This Quitclaim Deed form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is an LLC. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

King Washington Quitclaim Deed from LLC to LLC

Description

How to fill out Washington Quitclaim Deed From LLC To LLC?

If you have previously utilized our service, Log In to your account and store the King Washington Quitclaim Deed from LLC to LLC on your device by clicking the Download button. Ensure that your subscription is active. If not, renew it according to your payment agreement.

If this is your initial experience with our service, follow these straightforward steps to acquire your document.

You have unlimited access to every document you have acquired: you can access it in your profile within the My documents section whenever you need to retrieve it. Take advantage of the US Legal Forms service to swiftly locate and save any template for your personal or business requirements!

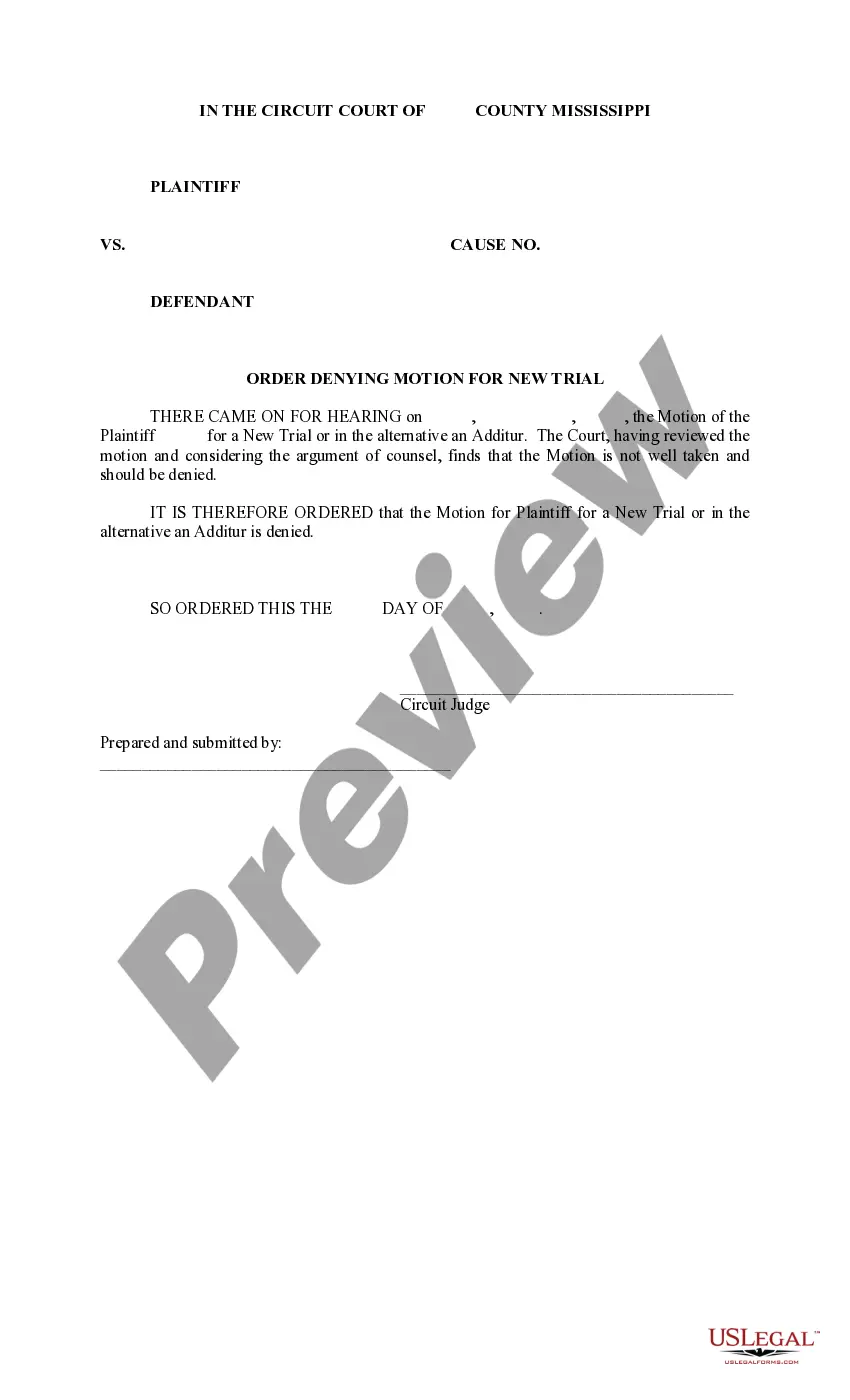

- Confirm you’ve found a suitable document. Review the details and use the Preview feature, if available, to verify if it meets your standards. If it doesn’t suit your needs, use the Search tab above to find a suitable one.

- Buy the template. Click the Buy Now button and choose a monthly or yearly subscription option.

- Establish an account and complete the payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your King Washington Quitclaim Deed from LLC to LLC. Select the file format for your document and save it on your device.

- Finalize your sample. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

To transfer a property into an LLC, start by obtaining a King Washington Quitclaim Deed from LLC to LLC. This document allows for the transfer of real estate ownership from an individual or entity into your LLC. Complete the deed, ensuring that all necessary information is included, and then record it with your local county office. Remember, it's essential to consult with a legal professional to ensure compliance with local laws.

Transferring property from personal ownership to an LLC can be straightforward with the right process. You can use a King Washington Quitclaim Deed from LLC to LLC to achieve this transfer effectively. This deed allows you to move ownership without complicating the legal aspects. Additionally, using a reputable platform like US Legal Forms can guide you through the documentation required for a seamless transition.

To put your property in an LLC, begin by forming the LLC legally, which involves filing articles of organization with your state. Next, execute a quitclaim deed to transfer ownership from your personal name to the LLC. This ensures that the property is officially held under the LLC's name. Using a King Washington Quitclaim Deed from LLC to LLC can effectively facilitate this transfer process and make it straightforward.

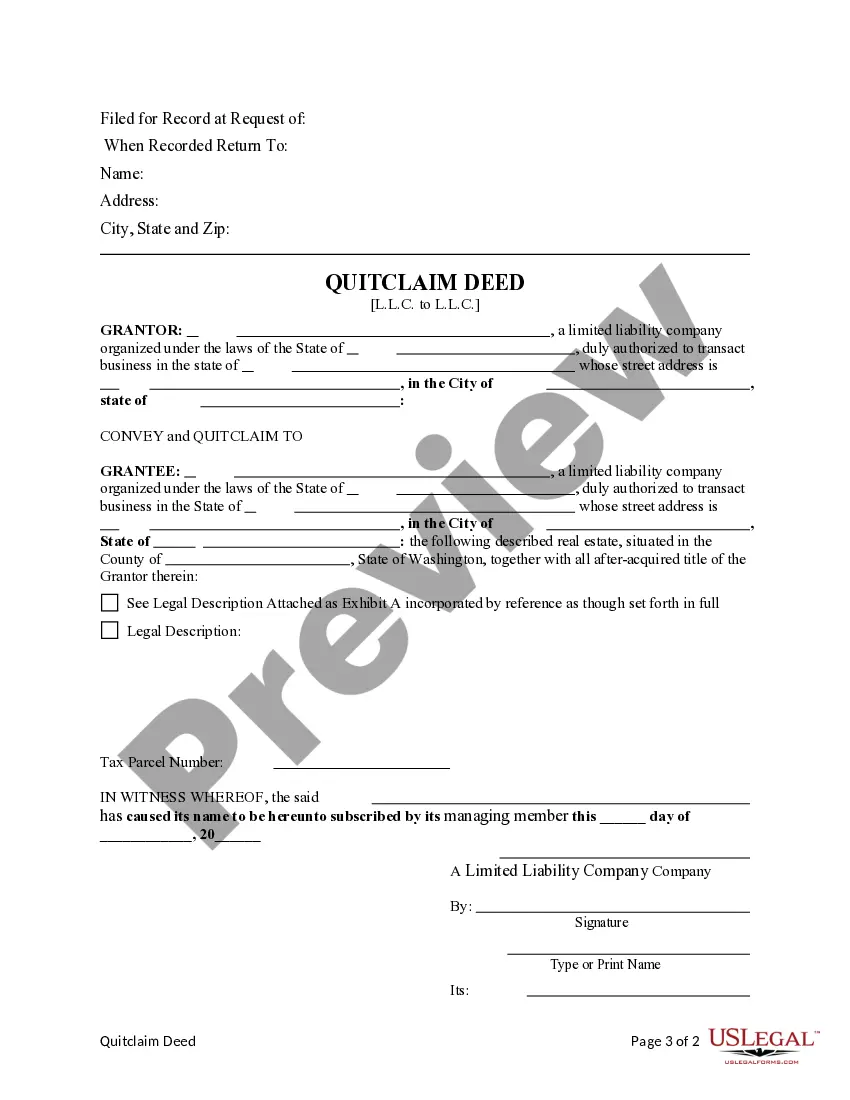

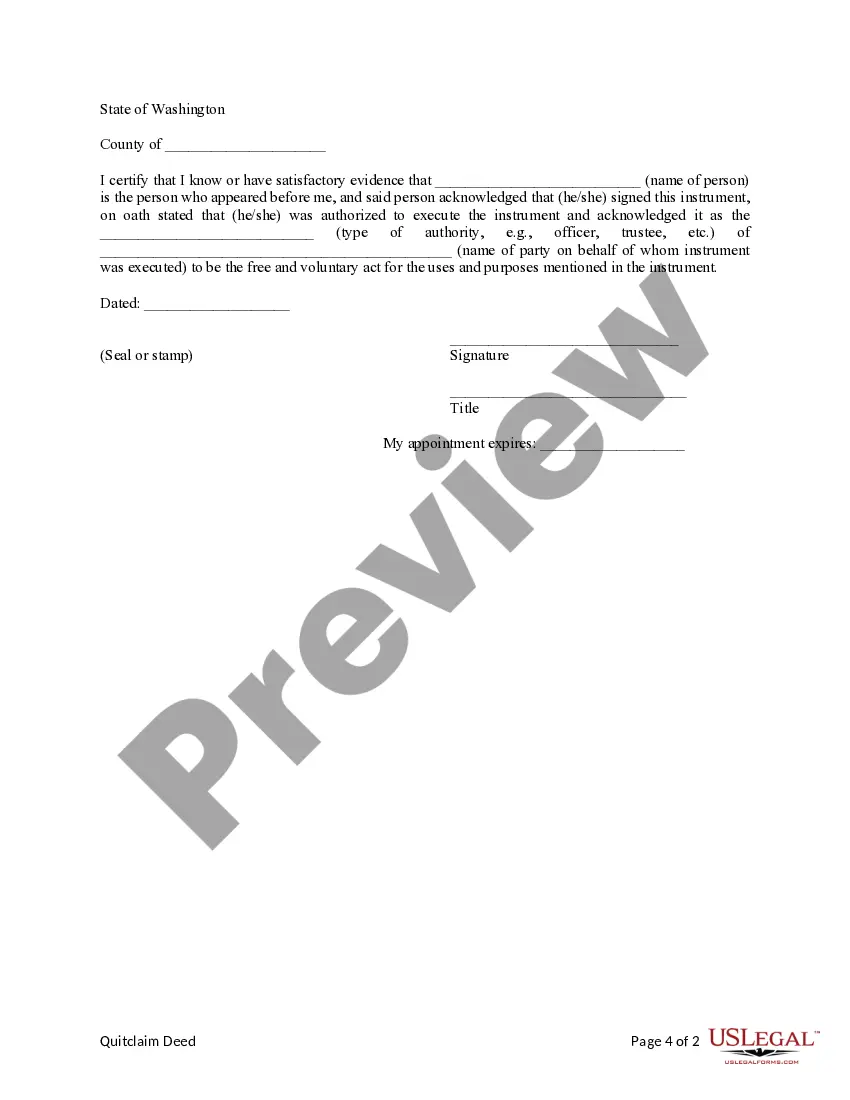

Filling out a quitclaim deed in Washington involves several steps. Firstly, you must include the name of the person transferring the property and the LLC's name receiving it, along with a clear property description. Be sure to have both parties sign the deed before a notary, then file the completed deed with the local recording office. Utilizing tools from uslegalforms can simplify this process, ensuring accuracy in completing the King Washington Quitclaim Deed from LLC to LLC.

To quitclaim property to an LLC, start by obtaining a quitclaim deed form tailored for your state, such as Washington. Fill in the necessary details, including the grantor's and grantee's information, and then sign the document in front of a notary. Following this, file the quitclaim deed with the county recorder to finalize the transfer, ensuring all aspects of the King Washington Quitclaim Deed from LLC to LLC are adhered to.

To transfer assets from personal ownership to an LLC, you typically need to execute a quitclaim deed, effectively conveying ownership to the LLC. This process involves preparing the deed, signing it, and then filing it with the appropriate local government office. Using a King Washington Quitclaim Deed from LLC to LLC can facilitate this transfer, making it clear that the LLC now owns the property.

People commonly place property in an LLC for various reasons, including protecting personal assets from liabilities associated with real estate ownership. Additionally, holding property in an LLC can simplify the management of rental properties, making tax reporting more straightforward. Many also find that using a King Washington Quitclaim Deed from LLC to LLC streamlines transfers within family or business structures.

While placing your property in an LLC can offer liability protection, it may have downsides. Liability protection can come with costs such as startup fees, annual maintenance, and possible tax implications. Moreover, lenders may require personal guarantees for mortgages, potentially compromising the shield intended by the LLC. It’s crucial to weigh these factors when considering the King Washington Quitclaim Deed from LLC to LLC.

Yes, transferring property from one LLC to another LLC is possible using a King Washington Quitclaim Deed from LLC to LLC. This deed facilitates the transfer process and helps ensure that ownership records are updated. It’s important to consult legal resources or platforms like US Legal Forms to guide you through the paperwork.

Transferring property to an LLC in Washington requires drafting a King Washington Quitclaim Deed from LLC to LLC. This deed must accurately reflect the transfer and be signed by authorized representatives of the LLC. After preparation, record the deed with the county office to finalize the transfer.