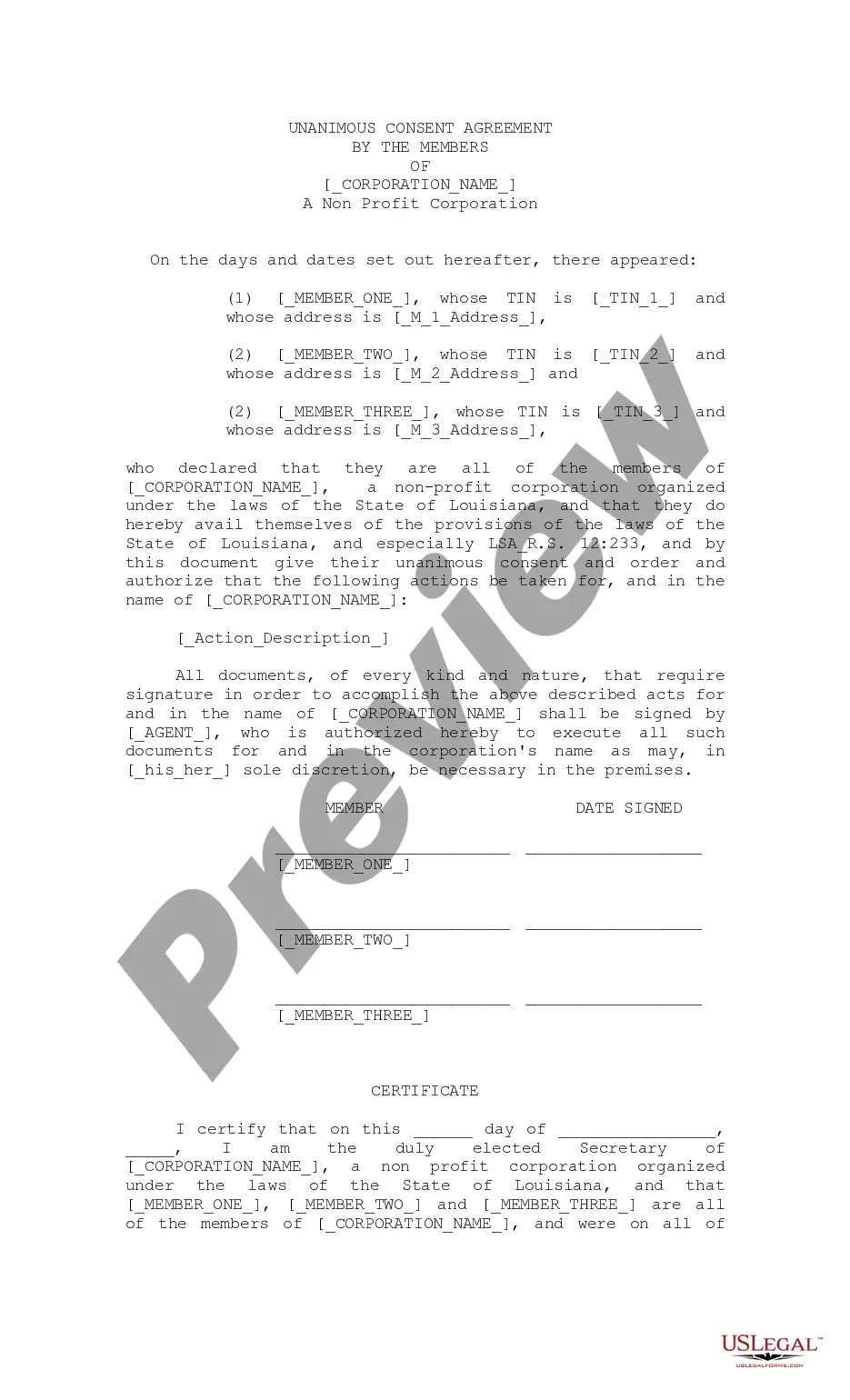

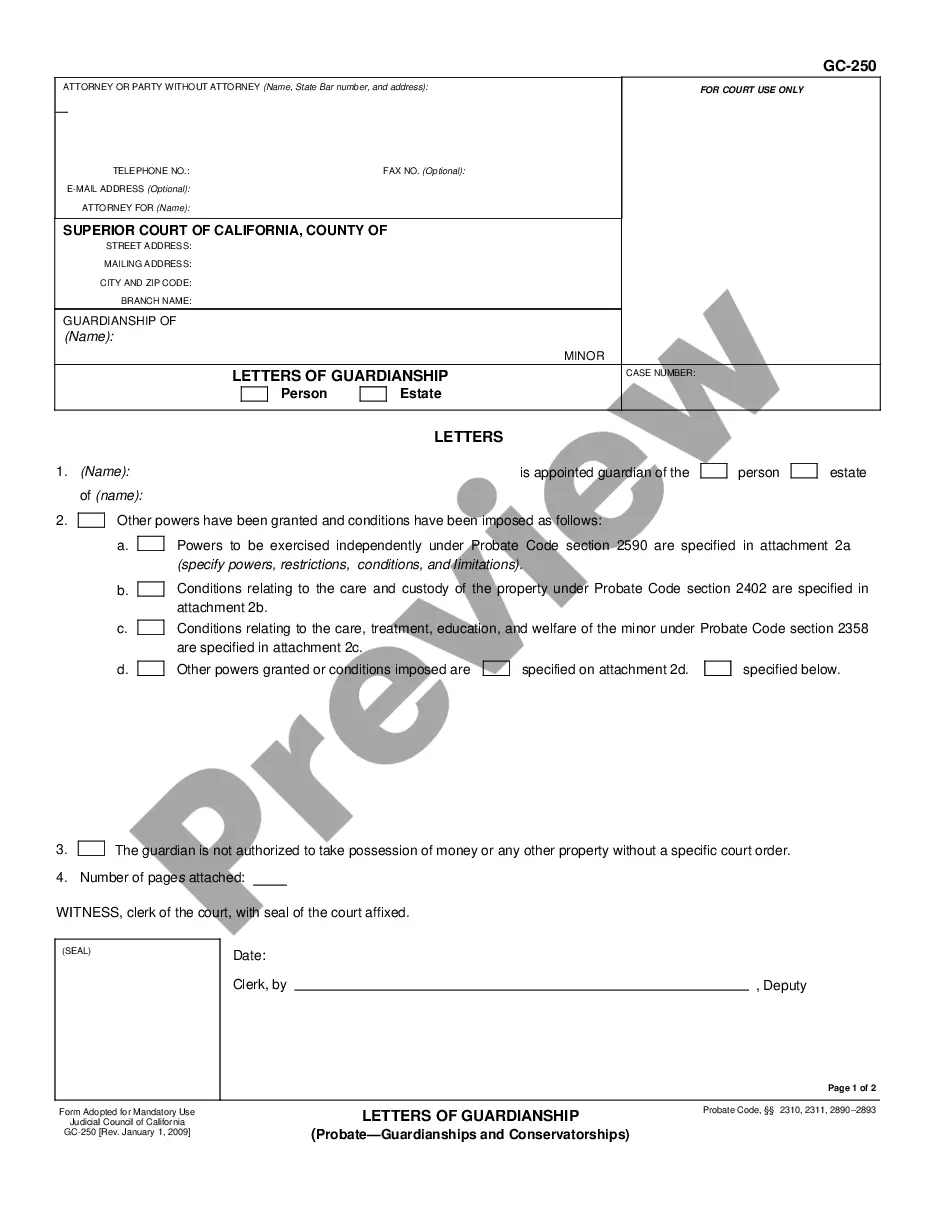

This Complex Will with Credit Shelter Trust for Large Estates form is a complex Will designed to enable a couple to maximize the amount of property that can pass free of estate taxes. The Will leaves the maximum tax free amount allowed (i.e. 1,000,000.00 as of 2001) to a trust and the remainder of property to the surviving spouse. All of the property passing to the Spouse is estate tax free. Therefore, no estate taxes are due at the death of the first Spouse. Since the trust has 1 million dollars that can pass to the children tax free, the surviving spouse can also leave 1 million to a similar trust or children and thereby enable 2 million dollars instead of 1 to pass to the children estate tax free. Income from the trust can be disbursed to the surviving spouse and children.

Seattle Washington Complex Will with Credit Shelter Marital Trust for Large Estates

Description

How to fill out Washington Complex Will With Credit Shelter Marital Trust For Large Estates?

Regardless of one's social or professional ranking, completing legal documents is an unfortunate requirement in today’s working landscape.

Often, it's nearly impossible for someone without a legal background to create these types of documents from scratch, primarily due to the complicated language and legal intricacies they involve.

This is where US Legal Forms can come to the rescue.

- Our platform provides a vast library of over 85,000 ready-to-use state-specific documents suitable for nearly any legal circumstance.

- US Legal Forms is also an excellent resource for associates or legal advisors looking to save time by utilizing our DIY documents.

- Whether you need the Seattle Washington Complex Will with Credit Shelter Marital Trust for Large Estates or any other document that applies in your region or county, US Legal Forms has everything at your fingertips.

- Here’s how you can obtain the Seattle Washington Complex Will with Credit Shelter Marital Trust for Large Estates in just a few minutes using our reliable platform.

- If you're already a member, simply Log In to your account to download the necessary form.

Form popularity

FAQ

A credit shelter trust (CST) is a trust created after the death of the first spouse in a married couple. Assets placed in the trust are generally held apart from the estate of the surviving spouse, so they may pass tax-free to the remaining beneficiaries at the death of the surviving spouse.

A credit shelter trust is a trust that is established in the will or living trust of the first to die of a married couple, most often for the benefit of a surviving spouse. It is generally created to avoid estate taxes at a first spouse's death by taking advantage of the available federal estate tax credit.

A marital trust allows the couple's heirs to avoid probate and take less of a hit from estate taxes by taking full advantage of the unlimited marital deduction?a provision that enables spouses to pass assets to each other without tax consequences.

Trusts may provide tax benefits Because you've transferred assets out of your estate, there may be transfer tax benefits with an irrevocable trust. Contributions to the trust are generally subject to gift tax requirements during your lifetime.

Yes, a Disclaimer Trust is often referred to as a Credit Shelter Trust. This is because married couples will add in the option for the surviving spouse to disclaim the first spouse's assets and move them into a Disclaimer Trust.

Protecting growth on the assets from further estate tax on the surviving spouse's death: A $5 million property or stock portfolio can be allocated to the CST on the decedent spouse's death.

Credit Shelter Trust vs Marital Trust - Is a Marital Trust the Same as a Credit Shelter Trust? No. A Marital Trust is a type of Credit Shelter Trust. You and your spouse can use a Marital Trust to pass assets to a surviving spouse, children or grandchildren.

The primary benefit of CSTs is that the surviving spouse can use the trust's principal and income during the remainder of their lifetime, for example, for medical or educational expenses. The remaining assets then pass to the beneficiaries and are not subject to estate taxes.

The four main types are living, testamentary, revocable and irrevocable trusts.