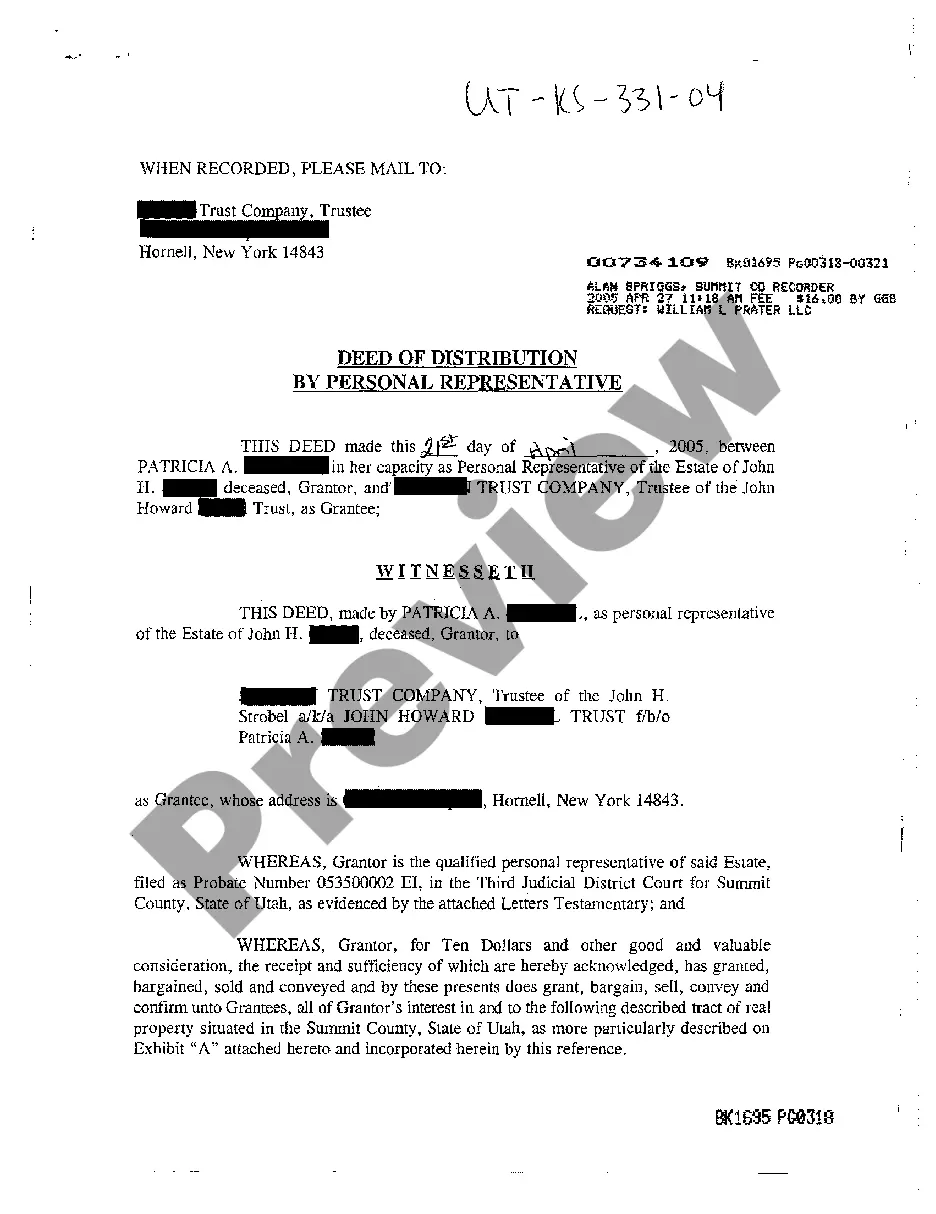

Salt Lake Utah Deed of Distribution by Personal Representative

Description

How to fill out Utah Deed Of Distribution By Personal Representative?

Acquiring authenticated templates tailored to your regional statutes can be challenging unless you utilize the US Legal Forms repository.

It’s a digital compilation of over 85,000 legal documents catering to both personal and professional requirements as well as diverse real-world scenarios.

All the documents are appropriately categorized by field of application and jurisdiction, making it as swift and straightforward as ABC to find the Salt Lake Utah Deed of Distribution by Personal Representative.

Keeping documentation orderly and compliant with legal standards is crucial. Leverage the US Legal Forms library to always have essential document templates readily available for any requirements!

- Familiarize yourself with the Preview mode and document description.

- Ensure that you've chosen the correct one that fulfills your criteria and aligns with your local legal obligations.

- Search for an alternative template, if necessary.

- Should there be any discrepancies, utilize the Search tab above to locate the appropriate one.

- If it fits your needs, proceed to the next step.

Form popularity

FAQ

Whether a will must go through probate in Utah depends on various factors, such as the nature of the assets and the overall size of the estate. If there are no disputes and all assets are easily transferable, probate may be unnecessary. Consulting with a legal expert can help clarify requirements and ensure the Salt Lake Utah Deed of Distribution by Personal Representative is executed correctly.

In Utah, the necessity for probate is typically determined by the size and structure of the estate, as well as the presence of a valid will. Generally, the personal representative or executor appointed in the will decides if probate is required. An expert can guide you through this decision, especially when considering how a Salt Lake Utah Deed of Distribution by Personal Representative may come into play.

A transfer on death deed in Utah allows individuals to designate a beneficiary for their real property, effectively bypassing probate upon their death. This type of deed provides a straightforward way to transfer assets while retaining ownership during the grantor's lifetime. Utilizing a Salt Lake Utah Deed of Distribution by Personal Representative can complement this strategy, ensuring all estate distributions are handled appropriately.

Not all wills must go through probate in Utah. In cases where an estate is small or assets are streamlined into joint ownership or beneficiary designations, the process may be avoided. However, for larger estates or those without clear beneficiary designations, probate becomes essential. Understanding these nuances can help clarify the role of a Salt Lake Utah Deed of Distribution by Personal Representative.

There are several reasons why a will may not go through probate in Utah. If the estate's value is below a certain threshold, or if all assets are jointly owned or have designated beneficiaries, probate may not be necessary. Additionally, if the will is deemed invalid due to lack of proper execution, this could also prevent probate. These factors can influence how a Salt Lake Utah Deed of Distribution by Personal Representative is utilized.

Yes, Utah is a deed of trust state, which means lenders use a deed of trust to secure real property loans instead of traditional mortgages. This process allows for a three-party agreement between the borrower, lender, and a trustee. Knowing this can be beneficial when considering how property distributions, such as a Salt Lake Utah Deed of Distribution by Personal Representative, will affect real estate assets.

In Utah, formal probate involves a court overseeing the entire probate process, which can include appointing a personal representative, validating the will, and settling estate debts and distributions. On the other hand, informal probate is more streamlined, where the personal representative may not require court supervision if there are no disputes. Understanding these differences can help you decide which route is best for handling a Salt Lake Utah Deed of Distribution by Personal Representative.

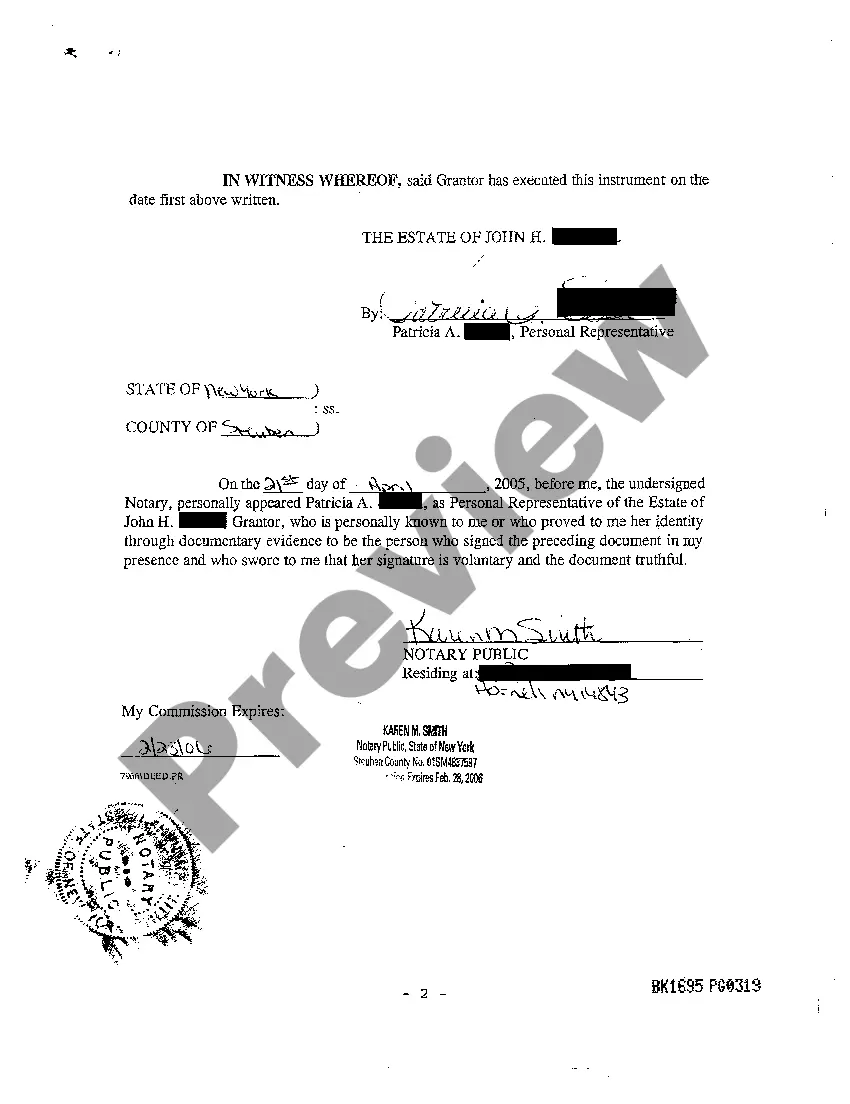

A personal representative’s deed conveys the title and interest of specific assets within an estate to designated beneficiaries. For instance, when dealing with a Salt Lake Utah Deed of Distribution by Personal Representative, the deed formally transfers responsibilities and rights of ownership from the estate to the heirs. This ensures that all beneficiaries receive their rightful share as dictated by the will or state law. Utilizing tools from uslegalforms can streamline this documentation process, making it easier for personal representatives to fulfill their roles.

A personal representative's deed conveys ownership rights to estate property or assets. This could include real estate, bank accounts, or valuable personal items that belong to the deceased. In producing a Salt Lake Utah Deed of Distribution by Personal Representative, the representative ensures everything is properly assigned to the rightful heirs. This act not only legally finalizes the distribution but also confirms the representative’s authority in the process.

A deed conveyed refers to the legal document that transfers ownership of property from one party to another. In the context of a Salt Lake Utah Deed of Distribution by Personal Representative, this document becomes crucial for outlining how estate assets are divided among beneficiaries. This process ensures that all transactions are documented legally and clearly. Understanding the meaning of a conveyed deed helps stakeholders recognize the legitimacy of asset transfers.