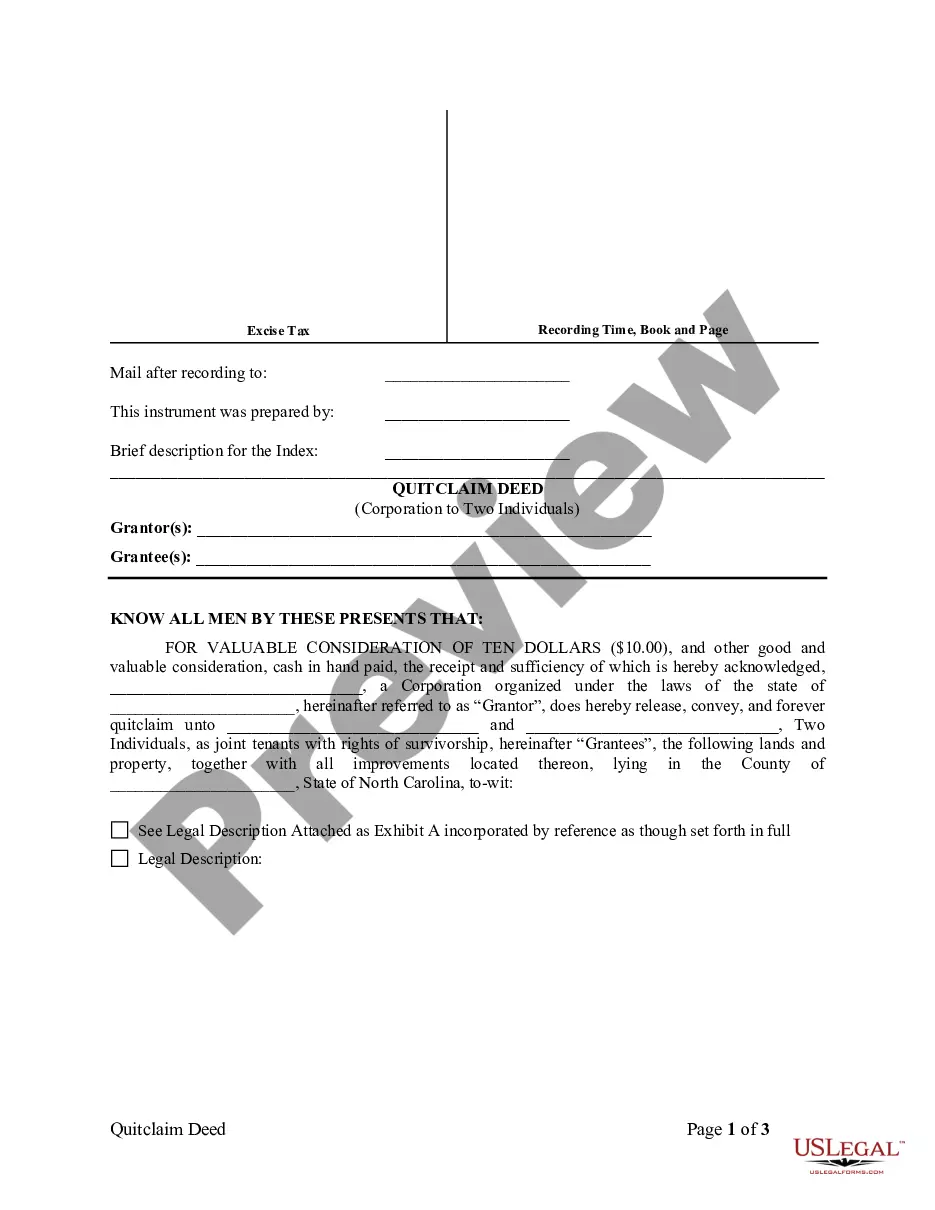

The best way to transfer property title between family members in Green Bay, Wisconsin, is to use a quitclaim deed. This straightforward process involves filling out the necessary forms and having them notarized. After that, file the deed with the county register of deeds office to legally document the transfer and avoid potential disputes in the future.

In Green Bay, Wisconsin, you should record your mortgage at the county register of deeds office. This office acts as the official repository for all property-related documents, ensuring that your mortgage is publicly documented. Recording your mortgage protects your legal rights and provides critical information to future buyers and lenders.

To transfer a property title in Wisconsin, you need to fill out a title transfer form, detailing the current and new owner's information. It’s essential to sign this document in front of a notary public. You must then record it at the local register of deeds office in Green Bay, Wisconsin, to ensure the transfer is legally binding.

Yes, having a mortgage is considered public record in Green Bay, Wisconsin. This means that anyone can access this information, which typically includes the names of the mortgagor and mortgagee, the amount borrowed, and property descriptions. Public access to mortgage records helps maintain transparency in real estate transactions.

Transferring a property deed in Wisconsin requires completing a deed transfer form, which includes details about the property and the new owner. Then, you need to sign the form in the presence of a notary public. Finally, file the completed deed at the county register of deeds office in Green Bay, Wisconsin, to make the transfer official.