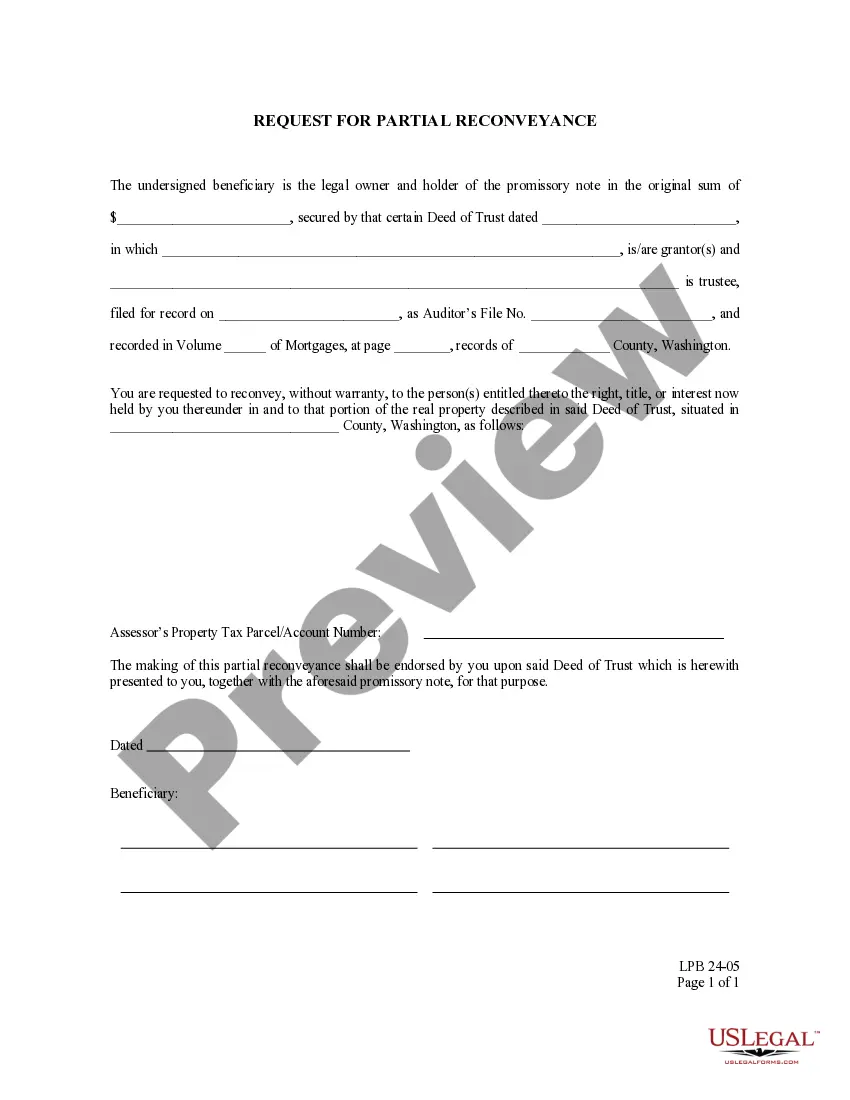

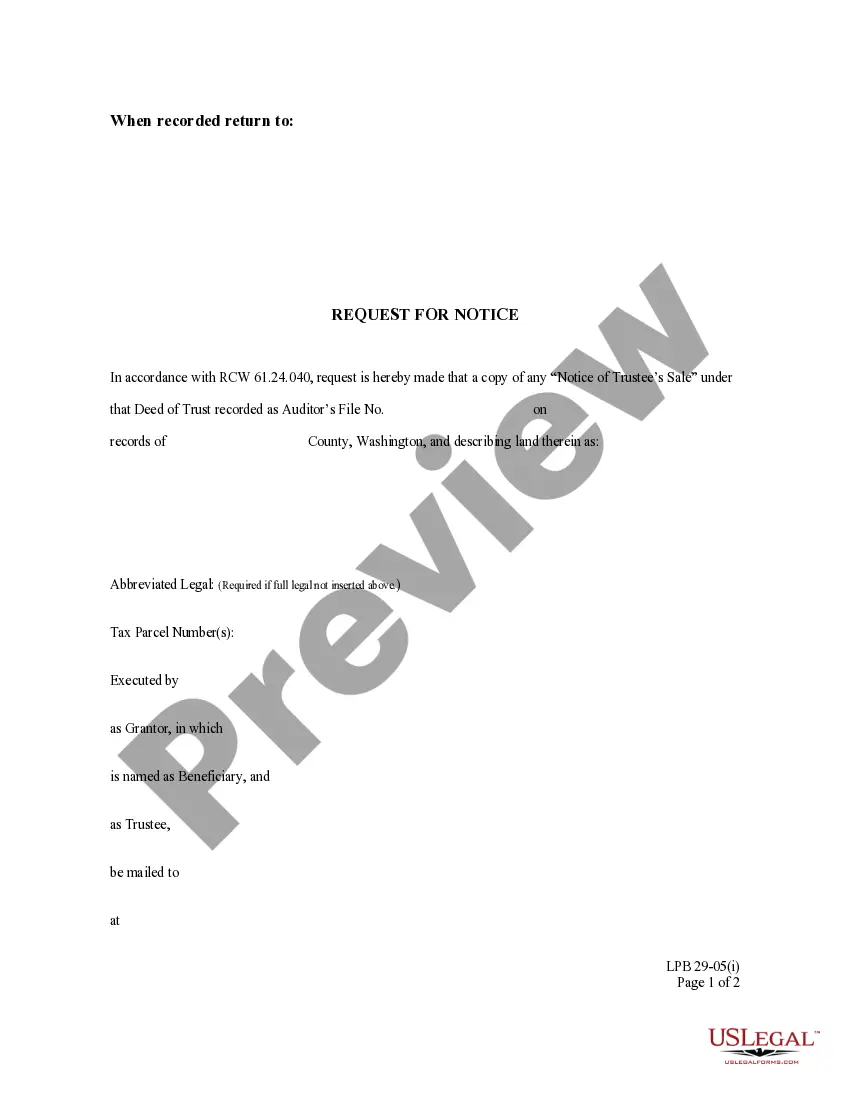

This is an official Washington form for use in land transactions, a Request for Full Reconveyance.

Seattle Washington Request for Full Reconveyance

Description

How to fill out Washington Request For Full Reconveyance?

Finding affirmed templates relevant to your local regulations can be challenging unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal documents for both personal and professional purposes and various real-life scenarios.

All the records are accurately categorized by usage area and jurisdiction sectors, making the search for the Seattle Washington Request for Full Reconveyance as straightforward as ABC.

Maintaining documentation organized and compliant with legal standards is critically important. Leverage the US Legal Forms library to always have essential document templates readily accessible for any requirements!

- Examine the Preview mode and form description.

- Ensure you’ve selected the correct one that fits your needs and perfectly aligns with your local jurisdiction requirements.

- Look for another template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to locate the appropriate one.

- If it works for you, proceed to the following step.

Form popularity

FAQ

Either the beneficiary of the deed of trust must be located and asked to sign a request for reconveyance or the property owner must prove to the trustee that the obligation was satisfied and the property should be reconveyed.

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form is completed and signed by the trustee, whose signature must be notarized.

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been paid in full and the lender no longer has an interest in your property. With your mortgage or deed of trust paid off, you cannot be foreclosed on by a financial institution.

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form is completed and signed by the trustee, whose signature must be notarized.

In a nutshell, the Substitution of Trustee and Deed of Reconveyance is a legal document that evidences security interest is being release by a lender. In most cases, the document shows that a loan has been paid off. Property owners may even receive this document if they have refinanced a loan.

Conveyance transfers ownership of property from one entity to another. A deed is an instrument of conveyance, describing the parties and the property being transferred. A lender who holds title to the property must issue a deed of reconveyance to transfer the property title to the borrower.

Removal of the deed of trust is usually done by a ?reconveyance? of the property affected by the deed of trust. In the typical case, when the money has been paid in full or the obligation has been fully performed, the beneficiary of the deed of trust makes a written request to the trustee to ?reconvey? the property.

A deed of reconveyance indicates that you've fully paid off your mortgage on your home, representing the transfer of ownership from your mortgage lender to you. Over the time you repaid your mortgage, you legally owned the property, but the lender held the mortgage lien, or claim, to it.

A Deed of Reconveyance is documentation that the debt secured by a Deed of Trust (a document that allows a third-party to hold the title to a property until it is completely paid for) has been fully paid.

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been paid in full and the lender no longer has an interest in your property. With your mortgage or deed of trust paid off, you cannot be foreclosed on by a financial institution.