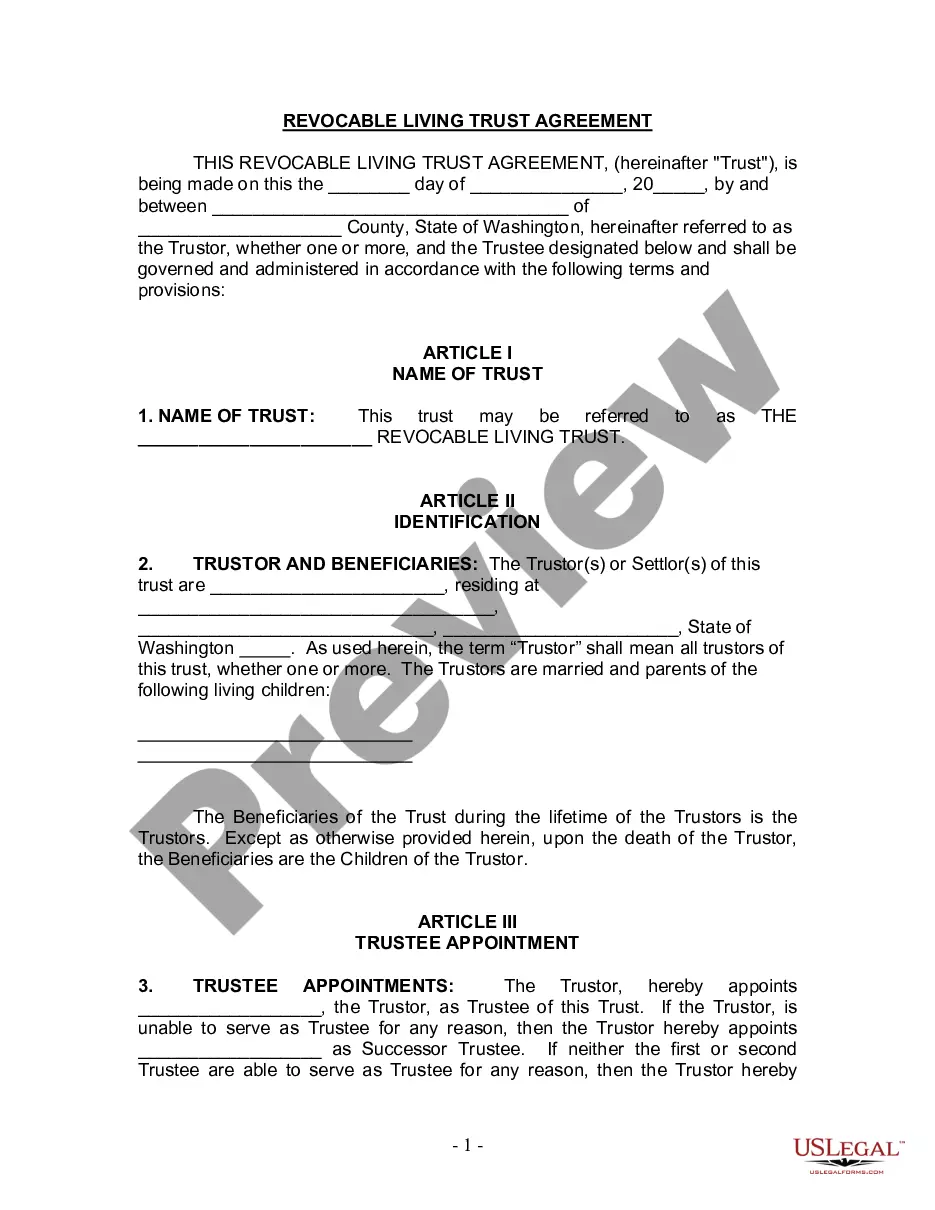

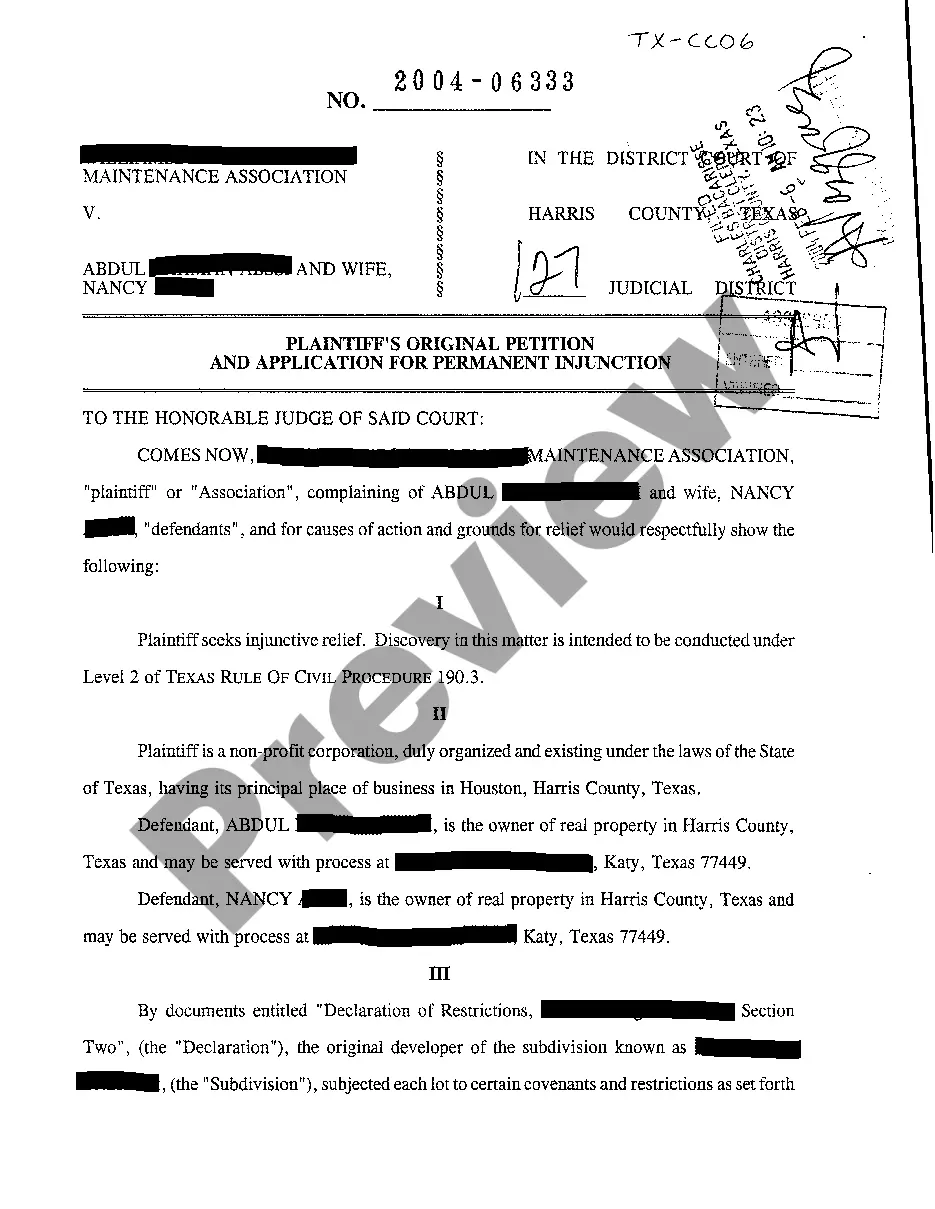

This form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with one or more children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Seattle Washington Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children

Description

How to fill out Washington Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children?

If you’ve previously benefited from our service, sign in to your account and preserve the Seattle Washington Living Trust for Individuals Who are Unmarried, Divorced or Surviving Spouse with Offspring on your device by clicking the Download button. Ensure that your subscription is current. If not, renew it following your payment plan.

If this is your initial use of our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents menu whenever you need to use it again. Utilize the US Legal Forms service to quickly find and save any template for your personal or professional requirements!

- Ensure you’ve found an appropriate document. Browse through the description and utilize the Preview feature, if available, to determine if it satisfies your needs. If it isn’t suitable, use the Search tab above to locate the correct one.

- Acquire the template. Hit the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process your payment. Input your credit card information or use the PayPal option to finalize the transaction.

- Obtain your Seattle Washington Living Trust for Individuals Who are Unmarried, Divorced or Surviving Spouse with Offspring. Choose the file format for your document and store it on your device.

- Fill out your template. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

Common Types of Trusts Inter vivos trusts or living trusts: created and active during the lifetime of the grantor. Testamentary trusts: trusts formed after the death of the grantor. Revocable trusts: can be changed or revoked entirely by the grantor.

A trust is also harder to contest than a will, offering security that your plan will remain in place. Washington applies an estate tax to estates worth over $2 million and federal estate tax applies to estates of more than $5 million. Your living trust will not shield your assets from this tax.

The price of creating a living trust in Washington depends on how you go about making it. The first option is to use an online service and draw the trust up yourself. This will cost a few hundred dollars at most. The other option is to hire an attorney, which could cost more than $1,000.

The beneficiaries you name in your living trust receive the trust property when you die. You could instead use a will, but wills must go through probate?the court process that oversees the transfer of your property to your beneficiaries. Many people create a revocable living trust as part of their estate plan.

Living Trusts. In Washington, because such property is not subject to probate, it need not be disclosed in the court record and confidentiality may be maintained.

A revocable trust can be changed at any time by the grantor during their lifetime, as long as they are competent. An irrevocable trust usually can't be changed without a court order or the approval of all the trust's beneficiaries. This makes an irrevocable trust less flexible.

A revocable living trust is a written agreement in which the trustor, the person who creates the trust, names a trustee and governs the manage- ment of trust assets during the trus- tor's lifetime and upon the trustor's death.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

In general, however, Washington State law will not allow a private trust to continue longer than 21 years after the death of the last identifiable individual living who has an interest in the trust at the time the trust was established. Charitable trusts, on the other hand, may continue indefinitely.

How Much Does a Trust Cost? If you hire an attorney to build your trust, you'll likely pay in the range of $1,500 to $2,500, depending on whether you are single or married, how complex the trust needs to be and what state you are in.