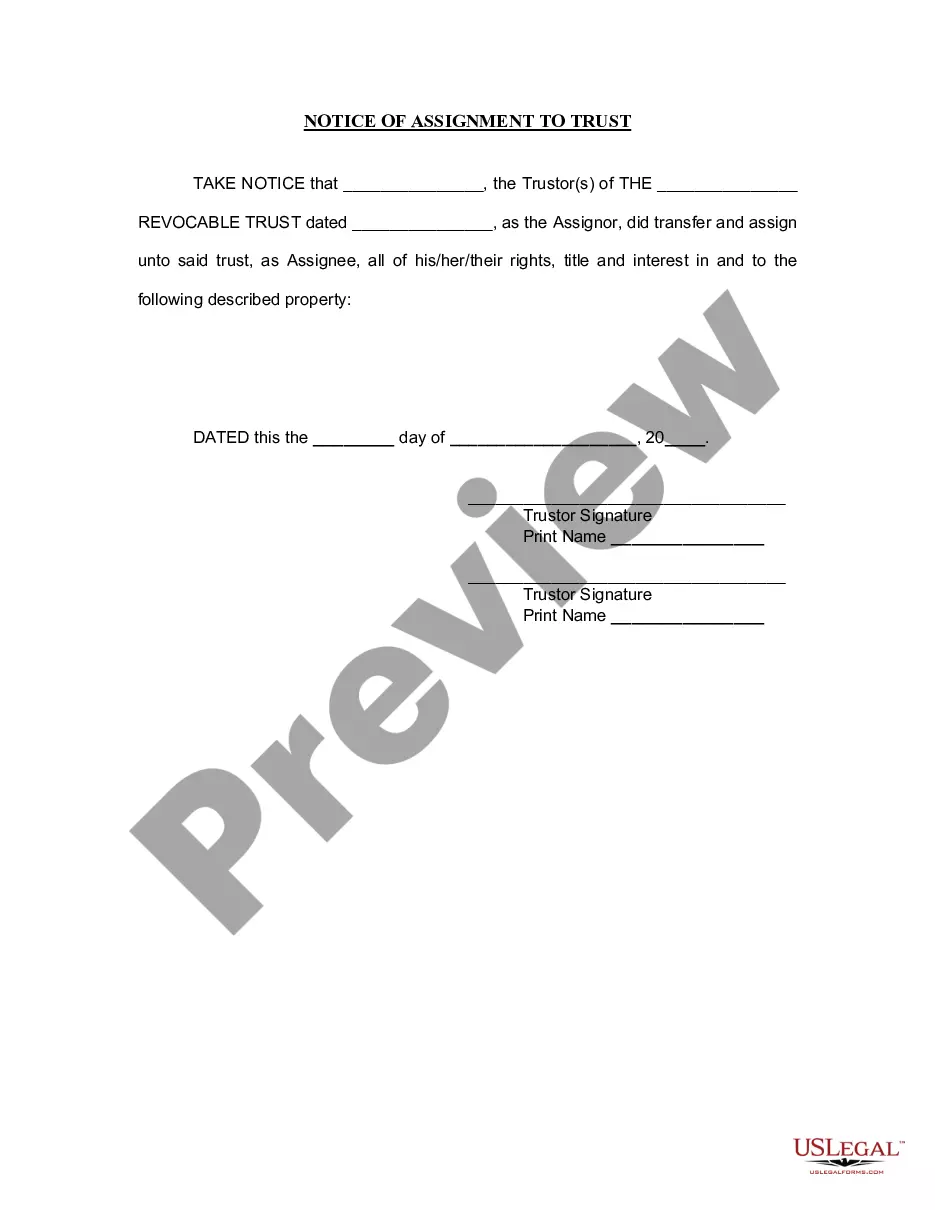

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Seattle Washington Notice of Assignment to Living Trust

Description

How to fill out Washington Notice Of Assignment To Living Trust?

If you've previously utilized our service, Log In to your account and download the Seattle Washington Notice of Assignment to Living Trust onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it as per your payment plan.

If this is your inaugural experience with our service, adhere to these straightforward steps to acquire your document.

You have uninterrupted access to all documents you have purchased: you can find them in your profile under the My documents menu whenever you need to utilize them again. Leverage the US Legal Forms service to quickly discover and save any template for your personal or professional usage!

- Ensure you have located a suitable document. Browse through the description and utilize the Preview option, if accessible, to confirm it aligns with your requirements. If it does not fit your needs, use the Search tab above to find the correct one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your Seattle Washington Notice of Assignment to Living Trust. Select the file format for your document and save it onto your device.

- Finalize your sample. Print it or utilize professional online editors to complete and electronically sign it.

Form popularity

FAQ

Living Trusts. In Washington, because such property is not subject to probate, it need not be disclosed in the court record and confidentiality may be maintained.

To transfer ownership, you will need to obtain a title change form from your DMV and complete it, naming the trustee (as trustee of your trust) as new owner. Sales tax should not apply to the transfer and if the clerk tries to apply it, you will need to speak to a supervisor.

General information about charitable trusts can be obtained by calling the Charities Program at 1-800-332-4483 (toll free within Washington State.) Local or out-of-state callers may contact the Trust Program at (360) 725-0378.

An IT77TR form (Application for registration as a Taxpayer or Changing of Registered Particulars: Trust) must be completed for each trust. Trustees are required to present themselves to SARS in person in order to register the trust for Income Tax.

A Washington living trust holds your assets in trust while you continue to use and control them. After your death, the trust passes assets to your beneficiaries according to your instructions. A revocable living trust can provide flexibility and control.

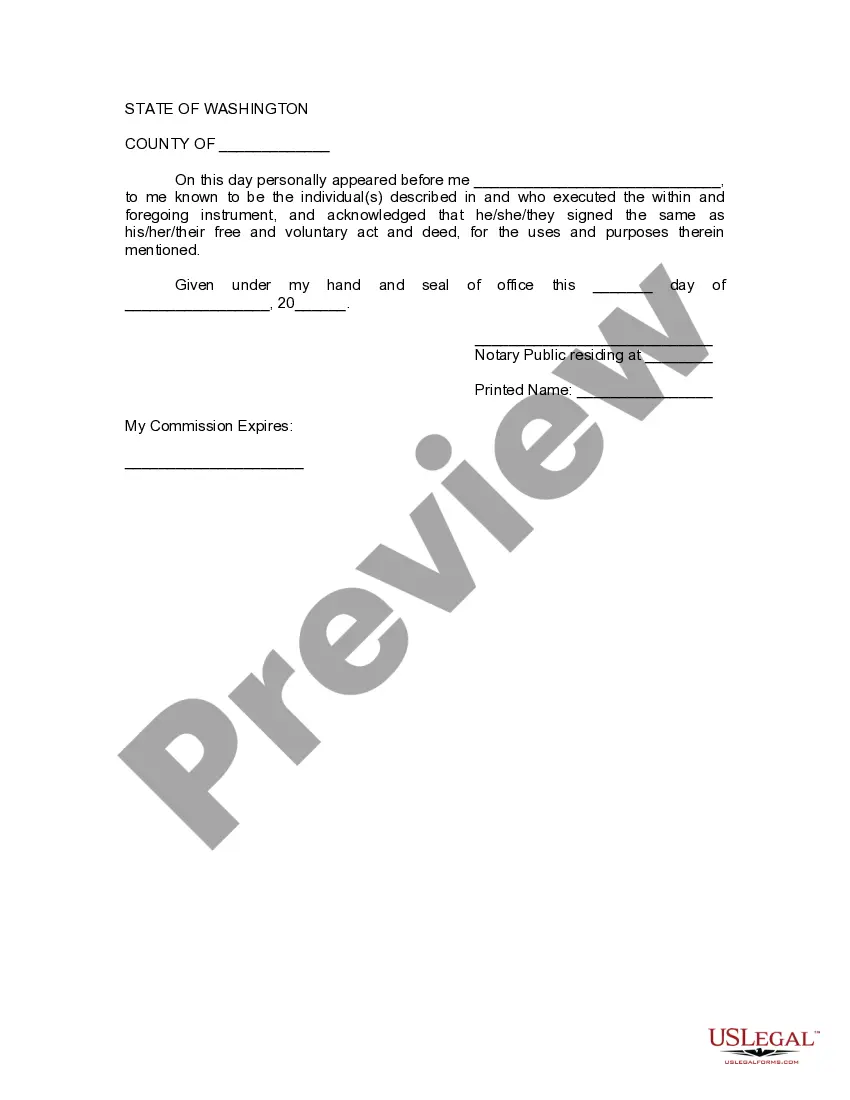

To create a living trust in Washington, prepare a written trust document and sign it before a notary public. To finalize the trust and make it effective, you must transfer ownership of your assets into it.

They are more costly and take more time to get set up correctly. Trusts don't become public record, so you can maintain privacy about how your estate was split.

The trustee must register the trust by filing with the clerk of the court in any county where venue lies for the trust under RCW 11.96A.